This week was a mixture of happy and ‘horror’ week for me. At the same time, I will start being more transparent and open up even more of my portfolio. Today I will open up my trading portfolio for all to see, though it is nothing to be proud of. It documents my journey as I struggle towards success.

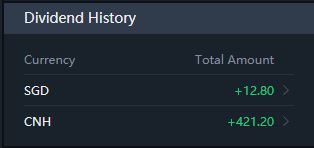

Let us talk about the happier things first. I have got my first round of dividend payouts. I do not buy shares that much, but had played crypto-currency and forex a bit more. The shares I used to buy in the past either did not pay dividends (such as Alibaba) or I ‘game over’ before the dividends were paid out. As such, after so many years, when I decided to be patient and go for safer shares, I got my first dividends.

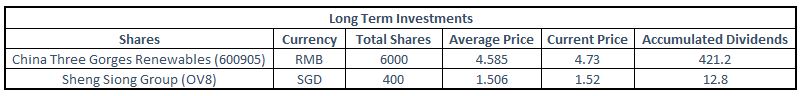

I currently hold Sheng Siong Group (OV8) and Three Gorges Renewables (600905) shares, and the above denotes their dividends paid out / declared on 14 and 15 August respectively. Sheng Siong pays dividends twice a year, with about 4% annual dividend yield. Three Gorges pays out once a year, at a much lower rate of approximately 1.6%. There will be many more dividend payouts to come, as I intend to keep them for the long term.

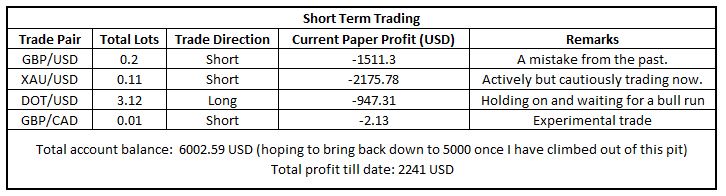

Now back to the horror stories. I have mainly 3 types of trade in my forex trading account – the old GBP/USD trades from the past which I simply could not get rid of, the current XAU/USD trade which I am actively playing, and the DOT/USD crypto currency trade which I am holding on in anticipation of a bull run which simply does not show any signs of coming. I opened only very small trades, for my intention was to earn about 100 USD per week as coffee money. Unfortunately, all 3 types of trades went in a totally reverse and ‘extreme’ direction the past week, pumping up my floating losses to a very high level. I was already in a danger zone, so I had to top up another 500 USD (and pay a small percentage fee) to be safe. Profit for this week was only a pathetic 2.35 USD, which is a disappointment by itself, but made worse by the ballooning floating losses.

Now to the further opening up of my portfolio:

Welfare pack for this week:

Download this week’s CFTC Commitment of Traders (big monies) analysis here.

Read more on what is the CFTC Commitment of Traders report.

Do note that the financial markets are volatile and unpredictable. The above report is only another set of tools to help with our analysis, and by no means is a 100% indicator as to what will follow. It should be used together with other necessary research which a trader or investor should do.

Showing 1 - 2 out of 2

Page 1 out of 1

| - | Resources | Price | |

|---|---|---|---|

|

|

$5.00

|

||

|

|

$1.00

|