This week was another bad week, with the DXY plunging even further. The GBP shot past 1.32 and the XAU broke the all time high to 2531. I did not enter new trades because I was unsure whether the new high would bring in a new wave of hype and FOMO, and decided to play it safe in order to conserve my ammunition first. My float was also on a riskier side due to the plunging DXY.

The good thing about this week was that crypto seems to have just a little bit of revival, with the DOT seemingly pick up pace by a bit. Hopefully the DOT will continue to rise in prices without any further incidents.

I have increased a bit more stakes in my experimental GBP/CAD trades to get familiarity and in an attempt to get away from the USD for some of my trades, though admittedly CAD is also very much closely linked to the USD.

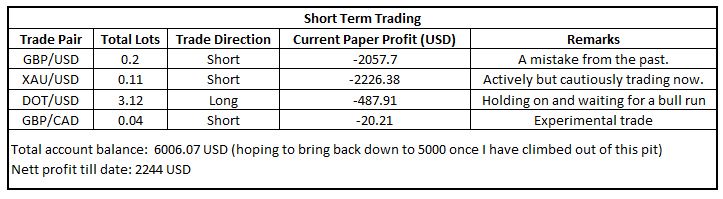

My short term trading portfolio as of now:

Separately, the RMB has fell sharply against the SGD, with 1 SGD = 5.476 RMB now. If the RMB remains this low against the SGD, I may put in some money into the RMB about 3 months later.

Welfare pack for this week:

Download this week’s CFTC Commitment of Traders (big monies) analysis here.

Read more on what is the CFTC Commitment of Traders report.

Do note that the financial markets are volatile and unpredictable. The above report is only another set of tools to help with our analysis, and by no means is a 100% indicator as to what will follow. It should be used together with other necessary research which a trader or investor should do.

Showing 1 - 2 out of 2

Page 1 out of 1

| - | Resources | Price | |

|---|---|---|---|

|

|

$5.00

|

||

|

|

$1.00

|