Few days back I went out for lunch and passed by a few jewellery shops, all of which were swamped with people trying to buy gold jewellery. As of now there are no news yet of retailers snapping up gold aggressively, but there are indeed many people buying up gold in the jewellery shops. Today we will talk about the act of buying spot gold either for investment or for hedging. We will not talk about contract-for-difference (CFD) gold trading or any kind of trading in the financial market, nor will we talk about whether it makes sense to actually buy gold for investment or hedging.

When buying spot gold, it basically means spending the money you have to buy a certain amount of gold on the market. It is like spending $1 on an apple on the market. You pay $1, you get 1 apple in your hands. There are a few ways to go about it, which we will explore one by one below.

Buying From Jewellery Shop

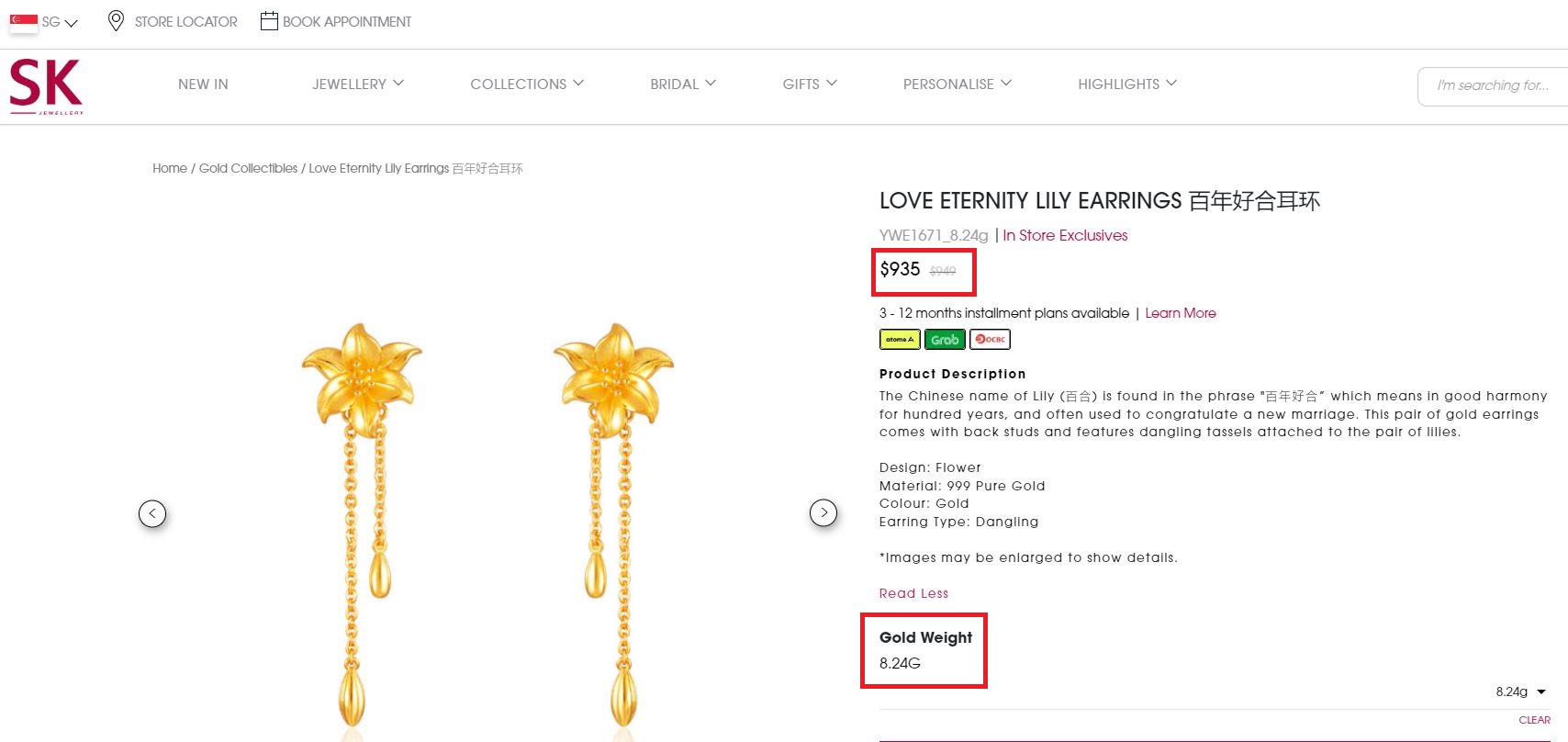

Buying gold jewellery from a shop is a poor investment choice. The gold jewellery from the shop has other cost added into it, such as design cost and packaging cost etc. Gold jewellery is often given as a gift to others such as a parent’s gift to their children in the wedding, or to be worn as an accessory. Hence the design of the jewellery can at times be intricate and the packaging quite fanciful. Even the dullest jewellery chain you see some old men wearing also has a certain markup.

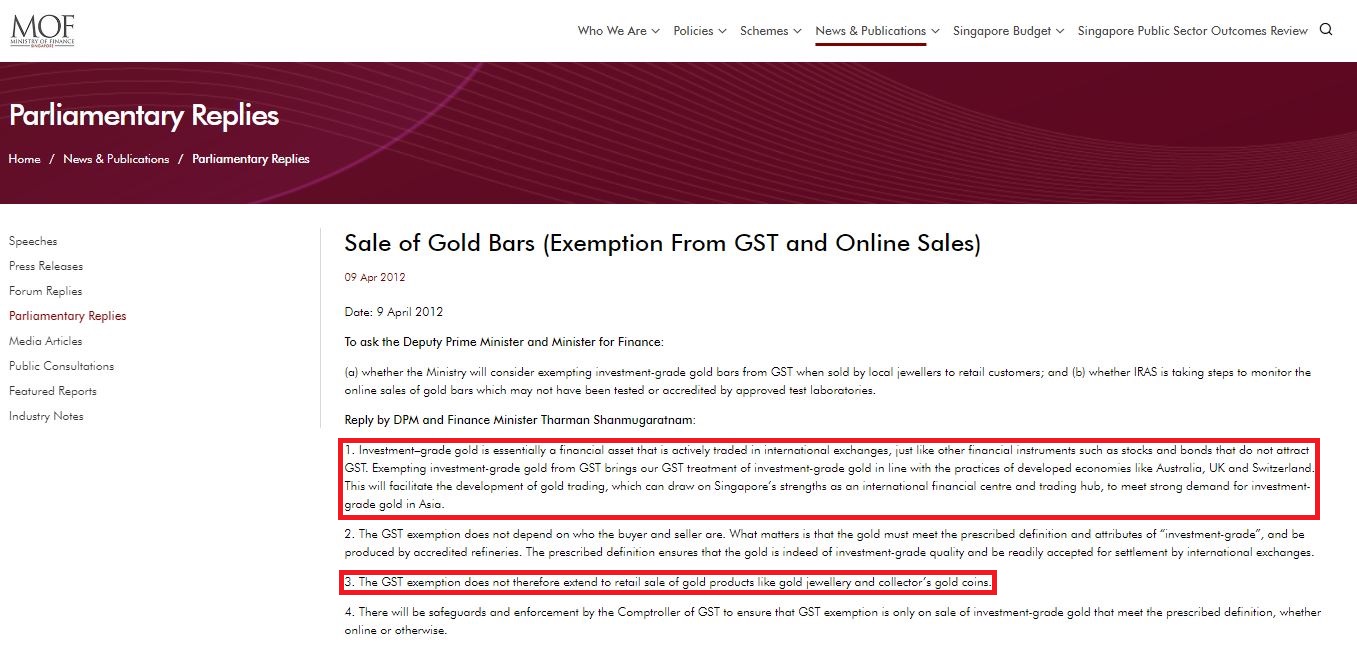

On top of the design and miscellaneous cost, there is also the Goods and Service Tax (GST) incurred. In Singapore the GST currently stands at 7% with an impending increment to 8% and 9% in 2023 and 2024. That is because the gold jewellery is a product. When there are transactions on goods, there should be a tax. Furthermore, when you try to sell the gold back, you will also not get a very good price. Unless you are holding on to a designer gold jewellery, which would also mean that you have paid a significant cost for the design, most gold jewellery are melted to make new gold products. Any designing cost, sentimental value etc will not be taken into account when the shops buy back your gold.

What the above means is that generally:

When you buy gold jewellery, you are paying for: the price of gold + designer cost + miscellaneous cost (eg packaging) + GST

But when you are sell gold jewellery, you will only get: price of gold – GST

Hence from this we can determine that buying gold in the form of jewellery as a form of investment or hedge is not practical. Although we see many middle aged or the elderly doing so, please do not do so yourself. Advise your family members and friends against doing that too.

Take note of the gold weight and its price, and then compare to the prices in the investment-grade gold below. To add on, I am not entirely sure if this price already includes GST.

Buying Physical Gold From Banks Or Specialised Shops

Some banks and specialised shops sell gold bars and gold coins. These investment-grade gold are exempted from GST, with more details here.

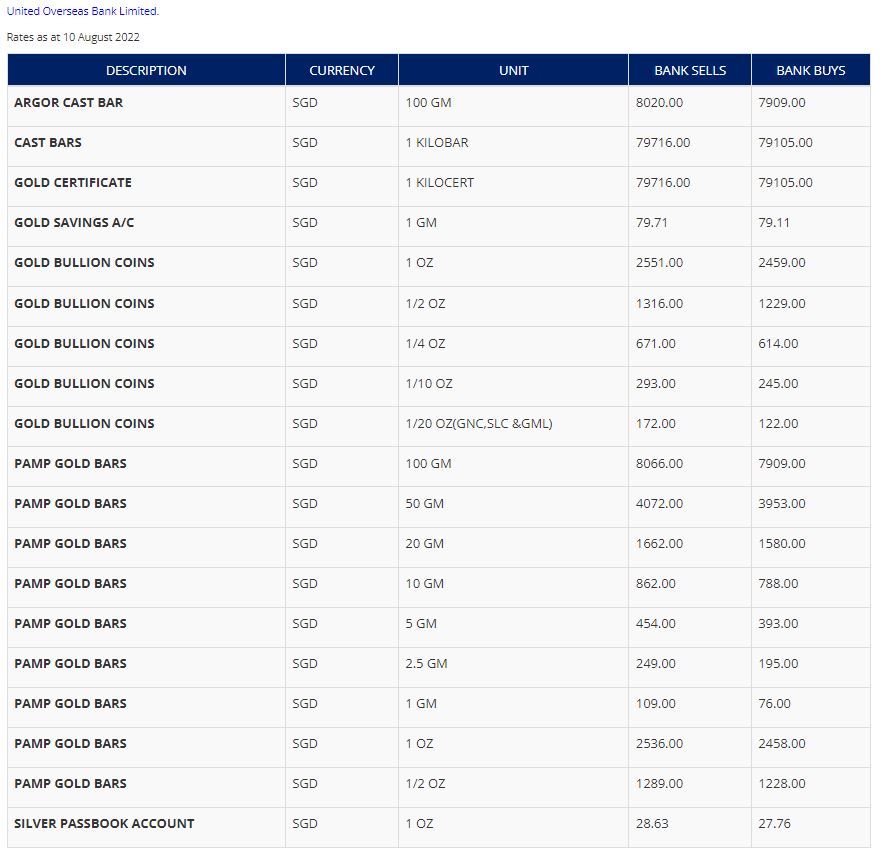

In Singapore, United Overseas Bank (UOB) is the only bank which sells gold. We now look at the price of gold as at 10 August 2022.

We see that physical gold is generally sold either in the form of bullion coins or pamp gold bars. Basically gold coins have some fanciful design and are priced just slightly higher than gold bars but still much lower than jewellery. I would say skip the gold coins and go for the gold bars instead. If your intent is purely for investment or as a hedge towards uncertainty, get rid of the unnecessary cost. An ugly gold bar is still cheaper than a fanciful gold coin of the same weight.

If we look at the prices carefully, we will see that heavier gold bars are cheaper than the lighter gold bars in terms of price per gram, probably because of the bulk buy effect. Of course buying the kilobar cast bars are the most value for money, but not all of us have that much money. Personally I bought the 100g gold bars when I just started out. There is still that price difference, but for many people perhaps 100g at a time is more doable.

You go to the bank, or the specialised shop, and you take back physical gold. Gold which you can actually feel in your hand and keep in your house.

Gold Certificate

For those who do not want a physical metal piece, there is the gold certificate offered by UOB. I do not know if overseas banks or shops also offer this, but Singapore’s UOB can give you a piece of paper to prove that you own this amount of gold, which they will honour. For now, the gold certificate is only for 1 kilogram of gold (see picture above). But, it does not come free.

Instead of carrying one gold bar home, you can now take a piece of paper with you. It is much like a title deed for your house, a piece of paper proving that you own the real estate and that you have the authority to do transactions with it. Just that this gold certificate has to be maintained yearly.

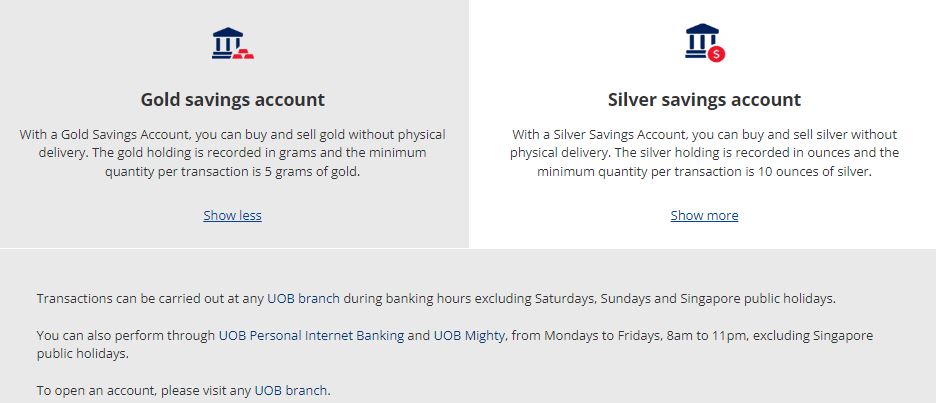

Gold Savings Account

However, still not all would like to take home physical gold nor have the certificate. In the digital age, people generally do not like to take physical things. Instead of bringing cash, just a credit card will suffice. Instead of a credit card, people in China simply take out their phone and use Wechat or Alipay to transact. What is that about taking physical gold home? What if I lost that small piece of metal? What if the thief came and stole my gold? What if I accidentally threw out the certificate as some scrap paper? Yes there is the option of renting a safety deposit box, but that cost me unnecessary money!

To solve this issue, UOB has the gold savings account, where you can buy and sell gold digitally. To put it simply, take it as buying spot shares on the stock exchange market. Your purchases and sales are directly reflected into the savings account, and if need be you can just go in and withdraw physical gold.

However take note that there is a maintenance fee for the gold savings account.

In Singapore, your savings with the bank are protected up to an amount of 75,000 SGD. This means that if the bank which you put your money in fails, Singapore has an insurance system that guarantees you will get up to $75,000 of your savings back. This system is also available in China, where they protect your savings of up to 500,000 RMB. However, in the small print disclaimer, UOB tells you that your gold savings account is not protected in the event that the bank fails.

Of course, being one of the biggest banks in Singapore, though the chances of it collapsing like Lehman Brothers are low, is not impossible. That being said, I would not worry too much about it. Just that if you are holding a gold savings account with the intention of having frequent trades, then you might as well open a trading account elsewhere and trade gold instead of using this gold savings account. If your intention is just to have a cheap and safe place to store your assets, then just take note that instead of earning interests, you are spending money to maintain that account.

Conclusion

To invest in gold, whether for future appreciation or as a hedge, do not go for jewellery. Go for non-taxable investment grade gold. Personally I like to take physical gold home. Investments are about minimising cost and maximising profits. It is not that difficult to bring home that piece of gold and store it somewhere safe in your house. If you are rich enough to buy a lot of gold, then putting in a safety deposit box will be a lesser cost compared to the gold savings account but still more than the gold certificate if your house is not that safe. Although with a lot of gold, the gold certificate is a cheaper option, but you are restricted in the sense that you can only trade with the institution which presents you the gold certificate, in this case UOB of Singapore. But with physical gold, you can walk in anywhere to sell.

Personally, whether I have little or a lot of gold, my preference is definitely to get physical gold and keep it at home. But that is purely out of my personal preference based on the factors mentioned above.

Showing 1 - 2 out of 2

Page 1 out of 1

| - | Resources | Price | |

|---|---|---|---|

|

|

$5.00

|

||

|

|

$1.00

|