Most of us pay for intangible things. In fact I would say that about up to 60% to 80% of what we pay are for intangible things. When the ladies bought a Chanel bag, they are not actually buying a bag, but the social status that comes with it. A Casio watch can tell time as well as a Rolex, and a Toyota can ferry the driver as well as a Bentley. This includes every other thing that we pay for, from eating in a fanciful restaurant to buying a house in a prime location, from sitting in a business class flight to a marriage proposal with a diamond ring, the intangible things not only includes social status, but also time, convenience, energy, proof of love, network and every other thing not easily quantifiable by numbers. Though it is subjective, one should not give up trying to put a value to the intangible things in our lives as it will help us make better decisions.

Working out the cost of an intangible item allows us to know what exactly are we paying for and what benefits we can reap from the purchase decision. While a Bentley car is able to get you into an exclusive network, a Chanel bag grants social status, a bigger diamond proves your love and the Rolex proof of your success, today we will use the item that affects the most people – housing. Practical and down to earth.

By now most people know it is generally better to buy a house rather than renting, so we will narrow down our scope into whether to change into a bigger and better house as we move on to the different stages of our lives.

Context

The examples below are based on the Singapore context, which I am familiar with. The figures quoted are either accurate (after doing homework) or a good estimate based on current market (such as housing prices). Using the same logic and method of calculation, one can apply to his or her own context, be it in a different country or different product which one is considering to purchase.

Assumptions

We assume Tom currently has a 2-bedroom house which he bought at 300k + 40k renovation at an average location a couple years back when he got married and did not have so much money. Tom now has 2 children and he foresees that privacy will become an issue, especially if the 2 children are of different genders. Tom now also thinks about proximity to a good primary school as his children grow up.

Tom’s house now is able to sell at 450k. Tom now also sees a 3 bedroom flat in a better location for 750k, which will require another 70k for renovation, bringing it to a total of 820k. For the ease of calculation, we will omit out cost such as interest rates, stamp duty, agent fees etc. Tom will now need to fork out an additional 370k for a new house. We will set the timeframe to when both of Tom’s children finishes primary school.

We will assume inflation is at 4% a year, a relatively low amount if you ask me. The reality on the ground is often more traumatising.

Tangible Benefits – Cost Savings On Transport

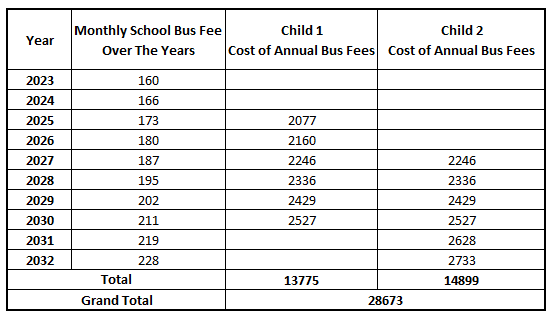

With the proximity to school, Tom’s 2 children need not spend money on a school bus during their primary school years, which at the current rate is $160 per month and you will still have to continue paying even during the school holidays. With an inflation of 4% and assuming Tom’s elder child will start primary school in 2 years and the younger child will start in 4 years, we can do a simple calculation and work it out to the following:

One should also consider if the new house will be nearer or further away from Tom’s and his wife’s current workplace. A nearer workplace perhaps would mean lesser petrol cost and in Singapore, ERP savings. ERP stands for Electronic Road Pricing, which is a fanciful name for gantry fees for using the Singapore roads. One can make adjustments to the cost for the working adults and make the necessary calculations using the method shown above.

Tangible Benefits – Tuition Fees Saved Due To Good School

Certain parents are hardcore when it comes to their children’s academic results. Some are more chill and just expect a decent pass from their children will do. If you are the former, you can skip this aspect. If you are the latter, getting into a good school will probably mean better teachers, a better studying environment which will help your child academically to reach the standard you require without tuition.

Tuition fees are not cheap. We will consider a cost of $40 per lesson per subject for primary school students in a tuition centre, as compared to the more expensive reputable centres or private tuition. Assuming the child needs only tuition for 2 of the 4 subjects (English, Mother Tongue, Math, Science), that will be 2 subjects x $40 per lesson per week x 4 weeks in a month = $320 for a child = $640 a month for 2 children. A simple calculation for 12 months in a year for 6 years will work out to be $46,080. Supposed your children do not require tuition after entering the good school, that will be an actual $50,000 saved after pricing estimates for inflation.

Intangible Benefits – Cost Of Time

Time is a very precious resource. From sending children to the childcare or parents houses (in Singapore, some parents will help to take care of their grandchildren) to travelling to work (especially if you are taking public transport), much time is spent travelling. Tom could save 3 hours a day on travelling if he changes house, which is actually a significant portion of his day. Afterall, 3/24 is actually 12.5%.

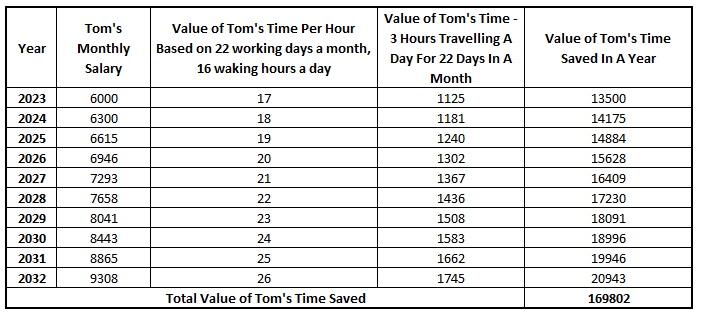

We assume Tom is earning a take-home salary of $6000 a month with an estimated yearly increment of 5%, we can then work roughly work out the cost of his time as follows:

Cost of time is a very subjective matter. While the politically correct answer is that time is invaluable, we can still attempt to put a value to it. How to do so differs from people to people. While there are others who will simply waste their extra time, there are people who use it for rest, or for upskilling, or even to do side jobs. If one is actively earning side income with the extra time, then it is easier to calculate. Else, simply work out the value of your time based on your own situation. If you think that the cost of your time out of working hours should be 0, then so be it.

We can also change a perspective. How much are you willing to pay for an extra 3 hours a day to rest, to engage in your hobby, to spend time with your family etc? Will it be $20 an hour? If so, you can price your free time on the amount you are willing to pay for and calculate the rest out.

Intangible Benefits – Conveniences

One of the reasons why people often buy houses in a prime location – near the transport network with many amenities nearby. Things are easy and convenient, of which time savings is also a direct outcome. And of course, this time savings is worth something. In Singapore, mature estates are defined as estates which have all the basic and required amenities within itself, such that a resident in that estate do not actually need to step out of the estate for his or her daily life. Transport network, supermarkets, sports facilities, libraries, shops, eateries etc. These conveniences not only save you time, but also energy.

If Tom change his house, he will also need to consider if there is any gain in conveniences in the different areas of his life.

Intangible Benefits – Privacy

As mentioned earlier, one of the reasons why Tom wants to change his house is because his children are growing up and there is a need to have separate bedrooms for each of his children, especially so when his children were of different genders. This is certainly a very critical aspect in which people are willing to pay for. Again, we ask ourselves, how much is Tom willing to pay for the privacy? It may be 50k, 100k or 200k.

Intangible Benefits – Happiness

Living in a better and fancier house definitely brings joy to most people. Not only do people get an upgrade in their socio-economic status, which they take pride in, a better house in both internal (eg bigger living space) and external (more amenities in the estate) factors definitely add some happiness points. This is why many people in Singapore will want to upgrade from public housing to condominium or even landed properties. Take for example, many condominium developments have a gym and swimming pool, barbeque pits and function rooms for social events, all of which also cost money outside. High end luxury condominiums have even more things such as a private lift to your floor or even a co-working space.

How much will you price the happiness?

Tangible vs Intangible

You may have noticed that the intangible benefits mentioned is double that of the tangible benefits in this article. That is on purpose. Because no matter how I look and calculate the different scenarios, most of the time, the tangible benefits alone do not justify the purchases. If one goes solely on the tangible returns, a whole new decision will be made. For example, Jerry only considers the tangible benefits. He also bought a house – a 3 bedroom public housing in a not so reputable area for 300k. It is a certain distance from the train station and the nearest amenity. Jerry does not even renovate his house but rents out 2 bedrooms immediately for a total of $2000 a month, taking an annual yield of 8%.

While Jerry do not like the area or the house, he is willing to take on inconveniences and certain unhappiness in order to maximise his money, considering solely the economical benefits. Just as a short sidetrack, humans are very adaptive animals. Humans can survive anywhere and get used to it very fast. That is why you see human beings living in all kinds of environment – from the forests to the mountains, from the deserts to the ice-cold desolate lands. Human beings are in fact so adaptive that such a feature becomes a double-edged sword, in that people easily settled into their comfort zone and refuse to get out easily, preferring to suffer a slow death. This applies not only in living environments, but also in our careers, our relationships, our finances, our freedom etc.

Back to the topic, if we solely consider tangible benefits alone, we will almost always be unable to justify the amount we are paying for. Why an LV bag instead of a brandless bag from the flea market? Why Bentley and not Honda or even public transport? Why Rolex and not Casio or even your own mobile phone? But even if we know we are paying for the intangible things, it is good to always break down the different aspects of intangible benefits which we are paying for, especially if it is a large purchase.

Conclusion

Each one of the benefits listed may be far from covering the whole gap if we upgrade our house. But breaking down and listing out each of the benefits will not only allow us to know what exactly we are paying for, it also helps us make a decision. There may be a house we really like very much, but if after all the analysis we find out that all the tangible and intangible benefits added together still cannot justify the cost of our new purchase, then it is a clear sign – no go.

Just like how we may love our ex-girlfriend / boyfriend a lot, but we know that after all things considered it is a no-go, then there is no choice but to break up. It is the same for our purchases. Even when paying for intangible benefits, it is always good to be logical and practical about it. Put a value to all the benefits which matter to you as best as you can, do the math, add up the sums and you will have the answer to your question.

To buy or not to buy – let math solve the problem for you. Although you can have one last cheat code – you can price the value of your happiness as high as you want it.

Showing 1 - 3 out of 3

Page 1 out of 1

| - | Shop Products | Price | |

|---|---|---|---|

|

|

$99,999.00

|

||

|

|

$1.00

|

||

|

|

Price range: $69.00 through $99.00

|