If you are not cut out to run a small business, the next logical option to consider, although definitely not the only option left, is investments and trading. But that being said, the financial markets is a zero sum game. Your wins are others’ losses, and vice versa.

No I am not scaring you, but this should be a warning into the territory you are venturing into. The stock market, the commodities market, forex, crypto-currency markets are filled with manipulation. Know the risks and tread carefully, do your homework and manage your risk. Ultimately, manage your emotions (ie your greed and your fear), because many fall into this trap. Then you should be able to manage some success.

But before you step into this territory, read up and expand your knowledge first. Like driving, you have to pass a theory test before you can get to drive the car. Knowing theory alone is not enough, as we all know changes on the road conditions requires you to react based on your skillset and experience. Yet, without theory, you cannot take the first step. Investopedia is essentially an encyclopedia for the financial markets. In it contains the basic theories which you can read up. Head over to the website, look at the top bar for the ‘Education’ link and start learning.

For the common people, there are a few markets we usually play: The stock market, the commodities market, the forex and the crypto market. Of course there are always the bonds market and other stuff. There are a whole lot of derivatives and financial instruments for you to play with, which we will not go into that here. There are many ways to go about doing this. Some hold it for longer term investment and some do day trades. The time people hold the stock / currency / commodity etc ranges from a few minutes to a few years. Choose what you like.

Stock Market

Perhaps the default choice for new players. While some go for capital gains, perhaps new players may wish to consider more stable blue chip stocks. A blue-chip stock is a huge company with an excellent reputation. These are typically large, well-established and financially sound companies that have operated for many years and that have dependable earnings, often paying dividends to investors. A blue-chip stock typically has a market capitalization in the billions, is generally the market leader or among the top three companies in its sector, and is more often than not a household name. For all of these reasons, blue-chip stocks are among the most popular to buy among investors. Some examples of blue-chip stocks are IBM Corp., Coca-Cola Co. and Boeing Co.

Capital preservation is the main reason why I recommend new entrants to try out blue chips stock first. Yes, their movement may not be much compared to others, and your 5% dividend per year may not look as appealing as the 20% annual gain stock of other companies. But remember, stock prices rise and fall. Before you truly know what you are doing, stick to the safe side first. It will take a much longer time trying to earn back what you lost. Take note however, that blue chips companies are also subject to fluctuations. Though usually may not be as great as the other smaller companies, they do take a beating now and then.

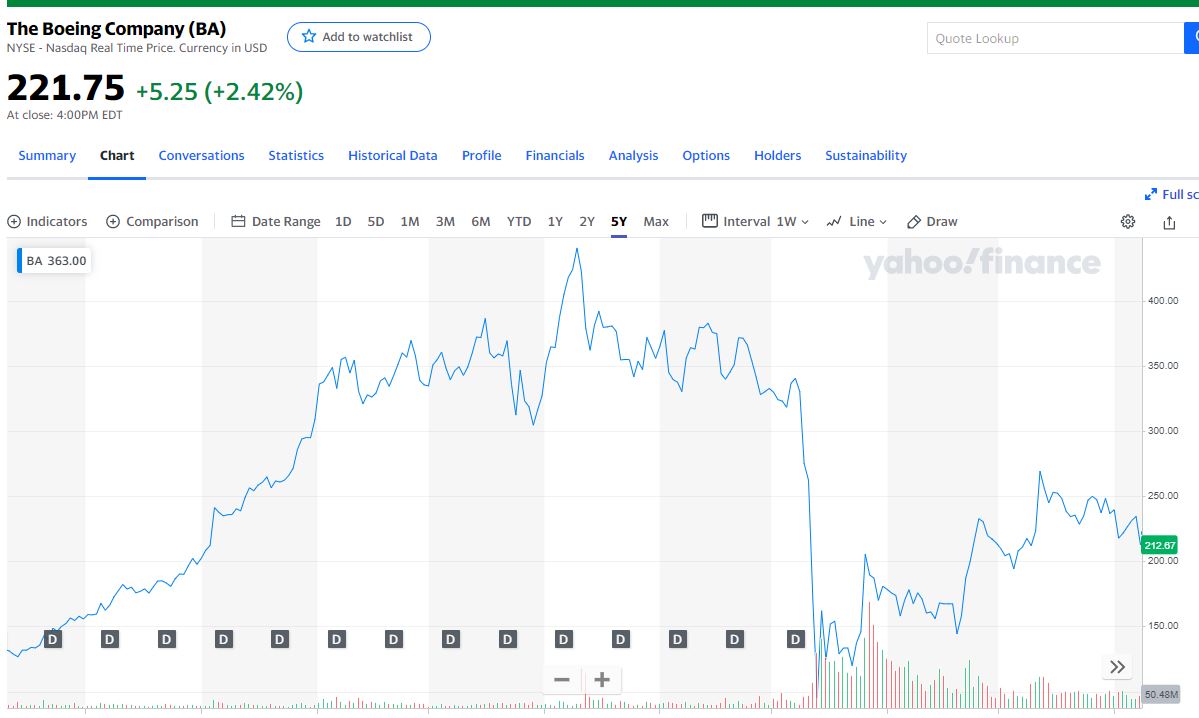

Below is the graph of Boeing stocks. It took a serious beating due to Covid.

I have friends who do not aim for the sky, but a decent amount of earnings per year. They buy blue chip stocks only, slowly accumulating their holdings as they get their salaries and bonuses. Their main earnings come from the yearly dividends rather than capital gains, although any gains are also considered a bonus. Short term losses and gains do not hold much effect on them, as they are know that in the long term, the stocks they pick will go up. Coupled with the dividends they get, a 7 or 8% per year earnings is actually achievable.

As to how to pick stocks, I will not go into that. There are many articles around for your research purposes. To start buying, consider Tiger Brokers as it charge a lesser fee and allows you the option to trade US/HK/SG/CN/AU stocks.

Crypto Currency Market

The crypto currency market is one which is gaining popularity over the years. If you think stocks move too slow, you will need to be able to stomach the volatility of the crypto markets. Like stocks, you put in money to buy a certain coin, be it Bitcoin, Ethereum or a whole range of other coin offerings. But take note, crypto market is unregulated and widely opened for manipulation (though not as if the regulatory authorities do actually monitor traditional markets and actually prevent manipulation). But it is very common for crypto currencies to pump or fall 20% or even 50% within a day or even an hour. If you ever play the crypto market, do only put in what you can afford to lose. Losing 90% of your money in the crypto market is sad and disappointing but not uncommon.

Below is a weekly chart of the price of Bitcoin. Note the highest and lowest point within this time period. 1 candle represents 1 week. Note: The fluctuations of Bitcoin is nothing compared to the other shitcoins – basically lousy, useless coins.

Among the different platforms, Binance is the biggest, hence it is the platform targeted by many governments around the world. US, UK, Singapore and other countries are gradually targeting it. Personally, I use OKEx as a suitable alternative. Not the biggest, but it sure does not stand out enough to be whacked.

For other financial markets like the Forex and commodities market, its nature is similar. Buy low and sell high (long), or sell high and buy back low (short). I will not go too deep into any of these as the internet is already filled with articles explaining them.

Again, like business, investment and trading of financial instruments is not for everyone. I know people who are very conservative and emotional, and they know they will not be able to stomach the fluctuations and the losses. Not to worry, there is no fixed path to success. Just because the others are doing it, does not mean you have to do it. While I play the stock and crypto market myself, I have also suffered losses which I have not recovered till date.

In the next post, we will explore the next available option.

Showing 1 - 2 out of 2

Page 1 out of 1

| - | Resources | Price | |

|---|---|---|---|

|

|

$5.00

|

||

|

|

$1.00

|