On 10 Mar 2023, the Silicon Valley Bank (SVB) collapsed. At the time of failure, it was the 16th largest bank in the US and the largest in the Silicon Valley. Its collapse wiped off the deposits of a few famous US companies such as Shopify, Roblox, Roku and Rocket Lab US etc.

To give a simple summary, the Fed’s continued interest rate hikes has caused SVB 2 issues:

1. A loss in SVB’s portfolio

2. Heavy withdrawals from SVB’s customers, which are heavily concentrated in the tech-startup sector. These companies are not well to do and will need their funds to tide them through the crisis.

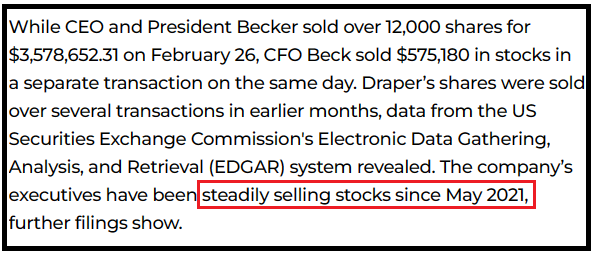

Like any other bank, SVB do not let the deposits sit there and collect dust. The excess money was used to invest in other financial instruments. However, such investments are often not liquid. In order to support the withdrawals, SVB was forced to sell a portion of their portfolio at a loss of $1.8 billion and wanted to sell another $2.25 billion of its shares to bolster its finances, triggering a panic for businesses and people to withdraw money from the bank, commonly known as a bank run. SVB could not sustain and it was eventually ordered to close.

How do we understand it in layman terms? Let us say you have a house worth 1 million, but you only have $10,000 in the bank, which is sufficient for your daily living. The value of your house fluctuates – sometimes it is worth lesser than your purchase price, sometimes more. But you know in the longer term, say 10 years, chances are that it will be worth more than today. Unfortunately, at this point in time, your house is only worth $800,000, which is still actually sustainable for you. The second unfortunate thing is, a family member suffers an illness and you need a sum of money for his or her medical care. The problem with non-liquid assets is this: Your asset may be worth $800,000, but you will only be able to get this price if you have the time to sell it. If you want to sell your house urgently, chances are you will get only $600,000 or even lower.

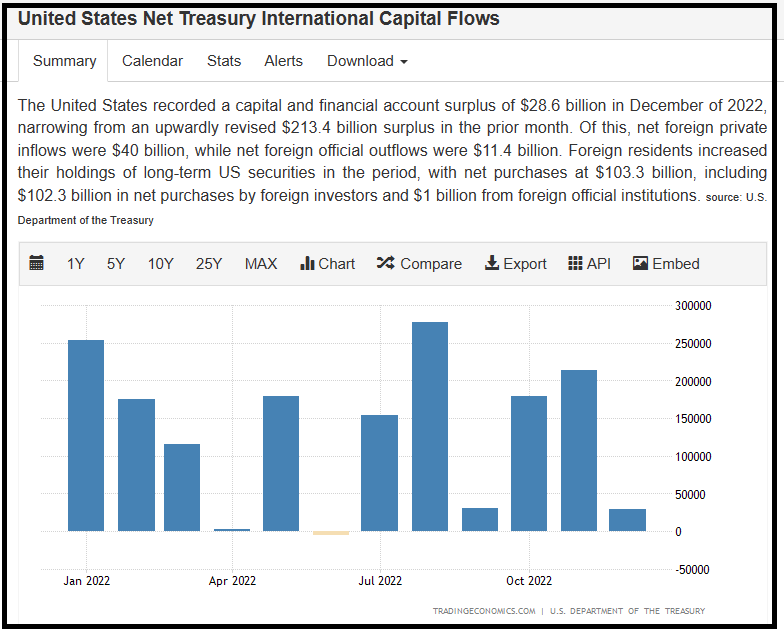

We do not have the actual breakdown of customer deposits in SVB, especially by countries. So we can only make some logical deduction over here with some targeted news report to support our analysis. Being one of the larger banks in the US, it only make sense that there is a significant amount of both local and foreign deposits in it. This is especially so in the past year as the Fed had been increasing interest rates aggressively, leading to a huge capital inflow into the US.

For the benefit of new readers, when the Fed increases interest rates, it makes more sense for monies to flow into the US to earn the higher interest rates. To capture the higher interest rates, naturally deposits in the banks will be the next course of action.

Lehman Brothers happened 16 years ago, and it plunged the whole world into an economic crisis. Today SVB happened, and it is only the first of the domino that fell. We can be sure that it will trigger a series of events.

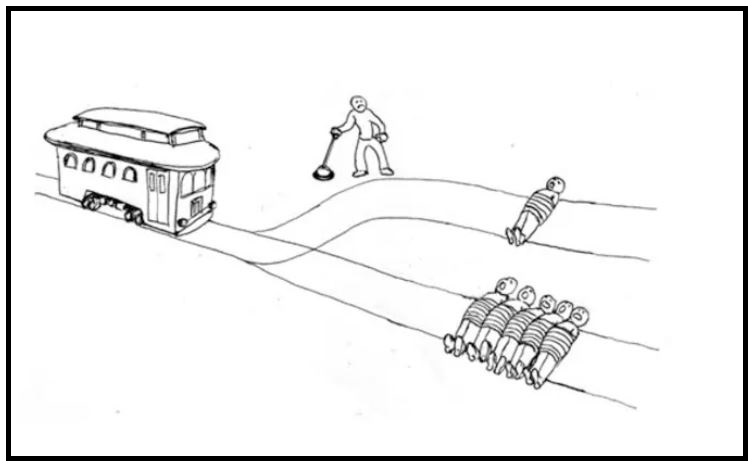

The US has a history of bailing out failed corporations. But just like Lehman Brothers, it chose to see the the banks fail. There is no proof, but it looks to me like the US wants to swallow up the foreign funds whole, and if in the process sacrificed some of the local companies, then so be it. As mentioned in earlier articles, the trolley problem was never an issue at all. Emotions and sympathy is not required in policy-making, especially so when the policy is out to draw blood.

There are 2 benefits for the US government to let some of their banks collapse. The first, as mentioned earlier, is to swallow up the foreign funds (translate to: daylight robbery). The second is to plunge the US and the world into a global recession. The Fed has been aggressively hiking interest rate in the name of bringing down inflation. But if we look at the news, whenever the economy shows signs of doing well, the Fed will increase the interest rates with more force. The US cannot be sitting on so much foreign funds and paying out sky high interest rates to these people for free. There has to be a use for the money – shopping of core and critical foreign assets in a global crisis. For one day that the recession has not yet come, the US has to pay out these interests for another day. Swallowing up all these foreign funds will ease some of the load on the US government.

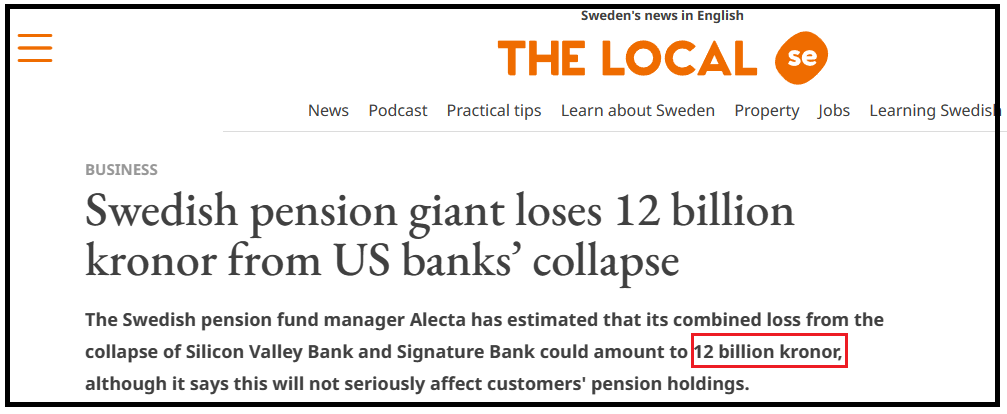

For information, in today’s exchage rate, 12 billion Swedish Krona = 1.13 billion USD. And this is just ONE customer. The US do not need to pay interest for this 1.13 billion USD, and in turn gets this 1.13 billion USD for free. How many foreign sovereign wealth funds, corporations and individuals bank with the US? If one has been following the news, one would also know that the super-wealthy Chinese and Russians has been running out of their own countries with their funds. Where do they bank? The US, UK, Switzerland, Singapore for example. US may not get the whole cake, but it certainly got a significant portion.

This first domino which falls will bring down many others, leading the world hopefully into a global recession.

How Does It Impact Me

The all-important question to us commoners. While it is good to study the bigger picture, I realise that my readers prefer to have a section on the direct things that will impact them. Practical applications from the theories we study.

Insurance On Your Deposits

In the US there is the Federal Deposit Insurance Corporation (FDIC) which insures the account holder’s deposit up to $250,000. In Singapore we have the Singapore Deposit Insurance Corporation (SDIC) which insures your deposits up to $50,000. Naturally for SVB depositors who put in millions of dollars, $250,000 is nothing. Similarly in Singapore, even a commoner could easily have more than $50,000 in the bank.

Just like nobody expects SVB to fail, I am pretty sure many residents in whichever country also do not expect their banks to fail. However, shit happens. The first thing you should do is to check out how much your deposits will be insured, and anything in excess you can either put in another bank, or put it under the name of another family member in the same bank. Most importantly, on paper, the money parked under one name in a particular bank should not exceed the insured portion of the deposits. There are so many different banks in the country, for a commoner, that is more than enough.

Understand The Country You Are Putting Your Money In

Wealthier people often like to park their money overseas. But even commoners like to do so as well. That is where you need to know the country you are dealing with. I have repeatedly said in this blog that the US has no credibility. Simply put, US is the bad guy. If you still want to put your money with them, then you will need to be fully prepared. At least for one, make sure that your deposits fall under the insured amount covered by FDIC.

Consider Gold

If you really have the extra money but do not want to put all into the bank out of fear, you may consider putting a portion of it into gold. The main purpose of converting money into gold is not to earn money. There are better financial instruments to do so. Its main purpose is to protect your money. Converting a portion of your cash has 2 benefits – hedge against the bank’s collapse and hedge against the currency’s instability. With the instability these days, sometimes currencies lose their value easily, Turkey for example. Even the GBP and Euro plunged heavily in 2022, wiping out a huge chunk of value on people’s money. I had said above that the US is trying to plunge the world into a recession. How confident are you that your country’s currency can survive?

The gold bars you bought can be stored either in a security deposit box with the bank (not even sure if this should be a pun) or even at your own house. The best of all, gold bar is fairly liquid. Any time you need cash, just walk in to a shop which deals with gold and change it out for cash.

Diversify

This word one of the key concepts in any foundation topics for investing. SVB’s main customers were Silicon Valley tech-startups. By them SVB rose to success, and by them it fell doubly quick. Startups have the drive to succeed, but as also mentioned earlier, they lack the funds and they have not yet succeeded. They are extremely fragile in a volatile environment. If SVB has a more diversified portfolio of customers, it would not have suffered such a heavy withdrawal. Not diversifying may nett you quick gains, but it can bring you down just as easily.

Conclusion

The collapse of SVB is more than what it seems on the surface. Politics and economics are dirty. While we do not have the power to influence the grand scheme of things, do be careful and make the correct decisions so that you do not become a sacrifice for other’s march towards glory.

Showing 1 - 2 out of 2

Page 1 out of 1

| - | Resources | Price | |

|---|---|---|---|

|

|

$5.00

|

||

|

|

$1.00

|