‘Sell the news’ is a term we often hear in the trading and investment world, where once a particular positive result has been confirmed, people start selling or dumping the asset involved. It may seem very strange to many new traders, and today we will explain it in a simple way and finally tie in with respect to my own prediction on gold.

Example – Housing

We assume that the government intends to build a new train station through or near a particular town, making transportation easier and by extension, the economy of the town better. A few of those who have insider news and have higher risk appetite will then start to buy up houses quietly, which may push up housing prices a little bit. When the government makes the announcement to the public, those who are fast will quickly react and start moving their money in. Prices start to rise even more, but not yet at the ‘bull run’. When the government starts the actual construction of the train station, that is when the ‘bull run’ starts. Investors begin to flood into the market as they see concrete evidence of the construction happening.

This bull run will hype up a lot of people, partly due to FOMO, and partly due to the different stakeholders who may stand to gain from the high housing prices. For example property agents, existing home owners and early investors who are looking to sell at a high, renovation companies etc. If the market is logical, the housing price should rise until the point where it reflects the true value of the house upon the completion of the train station, factoring in the economical benefits. However, there is always the psychological aspect. The train station does not only bring economical benefits, but also the convenience. Different people places different value on convenience and on the seemingly higher status of the town now. Throw in the hype and the FOMO, and the psychological aspect will push people to buy the houses at even higher prices, with new records being set every other day. At this point, the price of a house in that town may very well exceed way above its supposedly final and sustainable market value.

This bull run will continue, and people will only get more and more excited as the train station gets nearer to completion. Finally the train station is completed, and people cheered. However, the early investors who bought at a low will be the first to slowly and discreetly dump, and likely to be before the completion of the train station when prices are near the peak and demand still strong. The second batch of logical and quick-thinking investors, upon seeing the completion of the train station, the economic benefits and the convenience, will quickly work out the math that houses are overpriced now, and will also start to sell their houses.

When everybody start selling their houses near to or upon completion of the train station, we will see prices dropping instead of going up further. Selling the news happens because the market has already factored in the expectations of what is to be the final outcome in the prices, in this case the completion of the train station. More often than not, prices before the final completion is the highest because of the hype.

Do note that the above example is over-simplified, and that in real life, many other factors such as population, government policies, employment opportunities are at play.

Gold – Central Banks

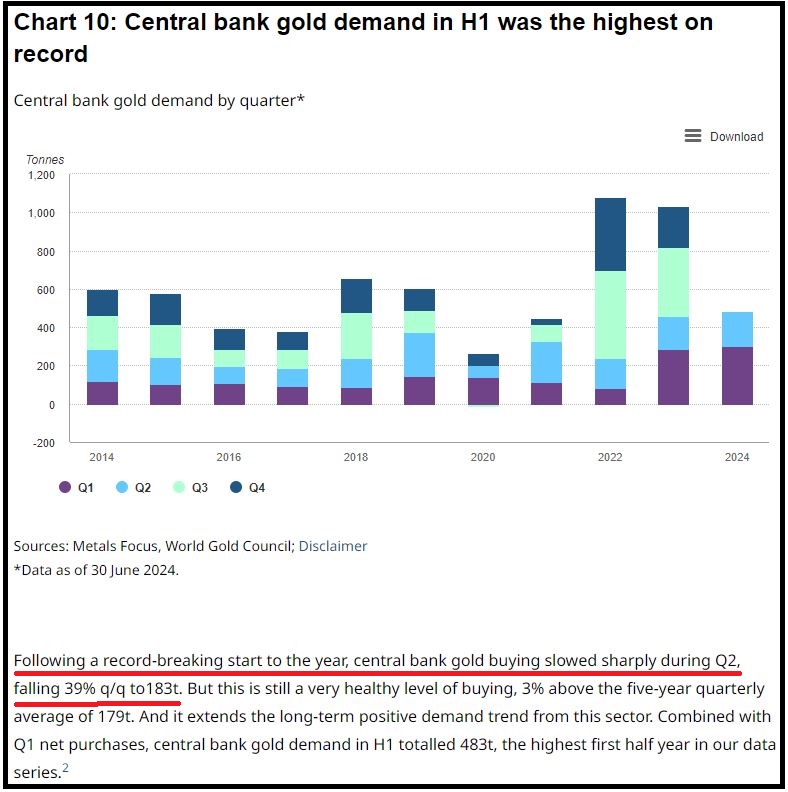

We take this example back to our trading, gold specifically. Gold price has consistently set an all-time high record for the past few months, with its highest at 2531.70 USD per ounce. It started when people realised that central banks, especially China, has been mass buying gold. This triggered a series of news on how gold now is a hedge against crisis, on how central banks foresee a financial downturn etc. Then the masses jumped in and pushed gold prices up to the ridiculous price it is today. However, the biggest players has already moved out or simply stopped buying in at this time.

We have also seen that not only in China, but elsewhere in the world, central banks has toned down their purchases of gold. Big players are moving out of the market slowly but surely. Yet the market is still supported by the hype of the masses.

Gold – Retail

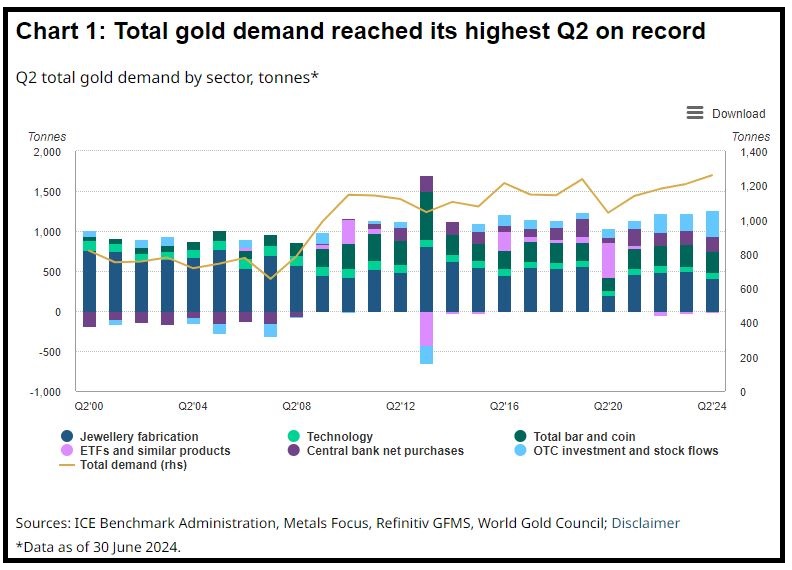

However, if we look at data logically, we know that central bank demand, while significant and looks like their volume is very big, is definitely not the largest portion of the overall demand. Retail (jewellery) is the biggest portion. If we combine total retail across all sectors, from jewellery to retail demand of ETFs to retail bar and coin, we will realise that the masses actually hold most of the purchasing power.

But prices of gold is too high, to the point that the retail market is suffering. The graph above and the news article headline below has shown that demand in the retail market has been impacted.

Fed – Interest Rates

The whole world is waiting for the Fed to drop interest rates, but the Fed has been prolonging the announcement but at the same time managing expectations. September 2024 is the widely anticipated interest rate drop, and this is when we expect the ‘sell the news’ event to occur. Interest rates is somewhat inversely related to gold price, though that does not necessarily means this ‘rule’ is fulfilled all the time. Yet for the past few months, despite the Fed holding on to the same interest rates, gold price has shot up to its current price today.

It is safe to say that the current gold price has already factored in the situation where Fed decrease interest rates. At this point, there should be nothing supporting the high gold prices – not demand from central banks, not demand from retail purchases, not the interest rates situation. My personal prediction is that when the announcement is made and in line with expectations, the ‘sell the news’ event will occur.

And compared to the housing example above, sometimes when the price of commodities fall, they happen much quicker and over a shorter span of time, catching the masses off guard.

What I Am Doing

Of course, one should always respect the market. The market is irrational and unpredictable, the market is manipulated and merciless. The market can and often defy our best homework and most logical predictions. But I am not just making theoretically correct fluff statements which do not concern me at all. I do the analysis, I do the homework, I put my money in. I have sold all my spot gold and I have shorted gold in my short term trading. If my prediction goes wrong, I suffer a burn as well. In fact I am having a paper loss right now because the market did not go the way I expected.

Nothing is 100% in the trading, and there is certainly a chance I can go wrong. But in all probability, gold will fall, and that is why I am putting my money in. And despite the current paper loss, I am tanking it through. Gold will fall.

Showing 1 - 3 out of 3

Page 1 out of 1

| - | Shop Products | Price | |

|---|---|---|---|

|

|

$99,999.00

|

||

|

|

$1.00

|

||

|

|

Price range: $69.00 through $99.00

|