Bitcoin first came out in 2009, and soon after a few other coins came out. Quickly gaining traction among the circle of blockchain and decentralisation enthusiasts, crypto currency soon became a hot topic and became a financial instrument by itself, with its own little economy and ecosystem. From Bitcoin’s decentralised payment methods, the crypto world has branched out to serve many other functions such as smart contracts, data storage, oracle networks, gaming tokens, NFTs, etc.

In a way, if we look at the crypto market as a financial instrument to trade and invest, we can somehow treat it like the stock market. You can invest and hodl (not a spelling error, but a technical term used in the crypto world for the long term holding of a coin), or you can do quick in and out trades. You can do the futures market and play with leverage or play with options.

Trading wise, I do not have much to write here. I am not good at it, and I have stopped doing quick trades, opting for longer term investments instead. If you do trading I am guessing that the short term technical charts are more important than the fundamentals. That is a whole lot of knowledge by itself which I do not have enough knowledge on. But what if you want to invest in some crypto, how should you do it?

First, you have to know that the crypto market is very volatile. It can easily 10x its value in 2 months, and can suffer a 90% crash the next. It is not regulated, full of open manipulation (not that the traditional markets are not) and contains considerable risks. But as I always said, everything has risks. The most important thing is to manage your risk.

The Potential Of Crypto Market

Crypto is still a very small market with a very low global take up rate of about 3.9%. The total crypto market cap is $1.70T, which is far lower than any of the traditional financial markets. What this means is that as more people take up crypto and its uses expanded, there is much potential for growth. Crypto is still at the growth stage where big monies can still be earned. As of now the whole of crypto market cap is still lower than the 3rd largest American company.

Amount To Put In

Personally I am of the opinion that the most we can put into the crypto market is 10% of your total savings. Although crypto has a lot of potential, it also has a lot of risks. Risks from hacking, from the unregulated systems (as it should be), from open and blatant manipulation to outright scams, crypto does have many potential landmines for people to step on. Hence putting 10% in to secure a spot in its growth is to me a good allocation. If all goes well, your 10% will earn you much. If things go wrong, at least that 10% will not kill you. Painful yes, but not fatal. For me, I have just started putting about 10% of monthly income into crypto.

Research

Research is a very important aspect when choosing which coin to buy and invest in. Just like you should not buy lousy stocks, you should not buy shitcoins either. Even if there are many people buying it, such as Dogecoin, I would not buy it, simply because it has no practical value. Shitcoins can earn you much money, but it can also crash overnight and wipe out everything. We are not talking about gambling and quick money here, but steady and safer earnings which should not have too much risks. The few paragraphs are a few of the factors which you may wish to consider when picking a coin to invest in.

About The Coin

What does this coin attempt to solve? There are many functions a coin can have as listed above. However when I invest, I will choose a coin that will have a future and practical use. Meme coins created as a joke (Dogecoin) serves no purpose. I reject all gaming coins too, because they are very dependent on the games they are used on. If it attempts to solve payment issues, what are its advantages over others? Cardano (ADA), Litecoin (LTC), Nano etc all aims to be the next currency of payment, but will they succeed? Why should people use Nano instead of USDT? Below we will explore some of the factors you may wish to consider while doing research.

Its Standing In The Field

As there are many coins in the market, every coin is ranked against each other. Some use transaction volume to rank the coin, some use market cap. But I do not use that. I measure it against other coins attempting to serve the same function. For example, Filecoin and Storj are both working for decentralised data storage, but Filecoin is the leader in the field. I am not saying that Storj is bad, but if I have to choose one, I will definitely choose Filecoin. There are many fruits in the jungle, and I do not compare an apple with an orange. I will choose what I believe is the best apple and the best orange to buy. It does not matter what is the relative ranking between the apple and the orange, what matters to me is that the apple and the orange has to be number 1 in their own field, or minimally a potential number 1 in the future.

Investors

Linked to the above point, we can check if a particular coin has any investors. When I say investors, it is not retail investors like us who buy some coins off the exchange, but the big monies who invest a lot of money in the project. Big monies will go where there are more potential. Big monies have the human talent and the complicated software to do analysis. They have information which we commoners do not have. Since I do not have access to all these information, tools and skills, I can follow what these big monies are doing. If big monies invest in coin A over coin B, then it is certainly one factor to decide where my money will go. Definitely, one should not base their whole decision on where the monies flow, as they make mistakes too. There are even coins which big monies invest in but which I do not agree with. That is why there are many factors to consider, and if a particular coin ticks most or all of your checklist, then perhaps it is something worth investing in.

Active Developer Team

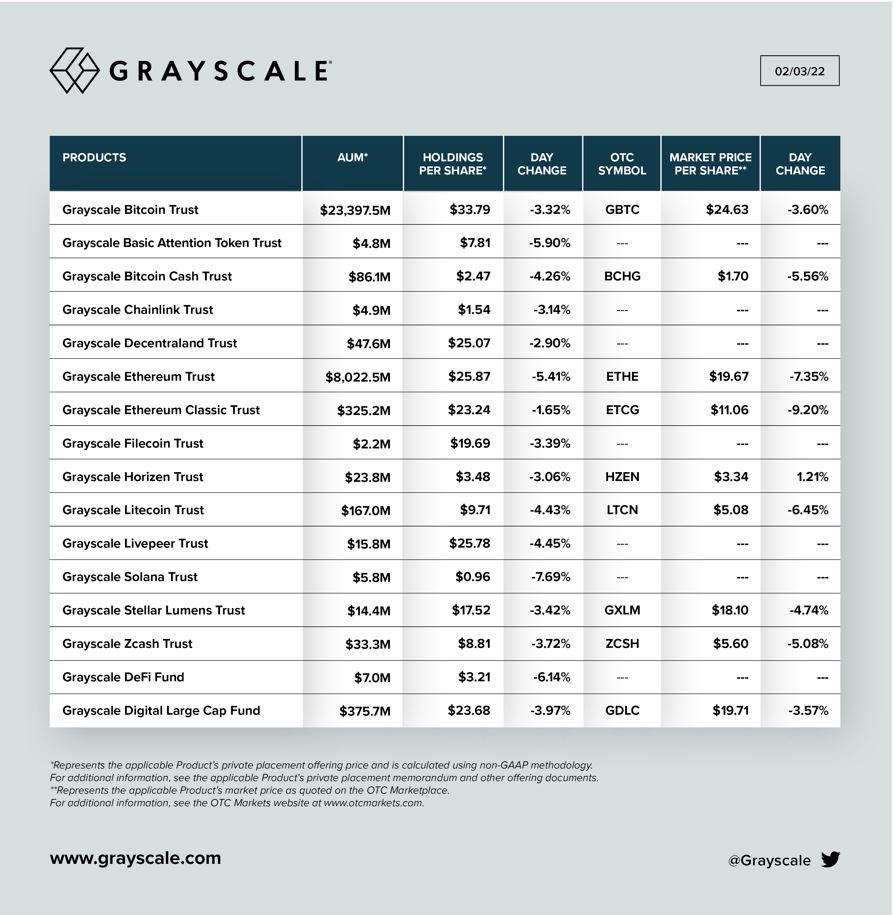

To know whether a coin still have future potential, look at what the developers are doing. Are they consistently working on their coin / project? Note that consistently working on it does not mean they have to churn out results every now and then, although that is ideal. For example, Litecoin is now as good as dead, though it was one of the earliest coins after Bitcoin. The developers are not doing anything meaningful, and there are no updates to the projects. A look at Litecoin’s website will tell you nothing much is going on. Despite this, Grayscale (see picture above) do have holdings in Litecoin, which highlights again the point of me not agreeing with every investment the big monies make. However Chainlink (LINK) has frequent twitter updates on what is going on, the website is updated with useful information and it has its own ecosystem. Cardano’s (ADA) founder is active in Africa doing work and pushing its project. These are the things which gave me confidence that the coin will improve and get better in the future.

Onboarding Projects And Ecosystem

One of the reasons why Android and Apple is doing well is because they have their own app ecosystem. With both their systems pushed worldwide, app developers will always create one version for Android and another for Apple. That is because they have a good ecosystem, and developers know that by putting up their apps with them, they are able to tap on the ecosystem. Does the crypto coin you are investing in have a thriving ecosystem with a lot of onboarding projects? Ethereum is a good example. Many projects are based on the Ethereum network, and it has a solid ecosystem. With more projects on it, the better the ecosystem, and in turn encourages more projects to be based on it. This creates a virtuous cycle which will push the project up another level. Of course, to maintain such an ecosystem and bring it up another level, these projects need to continually upgrade itself and ensure it stays relevant. Ethereum did just that, upgrading itself to Ethereum 2.0 when the old version was slowly becoming obsolete.

Do Not Blindly Listen To Experts

Do not blindly follow what the so-called experts said. Be it some banker from a well-known bank or a Youtuber with many subscribers, do not take whatever they say and swallow it down wholesale. I agree there are knowledgeable people out there who dive down deep into the numbers and all. If you can learn from them, that is good. But do take note that nobody is 100% accurate, and caution is to be exercised when following what they say. Most bankers and analysts talk based on hindsight, giving some explanation on an event which already happened. Many Youtubers do not even know what they are talking about. They simply choose their storyline and just twist the facts to suit their storyline.

For example if the Youtubers deemed that Bitcoin will go up in the long term, this is what will happen.

If Bitcoin goes up: my analysis is spot on!

If Bitcoin is stagnant: the whales (big buyers) are accumulating and getting ready to pump!

If Bitcoin falls slightly: a technical correction not worth worrying. Continue to hodl if you are a believer!

If Bitcoin falls significantly: we are bottoming out. Hold on and be ready for the pump!

If Bitcoin crashes: the whales are buying the dip! Do not miss out on this opportunity!

When Bitcoin finally goes back up: My analysis is correct all along!

Many people will make the mistake here of selective listening, where they only listen to the views which support their opinion but reject those which say the contrary to what they think. Be open-minded, learn the useful knowledge from those who know, accept views even if they do not support what you believe and be prepared to change your decision based on supported facts and conclusions which you arrived on your own after you have done your due diligence.

Your Feelings

When I say your feelings, I do not mean to say your gut feel or your intuition as to which is a better coin to invest. It is about whether you will be able to sleep well at night, having the confidence that the coin will go up one day and bring in the rewards, even if it is suffering from a crash right now. Pumps and dumps happen to the crypto market all the time. But if you are holding a shitcoin, you may worry a lot and lose sleep over it if it dumps, as you worry whether it will make a comeback. But if you buy a good coin after doing all the proper homework, you know that given enough time, it will definitely rise back stronger, then you will not be as stressed out as compared to buying a shitcoin. Ask yourself if you will be able to take the stress, if you will be able to feel calm and live life as normal if you buy a particular coin and it takes a big hit.

Conclusion

Of course, the above are only some of the factors one may wish to consider when doing research. There are many other factors involved which I will not be able to list down one by one. Some go deep into the details such as the tokenomics, crunching all the numbers. Of course if you can do that, that is the best. Leave a comment if you have other factors which you also consider when choosing a coin!

Showing 1 - 2 out of 2

Page 1 out of 1

| - | Resources | Price | |

|---|---|---|---|

|

|

$5.00

|

||

|

|

$1.00

|