“Economics is a subject that does not greatly respect one’s wishes.” – Nikita Khrushchev, First Secretary of the Communist Party of the Soviet Union from 1953 to 1964.

In 1792, the United States Mint commenced production of the United States Dollar (USD) during the administration of George Washington, the first president of the United States. In 1816, the British Empire started the gold standard, which basically means that their currency was pegged to and backed by gold. A unit of their currency could exchange for a fixed amount of gold. But only in 1873 when the German Empire adopted the gold standard that many others followed, including the US, the Netherlands, the Austria-Hungary Empire, the Russian Empire etc. The adoption of gold standard encouraged international trade and investment, as countries believed in each other’s currencies.

Bretton Woods System

However, due to World War I and the Great Depression, the gold standard was first suspended then finally abandoned in the mid-1930s. Fast forward to 1944, we have the famous Bretton Woods system, which marked the start of the US dominance in the global monetary system. The US, which controlled 2/3 of the world’s gold then, insisted that the system be based on gold and the USD. The USD will be pegged to gold at $35 per ounce, and the rest of the 43 allied nations who signed the agreement would have their currencies pegged to the USD, effectively making the USD the world’s reserve currency.

Naturally, this system placed the US at an absolute advantage when it comes to influencing other currencies and reaping off them. US later incurred huge debt from various activities such as the Vietnam War, had serious inflation and continued to print money way beyond what it should. This caused the USD to be overvalued (ie. not worth that much) after factoring its gold reserves, debt and inflation. In short, the US needed to only print a $100 bill, but other countries had to cough up an actual $100 worth of goods and services to match that $100.

As countries realised that they were being scammed, they exited the Bretton Woods system. In 1971, then-US President Richard Nixon announced that the USD would no longer be pegged to gold, which was the very basis of the whole Bretton Woods system.

Petro-Dollar

After the Bretton Woods system failed, the petro-dollar was introduced. Basically Saudi Arabia had an agreement with the US that all oil purchases has to be in the dollars. At that time, the USD was already the currency of international trade and finance. It was the default currency to trade. US was also a big importer of oil then. These 2 reasons coupled with Saudi Arabia’s decision gave the other oil exporters no choice but to continue using the dollar for their oil transactions. This system lasted till today.

In order to purchase oil for daily use and to power up the industries, countries have no choice but to continue buying and keeping USD. It does not make sense for countries to buy only the USD they require on a daily or weekly basis. They would usually keep a reserve of USD instead. This keeps the demand for USD high.

From the Bretton Woods system, the US has advanced to the petro-dollar system. The main benefits were 2: expansion of USD usage to all countries (everybody needs oil) and the removal of restrictions of pegging itself to gold. US now has free play. It can manipulate its currency at will.

International Trade

But is the petro-dollar system simply enough? No. There has to be another reason for people to take up even more USD. A reason which appears to benefit everyone else.

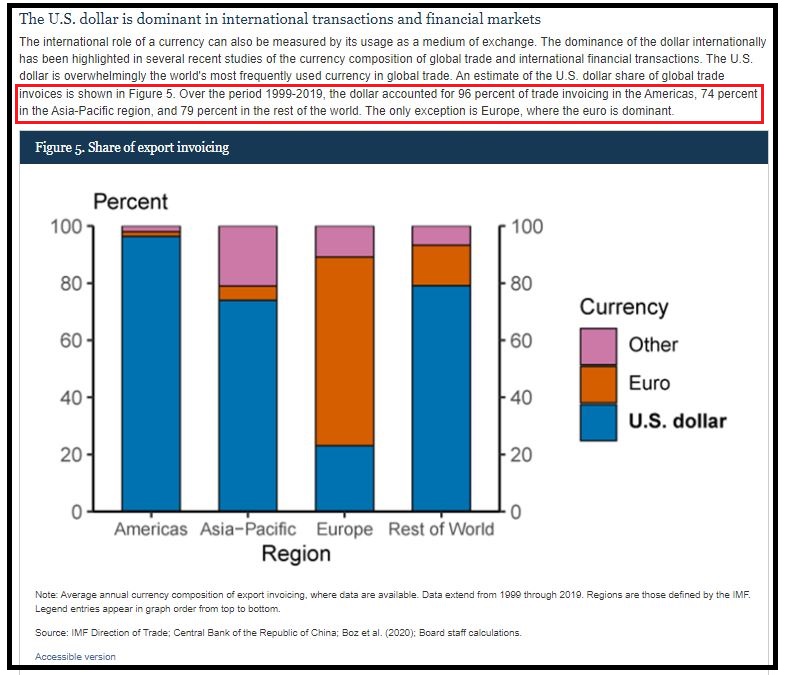

That is why the US is always a champion of international trade. From the World Trade Organisation (WTO) to many free trade agreements (FTA), US is always there. When there is an increase in trade, everyone earns money and is happy. Most importantly, USD, the currency for international trade, is used. This drives up the demand for USD more than ever as countries need more and more USD to facilitate their ever-increasing trade. As a result, about 80% of the world transaction currency is in USD, further solidifying the USD’s dominance in the global financial system.

Stablising Currency

However a country cannot just maintain the bare minimum amount of USD with some extra just for trading. It needs to have sufficient foreign reserves to protect its currency against any unforeseen circumstances, such as an economic crisis or an attack on its currency. If you do not hold enough USD, Big Brother will kindly teach you why you need to.

George Soros, famous for betting against the Bank of England, launched an attack on the Thai Baht in 1997. Using $1 billion of his $12 billion war chest, he shorted the Baht. Other fund managers soon joined the attack. To protect its own currency, Thailand threw out almost all its foreign reserve of approximately $40 billion but was not sufficient to defend against the attack, and the government was forced to float the Baht at the market rate, causing it to crash. Soros doubled his money to $2 billion and move on to his next target, but the after-effects caused much repercussions throughout South-East Asia known as the 1997 Asian Financial Crisis. Soros later went on to Hong Kong and suffered 2 defeats because another big brother China was behind Hong Kong. But that is another exciting story for another day.

The fund managers treated the Asian countries like a free ATM, withdrawing the hard-earned money that the countries worked decades for to earn. What happened was a series of crash not only in the currency market, but also the stock market. Companies collapsed one after another, assets were devalued to an unreasonable price. Now the question is, if you are the big monies, having profited from the big shorts, and foreign assets are now cheaply sold on the market, what will you do?

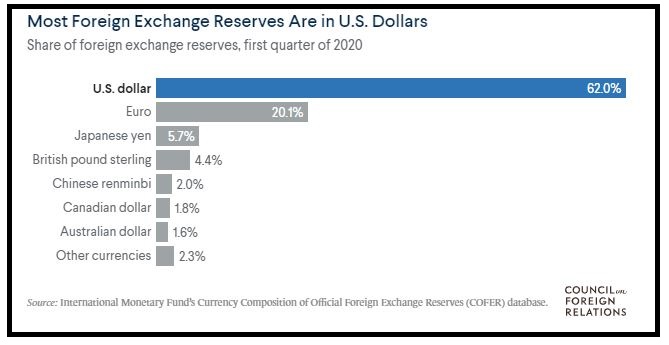

This gave other countries a wake-up call, one of which is that one must have sufficient foreign reserves to defend against the natural economic cycle and any malicious attack. If you are a central bank and had to decide which currency should make up the bulk of your foreign reserves, which currency will you choose? Naturally, the world’s reserve and most trusted currency, which is used widely in international trade.

US advanced another step forward. Not only must you have enough USD for your global trades, you must keep a substantial amount with you to defend against uncertainties. With enough sincerity USD, you will be safe, temporarily. Afterall, you did pay your protection money. Big Brother will be there for you, hopefully.

The World’s Central Bank

The world’s main currency is the USD. The US holds the minting rights of the USD. The US decides the interest rates of the USD. The US now holds the power to influence global financial system. The US has now become the world’s central bank. With this, it has fully cemented its dominance in the global financial system. That is why when the Fed talks, everybody listens. It places US in an active and decision-making role but all others in a very passive and reactive role. All others can only anticipate what the US will do and react accordingly.

This is like the US forcing all other countries to pay an annual tribute to them. All countries have to pay a tax to the US, failing which the consequences would be severe. From debt manipulation to interest rate exploitation to money supply controls, the US makes the world pay for their lifestyle and their continual expansion, with which they continue to trample on the others.

Maintaining The Current System

But US is not the only country with smart people. US is not the only one who knows how to play with politics and economics. Naturally, many countries are unhappy at being fleeced of their earnings and savings. The current system is only advantageous to the US but not to the rest. Everyone knows that, but not everyone has the power to move away from it. I had mentioned that with violence US enforces its will. Iraq tried it and was destroyed. Libya attempted it and was also trampled without mercy. With its military bases and deployment around the world, the US sends a constant threat to everyone directly or indirectly not to move away from its system.

One of the functions of its military is to force its system down other countries’ throat and supporting its financial domination. However, over the years, other countries are also gradually beginning to move away from this system. Russia is in an all-out conflict with the West, now choosing to sell its oil in Russian Rubles or Chinese Yuan. China has also increased its military power, built its financial network also known as Cross-Border Interbank Payment System (CIPS), made deals around the world and is now also pushing for more and more goods and services (especially oil) to be transacted in the Yuan.

Unlike Iraq and Libya, the US and NATO do not dare to go out on a full out physical war with either Russia or China, opting instead to crush them with other means which had been explained in detail in earlier articles. The reason is simple. Nobody will ever allow anyone to replace himself as the number 1.

But it is without a doubt, that the US is still the first in terms of physical force (the stick) and the monetary system (the stick disguised as a carrot).

Ending Notes

From barter trade we have went on to using money for trading. From domestic trading to trading with nearby territories to the global trade we have today, everything requires the use of money. But the system we have and use today is not by chance. It is a deliberate step by step action over a long period of time. That is not to say that the very first founding fathers of America had sights of what it is today. Every generation did what they could, and the next built upon the foundation of the previous, leading to what it is today.

Although the timeline of a country is long, the same logic applies to us too. As we work for the comfort of our own generation and our children, so will our children build upon the foundations we set today. What kind of foundations are we laying for the next generation, as a family and as a country?

Showing 1 - 3 out of 3

Page 1 out of 1

| - | Shop Products | Price | |

|---|---|---|---|

|

|

$99,999.00

|

||

|

|

$1.00

|

||

|

|

Price range: $69.00 through $99.00

|