The fractional reserve banking system is a standard banking system in the modern day economy. However, it is a system designed to reap off the wealth of the masses without them realising it, of which one of the impact is that of inflation, which they explained it with a lie that it is good for you and the economy.

This post is highly contentious, and I do not expect many to accept the explanation and logic in it. For those who do not have an economic or financial background, it may be a little heavy for you. I will try to make it as simple and bite-sized as possible. For experts in this subject, feel free to correct me where I am wrong.

Mechanics of Fractional Reserve Banking

Fractional reserve banking is a system where the bank is allowed to keep a fraction of the customers’ deposits and loan out the rest. The reserve ratio differs by countries, with some dictating it to be at 10% while some to be at 3% or even lower. We will now use a simple example to illustrate what this means and the implications.

Tom has $1000. Tom deposits the $1000 to Jerry Bank, which is required by the country to have a reserve ratio of 10%. Jerry Bank keeps 10% of the deposit as reserve ($100) and loans out $900 to Quacker Company. Quacker Company employs Spike and pays him $900 as salary. Spike, being a thrifty person, deposits his $900 salary to Jerry Bank. Jerry Bank then keeps 10% ($90) and loans out $810 to another company. The whole process repeats. Mathematically, if the reserve ratio is 10%, then with each round of new deposits, we will have the initial deposit of $1000 and subsequent deposits of $900, $810, $729, $656.10 and so on.

Now this is where the Mathematics you learnt in school can come in (you can skip this and go straight to the conclusion of this calculation):

The total deposits can be calculated as D = 1000 + 1000(0.9) + 1000(0.9)2 + 1000(0.9)3 + ….

The geometric series where |r| is less than 1 is: S = a/(1-r)

Substitute a = 1000 as the initial number, r = 0.9, we will have S = 1000 / 0.1 = 10000

Conclusion: With every $1000 put in the bank, theoretically speaking, the bank can create another $9000 out of thin air on a reserve ratio of 10%. The economy has $10000 now. This number will go far further for reserve ratios less than 10%. Now you mutiply whatever you have to the number of people in the population or to the amount of money involved, and suddenly it all makes sense why there are billions and trillions of money circulating in the economy.

Take note that the above process is a simplified one. If we throw in different derivatives and money printing, the amount goes even higher.

The Original Economy

Money originates as a form of tool to make exchanges convenient for people, without which people has to rely on barter trades. Tom has pigs, but he wants to eat chickens. Jerry has chickens, but he wants to eat ducks. Quacker has ducks (lol) but he wants chickens. Barter trading becomes complicated as the value of a chicken is not equivalent to a pig, which is not equivalent to a duck. Money comes in, which everyone recognises the value of in the exchange of goods and services. Currency is then issued out to represent the money. Currency has taken the form of sea shells, of silver and gold, and of course in modern times, paper currency issued by the central bank and currently, digital numbers in the bank. We will come back to this later.

Let us imagine an economy with no fractional reserve banking system. Tom’s pig farm is worth 500 silver coins, Jerry’s chicken farm is worth 200 silver coins and Quacker’s duck farm is worth 300 silver coins. The total value of the economy is 1000 silver coins, and there are 1000 silver coins in circulation. They trade among themselves and as long all things remain the same, ie no increase or decrease in production, the 1000 silver coins will be worth the same yesterday, today and tomorrow. There is no inflation, for the worth of a pig is the same yesterday, today and tomorrow.

Inflation

If the 1000 silver coins for some reason multiply into 10,000 silver coins out from thin air, what do you think will happen? A pig will no longer cost the same amount of silver coins, but will cost more. A pig which cost 5 silver coins today will cost 6 silver coins tomorrow, then 7 silver coins the day after even though the pig is still the same pig. This is what we called inflation. This inflation is carefully calculated, controlled and put out into the economy. Now imagine you have a savings of 210 silver coins. Today your 210 silver coins can buy 42 pigs, tomorrow your 210 silver coins can only buy 35 pigs and the day after, 30 pigs. Your purchasing power has dropped.

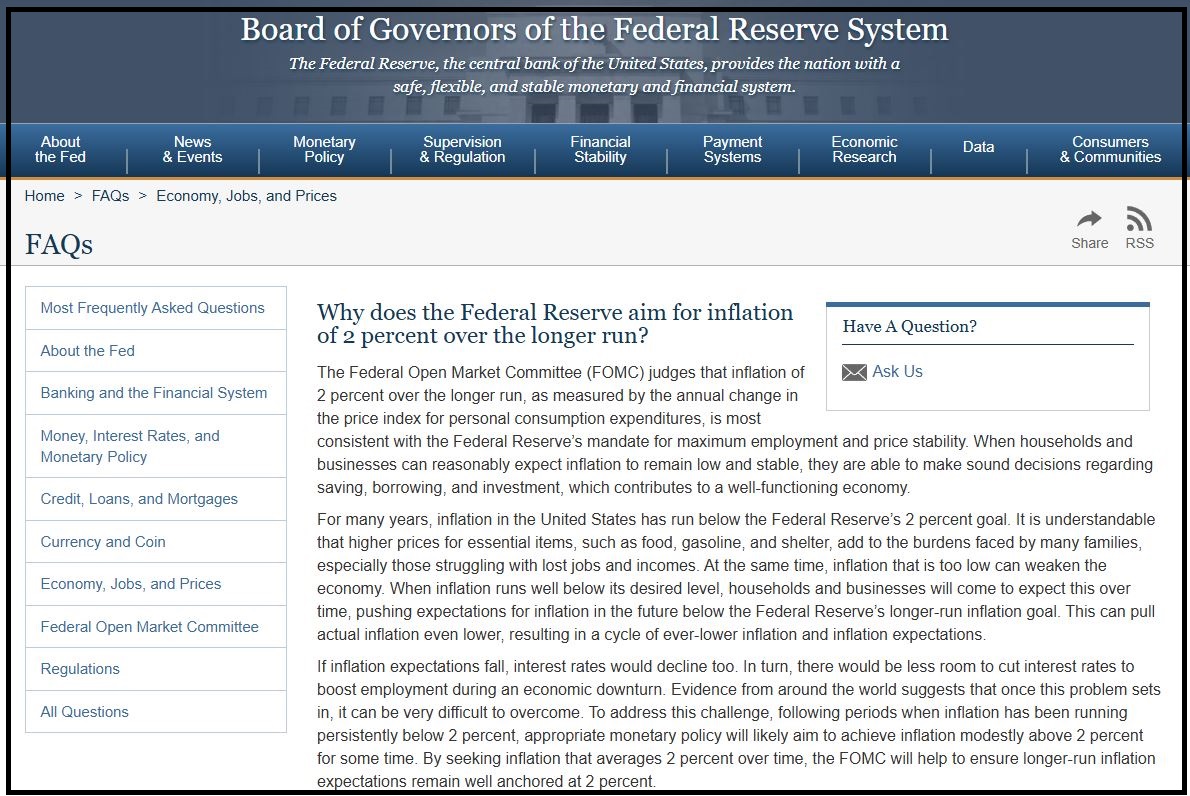

Therefore a reason is needed to convince the whole population that inflation is good for them. A lie shamelessly spewed to the public that inflation is good for the economy. You would have often hear on the news the Fed’s target of 2% inflation over the long run. That famous 2% which for some reason looks like 20% inflation year on year. Let us look at the lie straight from the Fed.

In simple plain language, it means that gradual consistent inflation is good for the economy because it stimulates spending. If the shoe you want to buy cost $100 today and $102 tomorrow, then you will be motivated to buy today instead of tomorrow. When people spend, the economy will be stimulated, people will have jobs and everyone is happy. Furthermore, it allows room for the Fed to lower interest rates to boost employment during an economic downturn. But all these is utter bullshit spewed to make you believe in a system designed to reap you off.

If a pig cost 5 silver coins yesterday, the same pig should cost 5 silver coins today and tomorrow. The pig is still the same pig. There should only be more money added into the system if there is a higher production (either in terms of quality or quantity) equating to a higher total value of goods and services.

How The Banks Earn

Till this point we learnt what is fractional reserve banking, how the money multiplier effect comes in, of which the impact is inflation. I have written an article on the real cost of inflation, which you should read for background knowledge. But what do the banks earn? And what do they really earn, and at whose expenses?

From young, we were taught that banks earn money by lending our deposit to others. They collect a higher interest from their borrowers but paid a lower interest for our deposits, and they profit from the difference. But if the money they lent out were created from nothing, then what is the actual cost to them? Theoretically, their only cost is the interest paid out to the very first deposit in the system, as all subsequent ‘deposits’ are just numbers in their ledger. They lent out money they do not have, to collect back interests which should not exist, and their accounts grew fat from the numbers.

Note the push now to digital economy. Traditional money printing still incurs basic cost such as the paper, the ink and the manpower to escort the materials and final delivery of goods. But with modern times, you are working for a number that the banks simply pressed at the keyboard for almost no cost (except for the manpower pushing the button). With a digital economy, not only can your every transaction be monitored, you might as well be working for Neopoints in the game Neopets. Just imagine today the US government take back the USD and decided to say Neopoints will be legal tender. Isn’t it just the same? You slave for days, months and years for numbers that just change in your bank account. You will probably tell me these numbers can exchange for actual resources, and we will come to it shortly after this.

And that is why Bitcoin is so popular, even though it will never be the next gold. Bitcoin cannot be manipulated at will, not with our current and foreseeable capabilities of computing.

As the economy gets artificially pumped up with insane amounts of money, the interests which the banks earn will then take up a significant portion of the money pool. To quote a simple example, if I buy a condominium at $1 million, with a downpayment of $300,000 and a loan of $700,000 paid out over 25 years at perhaps 2% interest, then the amount of interest I have to pay back over a $700,000 loan will be slightly more than $190,000 – a staggering amount of 27%. Multiply that over the amount of loans the bank issues out, and we will realise that the banks earn a disgustingly big portion of money circulating in the economy, of which almost a big bulk of them is just fluff. What is more, is that through a series of complex moves, they sell your loan back to you, and you happily take it up.

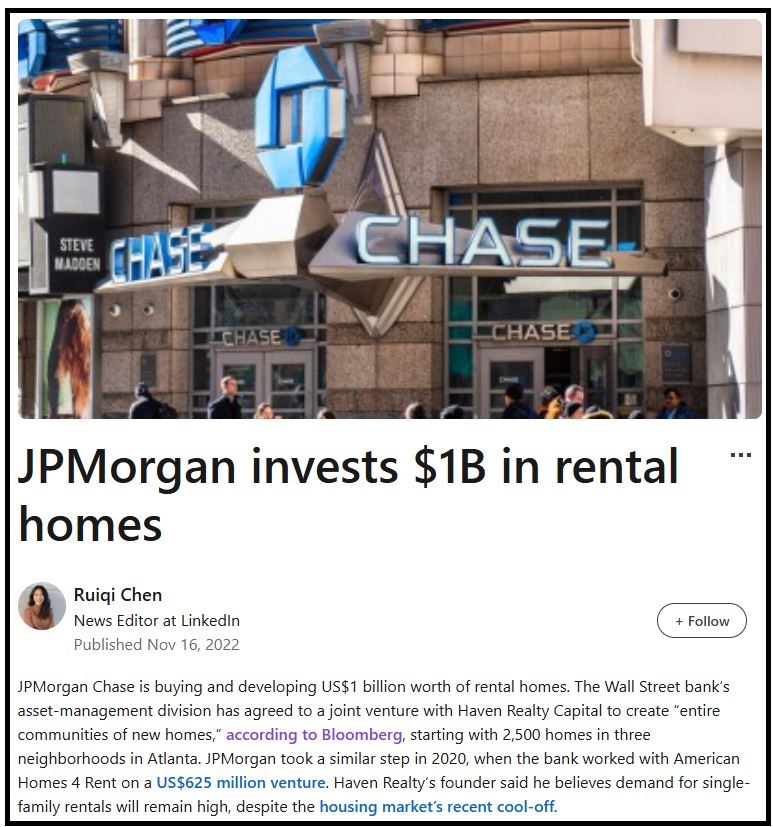

Now, readers may have one question at this point. If the money the banks created is fluff, the money they lent out is fluff and the interests they earn are fluff, then what is the point? Money is indeed fluff but resources are very real. With this fluff money, they buy your time and labour as employees. They buy up land and properties, assets and gold in the name of investments. Just do a research on any bank, and you can see their hand reaching out to assets in different sectors all across the economy – from energy to transport, from utilities to technology, from F&B to construction, the list goes on. And with the tangible resources they gained from using the fluff money, they control the economy even further.

Conclusion

The fractional reserve banking system is probably the largest financial scam there ever is. In an era where slavery has been abolished, it allows the banks and the big corporations to enslave the common people through debt and inflation. Mankind has little needs, but oversupply of goods through mass production has caused us to needlessly and endlessly spend on useless purchases – from the clothes we will wear only once to the constant upgrading of a brand new car to the mindless purchase of condominiums at all time high prices – all of which are designed to sink us deeper into debt (although this is also partly the consumer’s own fault). And finally when we are old and ready to retire, we realised that inflation has indirectly wiped out the purchasing power of our savings by half. In other words, we worked half our lives for nothing.

Fun fact 1: It was not the previous generation who makes things so expensive. They had no say. It was the bankers.

Fun fact 2: Central banks printing money is not the main cause of money supply going up. While it does contribute, the fractional reserve banking system is the main culprit.

Fun fact 3: The US reserve ratio is 0%. Think carefully about what this means. In crypto terms, the USD is the largest shitcoin there ever is.

This post has been intentionally simplified so that any common man can understand. Of course this topic is a whole lot deeper and extensive, stretching out to a variety of topics, of which I have linked some of them to my past articles. You are encouraged to do your own research for a deeper understanding.

If you ask me what should you do after knowing all these, it will be:

- Do not spend unnecessarily and try to be debt free.

- Invest in assets such as stocks, properties, money generating assets. Pick one which is suitable for you. Not everyone is suited to play stocks.

- Work hard and sacrifice now, so that you can get your financial freedom.

- Once you have financial freedom + money generating assets, then you are truly free.

Freedom means nothing to some. Yet it is also everything to strive for.

Showing 1 - 3 out of 3

Page 1 out of 1

| - | Shop Products | Price | |

|---|---|---|---|

|

|

$99,999.00

|

||

|

|

$1.00

|

||

|

|

Price range: $69.00 through $99.00

|