Readers of my blog would know recently I invested in Fu Shou Yuan (01448), and even more recently added more shares when the share price dropped. I missed my third batch of entry before the ex-dividend date on 7 April 2025 by 1 cent, much to my dismay but I decided not to FOMO and chase. Fortunately, the market crashed and I managed to get my third batch at a far lower price.

When investing in a stock, we are investing in the company, putting our money in a company which we believe will do well. There are many categories for business, and one of the classification guidelines I always use when buying stocks are separating companies with elastic demand and those with inelastic demand. Fu Shou Yuan is a funeral service provider, which speaks volumes about its demand inelasticity.

Background

The funeral industry can be categorised into 4 main parts: funeral services, disposal of remains, cemetery services, and other funeral product sales and services. The Chinese government generally has the biggest market share, but few private companies has their hands dipped into the cake as well. Fu Shou Yuan is one of them, and the largest among all the private funeral services provider. Founded in 1994 and listed on the Hong Kong stock exchange in 2013, Fu Shou Yuan has its ups and lows, but overall the shares are not really rising in price, as shown in the yearly chart below.

We will come back to the share price again later.

The Growing Industry

The aging population of China has been growing over the years. The first question some people may ask is, China has been around for so many years, why only now is aging population a concern? Aging population is often measured in terms of percentage of the overall population, and with their famous one child policy, their total population is in a decline. While many other countries do not have extreme measures of birth control, their natural drop in fertility rate also reduces the total population over time. Sharper people will realise that hence for many countries, while the percentage of old people increase with regards to the total population, does not mean the absolute number of people dying will increase. But China is an exception.

Before I go into further explanation, let us look at some charts.

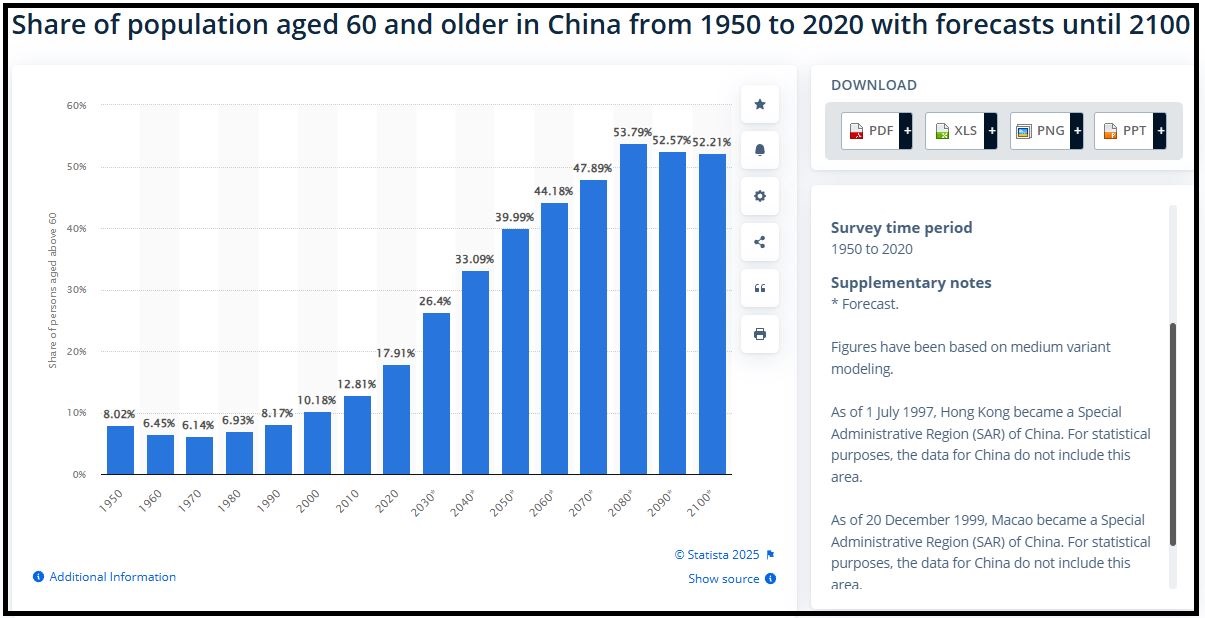

First, we can see from the chart that indeed, the percentage of old people in China has been increasing and will continue to increase over the years, with its forecasted peak at around 2080.

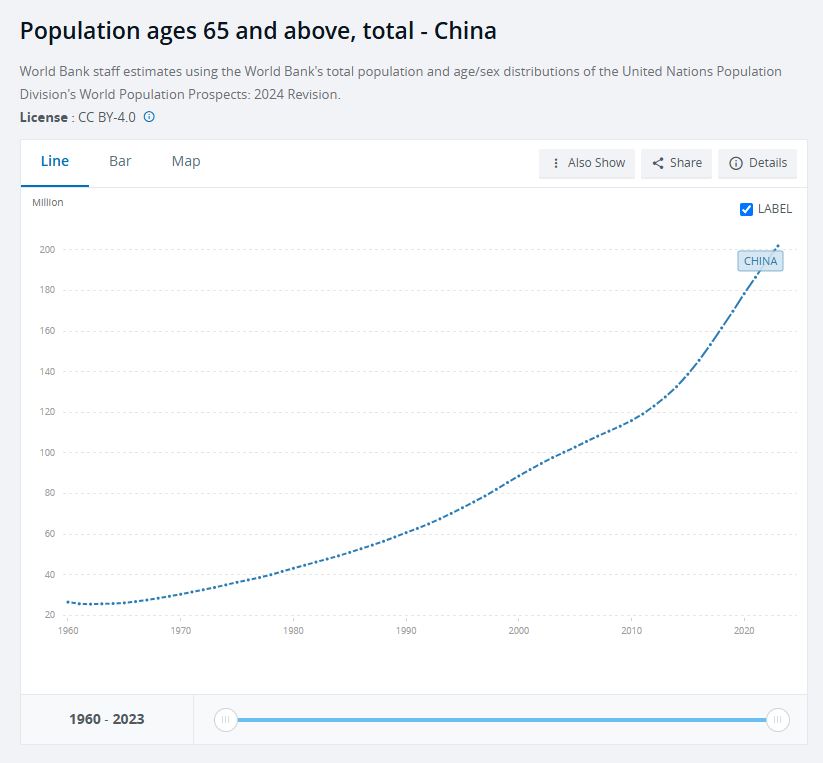

But when we look at World Bank statistics, we realised not only is the percentage of old people increasing, the absolute number of elderly is also going up. The World Health Organisation has also predicted that the number of old people will increase from 254 million in 2019 to 402 million in 2040.

Most will be understandably confused if they do not understand the history of China, on how the aging population can increase in both percentage and absolute numbers with such force. China fought in the World War 2 from 1937 to 1945, during which millions died. After WW2, China went back into civil war between the Kuomintang and the Chinese Communist Party. The civil war started before WW2, and a temporary truce was called as they united to fight against the Japanese. However, as soon as WW2 ended, they went back at each other’s throats again, with many more people dying.

Peace came in 1949, but China took part in the Korean War (1950-1953, 174, 598 dead), Great Leap Foward (1958-1962, approximately 30 million dead) and Cultural Revolution (1966-1976, approximately 1-2 million deaths). Peace was not so peaceful in those days afterall, and we can see that the population after that are relatively young as people continued to give birth. In fact the one-child policy in 1979 proved that despite so many deaths earlier, there were too many babies being born and the government had to step in to control the population.

The babies and young people of the 1950s, 1960s and 1970s are growing older now. This background can explain why China has this weird situation of aging population both in percentage and in absolute numbers.

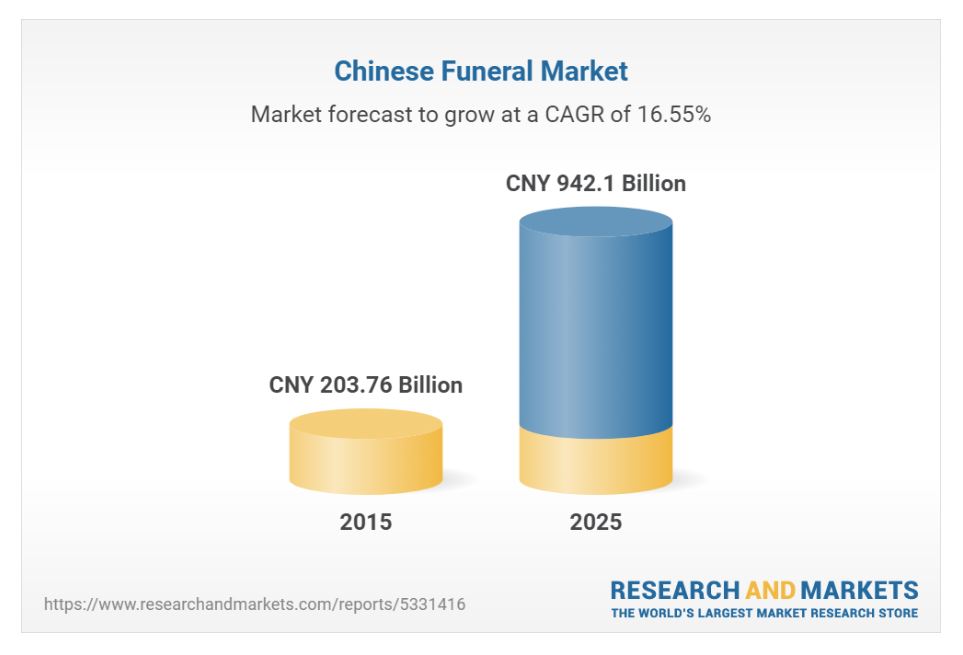

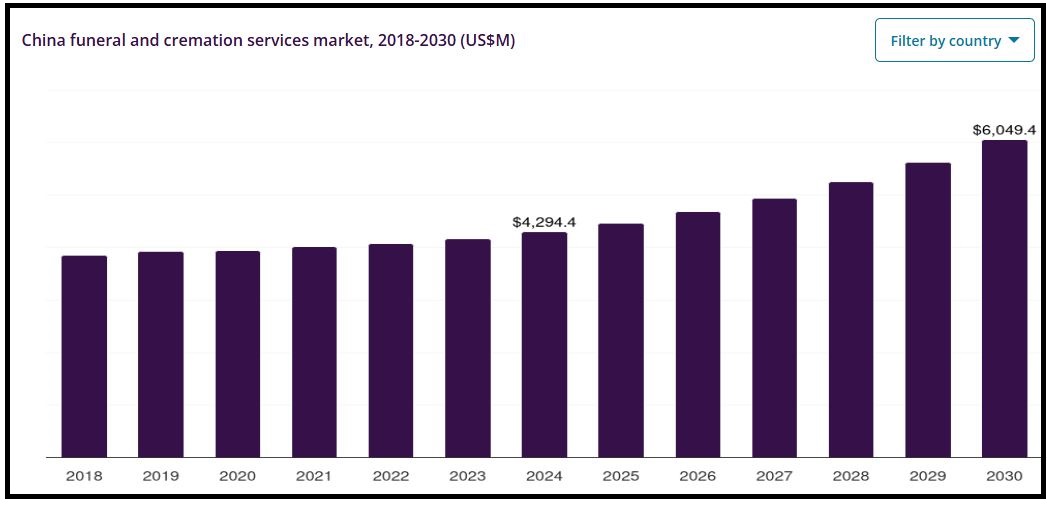

But how much profit will that translate to? Different research yield different numbers, but all of them are aligned in one aspect: the money in this sector has been growing and will definitely go up further in the future.

The Company’s Financials

Now that we know the industry will be profitable in the future, what about the company itself? From their 2024 financial report (page 42 and 43), we see that they have the following:

- 2056.6 million RMB in bank balances and cash, 188.4 million RMB in time deposits, 589.2 millon RMB in unlisted cash management products.

- No outstanding bank borrowings.

- Gearing ratio = total debt / total equity = 0.5%.

- Current available burial plots: 2.83 million sqm (page 45 of 2024 financial report) – equivalent to decades (anywhere from 20 to 60 years of inventory).

Financials stated that they have a lot of cash and inventories to buffer for crisis. They have also stated that the cash is meant for future expansion plans (although no immediate plans for now), which means they are likely to get bigger next time. Very little debt + a lot of cash + a lot of inventories (+ high inelastic demand) = very safe company.

The Customer Base

What about the customer base which Fu Shou Yuan serves?

We do not have the latest statistics, but older data in 2012 stated that the top 5 funeral services company in China takes up only 3.2% of the total market share, of which Fu Shou Yuan alone covers 1%. Do note that in China the default go-to for funeral services is the government. Fu Shou Yuan is the largest private funeral services company in China. According to unverified sources of data, Fu Shou Yuan’s market share is 2% now.

Fu Shou Yuan caters for people who requires a better service in this aspect, as people who requires standard services will go to government organisations. However, while people used to think they cater to the rich, I am more inclined to believe that Fu Shou Yuan actually caters more to the upper middle class. Let us look at some statistics and do some inferences. Again from their own financial report, we have the following:

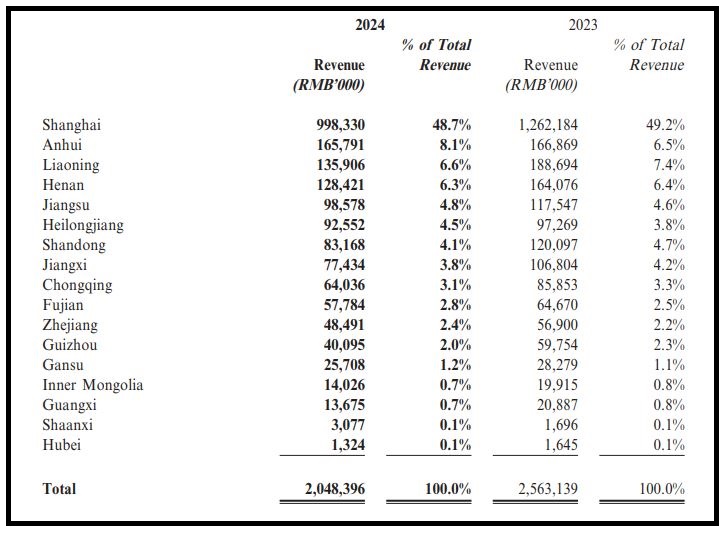

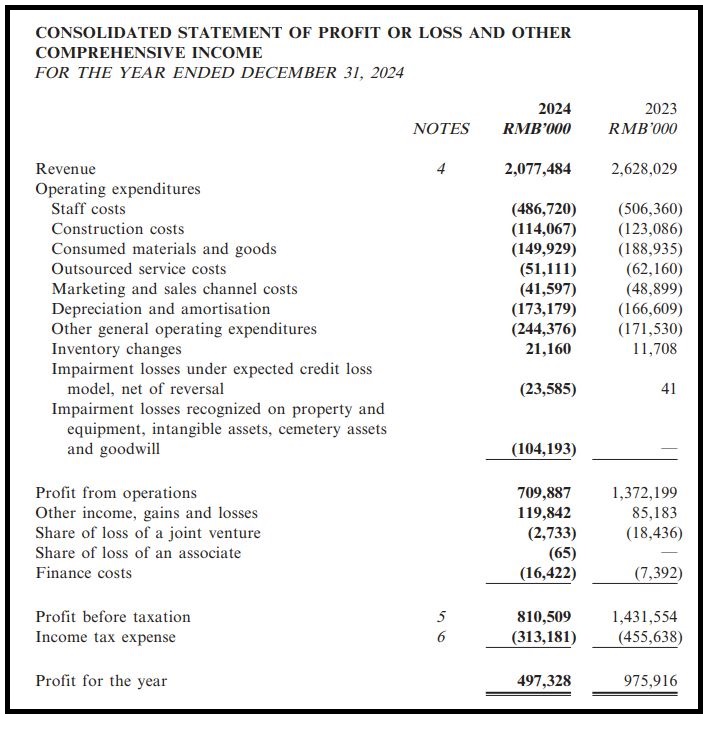

Fu Shou Yuan’s main revenue comes from Shanghai, their financial centre and where the rich are congregated. Of course there are rich people everywhere (Guangdong, Shenzhen, Beijing, Shanghai), but Shanghai outranks them all. Secondly we can see that revenue dropped significantly from 2023 to 2024, and profits dropped from 975.9 million RMB to 497.3 million RMB. Do note that 2024 is a very difficult year for many. The Chinese housing bubble crashed in 2022, and by 2023 and 2024 everyone was complaining it was a difficult time.

This is just my inference: the drop in revenue in 2024 suggests that a very significant portion of Fu Shou Yuan’s customers were the upper middle class who lasted 2023 but could not tank anymore by 2024. The poor would definitely use government services, and the rich will not be impacted by an economic slowdown to this extent. We can infer this: This group of affected people are the portion of middle class who have good jobs and good income during good times, and they are likely to be the type to spend on fanciful condominiums and big cars. We see this group of people in every society and they make up a very significant portion.

Middle Class Spending Power

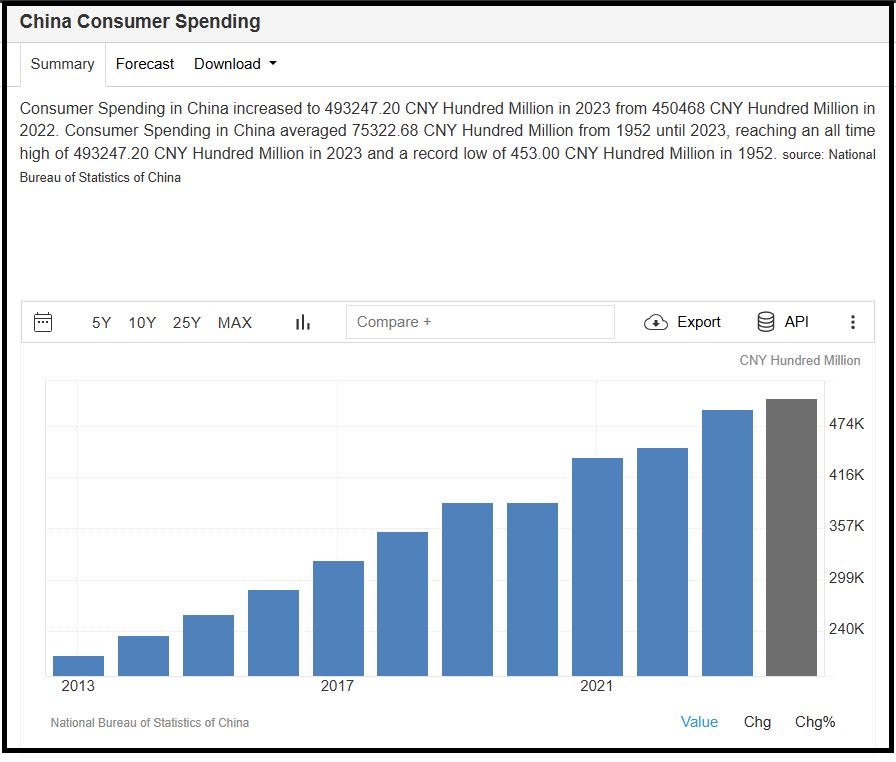

China’s total consumer spending in 2024 was 5.06 trillion RMB, and we can see it growing over the years despite economic hardships.

I do not have the raw statistics to show (sometimes statistics regarding China is difficult to get), so we will again do some inference which we can observe from our own societies.

- The middle class makes up the bulk of the population.

- As a whole, the middle class spends the most.

We will skip the bottom class. They have no spending power.

For the upper class, even if you are very rich, you can only spend so much. You will buy maybe 1 mobile phone, 2 or 3 at most. You will still buy 1 car, maybe 2 or 3 at most. Generally, the same goes for other goods. However, if you have 10 middle class people, they will buy 10 phones or 10 cars as a whole. The same logic applies to graves and burial plots. The middle class is where the money is. Although I said earlier that Fu Shou Yuan probably caters to upper middle class and the upper class, but lower middle class everywhere will always strive to reach the upper middle class. Hence it makes sense to consider the middle class as a whole in terms of population and spending power.

It is true that the economy is bad now, and that affects the middle class significantly. But as with most economies, it will recover. This is part of the economic cycle and given China’s current strength, recovering from an economic downturn is simply a matter of time. It will not end up like Zimbabwe or Venezuela.

Payments

In addition to buying the burial plots, customers are to pay in advance the burial plot maintenance fees. Maintenance contracts are fron 10 to 20 years, and such fees are paid in lump sum together with the purchase of their burial services (page 16 of financial report). I do not have data on how much is the maintenance fees, but it will not be surprising to know there are different tiers to it. What is most important to note is that they collect payments in advance from 10 to 20 years. Money is inflationary, and money today is more valuable than money tomorrow. And that is why if they can collect such money way in advance, they earn more than what it appears.

The Dividends

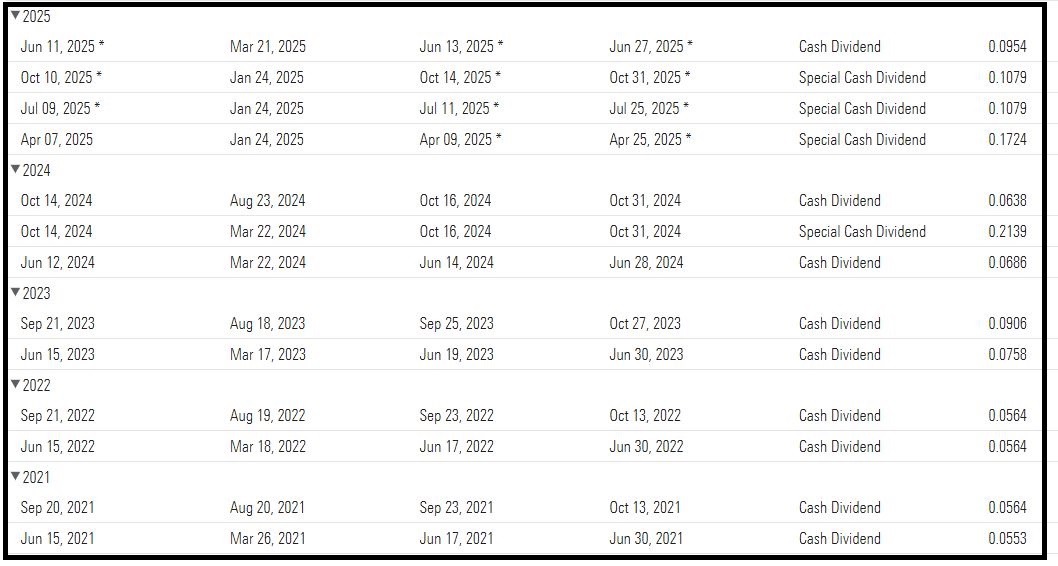

I invest in Fu Shou Yuan not because I expect its prices to shoot up in the future. I do not expect a Tesla or Nvidia style capital gain. Rather, you can consider Fu Shou Yuan to be in the rental business. Instead of renting properties to living people, they rent graves and burial plots to the dead. So it is better to consider them like a REIT or property company. In this case, the dividend yield is where we should focus on.

Over the past few years, Fu Shou Yuan has increased the amount of dividends distributed out to their investors, with 2025 being the biggest so far. While the company has some questionable attempts at innovation such as their AI modelling of the dead, the nature of this business is generally unchanging. Humans have been burying or cremating the dead for thousands of years, and there is little change to how things are done over the centuries, save for making things more fanciful. With such a strong financial backing and growing population, we can very bluntly yet confidently say, even if the management is not the best, even if they do nothing but sit on their stockpile, as long as they do not do something too far off the bat, the profits will still come in consistently. The management can lie flat all they want and try out all their lame attempts at innovation, as long as they do not make stupid critical decisions the money will still come rolling in.

Note: there have been criticisms about the incompetency of their management, which investors will have to take note.

The Dividend Mathematics

Some say the reason why Fu Shou Yuan distributes so much dividends is to attract people to invest in their ever-falling stock. But I will say that is just investors being paranoid. Covid period saw their share price hitting all time high, and after that stock prices went down simply because of macro-economic conditions – Covid crippled the economy, and the government made a bad decision to pop the housing bubble then. But China will recover, and when they do so, I am confident the share price will go up again.

But let us assume that the share price do not go up. At the time of declaration (24 January 2025), their share price was 3.88 HKD, which went up to 4.34 HKD before dropping to about 3.45 HKD at the point of writing. Considering the total dividends this year (0.1724 + 0.1079 + 0.1079 + 0.0954 = 0.4836) / share price at time of declaration (3.88) = 12.46% dividend yield, this is by far one of the highest yield in the market all around the world. At my current average price, I have a 10.9% yield (was 11.9% but my third batch of stocks missed the first dividend payout). But let us be slightly more conservative and drop the figures to 8% instead. At 8% yield, assuming the price do not move upwards anymore, all you need is 13 years to earn back all your investment money, making your shares free (100% profits).

If you are confident enough to continue investing when the price drops, not only can you average down your cost, your yield will be higher in terms of percentage when the price rebounds back up. For example, at $3 you buy 10,000 shares for a total of $30,000. The company declares a dividend of 5% yield, making it 0.05 x $3 per share x 10,000 shares = $1,500. The share price now shoots up to $6. The company again declares a dividend of 5% yield, maing it 0.05 x $6 per share x 10,000 shares which you are still holding = $3,000. But do not forget your shares were bought at $3, effectively making your dividend yield 10%.

Fu Shou Yuan is a high dividend paying company, and I intend to load up more if the share price continues to drop. Because if it goes up, my dividend yield will be high, and in a couple of years I can make recoup everything I invested, making my stock holdings free of charge and every dividend after that pure profits. Although I do not expect a AMD level capital gain, but I still expect its share price to go up + a good dividend yield = a combo of healthy capital gains + regular dividend yield.

Conclusion

Again, this is not financial advice, but the homework which I have done and which I am sharing with my readers. I am buying Fu Shou Yuan as it dips because it is a solid company with an inelastic demand, a good business model and a good dividend yield. I have confidence that it will rebound back up once the economy recovers.

Readers are advised to do their own research and due diligence before buying any stocks and not just blindly take what I say without further consideration.

Showing 1 - 3 out of 3

Page 1 out of 1

| - | Shop Products | Price | |

|---|---|---|---|

|

|

$99,999.00

|

||

|

|

$1.00

|

||

|

|

Price range: $69.00 through $99.00

|

Do you have any updates on the recent, profit warnings?

They have not released the financial accounting yet. But from their statement we have 3 reasons: bad economy, increased taxes and impairment of goodwill assets. I have explained the bad economy above, so it is within expectations. China’s economy is turning for the better now, and although it is still bad now we can expect improvements. Nothing much we can do about taxes. Goodwill assets are intangible assets, and the impairment would be mostly just accounting adjustment instead of concrete losses.

That being said, the financial accounting has not been released, so we do not know how much of each contributed to the overall losses. Personally, I added more shares and am just holding on long term for the dividends and for the economy to turn better. This is not financial advice though.

Compared to the profit warning issued in March 2025, the only notable difference is the omission of “a decrease in the Group’s core business revenue.” We’ll have to wait for the financial statements in the coming weeks for a clearer picture.

Also, do you think shifting consumer attitudes toward funerals could have contributed to this decline? Last year, I visited Fu Shou Yuan in Shanghai to get a firsthand look and spoke with an analyst. Her view was that Fu Shou Yuan primarily serves high-end clients, making them less susceptible to changing consumer trends. What are your thoughts on this?

This is the link to the shift in consumer preference:

https://www.theborneopost.com/2025/04/07/captain-of-sea-burial-ship-charts-chinas-changing-attitude-to-funerals/

Happy NDP! From your fellow countryman

Yes indeed there is a trend in shifting consumer attitudes. This is just my speculation, but I believe this long lasting tradition is just like religion. Despite advancement in education, shifting attitudes in people over the years, religion still hold an important place for many. Though many shift away from traditional funeral services, but there is still a big market for it. Fu Shou Yuan captures only 2% of the funeral market in China, with most going for government provided services, so there is definitely enough cake to eat.

Secondly, from what I gather about the Chinese, the richer you are, the more ‘face’ you want and need to have. Giving passing members in the family a proper and grand funeral becomes more important as you get richer.

Lastly, I inferred that a significant portion of their customers is actually upper middle class. In the latest report, they also said that the drop in revenue is due to economic headwinds. Only the middle and lower class are affected by it, and I believe that my inference should be correct. If I am correct (which I hope I am), then once China’s economy pick up, the middle class spending power should go up again.

Happy NDP to you too!