Bitcoin, dubbed to be the digital gold, and even some cases the future of gold, has gained hype in this round of bull run mainly because of Donald Trump. His policies favour crypto-currency, especially Bitcoin. In this cycle, Bitcoin has reached its all time high of 99588.01 and many believe that it is only a matter of time before it breaks 100k. However, despite all the hype, there are a few reasons why Bitcoin will never be the next gold.

Too Little Bitcoin

There is a maximum supply of 21 million Bitcoins, of which nearly 20 million had already been mined. Gold on the other hand, has an estimated total supply of 244,000 tons (187,000 tons produced and 57,000 tons as underground reserves). While also limited in supply, there is also the occassional discovery of a new gold mine / deposit which will increase the supply.

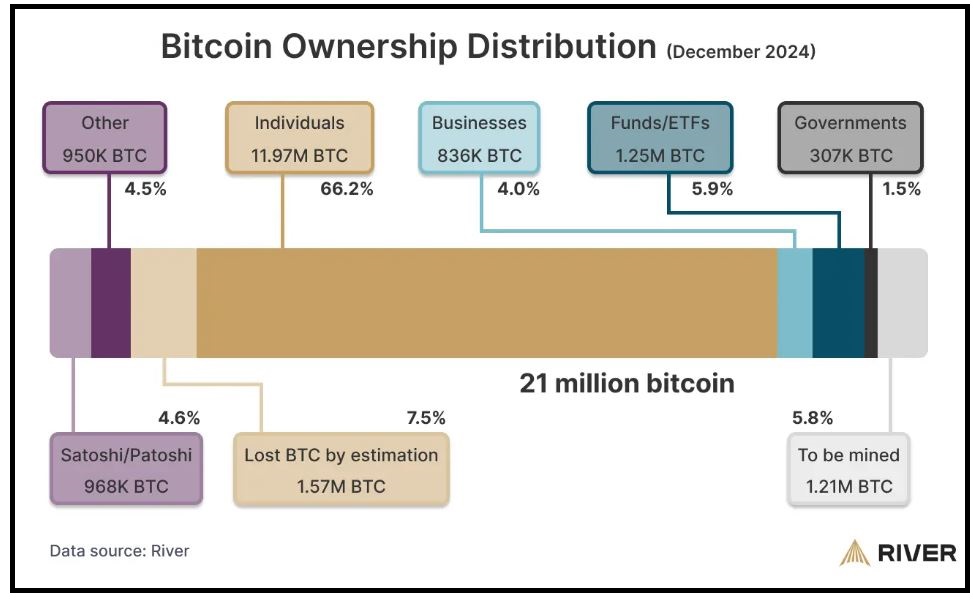

Gold is limited in nature, but at the same time there is enough to go around for retail use, institutional trading and investments, as well as central bank reserves. Bitcoin on the other hand, though can be broken down to satoshis (0.00000001 Bitcoin = 1 satoshi), is still quite limited in nature. Considering that the crypto whales, including those institutional investors have already got themselves a significant portion of the total Bitcoin supply, there is simply limited grounds for governments to cover and make it as a substitute for gold. Note that this does not mean governments will not hold Bitcoins as it can still be used for other agendas.

Price Instability

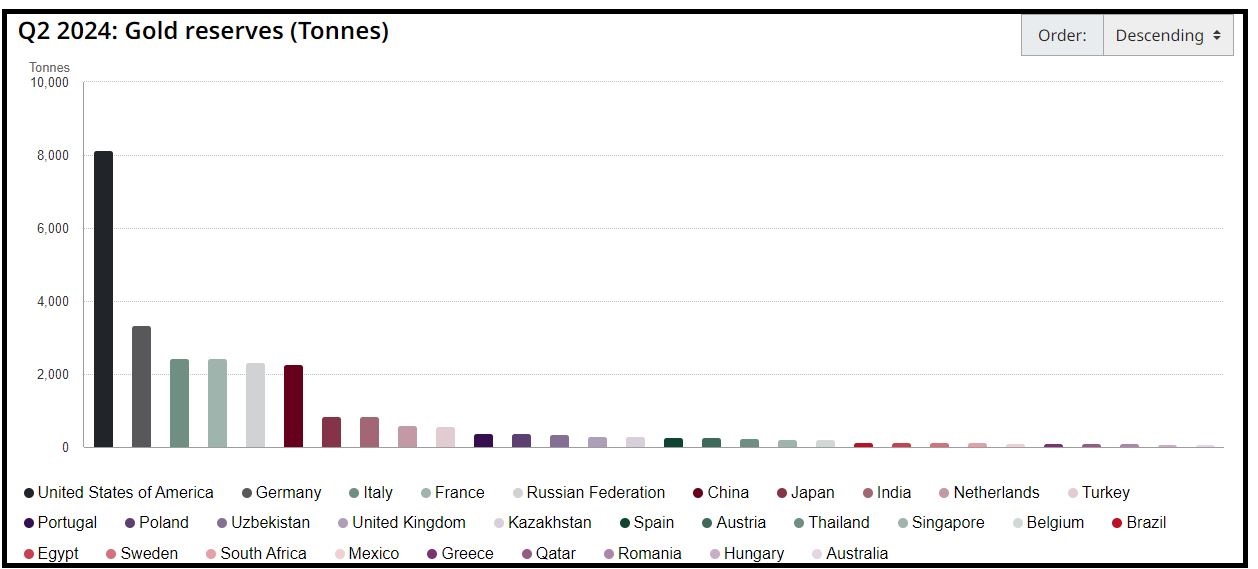

Gold is relatively stable as an investment and as a central bank reserve (but volatile if we do short-term trading). While it has its ups and downs, it generally appreciates over time. Note that the purpose of gold is mainly to hedge against uncertainty and to give countries the confidence to say their currency is solidly backed by something concrete. While the confidence of a country’s currency is not solely determined by its gold reserves, it certainly helps to know that there is a mountain of gold behind to support the country’s claims. And for this to work, the price of gold has to be stable. Many countries cannot afford to be suddenly poorer by a few billion just because the price of gold dropped out of nowhere.

Bitcoin on the other hand, is highly volatile. After every bull cycle, it drops significantly. From the high of about 19,000 in 2017 to the low of about 3800 in 2018, from the high of about 69,000 in 2021 to the low again of 15,000 in 2022, Bitcoin is simply too unstable. One can imagine if a poorer country substitutes Bitcoin for gold, and suddenly see its reserves plunge to 20% of its original value, the economy will suffer, much less guard against a surprise economical / financial attack from countries or institutions with ill-intent. One can remember what George Soros did to cause chaos to other countries.

Bitcoin Is Not Tangible

Money has evolved from paper currency to digital numbers in the bank. Central banks do not even need to physically print money anymore, but key in a few numbers in their accounts. In a sense, the money we have is intangible. But this intangible money which we use to exchange resources has to be backed by something concrete and tangible. Be it the military, gold, economical chokehold on other countries etc, these are something tangible and concrete. Bitcoin on the other hand, is a bunch of numbers floating in the air. It can be used by the governments to achieve a certain agenda such as promoting crypto ETFs in order to suck in more money from other people, but too fluffy to trust a significant portion of the nation’s stake on it. One wrong move, and a country which is not strong enough can sink.

Conclusion

Bitcoin is the hype. Its die-hard fans swear by a lot of things, including being the next generation gold. However, realistically speaking, it cannot be done. But we as retail investors certainly can put just a bit of disposable income in it for the long run. Bitcoin is suitable for trading and speculation, for indivdual long term investments even. But to substitute gold as a country’s reserve, it is highly unlikely.

Showing 1 - 3 out of 3

Page 1 out of 1

| - | Shop Products | Price | |

|---|---|---|---|

|

|

$99,999.00

|

||

|

|

$1.00

|

||

|

|

Price range: $69.00 through $99.00

|