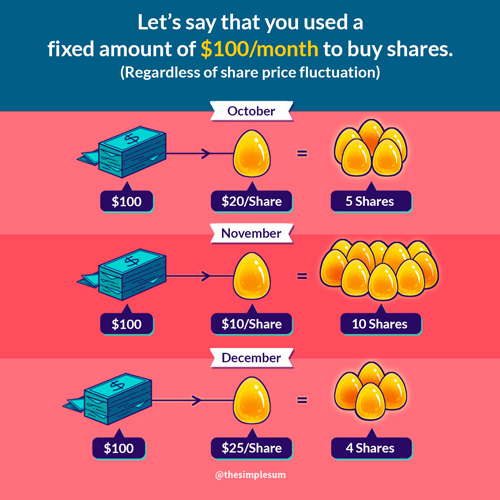

Dollar Cost Averaging (DCA) is a method used by many and sworn by many as the fail safe way to trade or invest. Basically, at every fixed time interval, be it 1 week, 1 month or 1 year, you put in a fixed amount of money into buying the particular financial instrument. This can apply across a wide range of financial instruments, from stocks to commodities to funds to crypto currencies. This works for people who do not wish to time the market, simply because it is very difficult to do so. By doing DCA, you slowly build up your portfolio.

Take for example, American Airlines share price is worth 20 USD now. I have decided to put in 500 USD in every month. In January, I put in 500 USD and got myself 500 / 20 = 25 shares. In February, the share price dropped to 18 USD. With the same 500 USD, I now get myself 27 shares. In March it went up to 23 USD, and I got myself 21 shares. At the end of 3 months, I bought a total of 73 shares with a total of 1500 USD, giving me an average of 20.54 USD per share. It is lower compared to its ‘high’. From this we can see that, when market goes down, the same money will take the opportunity to buy more shares, and when the market goes up, you reduce your risk by buying lesser shares.

Supporters of DCA will say since market overall is going up, we can make use of the fluctuations to slowly buy at fixed time intervals and slowly accumulate. You will still be at an advantage because at the end of the timeline, you will still be better off than today. Another advantage is that seldom do people have one lump sum of money they can put in. Perhaps when I draw my 3000 USD salary every month, I can take out 500 USD to buy the shares and build up my portfolio over time. In an upward market, yes this is actually a decent strategy. But even though when we pull out the charts and see an overall upward market over the decades, it is not always on an upward trend. There are recessions.

Let’s say there is a recession coming soon and the next 3 years is a bear market. That is the general big direction. You continue to use DCA. Yes you buy more and more shares every month as the price drops, but you are also wasting your money by buying it at a higher price. You are spending money buying something which you know will be cheaper the next month. Note that we are talking about a long term downward trend, not a short term downtrend in an overall upward trend. This is a very dangerous thing to do, especially if your holding power is weak. Maybe you will need to cash out the money in 2 years to prepare for a wedding. But it is a long term bear market! The economy will not U-turn in the next 2 years! What will you do? You can only see the paper value of your stocks go down every month. This is not what the supporters of DCA told you. You are supposed to see your paper value slowly go up over time, even though in the shorter term there may be fluctuations.

If you know that it is a bear market, perhaps the more logical thing to do is to park your cash one side, then buy it in bigger batches at different appropriate times. For example, we know that unlike crypto currencies, the stock market do not simply reverse from a bear market to a bull market in a matter of weeks or even a few months. You will probably not know when is the end of the bear cycle, but as you monitor and research, you may have a few ideas that this particular point may be a turning point? Then you can put a lump sum in and continue to observe the next few months. If you are wrong and it drops further, yes it is not the ideal decision but it is still better than continuing to put in money every month right from the start. Continue accumulating your money for the next few months and put in again when you feel the time is right. But remember you can only put your spare cash, because you do not know how long it is later that you can take out. In this case, you have changed from DCA to buying the dip. Although as you observe and test, you might actually be buying a few dips before the thing turns around.

As you might have realise it by now, the above still talks about going longs (buy at a lower price hoping it will go up) rather than shorting, which is a better strategy in a bear market. But shorts (selling at a higher price first then buying back at a lower price to close the trade) comes with it another set of risks which I do not recommend to people who are just starting out.

The above exposed the critical flaw of DCA. Every strategy has its own loophole and critical flaw. But first, you must read the general direction correctly. Only when you read the general direction correctly, then you can apply the correct strategy. In the event the general direction is read wrong, even if you have the seemingly good strategy, it will only cause you endless pain.

Another example we can use here is the average down strategy. Basically, this time instead of going by time period, we go by price. Assume again American Airlines shares is 20 USD now and you spend 2000 USD to buy 100 shares. It then falls to 18 USD. To average down, you throw in another 2000 USD again to buy 111 shares, giving a total of 211 shares at an average price of 18.95 USD. As the price falls further, you buy more, accumulating more shares at a cheaper price and thereby lowering your average purchase price each time.

Similar to the DCA strategy above, this works only in an upward trending market. We know the market is trending up, but we also know there are dips here and there. And so we use this strategy to average down our buying price little by little, so that when the market finally goes up we will make a capital gain. However in a bear market, you will be forced to keep pumping money inside with no way out, simply because your share price do not go up.

In conclusion, as you research, you may have heard of many different seemingly useful tactics and strategies for trading. No one strategy is foolproof. If there are, there would be no poor man around. Every tactic has a critical flaw, which you must know before employing it. And more importantly, while there is no need to read the short term trend of the market so accurately, you must be able to read at least the medium to long term trend correctly, or risk trapping your own money inside your investment. In the worst case scenario, you may even lose everything.

Showing 1 - 3 out of 3

Page 1 out of 1

| - | Shop Products | Price | |

|---|---|---|---|

|

|

$99,999.00

|

||

|

|

$1.00

|

||

|

|

Price range: $69.00 through $99.00

|