Water, the building blocks of life, necessary not only for basic survival, but also have a wide range of applications in various industries. I do not need to explain the importance of water, nor the inelasticity of the demand of water. Just like the power (electricical) supply companies I invested and are interested in, water supply companies also hold a lot of appeal for me.

I originally was researching on China Water Affairs Group Ltd (“China Water”, stock code 00855), but in my research I came across Beijing Enterprises Water Group Ltd (“Beijing Water”, stock code 00371), which I believed is as good or even better. Hence today I will do a comparison between both of them.

Background

China Water was originally an electronics company known as Cedar Base Electronic (Group) Limited, established in 1993 and listed on the HKSE in 1998. In 2003, it was sold to Mr Duan Chuan Liang, also its current executive director and largest shareholder. Mr Duan Chuan Liang had worked in the Ministry of Water Resources in China for more than 10 years. While officially this company does not have the backing of the government like our previous investments such as COFCO Sugar and Hainan Rubber, we could infer that Mr Duan Chuan Liang still has an extensive network with the relevant agencies to get the business running.

Beijing Water was incorporated in 1992 and listed on the HKSE in 1993. Like China Water, the company has undergone a series of changes such as acquisitions and mergers before reaching to where it is today. Beijing Water’s largest shareholder is Beijing Enterprises Holdings Limited is a state-owned enterprise. The second and third largest shareholder are both subsidaries of China Three Gorges Corporation. This means that Beijing Water has the backing of the country.

The Water Business Ranking

This picture shows the ranking of the different companies in the China water business in 2023, based on their revenue. At the top is Beijing Water with a revenue of more than 20 billion RMB, and China Water at the second tier with revenue between 10 to 20 billion RMB.

Scope of Business

For China Water, I will refer to 2 reports – the interim financial report 2024/2025 and the annual financial report 2023/2024, which can be found in this link.

For Beijing Water, I will refer to their 2024 annual report, which can be found here.

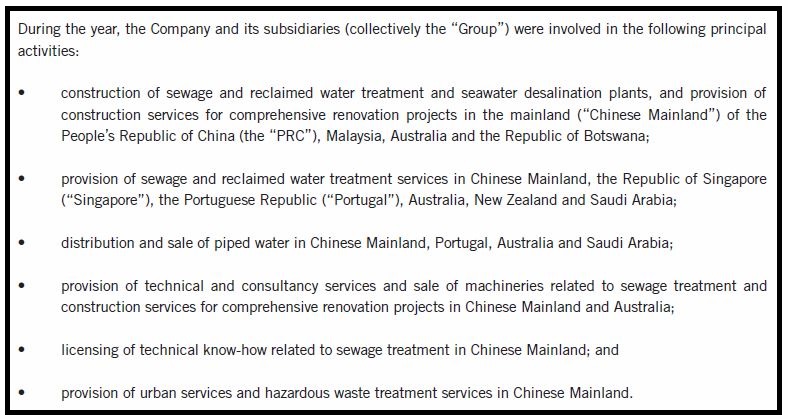

Firstly, we can see that China Water has operations in many parts of China and their businesses have 4 main categories as shown in the picture below.

However, Beijing Water not only deals with the Chinese market, it also has overseas markets.

I do not have the exact distribution and scale of business for Beijing Water in the Chinese market, but from the ranking chart in the previous section, Beijing Water is on a higher tier than China Water, so we can safely assume that Beijing Water has a bigger market presence than China Water.

Both companies provide about the same type of services, just that they have differences in how they categorise them. So in this aspect, neither companies have an edge over the other. It is not like COFCO Sugar where on top of their sugar business, they have an additional tomato segment.

Revenue and Profits

When we look at China Water’s interim report from 30 September 2023 to 30 September 2024 (picture below), we will see that total revenue has fallen by about 13.0% while profits has fallen by 8.1%. However, Beijing Water’s revenue only fell by 1% and profit fell by 5.1% (2024 financial report page 92 and 93). This suggests that under the same environment, Beijing Water has a stronger resilience than China Water.

No breakdown is given in Beijing Water’s financial statement on revenue and profits derived from each country and their contribution to the overall profits and losses. But overall, the combined total of Beijing Water’s overseas revenue and profit is in the low percentage. (2024 annual report, page 10)

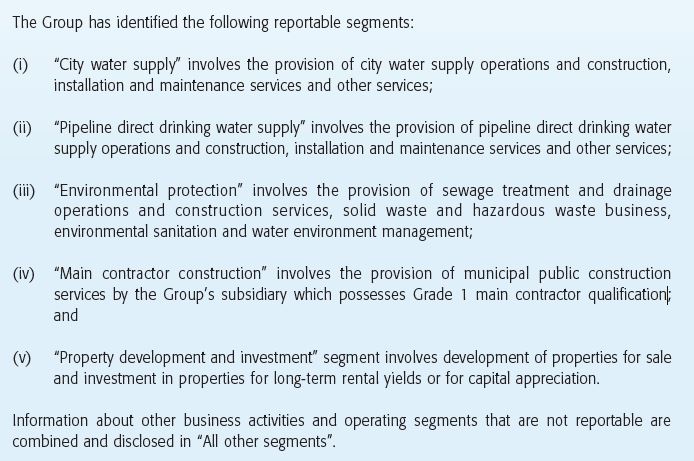

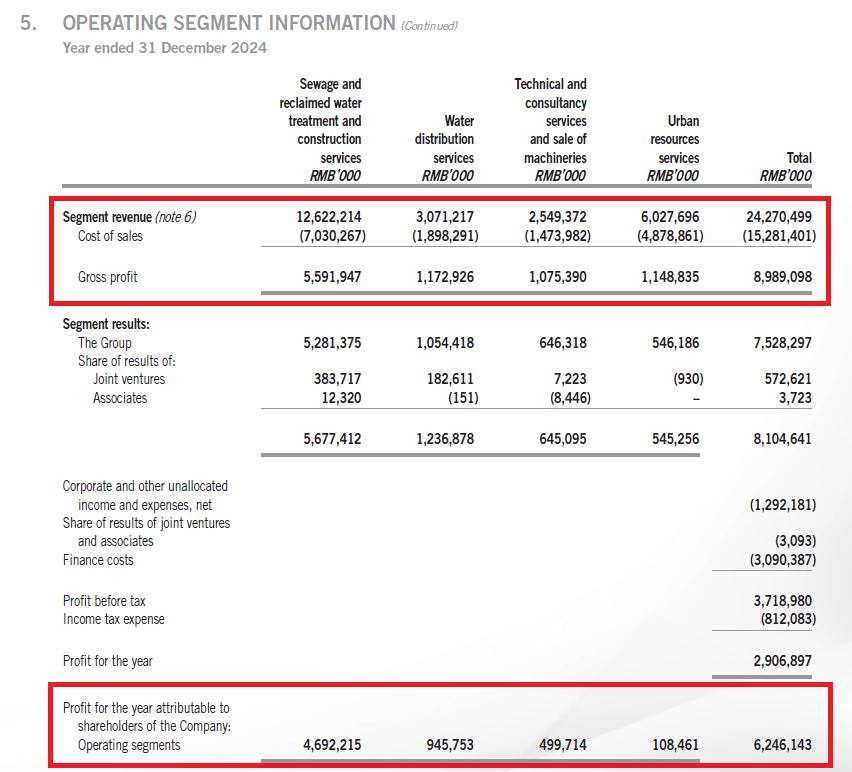

However, we take note that for China Water, their “environment protection business” and “main contractor construction and others” increased in profits, not only in absolute value but also in percentage. This is different from Beijing Water, whose profits (pictures below) across the board fell despite urban resources services being the only one increasing in revenue. Beijing Water’s urban resources service (definition on page 23 of financial report) and the sewage and reclaimed water treatment segment seems to be the same as China Water’s environmental protection services. It is just a difference in categorising their businesses.

Economic Outlook

China’s economy has been bad for a few years now, and as I have said above, water is used in various industries from factories to F&B. Hence, a slow economy translates into lower demand of goods and services, and in turn lower demand for water, and hence a lower revenue and profit for both companies. That being said, China has been actively trying to stimulate their economy. I will skip all the talk about their stimulation policies such as fiscal expansion and lowering of interest rates because that is another topic. The bottom line is China is trying what they can to revive their economy.

In all honesty, China still has some ways to go before a recovery to normal. Ground sentiments are still very negative and it is also a fact that many people are unable to find proper jobs. But as with all economic cycles, getting out of an economic depression is a matter of time. When that happens, the water supply business for both companies will also recover. When will it recover, we do not know yet. But at least during such difficult times, it may be a good opportunity to start slowly accumulating some shares.

Water Policy

While water makes up about 70% of the Earth, only about 3% is freshwater, and even lesser is drinking water. Water hence, is a very scarce and precious resource. And if China has policies and measures for its strategic resources like sugar and rubber, then it is not surprising that there is a policy for water.

Full article in this link, but in essence, China plans to have more water conservation systems and technologies with the objective to “promote water conservation across society, ensure national water security, advance the nation’s goals to create an ecological civilization and drive high-quality development.”

This is where China Water’s enviromental protection business and Beijing Water’s sewage treatment and urban resources services comes in. They deal with waste treatment and water treatment, a necessity in the water conservation aspect. If the water supply business is dependent on the economy for its recovery, then the water treatment and conservation segment will be one big potential for the future for both companies.

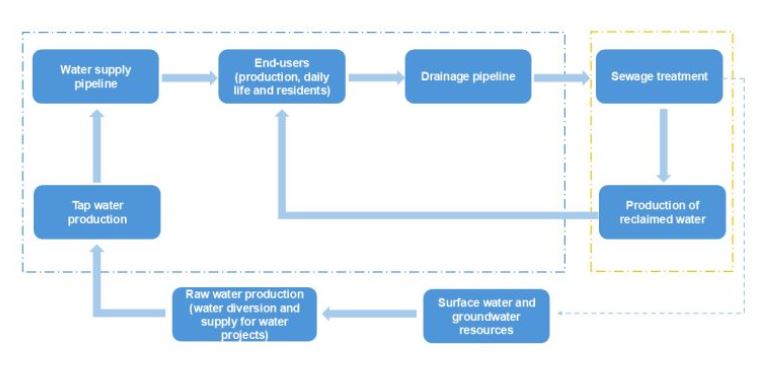

The picture above gives a summary of China Water’s business model. I am unable to find such a process chart in Beijing Water’s website, but water processing is not rocket science, and things operations should be somewhat similar.

China Water has invested greatly in environmental protection assets. Its current assets in this area has increased from 879.7 million HKD in 2022 to 1.48 billion in 2023 (2023 annual report, page 125) to 1.8 billion HKD in 2024 (2024 annual report, page 126). On the other hand, assets in this segment from Beijing Water seems to decrease from 2022 to 2023, and only a slight increase in the sewage segment but no change for urban resources in 2024 (2024 annual report, page 138). This is despite increases in revenue for these areas (2024 annual report, page 140).

This suggests that China Water is geared up and ready to take this segment of business, which the Chinese government is intending to put more resources into. Both companies see an increase over the years in their total assets though.

The Numbers

The screenshots will take up too much space so I will just provide the links, but in essence:

- Beijing Water has a higher dividend of around 6-8%, while China Water has lower yet still decent dividends at about 4.5-6.5%.

- Beijing Water has a higher P/E ratio of 15.55 while China Water’s P/E ratio is 9.40.

- Both has good P/B ratio of 0.67 and 0.77 respectively.

- However, Beijing Water has a gearing ratio of 1.19 (2024 annual report, page 19) while China Water’s gearing ratio is only 0.661 (2024 annual report, page 4).

- As a result, though Beijing Water’s gross profit for 2024 was about 9 billion HKD, financing cost amounted to 3 billion. Less financing income of 793 million, it resulted in a nett financing cost of 2.3 billion, taking up roughly 25.6% of its gross profits (2024 annual report, page 92).

- China Water’s financing cost of about 1.4 billion HKD less its financing income of about 685 million results in about 725 million financing cost (2024 annual report, page 106), which is about 15% of its gross profit.

- Do note that utility companies generally has a higher gearing ratio as they are capital intensive but generate a steady stream of cashflow.

My Plans

China Water has more potential for capital appreciation, and its dividend yield is actually pretty decent. Beijing Water has limited upsides but its higher dividends make it an attractive stock too. To me, both are good stocks and I will queue for both of them at my preferred price.

At the time of writing, China Water and Beijing Water’s share price is 6.21 HKD and 2.58 HKD respectively. Things may change in the future, but I plan to enter China Water and Beijing Water at 5.70 HKD and 2.30 HKD respectively. With my entry point as a reference, I will enter another batch for every 5% drop in price. I do not know whether I will get it, but even if I miss it totally, it is alright. I will just turn my attention elsewhere. That being said, under the Trump administration, there should be no lack of sudden drops for us to pick up some of the good stuff. So that is why we should do our homework early and be ready for any sudden opportunities.

Basis for my entry price: Personal preference. There is no complicated calculations. That is simply the price I am willing to accept and an entry price that will allow me to sleep at night.

Disclaimer: The above is just my homework and by no means financial advice. Readers and investors should do their own due diligence and form their own conclusion. I bear no responsibility for any successful or failed investments.

Showing 1 - 3 out of 3

Page 1 out of 1

| - | Shop Products | Price | |

|---|---|---|---|

|

|

$99,999.00

|

||

|

|

$1.00

|

||

|

|

Price range: $69.00 through $99.00

|