Note: There are many technicalities involved if we want to be very specific in the explanation of crypto currency. But considering that there may be readers who does not know much about the crypto scene, this article will intentionally use layman terms in order to better explain things.

Crypto savings or staking, in very simple terms, is essentially putting your crypto currency into savings or fixed deposits (which is also a kind of savings). As crypto gains traction these few years, more and more people are looking into crypto as an alternative form of financial instrument, be it for trading, investing or for savings. Today we will not talk about trading or investment, but only savings.

People has been turning to crypto savings in increasing numbers simply because the savings interest rates provided by traditional institutional banks have been pathetically low, to the point that it just serves as a safe location to park your money while it slowly erodes away in the face of rising inflation. Below are a few examples.

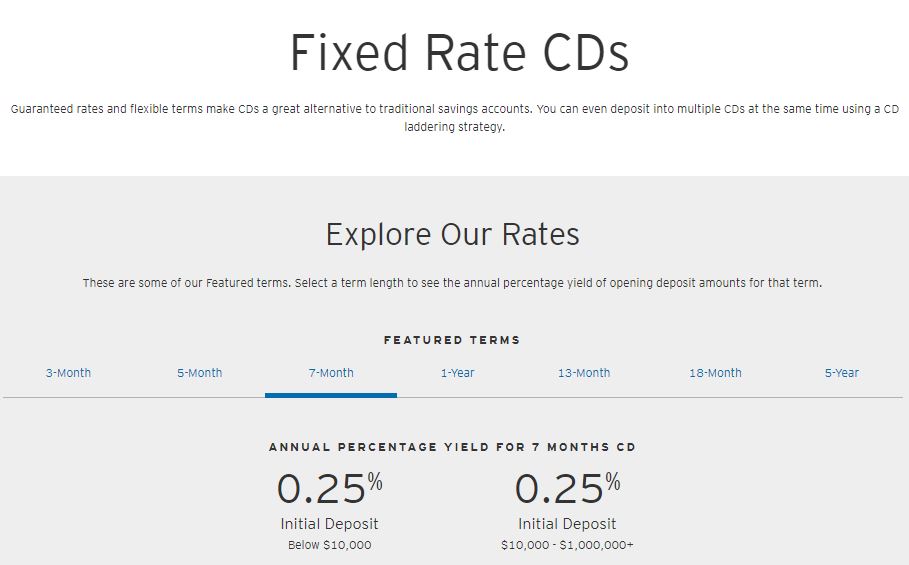

This is the New York’s Citibank’s fixed interest rates. Among all the featured terms, the 7 month term gave the highest interest rates of 0.25%, while the rest gave either 0.1% or 0.15% per year. Take note the percentage interest rates is calculated in per year terms, meaning for a 7 month term you would have to pro-rate it at 7/12 x 0.25% = 0.1458%. Basically it means that if you put $10000 in, at the end of 7 months you will get only $14.58, after which if you want to renew another fixed deposit term, you will have to see what are their terms again.

In Singapore, the United Overseas Bank offers the following interest rates:

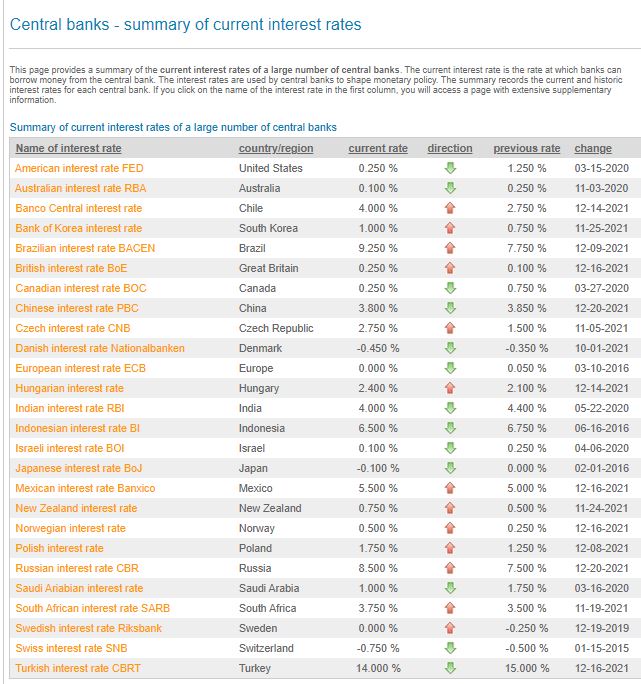

I will not go into the calculation anymore since it is the same concept and method as above. But we can see that the rate, while doubled that of Citibank, is also pathetically low. To give you a sense of what is happening elsewhere in the world, look at the chart below.

We can see that throughout the world, most countries have very low interest rates, except for countries with very weak economies such as Russia or Turkey. That is another set of economic theories and issues which we will not discuss here today. But basically you can understand it to be that the weaker the currency, the higher the interest rates. From this we can see that no matter the situation, putting money into traditional banks is no longer a viable option to properly manage our money. Granted we definitely need some liquidity for daily purposes like buying groceries and pumping petrol, but beyond that, it may not be wise to put too much money in the banks any longer.

Enter crypto savings, which has a relatively high interest rate. I know there are a lot of coins which offer savings or staking (take it as fixed deposits) terms, but for safety reasons we only look at stablecoins. Stablecoins are coins that are pegged to the USD. For example we have Binance USD (BUSD), USD Coin (USDC), Tether (USDT), etc. While there are just some very small fluctuations, generally 1 USD = 1 BUSD = 1 USDC = 1 USDT. When we put our money into savings, our purpose is not to earn big money, but to mainly protect the value of our money and ideally outrun inflation by a bit. If we want to earn big money we can either put in forex, stock market, trading crypto coins like Bitcoin etc. Savings should be a stable thing. Today I put 1 USD in, tomorrow I should expect to take out 1 USD equivalent of value out when I withdraw the money.

With this concept in mind, we will talk about savings using stablecoins. There are many platforms which offers savings or staking for such coins. From Celsius to Hodlnaut to Crypto.com, these platforms are like banks. You deposit with them, they take your money and loan it out to others at an even higher interest rate. Of course, while depositing USD in Citibank gives you the confidence that firstly USD will not collapse suddenly and Citibank is regulated by the Government, nobody can guarantee you what will happen to USDT tomorrow nor can anyone guarantee that Celsius or Hodlnaut or Crypto.com will be there tomorrow too.

There are risks which you must certainly be aware of. But case studies have also told us that British Pounds or the USD has also fallen much in value compared to the past, and that Lehman Brothers have also closed shop. There are risks everywhere, in the crypto world or in the world we are familiar with. I am not saying that one must put money in crypto savings. I am saying that crypto savings is a viable option, which although has risks, can also be managed. For example if I have $50,000, I may put $10,000 of USDT under Celsius, $10,000 of USDC in Hodlnaut and so on. It can be a combination of different stablecoins in one or more platforms.

If we take a crypto savings rate of 10% per year, and Citibanks’s 0.25% per year, we can see that you will need to put money in Citibank for 40 years just to match 1 year of rewards in crypto savings. Yes money in the bank can be taken out any time you want just by going to the withdrawal machine or to the bank teller, but crypto is not all that hard to take out these days. It may require a little more effort, but it is still doable.

While it is necessary to keep some money in the bank for daily purposes, do not constraint yourself to the traditional methods of savings. Inflation is running high, and if you do not outrun inflation, you are just reducing the value of your hard earned money over time. Nobody will help you. You have to help yourself. Do note that you do not need to put in all your savings into crypto staking. 10% or 20% of your money into crypto savings to try it out and get the feel should be sufficient.

Showing 1 - 3 out of 3

Page 1 out of 1

| - | Shop Products | Price | |

|---|---|---|---|

|

|

$99,999.00

|

||

|

|

$1.00

|

||

|

|

Price range: $69.00 through $99.00

|