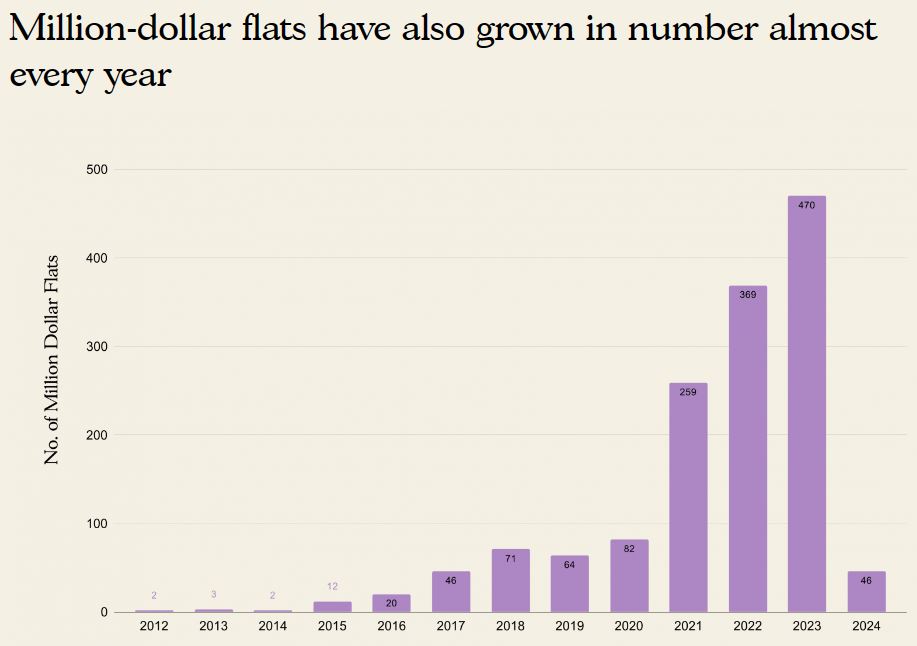

The first million-dollar HDB was transacted in July 2012 and made the news. Since then, the volume of million-dollar HDB transactions has increased over the years, especially during the Covid and ‘post-Covid’ period where mass inflation has made everything much more expensive.

Picture from Stacked Homes: https://stackedhomes.com/editorial/the-rise-of-million-dollar-hdb-flats-in-singapore-is-this-going-to-be-the-new-norm/

Background of HDB

HDB actually stands for Housing Development Board, a government agency in Singapore in charge of building public housing for the population. This post is written in the Singapore context, but certain portions can also be adapted and relatable to situations in other countries.

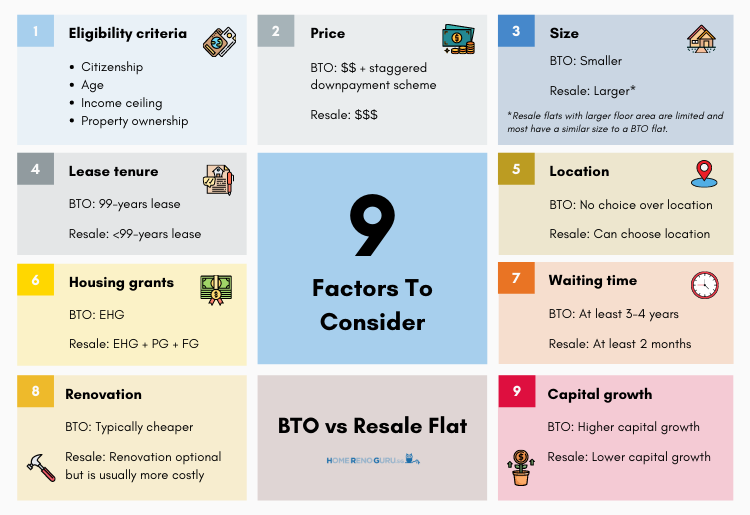

Most of the Singapore population stay in HDB flats, which are actually quite affordable when bought directly from the Government. However, newer flats sold by the Government has a long queue and long waiting time because HDB operates on a build-to-order system, and it takes a few years to construct a building. Also, while the newer generation flats are better designed in terms of functionality and appearance, they are generally smaller than the older generation flats. These 2 factors made the resale market attractive to many buyers. Another plus point of buying resale flats is that compared to seeing models, one walks into the flat for a viewing, and what you see is what you get. It is in the resale market that we see million-dollar HDB transactions.

Picture from Home Reno Guru: https://www.homerenoguru.sg/articles/tips-advice/bto-vs-resale/

The Actual Cost Of A House

When asked how much did a person pay for his house, the usual answer is the transacted price. However, an owner usually forgets to take into account the stamp duty (and additional buyer stamp duty for subsequent houses), the interests paid over the years and the renovations. Many financially less-savvy people has no concept of how much interests paid will go up exponentially with regards to the loan amount.

In Singapore, the interest is calculated at the end of every month. Assume you take a loan of $200k with 2.6% interests per year, then your first month interest should be $433.33 ($200k x 0.026 / 12). We assume again you are paying off your loan at $1000 per month, the actual reality for you is that your capital repayment is only $566.67 for the first month while the rest goes to your interest payment. On the second month the interest payable will reduce slightly to $432.39. This cycle will repeat and each month, the amount of interest you pay for will slowly reduce while your capital repayment portion will gradually increase.

However, take note that the cost above is only for a cheap ‘slum house’ in Singapore. I have bought a cheap house of my own, taking a loan of approximately $220k. However, when I recently reviewed how much interests I have paid for the past 6 years and some months, I have actually paid more than $25k in interests, raising my cost of the house by more than 10%. And my loan is not yet fully paid off. The percentage of interest with respect to the total cost of the house will get much higher as one buys a more expensive house, such as a million-dollar HDB flat.

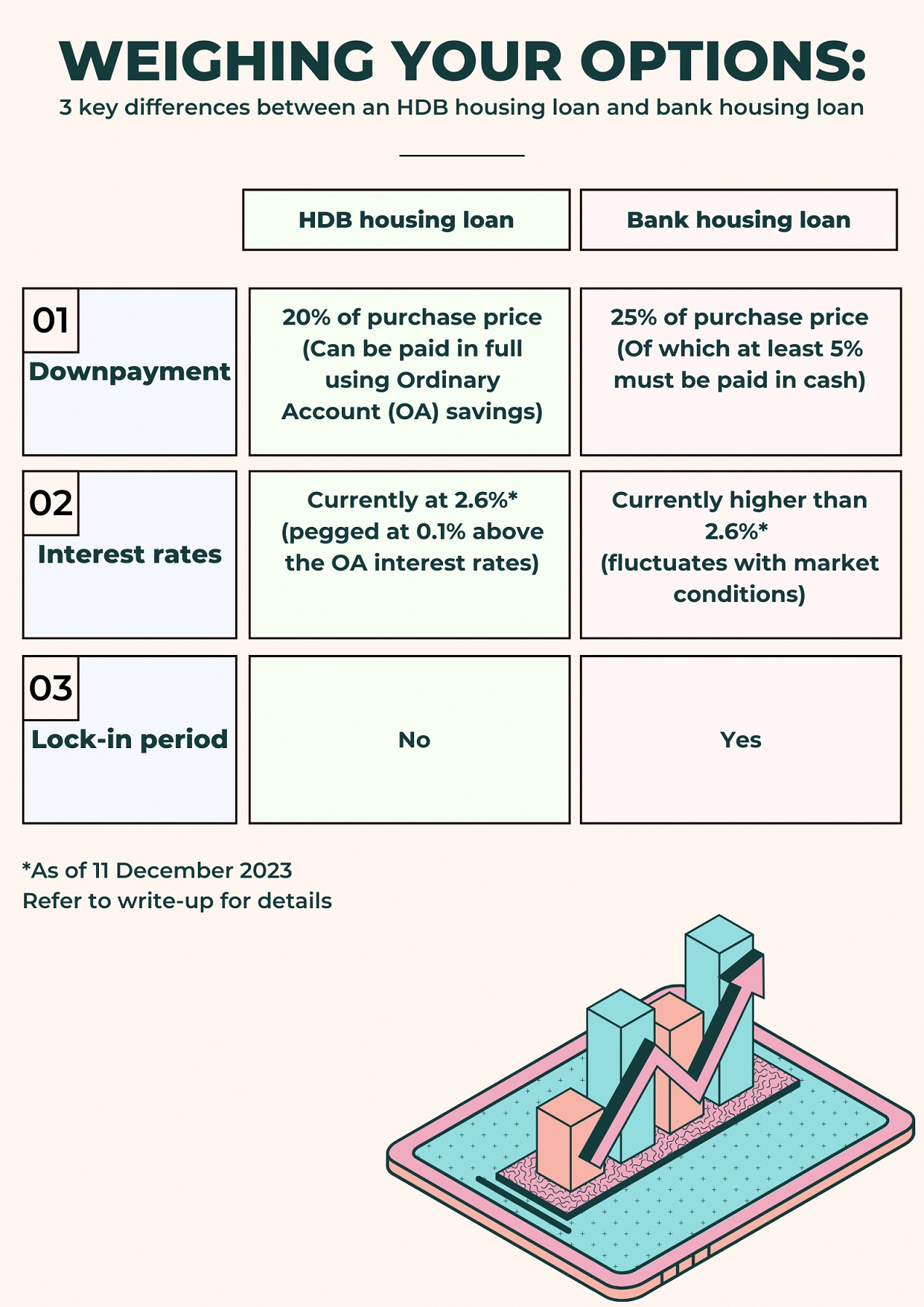

Note: In Singapore, HDB flat buyers have the option to loan from the Government at a fixed rate of 2.6% per year regardless of market situation, or from the bank. In the past, due to low interest rates, people generally prefer to loan from the bank. But there will always be people who go for stability. There is more to the decision between choosing which type of loan but the basics are briefly illustrated below.

Picture from CPFB: https://www.cpf.gov.sg/member/infohub/educational-resources/3-differences-between-hdb-loan-and-bank-loan

Future Market

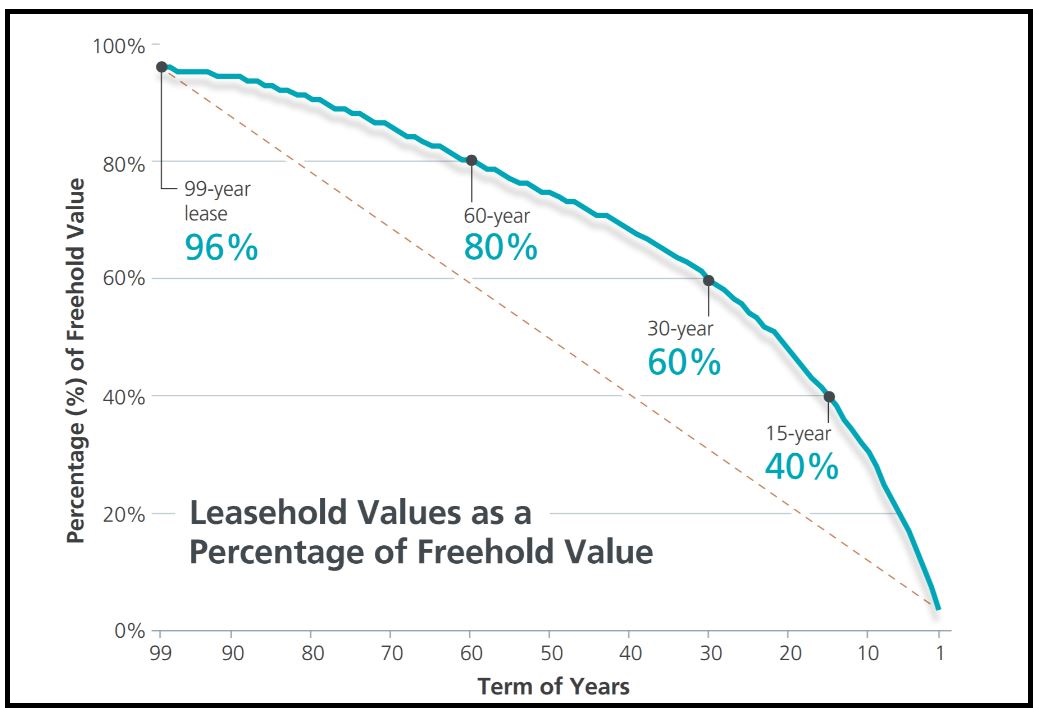

We assume that a couple bought a million-dollar HDB and managed to get everything paid off for $1.2 million, which if you ask me is highly unlikely. If they want to sell the house in the future, anything less than $1.2m is a loss. This is without factoring inflation. The issue is, HDB is ultimately a public housing project by the Government. It is not even a private property, which has lesser restrictions in terms of regulations. Based on this alone, it is doomed to cost less than a private property, assuming all other things remaining constant.

Assume we do not even want to make a profit, but breakeven at $1.2m, you will have to sell the HDB at $1.2m, and that is still losing out on inflation. If you were to outrun inflation, you may have to sell even higher. But at that price, would people still want to buy from you instead of spending a little extra to buy a condominium? Buying an expensive house limits your exit plan greatly. Do not also forget that as the years pass by, your resale HDB gets older and depreciates more quickly.

High Leverage = High Risk

Unless you are able to pay everything in cash from the onset, taking a loan essentially means you are playing on leverage. Most of us have a housing loan and there is nothing wrong with it if it is within our means to pay. However, if you are stretched to the limit trying to take the maximum amount of loan, anything can throw you off. A pay cut, a loss of job, an increase in interest rates or worst still a combination of multiple factors can sink you easily. Just like in the financial markets, those with very high leverage are only able to operate on a very minor band of volatility.

There are some who tell me they do not worry because they work in the government sector with an iron rice bowl. But shit happens. The Covid era saw a massive interest rate hike. Any accident or illness could impair your ability to work. Life is uncertain. Nobody can predict what will happen tomorrow. Stretching yourself to the limits means not allowing yourself any room to breathe, which is not a wise decision, financially or not.

Mass Development Condominiums

Condominiums used to be for the class above the masses. Not as rich as those who stayed in landed properties, but rich enough to own a private home. However, with recent developments, condominium projects have started to cater to the masses. Treasure at Tampines (a condominium development name in the East of Singapore) is one of the more famous mass development condominiums, with 29 twelve-storey residential blocks, housing a total of 2,203 units. Even the very average income earners are able to have a shot and a stake in it.

The mass development meant a lower purchase price, a lower monthly maintenance fee since it averages down among the residents and consequently, a chance for the masses to upgrade. But the truth is, if the masses can upgrade to a low level condominium, then the low level condominium is not really that much of a premium. The desire to escape the commoner class will result in an ironic reality where one finds himself still living among the masses, this time in a prettier bird cage and a higher debt.

Inflation And Debt Trap

But what changes, that people can now afford condominiums now when they cannot do so in the past? A few reasons for that, but inflation is the main reason. Inflation of money over the years means that people’s nominal salary has increased. Rising HDB prices also means that people can sell their HDB at a profit and upgrade to a condominium. Of course, mass developments lowered the cost of entry into the condominium route.

However, this may be a trap for those who entered. We assume that one bought a HDB flat at a total cost of $500k (all in, including interests). The HDB flat was then sold for $700k with a $200k profit (I will just use simple mathematics without going into details such as CPF or agent fees and stuff). The person then upgrades to a low level condominium at $1.2m, which is highly likely to be of a smaller size compared to his HDB flat.

On the surface, this person has upgraded from a commoner staying in a HDB to that of a ‘successful’ person living in a condominium. The truth is, many of the other masses has also done the upgrade and one cannot really confidently say he is out of the commoner class. Secondly, he has successfully increased his debt by another $500k just by buying a condominium. He is now one step away from financial freedom and have added another chain on himself. Thirdly, his seemingly upgrade is actually a downgrade in living quality due to space issues. If one thinks that a condominium has facilities like the gym, tennis court and swimming pool, one can expect a 2000+ unit development will have more than enough people fighting over the booking of the said resources.

The profits from selling a resale HDB can only be considered realised if the money is in the pocket, by downgrading to an inferior location or to a smaller sized house. Upgrading to a condominium is not considered actualising your profits, because realistically, you are just living in another smaller house with a bigger debt. Financially, those who upgrade are worse off.

Conclusion

Do not just blindly follow the crowd. In our path towards financial freedom, all accounting must be done properly with little room of error. A sense of what is going on in reality is also needed. While it is impossible for us to know everything, one minimally needs to have at least some level of general knowledge and current affairs to know what is going on, to know what is the financial and risk impact behind our every decision and to make cool-headed rational decisions.

The market is always irrational, but we cannot be. The path towards financial freedom is a difficult and lonely path. If you find yourself doing what everyone else is doing, then you are definitely not on your way to freedom.

Showing 1 - 2 out of 2

Page 1 out of 1

| - | Resources | Price | |

|---|---|---|---|

|

|

$5.00

|

||

|

|

$1.00

|