In the crypto world, there is a concept of funding fees for those who dabble with futures. Futures are contracts to buy or sell a certain asset at a future date. However, in crypto currency, most of the futures are perpetual futures, meaning they have no expiration date and go on indefinitely. Funding fees are therefore introduced to keep the spot and futures prices close and balance the system.

In this article, I will skip the unecessary technicalities and aim to simplify it such that the common man can understand and apply it for themselves. We will use Bitcoin (BTC) as an example, although you can swap it out to any other coin of your choice.

Spot and Futures

The spot market is one where you buy with what money you have. For example, if the price of a BTC is $100,000 now and you have $200,000, you can buy a maximum of 2 BTC and actually hold the 2 BTC in your wallet. You do not play on leverage and you get what you paid for in the market.

Futures on the other hand, are contracts that bet on the future price of an asset. You do not actually hold the BTC and people who play futures are either traders who short, or traders who play on leverage. While technically we can go long on futures on 1x leverage, very rarely do traders go for it. One might as well play on the spot market and skip the funding fees (we will come to it later). People who play on futures usually play on leverage, with the more conservative ones going for 2x or 3x, and the very high risk players playing up to 100x or 200x leverage.

I will skip the risks on playing with leverage, as we have already discussed this before. Just take note that playing with leverage comes with risks.

Funding Fees

In very simplified terms, when you play with futures, you either pay or receive funding fees. If most of the people are going long on BTC, then those who go long will need to pay funding fees to those who go short on BTC. On the other hand, if most people are shorting BTC, then you will receive funding fees if you go long. In short, to receive funding fees, you will need to go against the market. Each crypto exchange will have their own calculation and charges for funding fees.

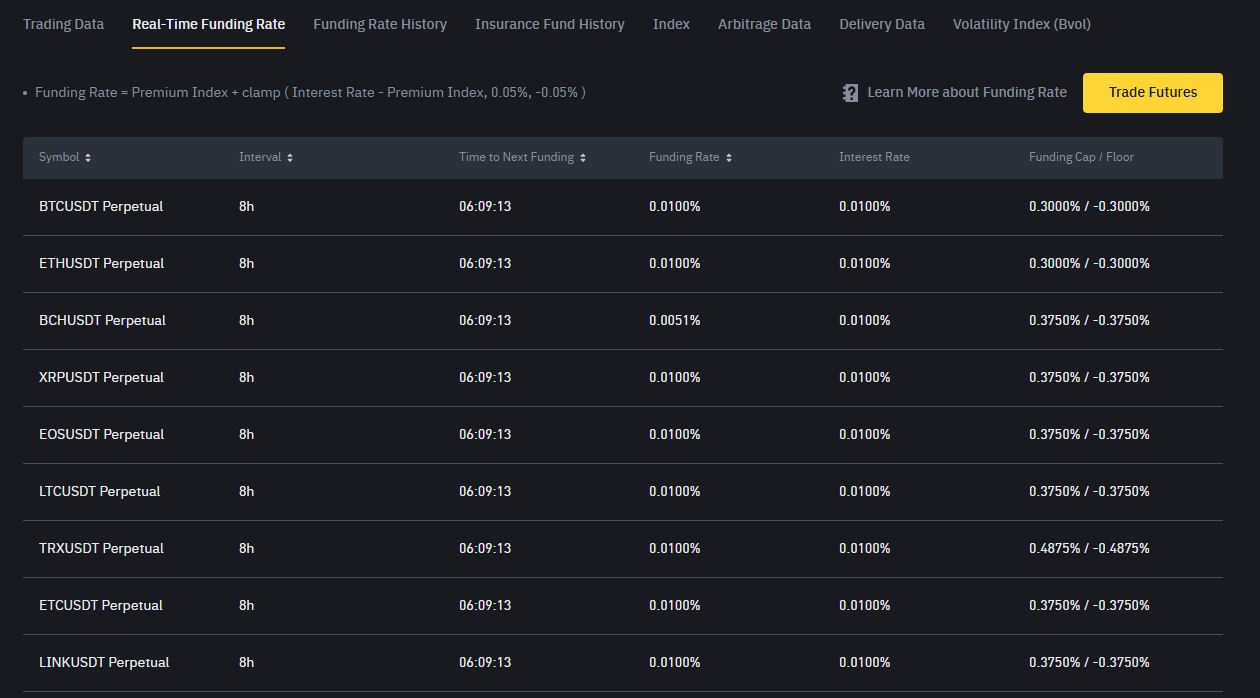

The screenshot below shows Binance funding rates for a few of the coins. The list is of course much longer, but we will look at BTC only.

Funding fees are paid out every 8 hours, at the rate specified above. The rate for BTC currently stands at 0.01%, meaning traders who go long will need to pay 0.01% fee every 8 hours. If the funding rate is -0.01%, then it means traders who go short will need to pay the funding fees.

Making Use Of Funding Fees

There are people who do not trade or invest in a certain coin, either because they know they are not cut out for it, or perhaps they are waiting for an opportunity. They choose to take a lower risk method of earning funding fees instead. How do they do it?

First, you will have to buy an amount of BTC on the spot market. For convenience sake, we will consider it to be 1 BTC. You buy 1 BTC on the spot market, meaning you go long on it. You then short an equivalent amount of BTC on futures contract at the same price which you bought your spot BTC, for example shorting 1 BTC on 1x leverage. Your spot and futures contract will nett off each other in terms of earnings and losses. Your spot BTC (going long) does not require you to pay any funding fee, but your BTC shorts will earn you a 0.01% funding fee every 8 hours.

Assuming 1 BTC is worth $100,000 now, 1% will be $1000 and 0.01% will be $10. You get $10 nearly risk free every 8 hours, or $30 every 24 hours. If you have $1m to sink in, you will earn $300 every day just by doing almost nothing.

One may think that 0.03% every 24 hours is nothing much, but if you stretch it out over a year, it will be 10.95%. This is a very good example of using money to earn money.

Things To Take Note Of

There are things to take note of even if it is an easy money.

Firstly, you may have seen from the calculations above, that to earn a decent amount of money, one needs to have a decent amount of cash to buy a big enough spot holding. If the amount of cash you have on hand is not big enough, the amount you earn may not be significant enough, even if you are earning about 11% per year.

Secondly, you are not able to earn this money all the time. You have to choose an asset which is on an upward trend. If BTC is on a downward trend, your spot BTC is likely to lose money, and while your BTC shorts can nett off the loss, the funding rate will not be in your favour. Chances are you will need to pay funding rates for your shorts if the majority of the market is bearish.

Thirdly, funding rate changes frequently. In a bull market like now, your funding rate is 0.01% for every 8 hours. However, in a stagnant market, the funding rate may even be lower, making it even less worthwhile for you. You will need to monitor funding rates every day to determine whether the deal is still worthwhile or not, and for the point mentioned in the above paragraph.

Fourth, it is better to choose a larger crypto exchange due to slippage. In simple terms, if you set a sell trigger for BTC at $100,000, but because very few people uses the crypto exchange, you may not find someone willing to buy from you at $100,000 at that point in time. The final price which you executed your BTC sale may be much lower than $100,000. These happens especially during a sudden pump or a sudden dump. One will realise that prices for BTC in smaller exchanges often go much lower than bigger ones during a dump, and vice versa. In bigger exchanges, slippage is more contained, which is something you may wish to consider.

Fifth, transaction fees is something you have to take note. For example, Binance has a 0.1% transaction fee, and 1 spot buy + 1 short contract = 0.2% transaction fees. You will need about 7 days just to recover your transaction fees. When you close your trades, you will incur another 0.2%. Different exchanges have different transaction fees, so you will need to take note of this. Of course, if your volume is big enough, then you may consider to upgrade yourself to a higher level of VIP status, thereby reducing your transaction fees. Screenshot below details Binance’s current VIP levels and trading fees.

Conclusion

There is no free money. But some money are definitely easier to earn than others. With money, you can earn more money easily. Let us all earn money together.

Showing 1 - 3 out of 3

Page 1 out of 1

| - | Shop Products | Price | |

|---|---|---|---|

|

|

$99,999.00

|

||

|

|

$1.00

|

||

|

|

Price range: $69.00 through $99.00

|