The modern paper money we often refer to as cash has come a long way in terms of trading. From the original barter trade to seashells, mankind later introduced copper coins, silver ingots and gold bars. Paper money and later bank notes came out as the banking system becomes more developed. Yet, for the next 1000 years, coins and paper money were the default mode of transaction. There were variations and derivatives, but until the past 20 years, cash was still king.

Work is busy recently, and till mid or late May I may not be able to publish new articles as frequently. Once everything settles down I hope to resume the normal pace of one article per week.

Cashless China

A cashless economy has been touted as one of the traits of a smart nation, a status which many developed nations attempt to achieve. Yet surprisingly, among all the countries in the world, China is leading everyone by a huge gap. The Chinese are proud that when they go out, they only need to bring along their smartphones. No longer do they need to bring out a wallet. Every payment can be made either via Wechat or Alipay, the 2 biggest payment service providers in China. Every business from the high-end restaurants to the small-time family-owned shop, from the street vendors to even the beggars, every entity and every individual has a QR code tagged to their e-wallet for receiving payments from everyone.

Such developments surprises tourists who know nothing about China, and bring inconvenience to the Chinese when they travel overseas where they still have to use cash.

Smart Nation

A smart nation uses information and communication technologies, relying on networks and big data to push out technology-enabled solutions. Just like a smart home may use biometric locks for their doors and Google Assistant to control their lights, TV, Spotify etc, a cashless society proves that the nation is technologically advanced enough to ensure efficient and secure networks for all (not just the military and a privileged few), where the major financial institutions joined in the project and that the majority of the population has the necessary technological devices (such as a smartphone) and the knowledge to use it. Of course, there is more work to achieving a cashless society than just the 3 simple points I mentioned above, that is why so few countries actually achieved it.

For the citizens, it represents a pride that their country is ahead of others. Remember that in the 2000s South Korea was proud for having the fastest and widest internet coverage in the world? For the masses, it represents conveniences and safety (over physical thefts and robberies as well as loss of wallets). Business owners no longer need to fret over preparing and finding small change for their customers, then bank in the profits. In China, both Wechat and Alipay e-wallets are even tied to services such as fixed deposits, investments and trading, insurances, credit payments, calling for private-hire drivers, purchasing train tickets and a whole host of other financial and daily services.

China is undoubtedly the leading nation towards a cashless society. One e-wallet to handle them all.

Benefits To The Chinese Government

When an overwhelming proportion of the population has been enticed to go cashless, that is when the Chinese government start to reap in the benefits. Every transaction leaves a record. How much you earn from your full-time job and your sidelines is made known. The how, who, what, where, when and perhaps why you spend your money is transparent to the authorities. For a start, in order not to alarm the public too much, such information will be used to fight crimes and result in a win-win situation for both the government and the people.

After a certain period has passed and people has been too entrenched into the system to effectively pull out from it, that is when the real intent begin to show. It is now evident to the people that their every transaction is being monitored. In fact, about 2 years back it was a frustration and joke to the Chinese people when many of their e-wallets or bank accounts were restricted / frozen because they conducted transactions at night – because apparently night transactions were either illegal or immoral, even if you were buying snacks from Taobao (their e-commerce shopping platform).

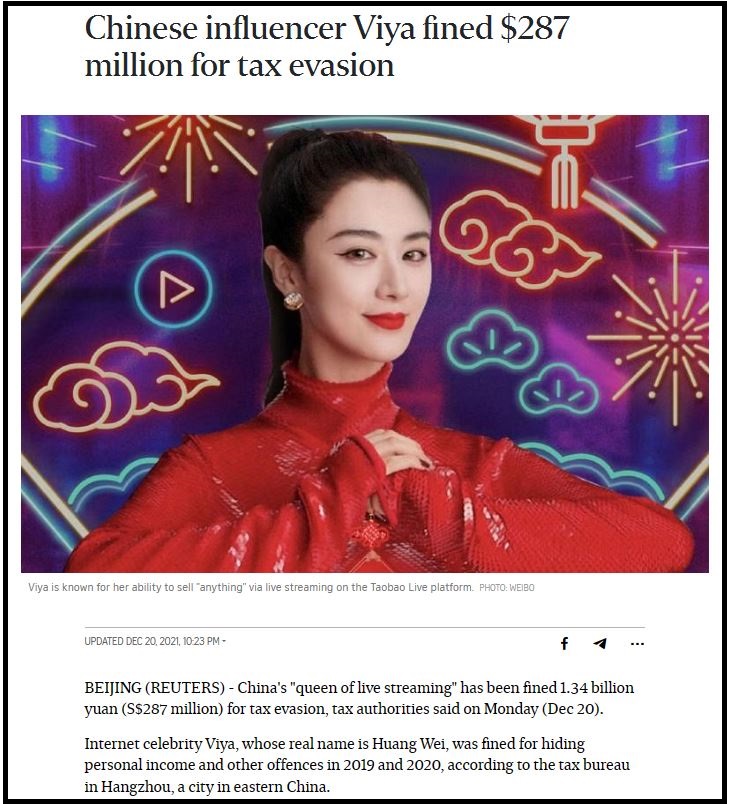

Then the government started clamping down on taxes. People who did not pay as much tax as they should. People who did not report their side income. People who did businesses but did not open a business account (business and individual taxes are different). The list goes on. But first, things must go step by step. The rich and successful from among the masses (not the really rich and powerful) will go first, in order to buy the hearts of the masses.

Then, once the stage is set, the Chinese government will go after the masses.

The Masses Must Be Poor

It is in the interest of the Chinese government to ensure that its people are effectively poor throughout their lives, yet hold on to some hope that they will be rich one day. When I say effectively poor, I do not mean they go without food or shelter, but that they must permanently slave at their jobs in order to sustain their family and lifestyle. And taxes, while necessary for the country to continue functioning, takes a big cut out of the people. Progressive taxes while on the surface looks like it is fair to everyone, also has the intent to prevent the more hardworking ones from accumulating their pot of gold too fast. Afterall, the more they earn, the more they have to give in terms of both percentage and absolute amount. As one earns more, the marginal utility of sacrificing one unit of time/effort to get one more dollar is reduced. And at a certain point people will begin to go: there is simply not much point to forge ahead further.

The continued slavery will ensure that the people obediently work at their jobs till they are old, effectively ensuring a healthy labour force, an obedient population who dare not stir trouble, and the prevention of inheritances creating a semi-rich second generation who YOLO and quit from their jobs like it is nothing (which is actually happening now). This is especially important to the current China, where the one-child policy meant that a single child will inherit much assets and money from the previous generations, and where birth rates keep declining.

A Small Part On How Taxes Work

The government needs to collect taxes, and the people do not wish to pay taxes. However, a certain balance is reached when the government taxes only on the full-time income and perhaps a small percentage from inheritance / property rental / dividend payouts etc, and close one eye on the side income which the honest individual spends time after his job to work on. That he can eat the whole pie without sharing a slice brings comfort to him.

However, when China starts to whack its people over taxes, people are pissed. In fact, in ancient Chinese dynasties, when the government started introducing all kinds of ridiculous and high taxes, it was a sign that they were on the brink of collapse. The corrupt and incompetent government had no means to sustain themselves with the standard tax revenue and had to fleece off the people as much as they can.

In many modern day countries, taxes are not only in the form of the standard income tax, GST and property tax, but also in many other areas such as water tax, electricity tax, cigarette tax, alcohol tax, luxury goods tax etc. Taxes stack and an average individual pay more taxes than he imagined. For example, if we take a look at the utility bills of a common household, we may see that the electricity and water itself has an electricity and water tax. The overall utility bill is subject to GST again, which is a second round of tax. The household then pays for the bills using their taxed income. In total, the $200 to $500 a month utility bill has 3 layers of taxes. The same logic applies everywhere in daily lives. From cars to alcohol, from cigarettes to Chanel bags, many items in our daily lives are taxed more than once. Minimally, everything you buy has 2 layers of tax (income tax + GST).

Why Cash Is Still King

The more taxes the government introduces, and the higher the taxes the government collects, the more it pushes people back to cash. The Chinese government may choose to do it in a subtle manner. Today they increase the water tax by a bit, tomorrow they increase the petrol tax by a small percentage, yet another day they increase the electricity tax by a fraction. People naively thought that taxes are what the Chinese government collects directly from them (the standard income tax, GST and property tax), but no. They are paying more than they know.

Currently in China, the more enlightened population who have realised all this turns back to cash, forsaking convenience for safety. Cash is untraceable. Cash is legal tender. They work for cash, and they spend cash. No digital records, no taxes, the whole cake to himself. As long as your official and traceable income can justify your savings and purchases, all is good. One can live daily purely on cash earned from side income and still be able to explain that he is thrifty throughout the years, hence saving every penny of his official income to buy a house.

No one can escape taxes all the way, but with cash, things can work out somewhat. Firstly, they do not need to pay extra income taxes under the progressive tax scheme. Secondly, certain merchants offer a small discount for buyers who pay in cash, for the same reason of tax avoidance. Thirdly, they can avoid unnecessary trouble such as having their accounts frozen just for buying snacks at night (remember daddy did say that night activities are all bad?).

For all the technological and digitalisation advances China made, its clampdown on the people and on taxes has ironically made people u-turn back to cash. People realised that old is gold. Cash offers safety. Cash offers privacy. Cash is still the king. And if one has too much cash? They turn to gold.

Showing 1 - 3 out of 3

Page 1 out of 1

| - | Shop Products | Price | |

|---|---|---|---|

|

|

$99,999.00

|

||

|

|

$1.00

|

||

|

|

Price range: $69.00 through $99.00

|