The US stock market seem resilient, and the AI hype is so strong it might as well be an AI bubble.

Background

The S&P 500, and by extension the US stock market, seems to be never dying, rising up and up despite numerous hits to it. The S&P 500 is now at an all-time high of 6791, bulldozing every negative news and defying every economic logic.

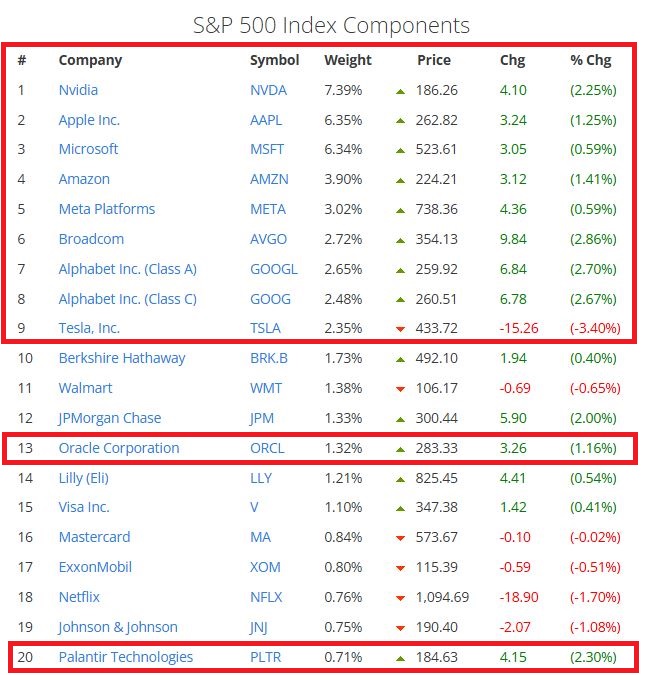

But if we take a look at what made up the S&P 500, we can see that it is heavily overweighted towards the technology companies, almost all of which participated in the AI bubble.

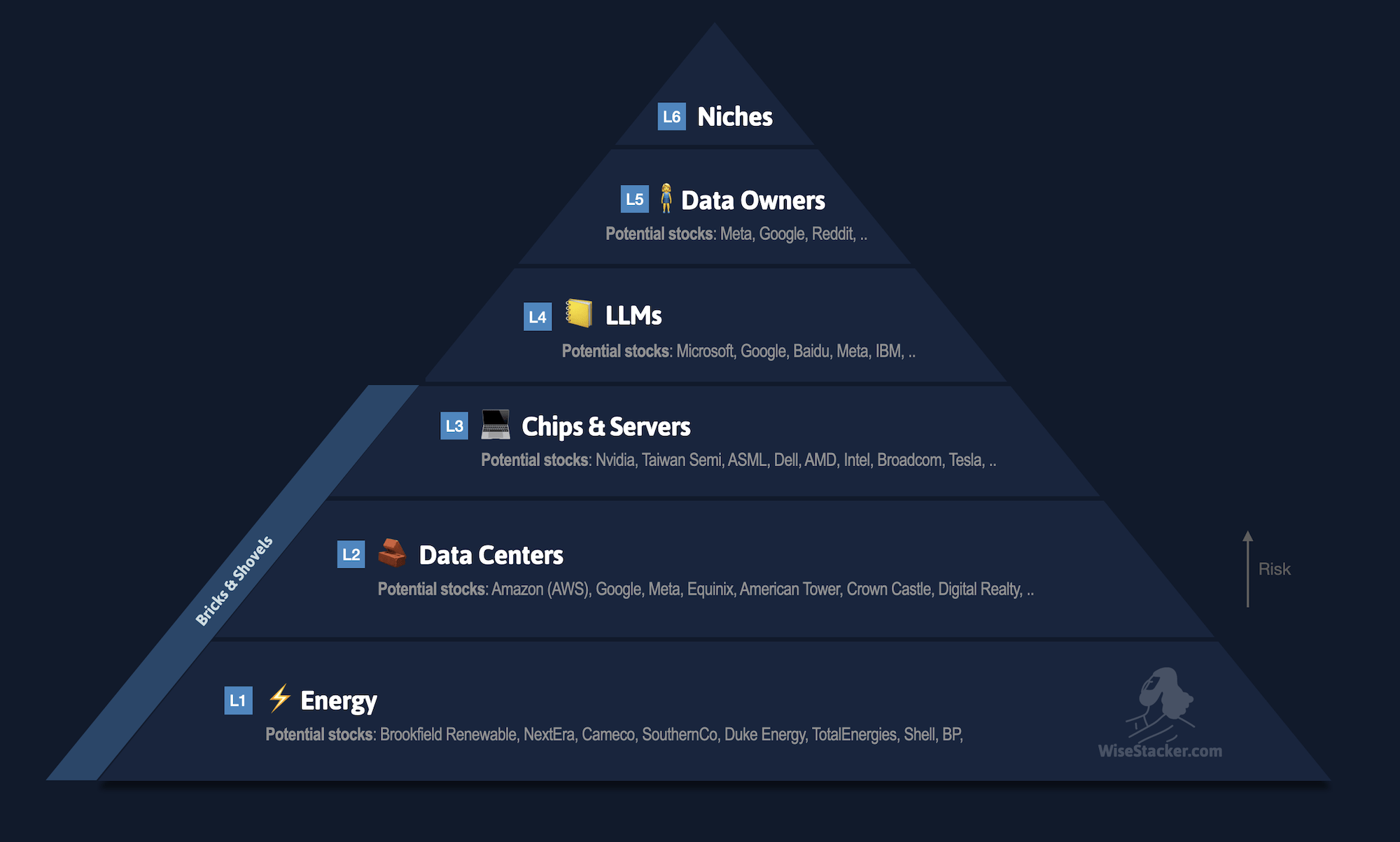

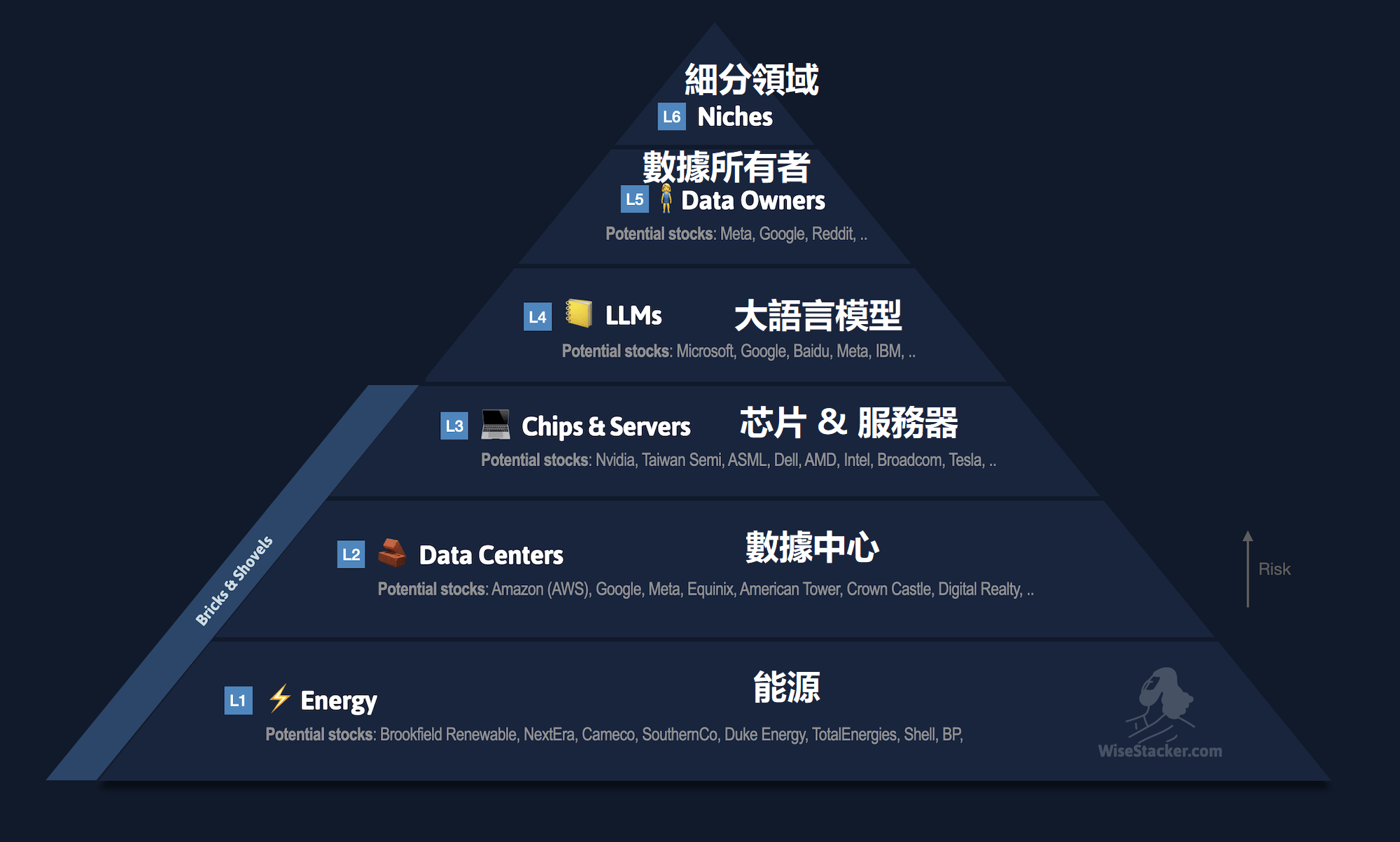

If we do a quick calculation on the above companies, we will see that technology companies in the top 20 made up 39.23% of the entire S&P 500. The S&P 500 which is heavily skewed towards technology is now heavily hyped up by AI. The first impression which many people have when they think about AI may be ChatGPT (Open AI) or Deepseek, but these companies / software sit at the very top of the AI pyramid, which represents a very small segment of the AI hype. Fortunately I have found a diagram representing my view of the pyramid.

Just a side note, I have been saying that energy is the foundation for the future where AI and big data, because energy is needed to run large and complex computations. That is why I am bullish on power companies in the long term.

The first 3 levels of the pyramid are classified as ‘shovels’, where they support but are not directly involved in the development of AI. In the California gold rush from 1848 to 1855, the ones who earned the most money were not the one who dug for gold, but those selling spades to the gold diggers. The AI that the public often associate with are like ChatGPT or Deepseek, standing at the top of the pyramid but supported by the 5 levels below it. In this picture we get an idea that certain big technology companies have businesses spanning across a few layers of the pyramid. Google is one such example, Microsoft another.

Now we are clear with the picture, let us get to the main point.

The AI Bubble

We are familiar with how Nvidia and AMD make record highs. We saw in the news how the rest of the technology companies also had their share prices jumped to insane levels, hence I will not repeat what everyone here knows.

Humans are smart sometimes. We do learn from history at times. The gold rush taught us that selling spades is better than digging for gold. That is why the stock market investors are buying into AMD, Nvidia and a whole load of other companies below the gold digger. But, AI development takes time. It takes a lot of research, effort and money.

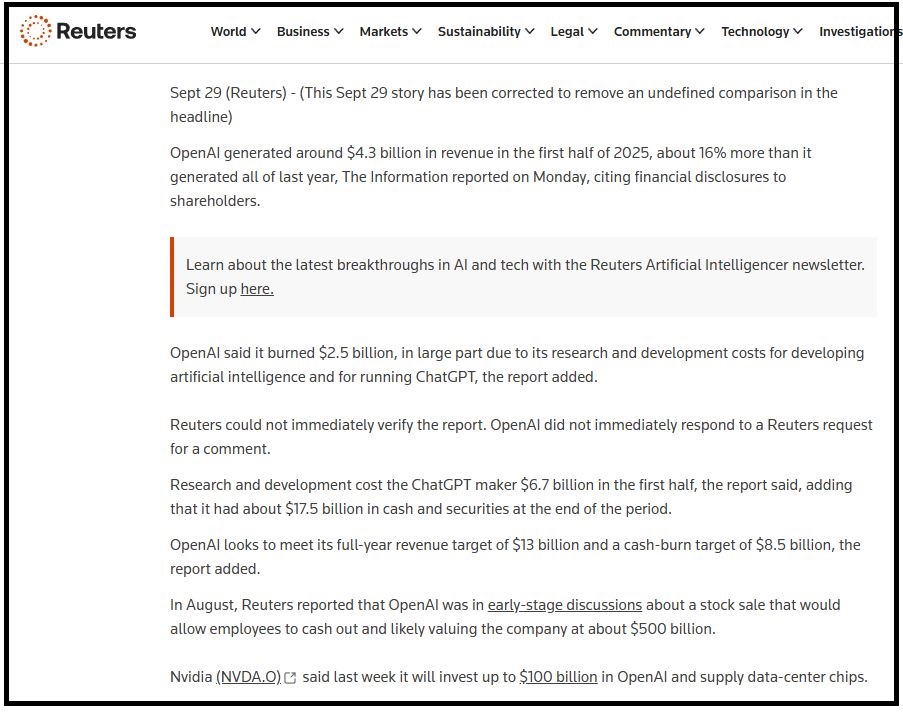

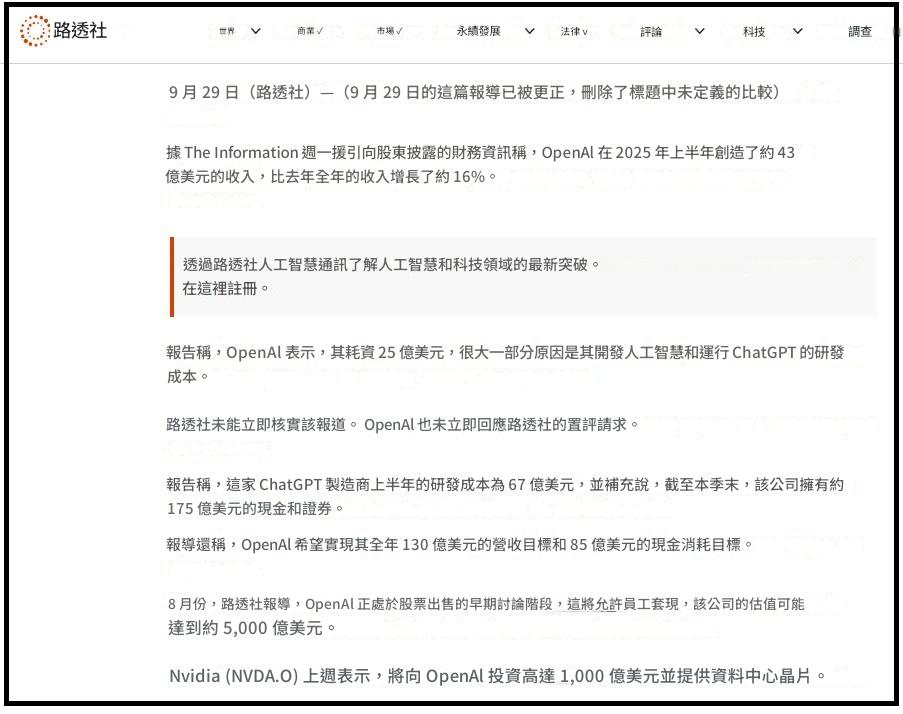

For now, OpenAI is still burning money. There is no gold yet.

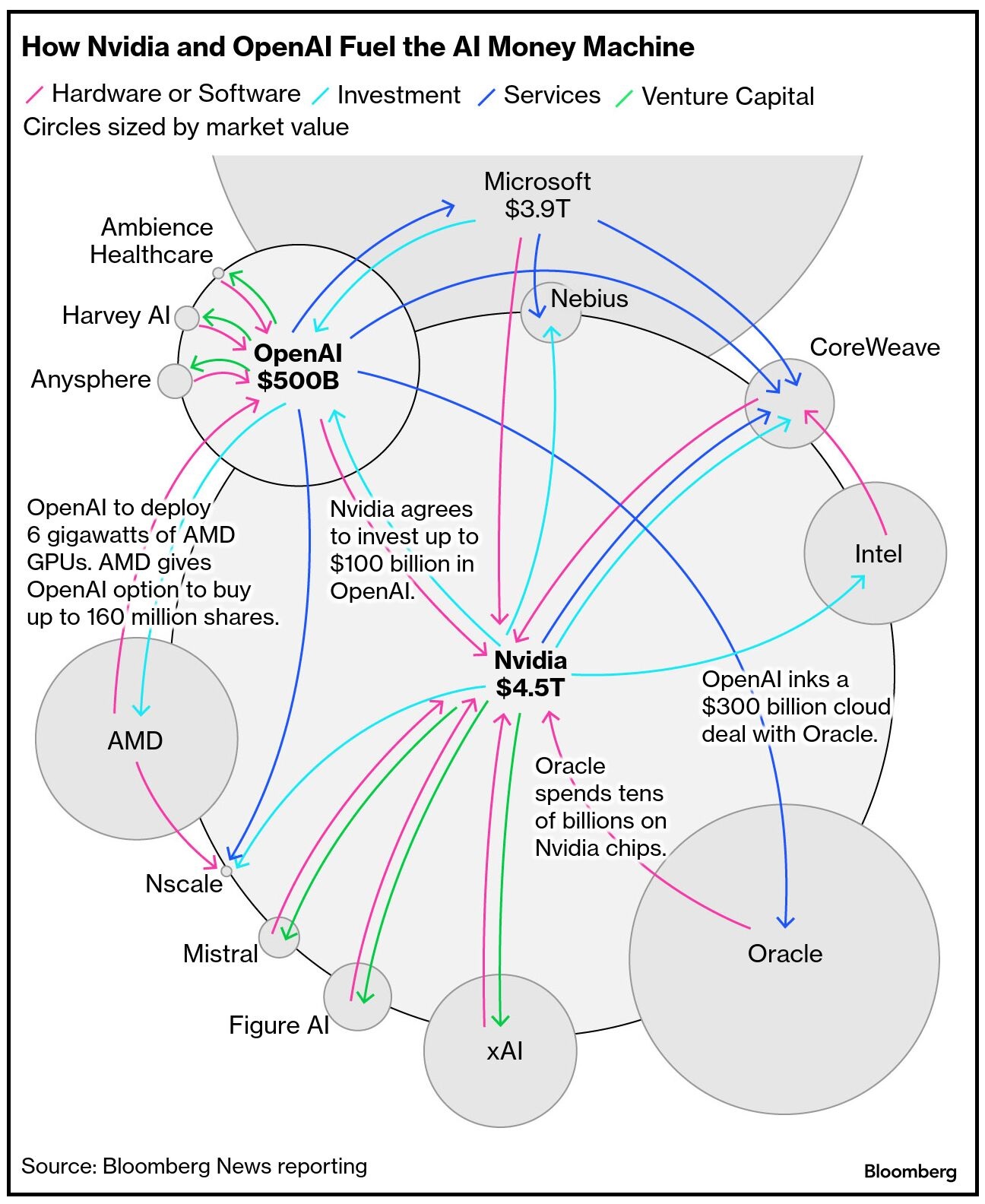

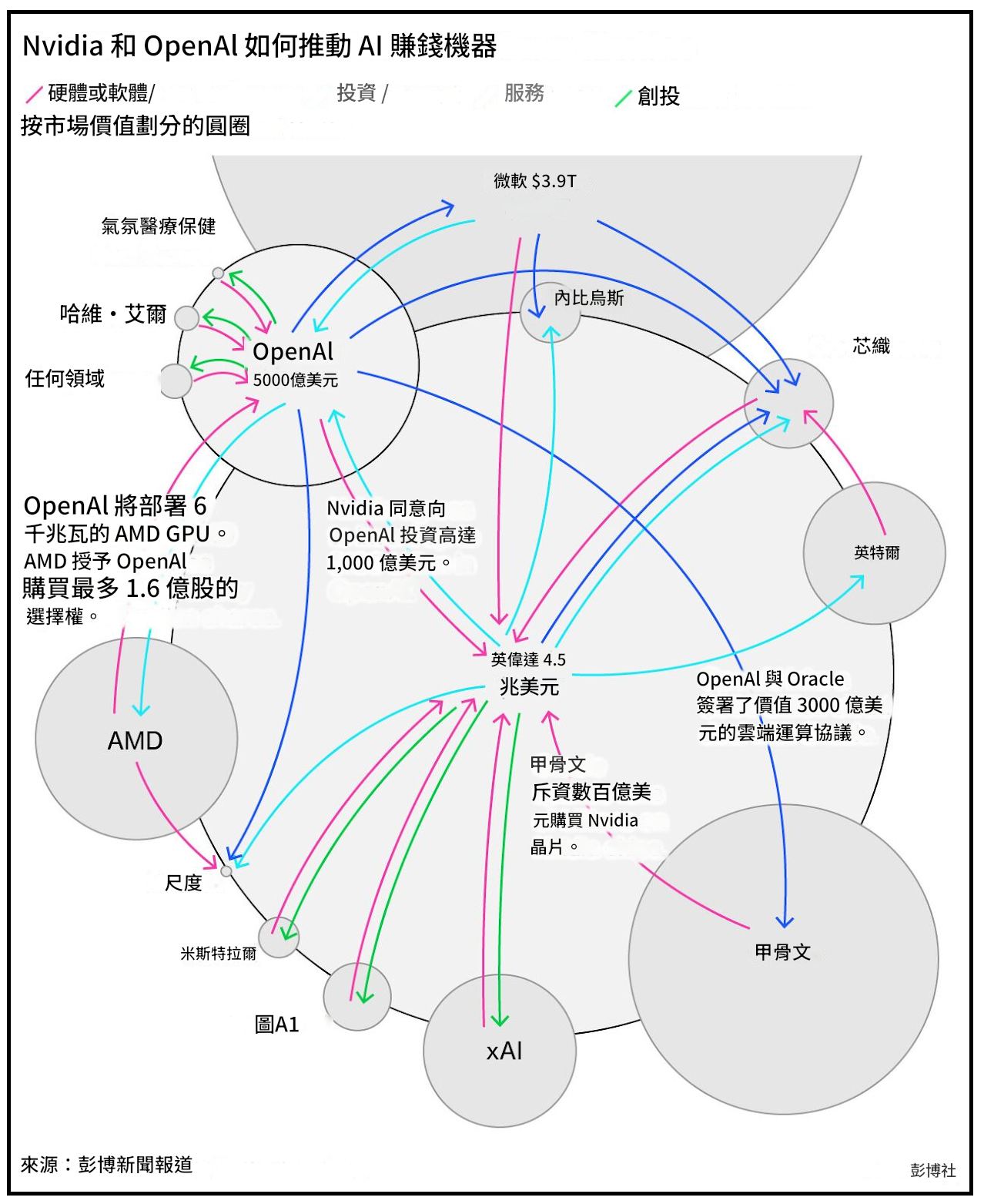

But despite this, OpenAI found it necessary to continue investing in other companies. Let us look at the chart of money flow given by Bloomberg. This is not something I made up, but reported by a well-known news source.

What happens when there is no gold? The one selling spades invests in the gold digger, the gold digger spends money on the porter, and the porter buys spades from the spade merchant. Look at how Nvidia the spade merchant is right in the centre of the diagram.

Nvidia invests $100 billion in OpenAI. OpenAI purchases $300 billion worth of computing power from Oracle. Oracle spends tens of billions on Nvidia chips to support their demand for computing power. This is just one circle, and the larger picture consists of other well-known companies like Microsoft and AMD. In the modern world where everyone can take part in a company’s business by investing in the stock market, this circular deal creates a scene of prosperity in the AI segment, attracting retailers’ money into the stock market and making them buy at the top while the big players offload their shares at high prices.

- As of 1 July 2025, Oracle CEO Safra Catz offloaded roughly $2.5 billion in company stock.

- As of 1 July 2025, Dell CEO Michael Dell offloaded about $1.22 billion.

- As of 1 July 2025, Amazon founder Jeff Bezos offloaded $737 million.

- Nvidia CEO planned to offload up to 6 million of his shares estimated to be at about $865 million.

- Warren Buffett has cleared off many of his US stock holdings.

Yes, the CEOs did not clear all of their shares, because they cannot. They represent the company. In fact, you can say Jensen Huang cleared less than 1% of his total holdings. But it does not make sense for so many of the tech bosses to sell off if technology and AI is indeed booming. Doesn’t that tell you something? Nobody knows the company better than the CEOs. These are smart people sitting at the top of their companies, and they do not get to where they are by playing house. And if they are selling their shares, I think that should be a warning sign.

Many companies are now trying to do something AI related or forcibly tagged their business to AI, even though it may be nonsensical and not related to their businesses. Ride the hype yo. While there are already certain tangible achievements such as ChatGPT and Sora, it is still far from the hype people dreamt of. It will get there, but not now, and investors are paying for these future expectations which will take many years to realise. The investments both by retailers in the stock market and the big techs through all the deals they inked are too large for the current market’s capability to fulfil. The deals formed by these companies are paper deals anyway, nothing concrete, nothing done.

The AI bubble will burst, and it is about to. When the musical chair stops, the US stock market will come crashing down. And this, may be another opportunity for us to grab. For now, all we need to do is to prepare our bullets in advance, so that we can do our part to ‘save the market’ together with Warren Buffett and be a contributing hero to the society.

美股似乎非常堅韌。AI熱潮也已經到了泡沫的地步。

背景

標普500,乃至整個美國股市,似乎就是打不死。即便被多次打擊,卻仍然不斷往上爬到今天的6791新高,可說是無視所有負面消息以及顛覆了所有經濟邏輯。

但是當我們仔細注意標普500的結構,就會發現指數是嚴重傾向科技公司的,而這些公司大多都參與了AI熱潮。

當我們做個粗略計算,就會發現,在前20排名的科技公司就佔了指數39.23%的比重。這代表指數是嚴重倒向被AI熱潮撐起來的科技公司。當人們提到AI,第一印象就是ChatGPT或Deepseek,但是這些公司是在AI金字塔上的最頂端,也只代表了AI熱潮的一個非常小的部分。我們可以看以下的圖:

跑題一下,我一直都說能源是未來AI和大數據的基礎,因為龐大與複雜的算力是需要能源來推動的。這就是為什麼我對電力公司非常感興趣。這金字塔最低三層就是賣鏟子的,它們不搞AI,但是在背後推動AI的發展。加州1848-1855年的加州淘金熱已告訴我們賺最多錢的不是淘金的,而是賣鏟子的。淘金的 Open AI (ChatGPT) 或Deepseek是被下面5層的行業支撐的。當然,我們也可以看出有些公司的業務已覆蓋這金字塔的好幾層,例如谷歌和微軟。

現在我們已看清了整個AI基建和業務,我們就奔重點吧。

AI 泡沫

英偉達和AMD創新高的事大家都知道,各個科技公司的股價被推到離譜的價位也是眾所周知,這裡我也就不重複大家已知的事。

人類有時很聰明,偶爾也會從歷史上吸取教訓。淘金熱教會了大家,賣鏟子比淘金賺錢。所以在股市上,大家都跑去買英偉達,AMD這些賣鏟子的公司股票。但是道高一尺,魔高一丈。我們吸取的教訓,資本家能不知道嗎?

AI的發展需要大量的研究,時間,精力以及金錢。而目前,OpenAI還在處於燒錢的階段。金,還沒被淘到。

但即便如此,OpenAI 還是覺得有必要繼續投資其他公司。我們看看這個由彭博社繪出的金錢流動。這不是我亂說的,而是西方知名報社,自己吐自己的。

沒有黃金的話怎麼辦?賣鏟子的投資淘金的,淘金的花錢僱傭搬運的,搬運的拿錢買鏟子。你可以看到鏟子商家英偉達在這圖的中間。

英偉達投資OpenAI 1000億,OpenAI花3000億從甲骨文買算力,而甲骨文轉手花幾百億買英偉達芯片來提供算力。如圖說繪,這只是一個小圈。在整個大藍圖上,還附加了額外幾個有名公司的圈子,例如微軟和AMD。這操作虛假的製造出一個前途無量,欣欣向榮的AI行業,吸引了無數的散戶在股市上投資,成了這些大股東的接盤俠。

於2025年7月1日,甲骨文CEO賣出250億的股票,Dell CEO 賣出12.2億,亞馬遜CEO賣出了7.37億,英偉達預計賣出8.65億,巴菲特幾乎已清倉了並坐在3250億的現金上。

確實,不是每個CEO都大清倉,但那是因為代表著公司的他們不能那麼做。但是那麼多科技的大佬紛紛的賣掉他們手上的股票,不覺得事有蹊蹺嗎?還能有誰比這些CEO更了解他們自己的公司?能做上那個位子的人,絕不是笨蛋也不是善茬。若他們都拋售股票,這應該讓我們警戒起來。

現在還有很多公司都拼命地與AI掛鉤,即便他們的業務和AI完全不相干。雖然ChatGPT和Sora給出了相對不錯的成績,但是和被炒熱的預期相比,還相去甚遠。AI總有一天會達到我們的預期,但不是現在,而現在投資這些公司的散戶是為了多年後的遙遠預期買單。散戶的高價投資,以及這些大企業之間簽的合同,遠遠超出現在市場所能實現的能力。再說了,大企業之前簽的合同,不也都是紙上談兵嗎?一分錢都還沒成交。

AI泡沫必定會爆,而也即將爆了。當擊鼓傳花的遊戲停止時,也就是美國股市崩塌的時候。這時,將會是我們能抓住的另一個機會。現在,我們只需要耐心的等,極力的去囤彈藥,到時和巴菲特大叔一起去救市,為這個社會盡我們一份綿薄之力。

美國的風口,要出現了。或許我這隻豬,不久後又能飛起來了。

Showing 1 - 3 out of 3

Page 1 out of 1

| - | Shop Products | Price | |

|---|---|---|---|

|

|

$99,999.00

|

||

|

|

$1.00

|

||

|

|

Price range: $69.00 through $99.00

|