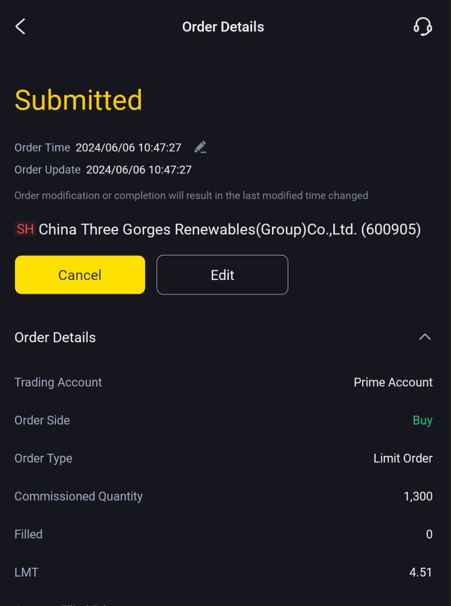

This week I put in another queue at 4.51 RMB with a position size of 1300 shares for Three Gorges Renewables (600905). Prices of the share fell to the lowest of 4.55 and dashed back up to 4.70 on the last day, closing finally at 4.69 RMB. Missed the trade by a mere 4 cents. Hopefully prices will fall back again soon.

It has been a good week for my short term trading though. Made a profit of 210.38 USD. I had stuck to plan with my XAU/USD grid strategy, and the XAG/USD was more of an experimental segment for me to get a better feel. Fortunately, I made a few correct decisions, and the XAG/USD trades resulted in the bulk of my profits this week. There were bad or boring weeks, and this week was one of the few good weeks.

Another lucky shot was when I decided to close my 2 DOT/USD trades. As mentioned last week, DOT is a crypto-currency. Shortly after I sold it, prices fell sharply and I opened another 10 trades on the grid. It then rebounded quite significantly. Right now I have some DOT/USD trades in losses, but overall it is in profit. But I am holding it on longer because I expect the prices to go up within the next few weeks or maybe months. I certainly hope that DOT/USD will fall further so I can sweep up even more at cheaper prices though.

Welfare pack for this week:

Download this week’s CFTC Commitment of Traders (big monies) analysis here.

Read more on what is the CFTC Commitment of Traders report.

Do note that the financial markets are volatile and unpredictable. The above report is only another set of tools to help with our analysis, and by no means is a 100% indicator as to what will follow. It should be used together with other necessary research which a trader or investor should do.

Showing 1 - 2 out of 2

Page 1 out of 1

| - | Resources | Price | |

|---|---|---|---|

|

|

$5.00

|

||

|

|

$1.00

|