Squid Game, an immensely popular Korean drama on Netflix that talks about a bunch of people playing a survival game, where the last man (or woman) standing would be awarded an insanely huge sum of money. With the recent rise and popularity of meme tokens, the Squid Game token (SQUID) was also pushed out to great popularity. Like other gaming tokens, SQUID is the currency required to play the specific game it was created for.

Based on CoinMarketCap, it started with a value of 0.01236 USD per coin on 26 October 2021, before steadily and subsequently exponentially rising to an all time high of 2856.65 USD per coin on 1 November 2021. By 2 November 2021, it was as good as dead. The coin became worthless, the links to the website became dead, the developers announced they are not going to do anything about the project anymore.

Basically, all the investors got scammed. In this particular case, the developers of SQUID churned out the coins, sold it to people for money, prevented them from cashing out, and ran away with all the investors’ money.

Among the crypto coins, there is a category called meme coins. Meme coins are basically shitcoins. They serve no proper function and are created as a joke. Dogecoin was the first of its kind, created by its founders as a joke to poke fun at the wild speculations surrounding crypto currency. However, as we all know it, it became popular and as of now lies in the top 10 coins. Some time after Dogecoin became popular, the Shiba Inu coin was later created as an alternative to Dogecoin. That being said, Dogecoin and Shiba Inu in the top 10 coins does not make it any less of a shitcoin. Just like how GME pumping up does not make it any better of a stock.

Why do people jump into such shitcoins? For one, it is the potential explosive growth that rewards its early investors. When nobody believed in Dogecoin, the early investors bought and those who hodl were rewarded with many times their initial investment. When Shiba Inu came out, there were also doubts surrounding it. Some bought, and many others treated it as a trash which tried to imitate the success of Dogecoin. Yet, “history” tells us that those who got in early were again rewarded.

Note: Hodl is intentionally spelt that way. It is a term used in the crypto world for just holding on to a particular coin.

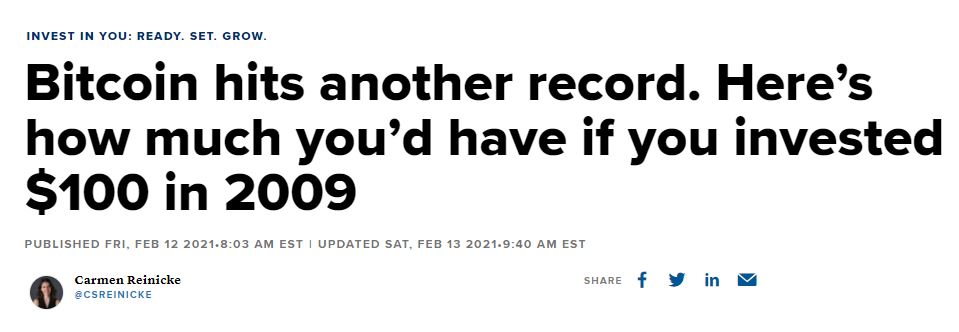

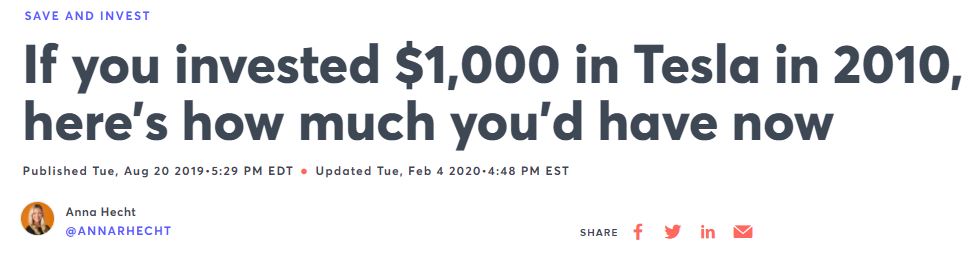

Stupid news articles like the following did nothing to help at all:

That is all easy to say. But in 2009, who would believe in Bitcoin? In 2010, who would have heard of Tesla? There are so many companies sprouting out everyday. There are so many innovation concepts that sounds great that are being proposed everywhere. Yet out of 100 or maybe even 1000, only 1 will succeed. The rest will fail. If today someone told you that a particular genius operating from his garage in the mountains of China is building up a spaceship that will get you to Mars in 10 hours, will you believe him? Will you put your money in with him? No, in all probability, you will not. Because the concept sounds so ridiculous, at least for our times. Who are the backing? How long will it take? Will it be practical? These are all practical questions. Yet, this same questions applied in 2009 and 2010 for Bitcoin and Tesla. Bitcoin will replace gold? Tesla will upset the oil industry? Are you serious? What are they in the first place? It is only now when they have succeeded, that this sort of trash articles came out.

Articles like that, in addition to the historical records of shitcoins like Dogecoin and Shiba Inu, spurred people on to take unnecessary risks. I go in now, I will hodl and be rich within the next 2 years. In their greed or quest for a better financial future, people forgot the risks that come with it.

Anybody can launch a crypto coin. Yet before they can be listed on centralised exchanges like Binance or OKEx, they will have to meet certain standards and screenings first before the exchanges allow them to be listed. That is not to say there are no shitcoins in exchanges. At least the chances of the development team suddenly disappearing with all your money is reduced significantly. New crypto coins are usually available for sale via decentralised networks, such as PancakeSwap. By the time the centralised exchanges list them on their sites, usually these crypto coins would already have multiplied a few times.

The reasons why I suspect that SQUID was so popular when it first started was because:

1. The coin itself was riding on a very popular drama which many of us knows.

2. The hype of crypto was great recently.

3. Meme coins and shitcoins have proven themselves to pay out great (they conveniently neglected so many others which failed).

4. Articles mentioned above are stoking people’s FOMO (fear of missing out) emotions.

5. People are just desperate to earn some quick dollars (the economies are not doing well and the Governments are not doing anything besides printing money and making everything more expensive).

This again brings all of us back to reality. There are risks in investments. The higher the risks, the higher the potential gains and losses. Just like you could earn 100% in a matter of minutes, hours, or days, the reverse can also happen. What if Tesla failed because of the big hands in the oil industry? What if people said Facebook was just a cheapskate imitation of the original Friendster? What if Bitcoin was just a first generation prototype which failed, but provided the inspiration and technology for those that followed after?

There are many what-ifs. So do your homework before investing or trading, and do not let stupid articles which premises are based on the power of hindsight affect you. Afterall, on hindsight, who isn’t a genius with 100% accuracy? Of course, there are the very early educated adopters who know what they are doing. They may have researched well, and believed in the product or company, and staked their money into which they believed. They are rewarded and they deserved it. Yet there are also many others who do the same and failed, and even more who do not know what they are doing.

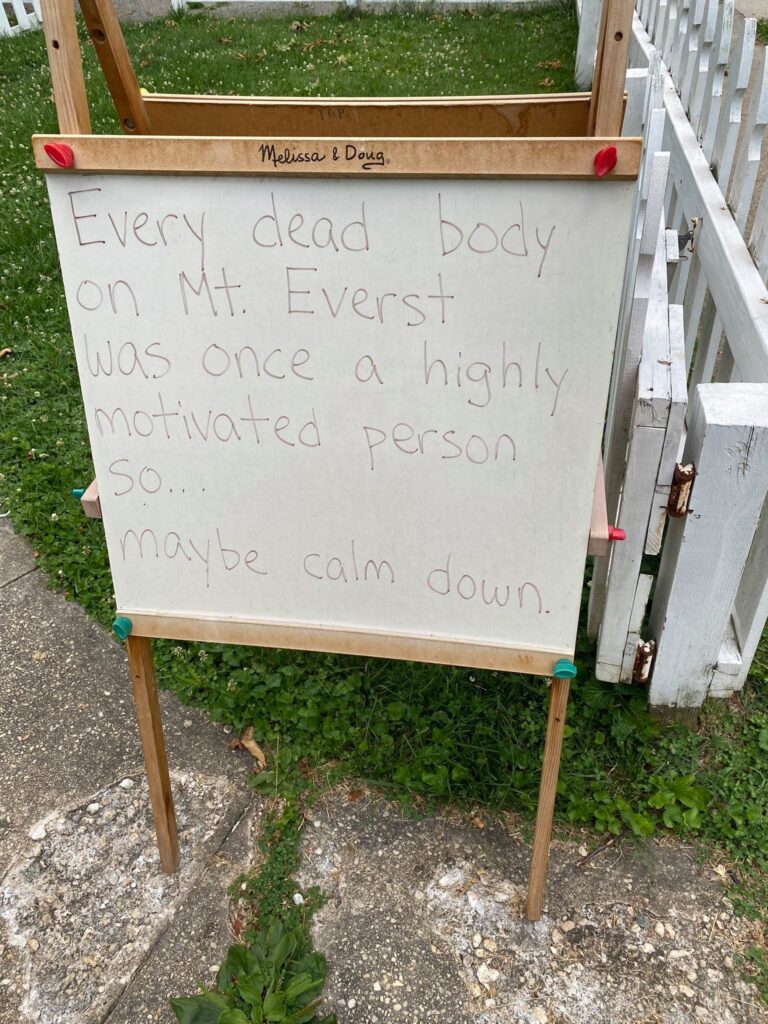

Calm down. Do your homework. Think logically. Put in the spare cash which you have no need for now. Know your risk and be prepared to lose. And finally, be patient. There are no easy money. Sure there are people who struck the jackpot. There are always people who struck the lottery, but do not bet that you will be one of them.

For those of us not destined to have that much luck shining down on us, make it up with your brains, effort, discipline and sacrifice.

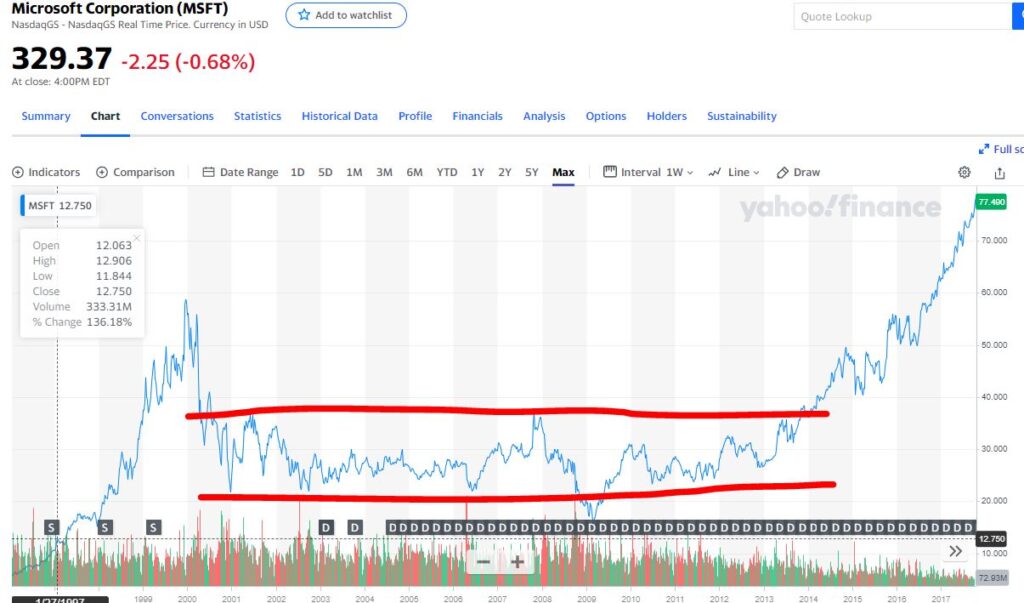

Just as a side note: Even Microsoft had traded sideways for about 15 years. 17 years later in 2017, it finally broke its last high in 2000. Imagine you are an investor, and for these 15 or 20 years you watch your stock not going anywhere, and all these time inflation is eating away at your money. I guess I do not need to explain the legitimacy and financial strength of Microsoft, but remember this case when you trade.

Showing 1 - 3 out of 3

Page 1 out of 1

| - | Shop Products | Price | |

|---|---|---|---|

|

|

$99,999.00

|

||

|

|

$1.00

|

||

|

|

Price range: $69.00 through $99.00

|