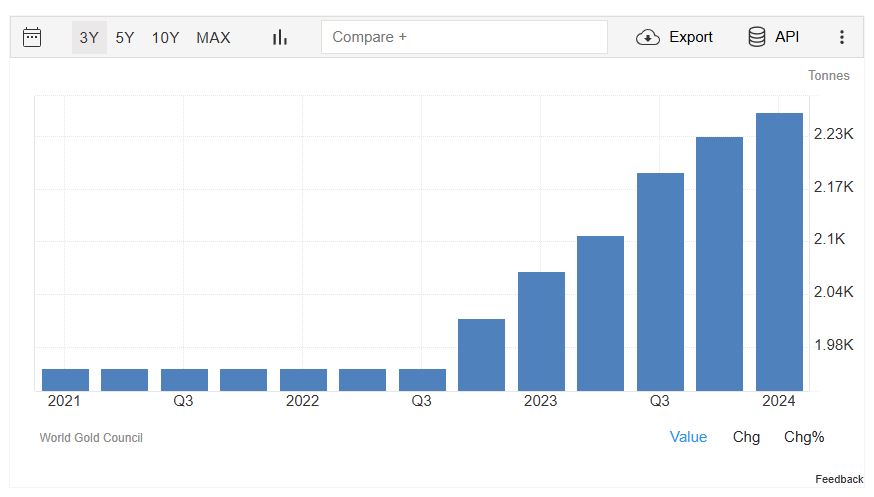

China started buying gold in Q4 2022, and had been steadily buying all the way till April 2024. Although China has been buying for so long, it was only in early 2024 that the masses took note of it. Gold prices rose from about 1700 USD/oz then to the 2450 USD/oz all time high. Throughout this period, China has increased their gold holdings from 1950 tonnes all the way to 2264 tonnes – an increase in 314 tonnes.

Hype On Gold

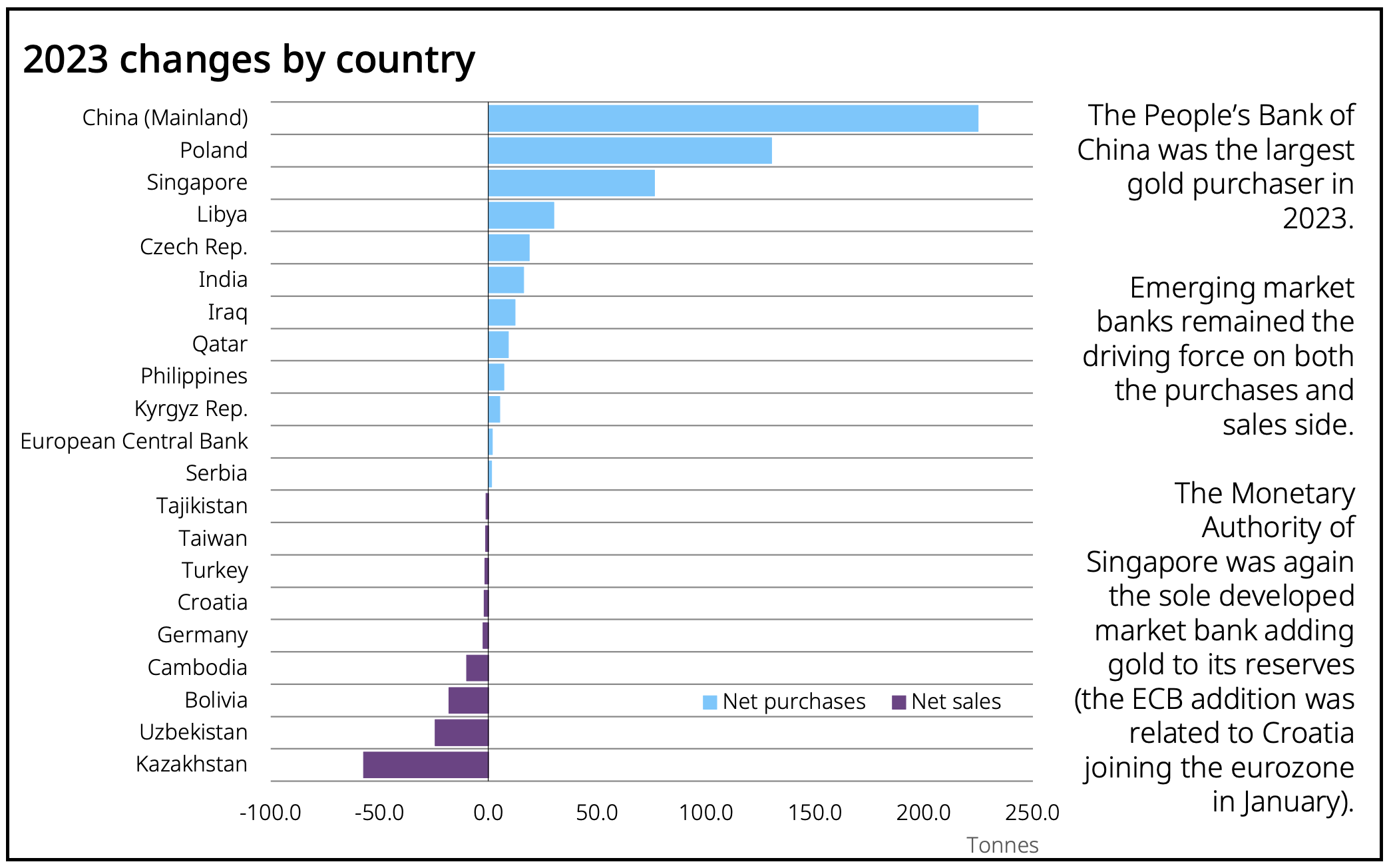

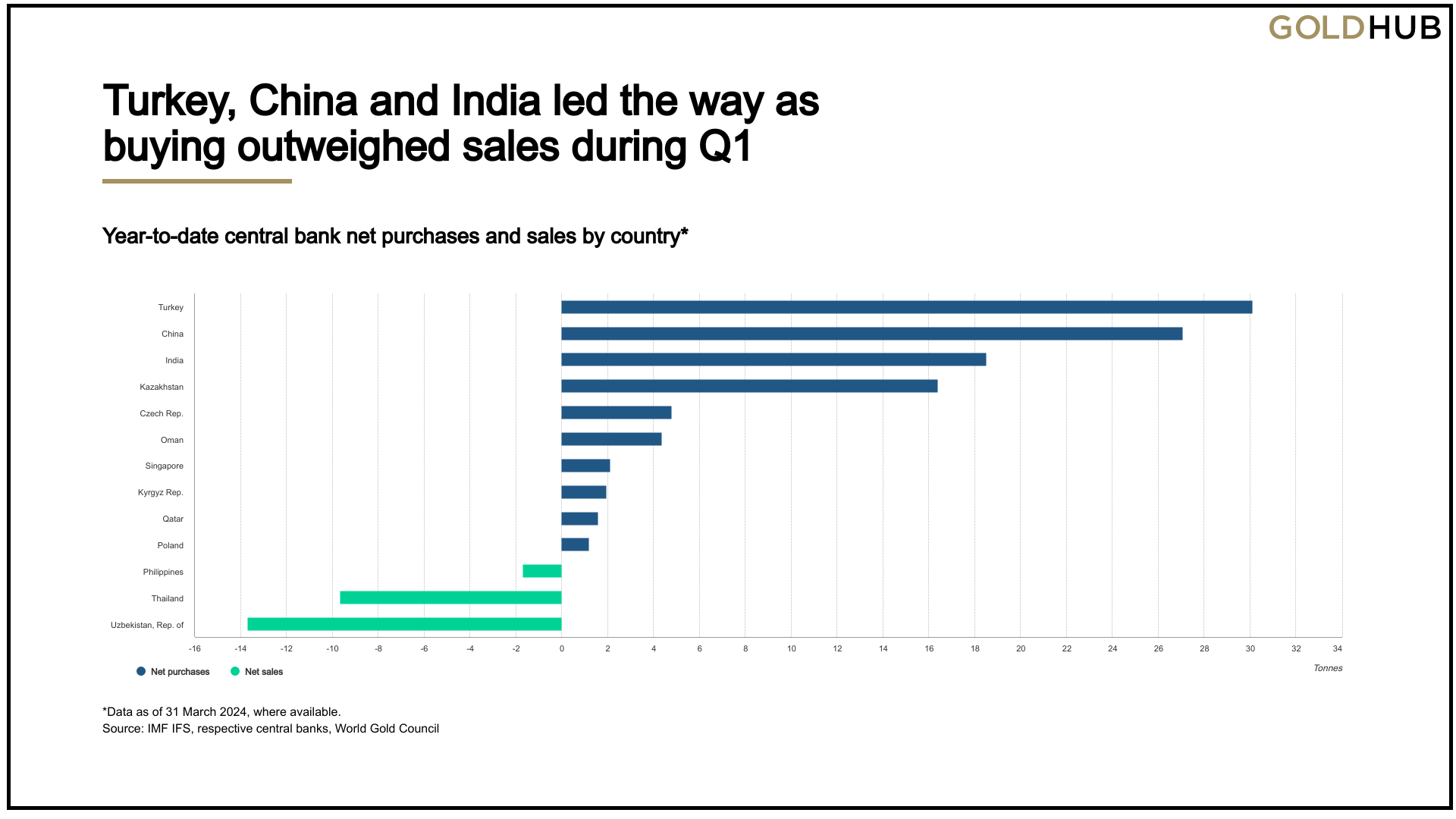

While gold price has been steadily increasing to the 2000 USD range for some time, the dash to record highs started only in January 2024. The hype on gold prompted a lot of analysis on the news and on social media, by experts and by influencers of varying knowledge levels. There were many explanations flying around, but the explanation on central banks buying up the gold and causing a lack of supply was the more prominent one. Afterall, not only China, other countries have been actively scooping up gold. The 2 charts below showed data from 2023 as well as Q1 2024.

Because the central banks of certain nations were actively buying gold, the first thing that came to mind would be increased demand and reduced supply. Basic economics tells us that that will cause the price to rise. However, there were also in-depth explanations that central banks buying gold should not be the main reason why gold price went up. For example, total central bank gold holdings were still smaller compared to total retail, that gold is actually an indicator of the lack of confidence in the economy and etc. These 2 reasons ended up being paired to each other – that the countries are preparing for a crisis ahead. The gold hype then started and everyone rushed to buy gold in one form or another (paper gold, gold mining company stocks, physical gold, gold ETFs) despite sky high gold prices.

However, as of May 2024, China has paused their gold buying, ending their 18-month buying streak. In fact China started to scaled down on their gold purchases even before the price of gold shot up. According to publicly available data from the World Gold Council, we look at 2023’s top 2 countries’ gold buying data:

| Gold Purchases (Tonnes) | ||

| Month | China | Poland |

| Sep-23 | 26.1 | 19.3 |

| Oct-23 | 23 | 6.2 |

| Nov-23 | 11.8 | 18.7 |

| Dec-23 | 9 | 0 |

| Jan-24 | 10 | 0 |

| Feb-24 | 12.1 | 0 |

| Mar-24 | 5 | 0 |

| Apr-24 | 1.9 | 4.7 |

| May-24 | 0, as reported in news | Data not available yet |

Of course, even as gold prices hit record highs, there are still certain countries like Turkey and India buying gold. But their volume can be said to be not that significant compared to the top purchasers.

Causation And Time Lag

Although central banks buying gold was not supposed to be the main reason why gold price went up, this storyline was still casted and the end result was as such. Prices went up. Similarly when it was announced China stopped buying gold in May, the price of gold fell by 100 USD/oz, which was about 4.16%. Following through this storyline, now that central banks has eased up on their gold purchases, we should expect that price of gold will drop in the next few months.

However do take note that as with the rise of gold, time lag also applies to the fall too. When the news come out about central banks sweeping all the gold in the market, that was already outdated data. The countries had already started to scale down on their purchases, just that the retail market is slow on the uptake, and hence the subsequent hype can be said to be irrelevant and illogical at best. Perhaps even market manipulation by certain organisations or corporates to fleece the people off. When it comes to the fall, the market also needs to have reaction time. A knee jerk reaction like the 100 USD/oz fall is not unexpected, but further drop should be a slow and gradual process.

The Political View

Earlier when I sold off my spot gold at about 2280 USD/oz, I said that price of gold will likely fall due to the US elections. There is a need to paint a picture of stability and prosperity, no matter how much in shambles the economy is right now. Like many other investors or traders, I do not aim to buy at the lowest or sell at the highest. Once it hits my range, I am willing to execute the trade. When I sold, I was prepared for the price to go up to 2400 USD/oz or even 2500 USD, although I certainly hope it did not. Right now, gold has reached the all-time high of 2450 USD/oz before beginning the fall. Of course in the very short term, gold may make one last struggle for another record high, but the overall climate does not seem to support that.

Firstly, as mentioned, the US elections. Secondly, central banks have begun to slow down their purchases. The gradual illusion of a better economy and the perceived fact that central banks found it too expensive + no more urgent need to hoard gold will be a double whammy on gold bulls.

Conclusion

The behaviour of central banks further supports my expectations of a falling gold price. I have also made the necessary trades in selling off all my spot gold (main money from gold portfolio) and opening shorts on gold (small amounts on gold portfolio) which one can see from my ‘Portfolio‘ category in this blog where I post my weekly trades. Of course, I cannot be sure I am 100% right. But probability is with me.

And I act on what I said, rather than just giving analysis but not committing any money into it. I will burn if I am wrong.