Food, without which we all die. Companies like Tecon Biology which deals in the food supply business are therefore dealing with an inelastic demand. Do take note that the food supply business is not like the F&B sector. Even if all the restaurants and cafeterias in the world close down, humans will not die. Tecon Biology is an agribusiness company with a few business segments, all of which relates to food supply.

Background

Established in 1993 and listed in the Shenzhen stock exchange in 2006, its largest shareholder is the Xinjiang Production and Construction Corps (“XPCC”). The XPCC holds a 22.66% stake in Tecon Biology and is a a state-owned enterprise and paramilitary organization in the Xinjiang Uyghur Autonomous Region of the People’s Republic of China (PRC). The XPCC and other state-owned organisations do not hold a majority shareholdings of over 51%, but Tecon Biology is still effectively a state-owned enterprise with the backing of the Chinese government. Readers of my blog would realise that this is one of my preferred type of companies – backed by government doing a business with inelastic demand.

Conclusion 1: The company is backed by the government.

Conclusion 2: The company deals with an inelastic demand.

Tecon Biology Overview

The company’s website seems to be down and they do not seem to bother to do anything about it. This is not the first Chinese company I have come across with this issue and I am beginning to suspect they are blocking out foreigners. However, we could get the 2024 financial report from other sources. For your convenience, you can download them here. Do note that it is in Chinese though.

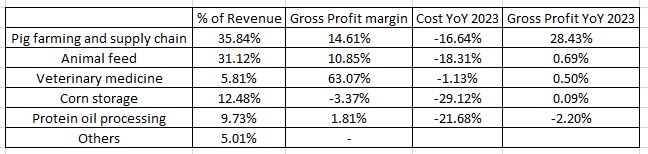

Tecon Biology has 5 main businesses, and their proportion in terms of the whole business are as follows (page 14 and 15 of 2024 financial report):

In 2024, Tecon Biology’s total revenue dropped by 9.72%, but profit actually rose by 144.38% (page 7). This weird accounting is due to a loss in 2023 and a reduction in cost in 2024, which allowed it to flip to a profit in 2024.

One may note that all its business segments actually contributes to other segments. Corn storage and protein oil processing contributes to animal feed, which contributes to pig farming, which requires veterinary medicine, and pig farming actually goes back to protein oil processing. This somewhat closed circuit is actually a very attractive factor for me.

A notable segment would be veterinary medicine, where it has a very high gross profit margin despite contributing to a low percentage in revenue. This means that if this segment of the business grows, it should contribute significantly to the overall business. We will come to that later.

Its 5 biggest customers make up 10.67% of its sales volume, and its 5 biggest supplier takes up only 4.58% of its procurement (page 17), so I would say it is pretty balanced. Neither any customer nor supplier has a chokehold on them.

Conclusion 3: Nobody has any chokehold on the company.

Animal Feed

Based on the clampdown on pig refattening, we can expect demand for animal feed to actually drop. According to All China Federation of Supply and Marketing Cooperatives (中华全国供销合作总社), the country’s animal feed industry has already dropped by 10% in value. Not only that, companies which can produce more than 100,000 tonnes of animal feed per year has dropped by 18 to 1032 companies, with a total production of 61.8% of the country’s supply. There is an increase of 1 company to the list of 34 companies having an annual production capacity of more than 1 million tonnes, and they produce 55.0% of the country’s animal feed. 7 companies has an annual production of more than 10 million tonnes.

Tecon Biology belongs to the category of company with annual production capacity of more than 1 million tonnes, having produced 2,837,973 tonnes in 2024.

This is an inference, but perhaps we can conclude that the business has squeezed out a number of smaller companies, and those few big companies has filled in the gap left behind by the smaller companies, which is why despite a drop in the overall demand, Tecon Biology actually still see a rise in revenue in this segment.

However, do take note that the government clampdown on pig refattening occurs in 2025, and the financial report we have is in 2024. We can expect to see a hit in this business segment.

Pig Farming

This clampdown and push for higher food prices will benefit its pig farming business though, with lesser competition and higher prices. Further details has been discussed in my article on China’s food prices, so I will not repeat that here. Essentially, this major segment of the company will do well. Even the Ministry of Agriculture and Rural Affairs of the People’s Republic of China (中华人民共和国农业农村部) have mentioned that pigs is a major segment of the livestock industry, that stabilising the pig segment will stabilise the whole industry and they have managed to turn around profitability through a series of policies including disease control. Although they have done so, pig prices remain low and they will streamline the process while strengthening the disease control part.

Conclusion 4: Pig prices will go up.

Conclusion 5: Importance given to disease control.

Veterinary Medicine

According to the policy set out by the Ministry of Agriculture and Rural Affairs, the Chinese Veterinary Medical Association (中国兽医协会) has also come out with guidance regarding the immunisation of animals. In fact, in February 2025, they also sent out another circular highligting the importance of stabilising pig production with special emphasis on their immunisation and disease control due to the weightage of pigs in the livestock sector. Do note that this will benefit the pig farming segment too. In short, China is gradually enforcing and ensuring food safety with regards to their livestock. If there is one thing we have learnt so far, it is to never go against the government. Be aligned with the government.

The animal feed and pig farming segments is relatively stable for Tecon Biology, so we will focus more on the veterinary medicine portion, where there is a much higher profit margin and potential for growth.

According to them (page 13) they are among the top few companies in terms of veterinary medicine production and have been pouring much resources into research in this segment. There are 9 research projects (page 18 and 19), most of which are done with the research phase and are just completing the administrative processes. The impact of these research projects range from having a wider range of medicinal offerings to filling the gaps in the market with new vaccines.

In 2024, they invested about 206 million RMB into R&D, a 22.79% drop from the 267 million RMB in 2023. I suspect that it was because they were suffering a loss in 2023. But on the flip side we can say that despite suffering a loss in 2023, they pushed on with their research in 2024 and achieved results.

Conclusion 6: Tecon Biology is actively participating and anticipating the veterinary medicine market in order to eat a larger cake.

China’s Animal Vaccine and Medicine Market

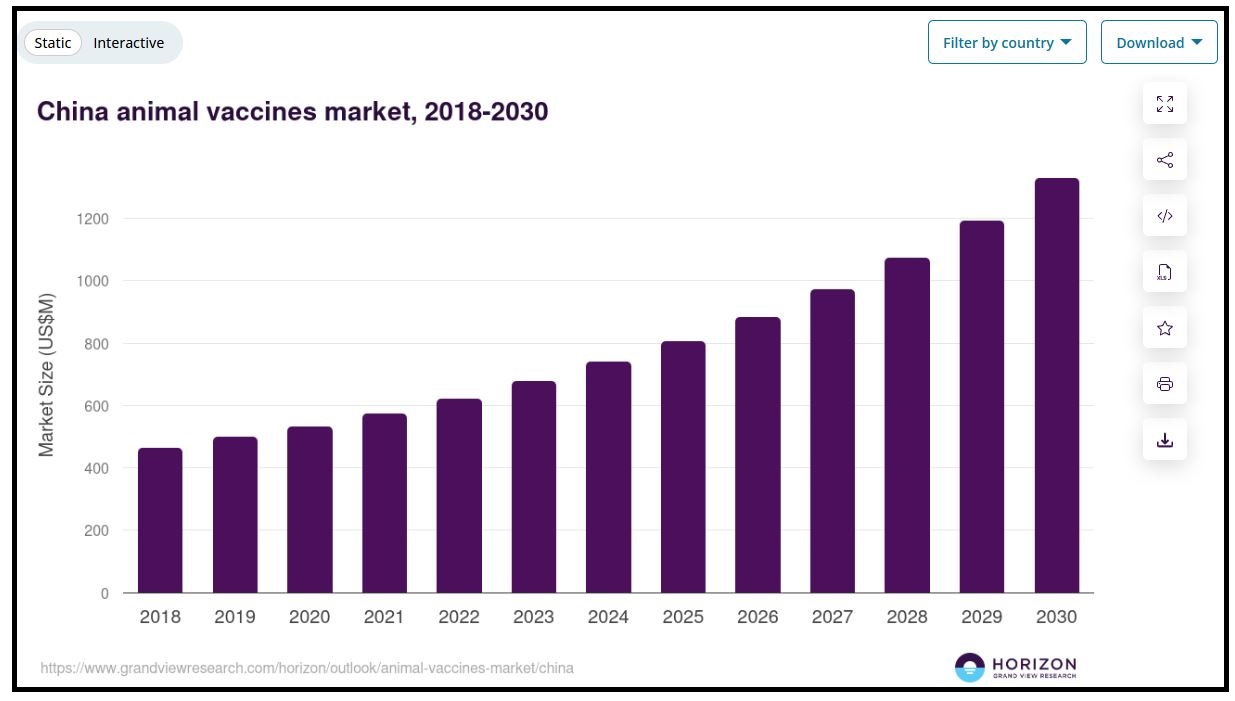

As China pushed down the policies for self-sufficiency as well as food safety, the animal vaccine is expected to grow. Based on historical data from 2018 to 2023, with 2024 as the base year and prediction up till 2030, we should expect the animal vaccine market to grow at approximately 10.5% annually. From the revenue of 739.5 million USD in 2024, we can estimate a market revenue of 1,328.4 million USD by 2030 – a 79.63% increase.

I do not have the detailed breakdown specifically for livestock, but if we zoom out and look at the market as a whole, which includes everything from pets to livestock, vaccines to medicine, we can see an expected 2x increase in market size from 2024 to 2032.

Conclusion 7: The veterinary vaccine and medicine market is expected to expand significantly.

Vietnam’s African Swine Fever

Vietnam has seen a severe outbreak of the African Swine Fever (“ASF”). In mid-July, there were 514 outbreaks, but today there are about 972 outbreaks. Total infected pigs has risen from 30,000 to more than 100,000. In 2018-2019, China had also suffered from the ASF, where half their pigs were infected, causing a $100 billion loss. Hence, China is quite concern about the outbreak in Vietnam and are taking preventing measures.

There is no indication that Tecon Biology exports their products overseas, and Vietnam does not seem to be a major import or export partner for China in terms of pork. Hence we can deduce a conclusion that Vietnam’s ASF should not have much impact on China’s pork prices.

However, the ASF definitely presents opportunities to the company in terms of their veterinary medicine. The worry of a spillover from their neighbour would push China to be more careful. This will be a short term boost to the Chinese market. I do not see any contribution to the long term impact despite what others may say.

The Mathematics

We crunch some numbers.

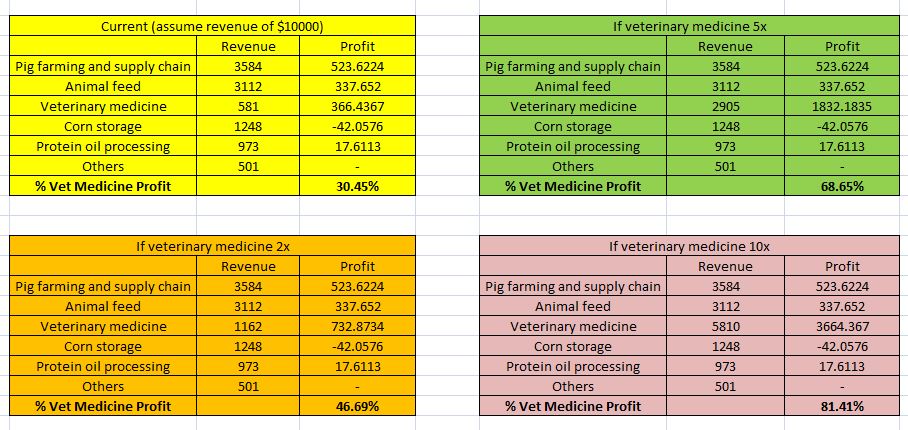

From the very first picture of this post we have the revenue contribution of each business segment and their profit margin. From there we can work out the contribution of gross profit for each segment. Assuming a revenue of $10,000 for easy calculation, we can see that the veterinary medicine aspect contributes 30.45% of profit. If we assume again that everything else remains the same but that the vet medicine segment expands 2x (orange), the profit it contributes becomes 46.69%. If it is 5x (green) it will be 68.65% and if 10x (pink), it will be 81.41%.

This market is aggressively expanding and Tecon Biology, being a significant player in the industry, is doing what it can to eat a larger slice of the cake.

Conclusion 7: The mathematics looks good.

The Finances

One thing that caught my eyes is the cutting down of cost. Cost cutting YoY 2023 is quite significant for most business segments except for veterinary medicine. This is something noteworthy.

P/B ratio: 1.23

P/E ratio: 12.52

Net asset value per share: 5.22

Cashflow: From -528 million RMB in 2023 to +281 million in 2024 RMB in 2024.

Assets: Increased from 6.4 billion RMB in 2023 to 7.0 billion RMB in 2024.

Conclusion 8: Strong finances.

Conclusion

I have bought the shares with entry price of 6.50 RMB per share and will continue to average down if prices go down. I am confident in this company.

This is not financial advice. Readers are advised to do their own due diligence and form their assessment before making any investments appropriate for their circumstances.

Showing 1 - 3 out of 3

Page 1 out of 1

| - | Shop Products | Price | |

|---|---|---|---|

|

|

$99,999.00

|

||

|

|

$1.00

|

||

|

|

Price range: $69.00 through $99.00

|