Japan’s 10 year, 20 year and 30 year bond yield has increased significantly over the past few months, and this fact is being plastered all over the news. Why is this a concern, and what impact does it have? I have seen quite a few articles on it, but none explains it the way a layman could understand well. Today, let me try to explain it in a very simple manner.

Background

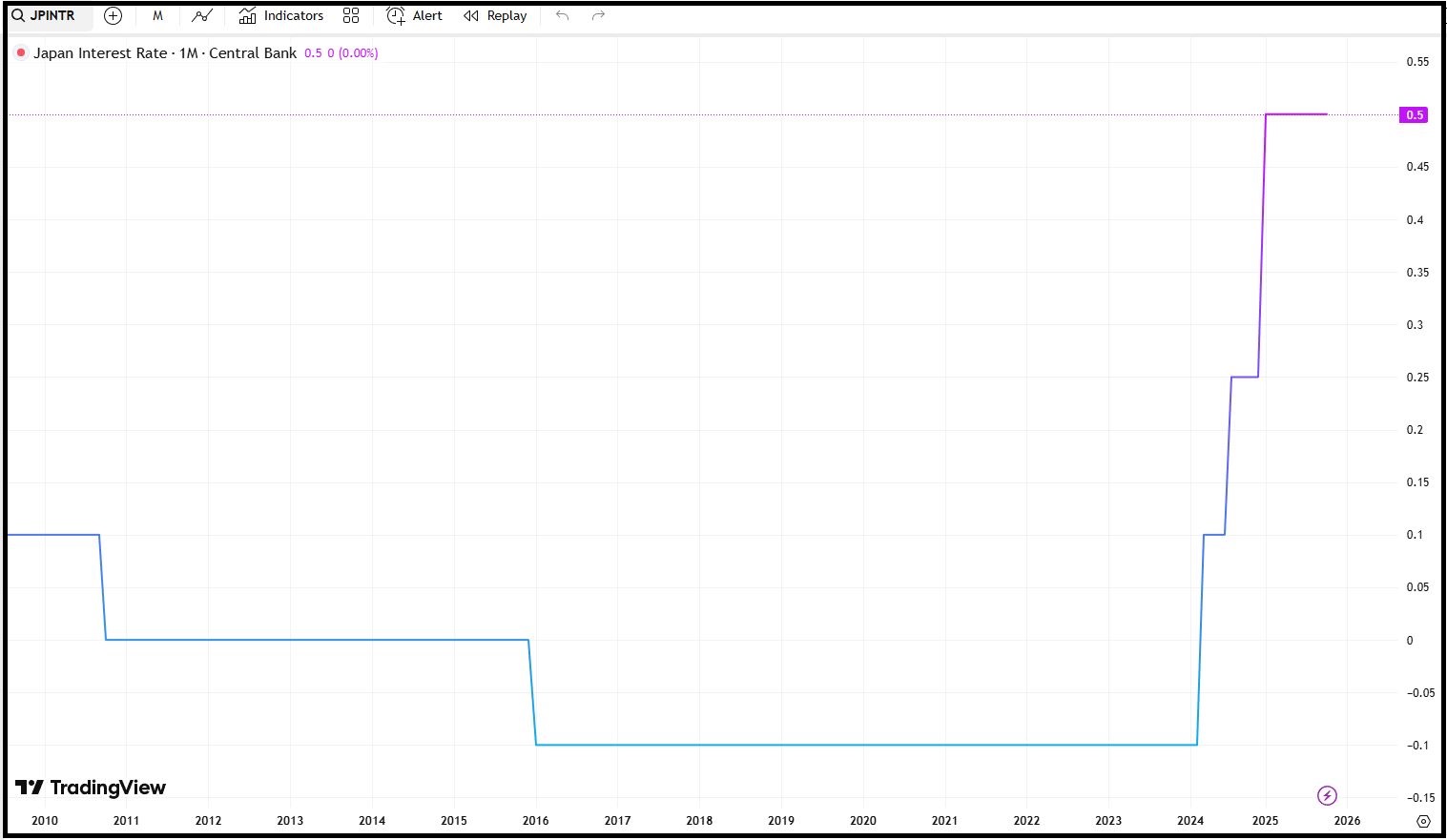

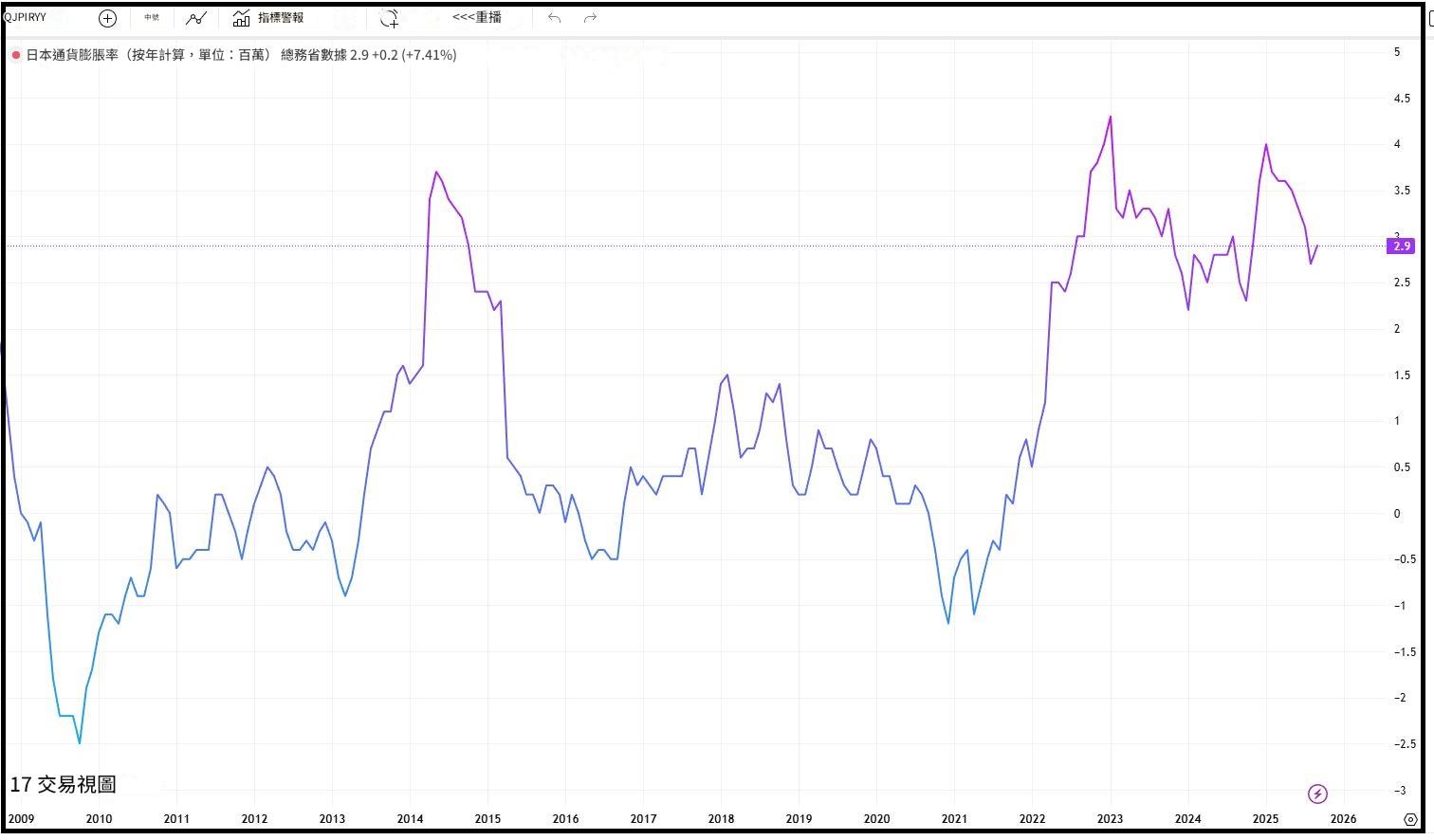

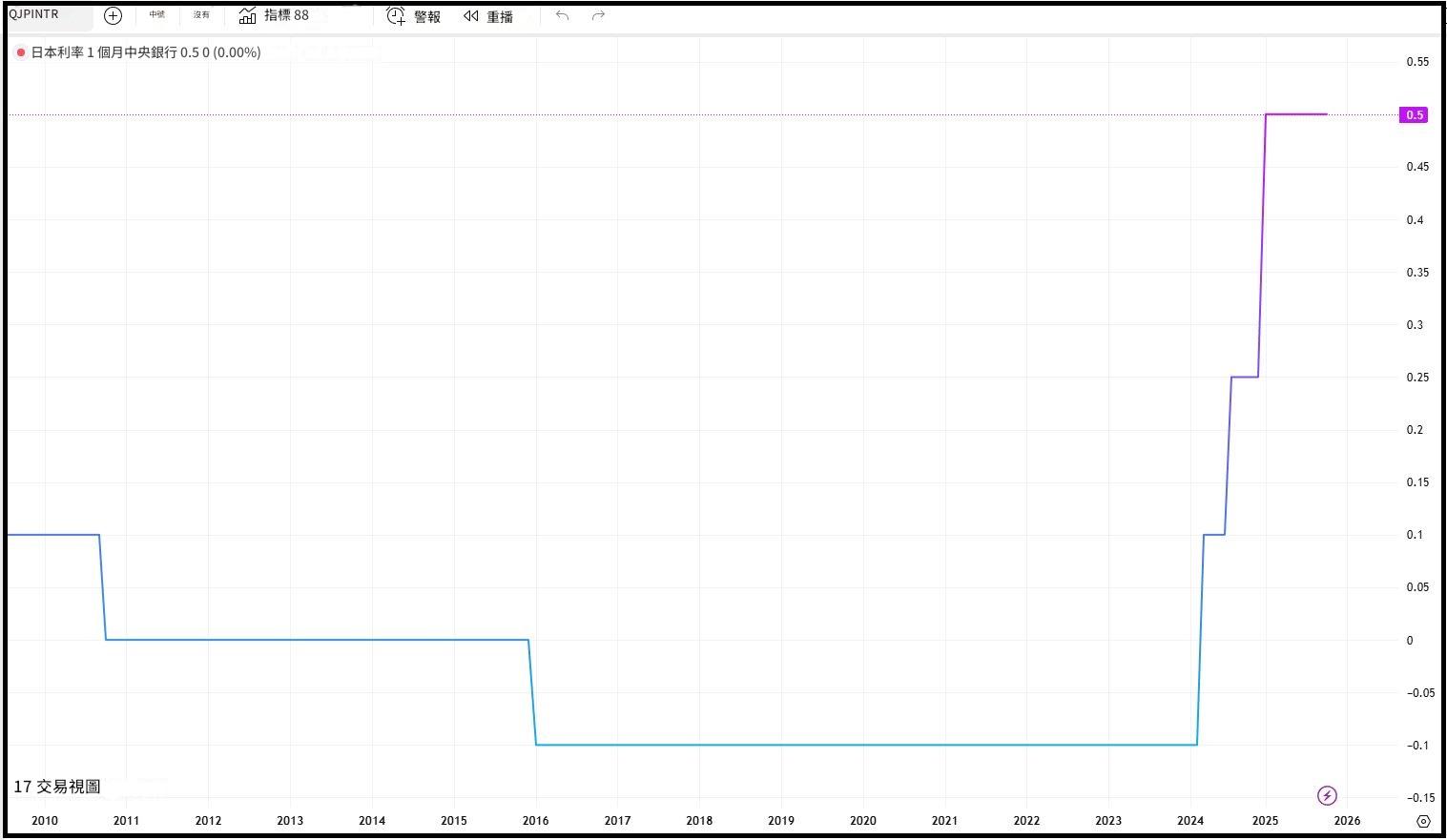

Japan has been known to have very low interest rates in order to fight deflation. In fact, before March 2024, Japan’s interest rates was at -0.1%. This means that the central bank charged a small fee on commercial banks and financial institutions for holding excess reserves with them. These banks and financial institutions were supposed to spend and lend out the money instead of saving, and in turn encourage spending in the economy. But it did not do well as the Japanese simply refused to spend.

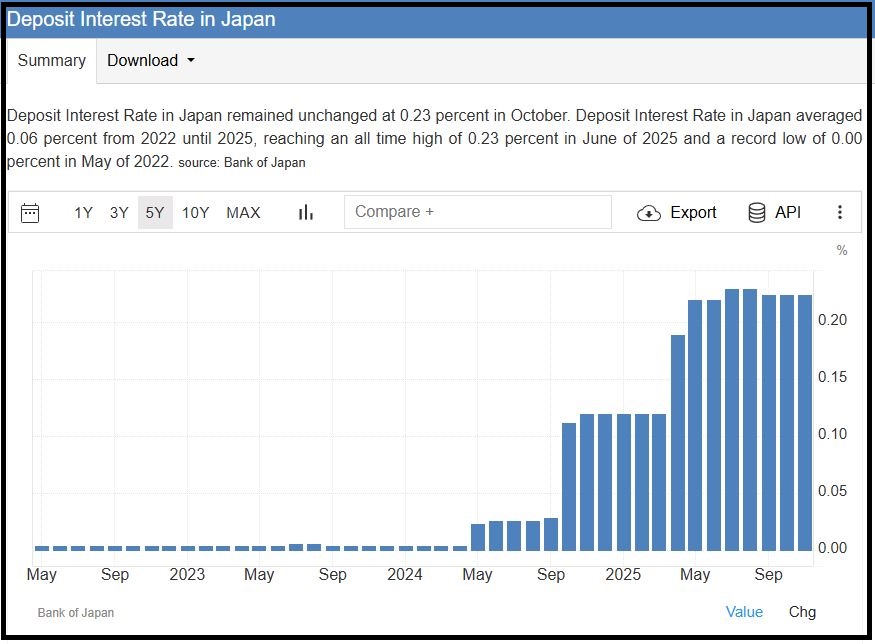

Take note that this is different from the deposit interest rate, which is what people get when they save with the banks in Japan. They still get some interests, albeit very little.

The Yen Carry Trade

The low interest rate meant that money can be borrowed very cheaply. This resulted in many people borrowing money from Japan, then converting the Yen to other currencies such as the USD to invest in. For example just some time ago, if you borrow the Yen at 0.1% interest rate, convert it into USD and do nothing but save it in the US banks, you could earn an interest of approximately 5%. If you borrow Yen, then convert into USD and invest in the US stock market, you could have earned far more. This is what we called the ‘Yen carry trade’.

So what happened was that people borrowed large amount of Yen to invest in other places. That is one of the reason why despite the huge Yen supply, Japan struggled to get out of its deflationary situation.

There is no statistics on how big is the Yen carry trade. Numbers range from as low as $700+ billion to $20 trillion. As of news report in September 2024, the Bank of Korea estimated the size to be 506.6 trillion Yen. Regardless, we know the amount is very big. People borrowed ridiculously huge amount of Yen to bet in the capital markets in the US and around the world.

And it seemed that Japan was being spineless for letting its currency go weak and causing its own economy to suffer, for Japan depends heavily on imports. But was that really the case?

Japan’s Trap

Why is the US able to control the world’s economy? Because many trades have to be settled in USD, and hence many people use USD, whether they like it or not. When a lot of people use your currency, which you have direct control over, you can manipulate the system as you see fit.

Now, when many foreign investors borrowed the Yen, over time Japan has actually gained a lot of clout over how they can manipulate the markets. Of course we know that realistically Japan is the US’ sidekick, but it does not change the fact that it has a lot of influence over the world’s financial system at this moment.

Starting from March 2024, Japan raised its interest rate and it is standing at 0.5% now with expectations to increase it further in December 2025. It may not seem like much, but it significantly increased the cost of borrowing, especially now that the US along with the rest of the world have been dropping their rates.

This was the first step.

The second step is to increase the bond yield. The Japanese government is now expecting to throw in a large fiscal stimulus, causing bond prices to fall and yield to rise. For the layman, a government bond is like an IOU from the government. The government issues a bond (IOU), and the market buys it. Money is transferred from the market to the government for spending (fiscal stimulus), and now the market holds the bond (IOU) which states how much money the government will pay to the holder of the bond annually, and to pay back the amount owed by a specific date.

Assume the bond is worth $1000 which pays $20 annually (2%). Now the government wants to throw in a large fiscal stimulus, so they will issue out many more bonds. Due to supply and demand, your $1000 bond is worth maybe $900 now. But the bond still pays $20 annually. So the buyer of the bond now pays $900 for a $20 annual return (2.22%). This is why when the Japanese government calls for a fiscal stimulus, bond yield increases.

Let us look at the 10 year, 20 year and 30 year Japanese bond yields now.

Global Impact

For the more conservative investors, they would borrow Yen and put in foreign bonds, perhaps US bonds. Now that Japanese interest rates and bond yields are rising, it makes lesser and lesser sense to borrow Yen to invest in foreign bonds. What people would do is sell off their foreign bonds and take back their money, either reallocating to Japanese bonds or simply pay off their debt and close shop.

For the riskier investors, on one hand you have the risk free 3.375% on Japanese 30Y bond. On the other hand you have a high risk stock market investment. Perhaps it may make some sense to cut back a bit. This may not seem like much, but do remember that many people and institutions borrow huge amounts and play on big leverages in the capital markets. A slight movement will liquidate them all.

So what happens when everybody is dumping foreign currencies to change back to Yen, either to reallocate to Japanese assets or to repay their debts? Yen will appreciate.

When Yen appreciates against other currencies, investors who borrowed Yen to exchange to foreign currencies will now have to spend more foreign currencies to change back to the same Yen, making the Yen carry trade even more unattractive. In fact, this may even significantly eat into some of their profits.

This causes a vicious cycle where more and more people will close off their trades (either through liquidations, dumping or graceful exits) in exchange for Yen, which will go back to Japan. What is the consequence? The global markets will tank.

We can expect the following: global bond price falls (yield increases), global stock market falls, commodities fall, cryptocurrency falls, Yen appreciates, global liquidity tightens. Everything points to a crash or a recession.

Conclusion

The Japanese government is taking back the Yen it lent out, and it will not be a happy ending for many. But since we already know what is going to happen, is there something we can do to capitalise on it?

Do note that the above does not constitute financial advice. Investors are to do their own due diligence before making any financial decisions.

最近幾個月,日本的10年,20年和30年國債收益率大幅上漲,而這也被各個新聞報導了。為什麼這是一個值得關注的事?我在網上看到好幾篇這樣的文章,但是都沒能很好的以一個很簡單的方式解釋。今天我試圖那麼做。

背景

日本為了抗通縮,一直維持著很低,甚至是負利率。在2024年3月之前,日本利率是-0.1%。這意味著央行會在銀行和金融機構的超額準備金上收取少量費用。這些銀行和金融機構是該花錢和把錢借出去的,而不是存起來。這政策本意也是要鼓勵消費,刺激經濟,但是最終因為日本人不愛花錢導致政策不算很成功。

注意以上說的和存款利率是不同的。人民在銀行裡存錢,雖然非常非常少,但是還是有收那麼點利息的。

日圓利差交易

這超低利率代表了投資家可以以極便宜的價格去借錢。這導致很多人很便宜地從日本借了很多錢,換去外幣(例如美金),然後去投資。就說前些日子吧,如果你以0.1%的利率借了日圓,然後兌換去美金,什麼都不做就放進銀行,就能賺取約5%的利息。如果你借了日圓,兌換去美金,投資美股,那麼你賺的是更多的。我們把這稱為日圓利差交易。

所以大家就去借了大量日圓,投資國外。這也就是為什麼即便日本大放水,日本國內的通縮還是那麼難纏。

對於日圓利差交易的規模,目前沒有一個準確的數據,說什麼的都有。低則7000億,高則20萬億。據2024年9月的一份報導,韓國央行估算這體量約506.6萬億日圓。反正規模很大就是了。大家都借了離譜數額的日圓投資在國外的資本市場。

而這看似沒種的日本,一直在讓自己的日圓貶值,導致非常依賴進口的經濟受損。但日本真的是孬嗎?

日本的陷阱

為什麼美國能控制全球的經濟?因為很多交易都得以美金結算,所以很多人使用美金。當很多人都在使用你有直接控制權的貨幣的時候,你就可以任意操作和擺佈這個系統。

同理,當很多人借了日圓,那麼這段時間日本早已累積了巨大的市場影響力。雖知實際上日本是美國的跟班,但這改變不了日本現在在國際經融係統中有著非常大的影響力。

自2024年3月起,日本開始把利率往上調,現在利率為0.5%,並且下個月還可能繼續往上調。這看似不多,但已大大的增加了借錢的成本,尤其在全球降息的環境下。

這是第一步。

第二步就是增加國債的收益率。日本政府目前計劃著大規模財政刺激措施,導致國債價格下跌,收益率上升。簡單說,國債就是政府的欠條。政府發個國債(欠條),市場買下。錢就從市場轉到政府手中讓政府花,而市場現在手握著國債(欠條),欠條寫著每年政府會為這欠條付多少’利息’,並且幾時把欠的錢還清。

假設國債值1000圓,每年付20元(2%)。現在政府要刺激經濟,所以發了很多債券。經濟學101,供應多時價格就會跌。這1000圓的國債可能現在就只值900圓。但是政府照樣付20圓的’利息’,所以收益率現在就是20/900 = 2.22%。這就是為什麼日本政府一說要刺激經濟,國債收益率就上升了。

讓我們看看日本10年,20年和30年國債的收益率。

全球影響

對於比較保守的投資家來說,他們會借日圓投資別的國債,例如美債。現在日本的利率和國債收益率在上升,意味著借日圓投資美債越來越不合理。這時,人們就會賣掉他們手上其他國家的國債,收回錢,要嘛投入日債,要嘛把借的錢還了回家睡覺。

對於那些比較激進的投資家,現在一方面是無風險的3.375%日本30年國債,另一方面是高風險的股市。或許這時減倉一下會比較合理。這看似不多,但是別忘了許多人和機構都是借了大筆的錢,槓桿拉到極限在資本市場玩的。一點波動能把他們全都給爆倉。

那麼大家都賣外幣買日圓的時候,會發生什麼事?日圓會漲。

日圓兌外幣漲的時候,借日圓的投資家現在得花更多外幣來換回之前借的日圓。這會使得日圓利差交易更不值得做。日圓的升值也很有可能掃掉他們一部分的盈利。

這就導致一個惡性循環 – 越來越多人關閉交易(不管是爆倉,甩賣或者計劃的退出)來換回日圓,日圓流回日本。後果是什麼?國際經融市場會血流成河。

我們可以預見這後果:全球國債價格,股市,商品,虛擬貨幣大跌,日圓上漲,全球資金縮水。所有一切指向市場gg或者經融危機。

結論

日本現在在抽水,而這不會是一個快樂的結局。但現在我們既然能遇見這個未來,是不是有什麼能提前部署的呢?

以上不構成投資建議。在投資前,大家必須做好自己的功課,定下自己的結論。

Showing 1 - 3 out of 3

Page 1 out of 1

| - | Shop Products | Price | |

|---|---|---|---|

|

|

$99,999.00

|

||

|

|

$1.00

|

||

|

|

Price range: $69.00 through $99.00

|