Few days back China Yangtze Power announced that they will be investing 26.6 billion yuan over a period of approximately 7.5 years into ‘ship locks’, with no indication of any investment returns. To put it plainly, state-owned Yangtze Power will be taking out 26.6 billion yuan and contributing it back to the country and economy. This was unthinkable and unexpected for many investors in the stock market, whether they invest in Yangtze Power or not. What do you mean taking part of my profit and giving back to the people?

In this article, we will talk about the lessons we can learn from this as well as comparing the systems between different countries. This article does not discuss whether a particular country is good or bad. Everyone just have different systems.

Although China has a capital market, it is fundamentally still a socialist country. This is different from the US and Singapore where I come from. In the US, the prisons can be privatised, and big monies can manipulate the market on a double standard which prohibits the masses from doing so. In fact, to protect the interests of the company, even if maintenance is done badly and a few planes crashed, then so be it. Whoever dared to harm the interests of the company may find themselves dying suddenly of an accident or face the might of the law. In fact, China probably could not imagine nor accept if one day their central bank is controlled by big monies.

I will not speak much about Singapore, but one thing I like is the way I can move my capital freely, something which China does not allow. In fact, if I want to exchange my Singapore Dollars to a foreign currency for tourism purposes, I can just go down to a shop near my house and exchange my currency freely. This is also something China does not allow. They have to go to the banks.

Readers of my blog would know that quite a few investments in my portfolio are in Chinese state-owned companies: Sinopec, CNOOC, COFCO Sugar, Hainan Rubber etc. These companies are stable, doing core and inelastic demands of the market and have the financial resources to tank through bad times (Hainan Rubber). However, the interests of their biggest shareholders may not be the same as the rest of the shareholders.

In a socialist country, we will take it for now that the welfare of the people comes first. At least in name it should be like that. Government of the people, for the people, by the people. Ironic considering that this quote came from Abraham Lincoln.

The biggest shareholder of these state-owned companies, naturally is the country. To take out the profits of state-owned companies for the benefit of the general population may come as a given to them, but it definitely clashes with my interests as an individual who has no responsibility for the welfare of the people. In fact, I am one of the masses who wish to be taken care of.

But what about investing in private companies? Private companies have more risks. Just a few days back China Evergrande Group delisted from the Hong Kong stock exchange. I guess I do not need to go into details on the losses of the shareholders. In financial markets around the world, there have been many examples of companies being delisted, and I have personally suffered from this as well, having invested in 2 delisted companies in my early days as an investor.

I have mentioned before that for us commoners who want to get rich quick, there are only 3 ways to go about it:

- Do illegal things

- Do immoral things

- Take risks

Playing the financial market is a risk in itself. However, with proper risk control, we can still earn a decent amount of money. Yet we need to take note that as long as we have some form of decent risk management, we can never be like the degenerates of WallStreetBets who YOLO’ed their money from $1000 to $1 million. Be rich or die in Wendy’s. And one of the factors when planning for risk control is to know what we are investing in and what is the cost of it.

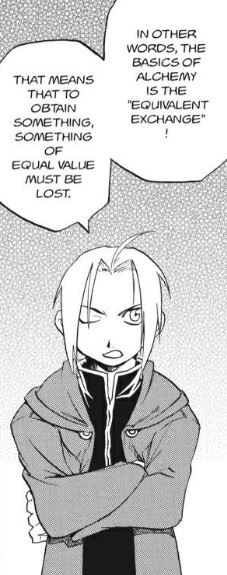

I invest in state-owned companies, and the cost may be the sacrifice of certain profits. I also invest in crypto currency, and the cost is high volatility which my heart has to endure. Choose your poison. To gain something, one should also sacrifice something of an equal value. We call that the “Law of Equivalent Exchange”.

Showing 1 - 3 out of 3

Page 1 out of 1

| - | Shop Products | Price | |

|---|---|---|---|

|

|

$99,999.00

|

||

|

|

$1.00

|

||

|

|

Price range: $69.00 through $99.00

|