Taxes, something which all of us have to pay one way or another. From the Goods and Service Tax (GST) or Value-Added Tax (VAT), from personal income tax to corporate tax, how much we pay depends on how much we spend and earn. Yet taxes is something we would want to cut down as much as possible, because they take out a cut of our earnings. The taxes imposed can range from the low side in non-welfare states to the high side in welfare states.

We have talked about the bigger pictures of politics and economics in the past few articles. Today we will talk about some down-to-earth applications which some of us can use. Afterall, knowing the bigger picture allows us to make long term planning, but having the down-to-earth information allows us to act on a more immediate basis.

The method talked about in today’s article has a few conditions to meet:

- Applies more to people living and working in countries without forced savings, but are under heavy taxes to fund the pension or welfare scheme of the country, such as in Nordic countries or countries like Australia and New Zealand.

- Not applicable for countries which have forced savings like the Central Provident Fund (CPF) in Singapore or the Employees Provident Fund (EPF) in Malaysia.

- Not suitable for people whose employers prohibits them from having a side business, such as those in the public service.

- Applicable for freelancers, regardless of your country of work.

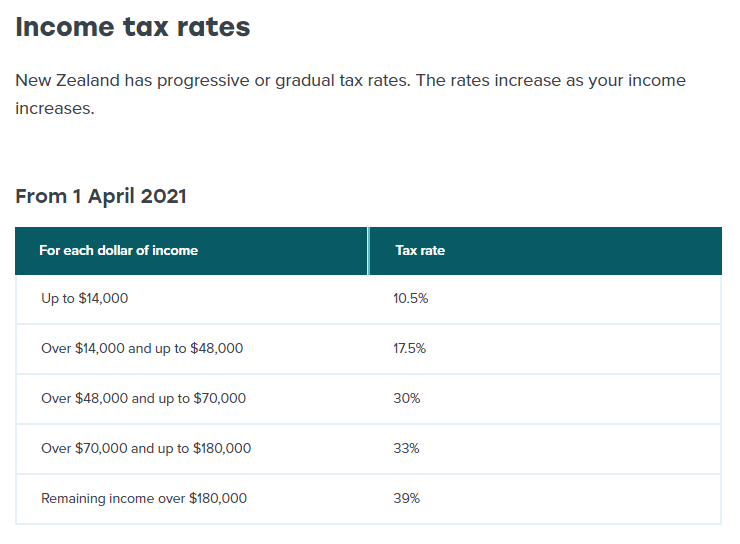

The basic idea of paying for lesser tax is to earn less, at least on paper. Let us assume you are earning a good income of $120,000 per year including bonus in New Zealand. Based on the tax rate in New Zealand, you will need to pay $120,000 x 0.33 = $39,600 in taxes.

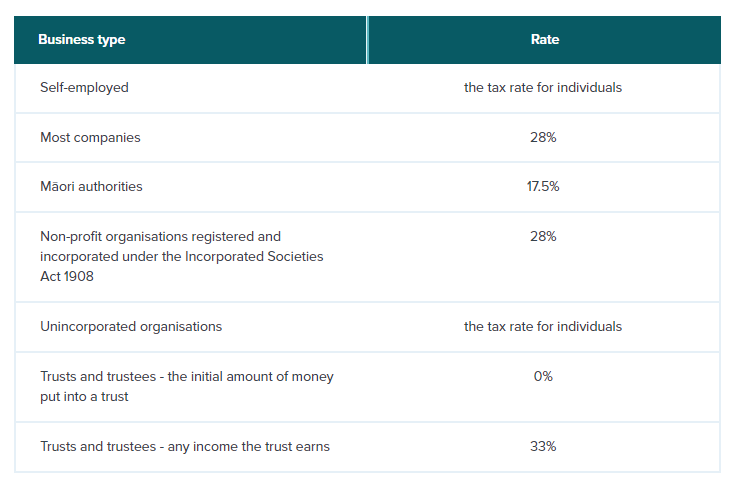

Now let us look at the corporate tax in New Zealand, which we will take it to be at 28%.

When Working In A Small And Medium-Sized Enterprise (SME)

If you are working in an SME, you can negotiate with your employer that rather than paying the salary to your individual’s bank account, they can pay to your company’s account. It is not difficult to register for a business in many countries, and you can easily set up a one-man company consisting of only yourself. In reality, you are an employee working for a company, but on paper you are a company providing services to another company.

You still get paid the same amount, ie $120,000 a year in our example. But now as a company, you are taxed only on your profits. Expenses incurred for running operations can be deductible from your revenue. We can now run it this way:

- Annual Revenue: $120,000

- Yearly housing rental for staff: $200 per week x 52 weeks=$10,400

- Yearly transport claim by staff: $5000

- Yearly food claim by staff: $10 per day x 365 days = $3650

- Yearly insurance for staff: $3000

- Overseas work trip including hotel and air ticket: $10,000

- Equipment renewal for company (eg computer, printer): $3000

- Petty cash: $3000

- Annual salary for director (which is you): $25,000

- (Add on your other expenses)

From this we can see that the above claims are basically just your daily living expenses. But if you are running a company, all these can be claimed as operating expenses, which will then reduce the taxable income. In the above example after deducting everything, your company will have a profit of $56,950. Pretty sure you have other claimable expenses which could reduce the profits to $40,000.

Now you have a company profit of $40,000 per year and individual salary of $25,000 paid to yourself by your own company. Based on the tax rate above you will need to pay a corporate tax of $40,000 x 0.28 and individual income tax of $25,000 x 0.175 = $11,200 + $4375 = $15,575

Remember that originally we calculated an individual tax rate of $39,600 for the same income of $120,000 earned. But with this new company, you can easily save $24,025 per year. This is especially useful if you are earning quite a high income but live in an especially highly taxed country. Now some readers may realised one missing aspect in this: GST. Companies doing transactions have to pay for GST or VAT to the Government. While GST have to be charged for goods and service provided, companies can also claim back GST for goods and services procured. Furthermore, in certain countries like Singapore, if your annual turnover is less than 1 million, there is no need to register for GST submissions. After all is worked out, you will still be better off in terms of taxes paid.

But do take note not to be too greedy and manipulate the numbers too much. It is one thing to be smart and find a loophole in the system, it is another to be greedy and outright flout the law. Do it too overboard and the taxman will come after you. Do also remember to keep all receipts and invoices for your expenditure though. At least scan the hardcopies and keep a digital copy for future audits.

If Working In A Big Company

What about the rest of us who work in big companies, where the HR has no time to negotiate nor entertain our request? Among the business models which you can register, there is the sole proprietorship model. I personally prefer a private limited company due to its limited liability, but a sole proprietorship is also sufficient if you are just providing services to a company and collecting a salary.

The good thing about sole proprietorship is that the business is under your name, and you can also open a business or corporate bank account. Using your business bank account, in which the recipient is your name instead of a company name, submitting the bank details up to your company’s HR for salary payment should not have any issues. Of course you can also do that while working in an SME should your HR is not someone easy to talk to.

The way each company in different countries operate is different, so you might have to check out your individual situation and circumstances yourself.

If Working As A Freelancer

If you are working as a freelancer, ie a self-employed person, then you can use this everywhere, regardless of whether the country has the forced savings system such as the CPF or EPF, because all the contribution to the CPF or EPF comes from your own pocket. As a freelancer, you have no employer contribution (more about it in the next section), so with this system of cutting taxes, you can be squared off just a bit with those normal salaryman who has company benefits as well as employer contribution towards the CPF or EPF.

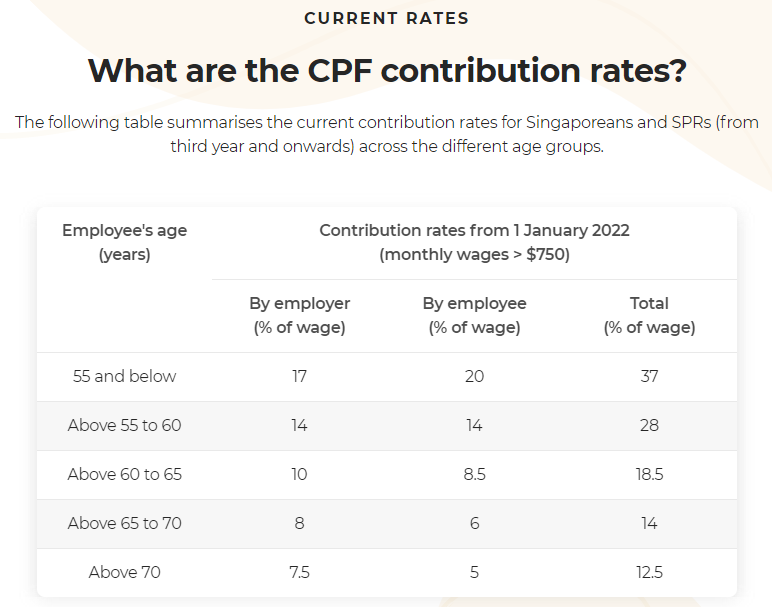

Why It Is Not Suitable For Normal Employees In Countries With Forced Savings

Countries like Singapore and Malaysia require that their employees cough out a part of their income to the state managed savings fund. The percentage is 20% and 9% for employees in Singapore and Malaysia respectively. But in exchange, the employers will also contribute 17% and 12% respectively.

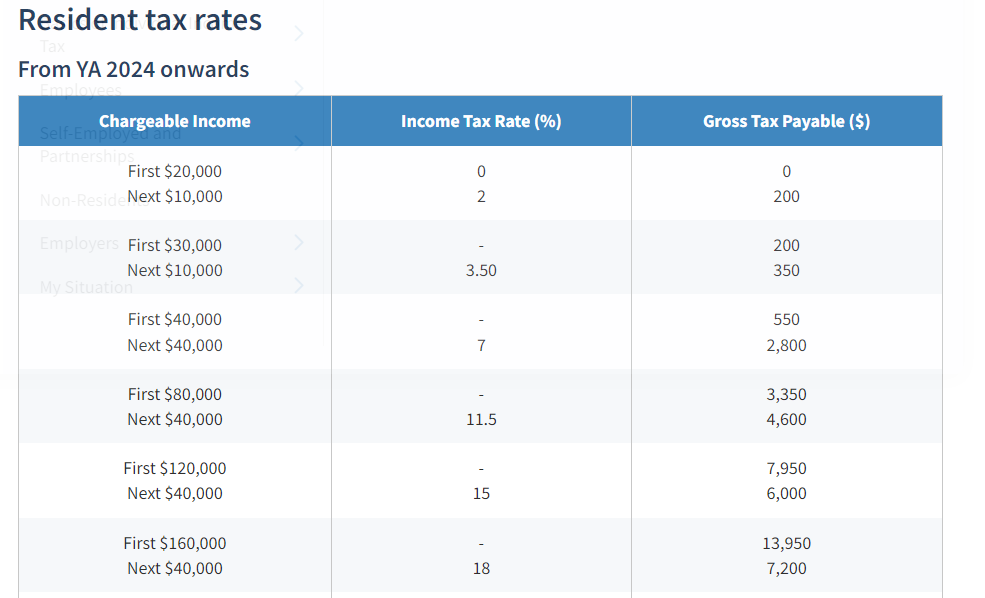

This contribution is actually also tax-deductible. Let us use the $120,000 annual salary example again, this time using Singapore as a reference. Out of the $120,000 you earned, 20% goes into your CPF, making your chargeable income to be $120,000 x 0.8 = $96,000.

If your income is $96,000, you will need to pay $3350 + $16,000 x 0.115 = $3350 + $1840 = $5190. In return for paying this amount of tax, your employer will also need to contribute $120,000 x 0.17 = $20,400 into your CPF. Using the same method of calculation, you can also work out the figures tailored to your own individual country. But in summary, where there is such a system in your country, the method of setting up a company for tax savings will not be applicable.

Tax takes out a significant amount of income out of our finances. In fact, I am of the opinion that CPF is a form of tax, but I do not think I will go into this topic unless specifically requested, because it touches on sensitive topics. If you manage to save a significant portion on tax, you will be able to hold on to a greater portion of the money which you have earned.

No system is perfect. In every system there is a loophole. Once a loophole is exploited enough, the Government will take notice of it and introduce new policies to patch the loophole. Perhaps before this loophole is patched in your country, try it out.

Showing 1 - 3 out of 3

Page 1 out of 1

| - | Shop Products | Price | |

|---|---|---|---|

|

|

$99,999.00

|

||

|

|

$1.00

|

||

|

|

Price range: $69.00 through $99.00

|