Yesterday I went to one of the gold retailers in Singapore and sold off nearly all my physical gold – 14 x 1 oz gold coins + 8 x 1/2 oz gold coins, a total of 18 oz. I had written about the technicals of buying spot gold, so today I will not talk about that.

Gold has recently hit the all time high and breached the 2300 mark. There are many technical analysis and fundamental explanations online on why the gold reached such record levels, so today I will not go too deep about it. Instead, I will approach it from another angle and explain why I believe gold price will fall soon. I may be wrong of course.

The Psychology

Traditionally, gold is a safe haven in times of crisis. Money printing can erode the value of money, but it cannot erode the value of gold. Gold is limited, and is recognised by all countries as the most concrete backing of their currency value.

In general, when interest rate falls, gold price increases. The Fed has been hinting at reducing the interest rates, and despite not having done so even after a few FOMC meetings, the price of gold has already moved forward and reached new peaks.

This is like us buying a property. If the government says they want to build a train line across the area or to develop a particular sector, housing prices will jump immediately. People know that the area will get more traffic in the future, thereby increasing the value of the houses. We assume that a house is worth $500,000 before the announcement of any developments, and after the development it should reach $1m. Upon the announcement, investors who are quick to move and execute their decisions will quickly snap up the available houses, and existing owners will also immediately increase their selling prices. The prices will appreciate until it reaches the $1m mark, which is deemed to be a fair price considering future amenities or infrastructure. However, do note that at this time, it is often that the new development is not yet completed, and at times not yet even started.

The market has already factored in the future value of the house in the current prices.

It is the same for gold or many other types of investments. While gold certainly still has some leeway to move, and may even hit 2400 or even 2500, I believe that the upside is quite limited when even the common retailers or marketplace aunties are joining in the hype. They are usually the indicator of a reverse direction. I do not have the ability to buy at the lowest price nor sell at the highest price, but once the price hits my range, I will consider taking action. At 2300, gold has certainly hit my sell range.

The Politics

The US is having their elections at the end of this year, and the US election is a big thing because it affects the whole world. As such, many countries have also directly or indirectly meddled with the US elections for their own benefits. But one thing we can know, is that the current government needs to portray a scene of prosperity during the election period to prove that all is rainbow and honey when they are in office, not the opposition.

Even though the world economy is in shambles now with no hope of returning to its former glory any time soon, the US will definitely attempt to show itself to be still capable to be the world leader, that the economy is still prospering. No matter what the reality is, the facade must be appealing. And to do that, the US will also attempt to rope in other countries for their own version of common prosperity under their great leadership. Afterall, we are in a global economy, and making use of each other to reach one’s own objective is a very logical thing to do.

The Predicted Future

My own prediction is that in the short term from now till about early next year, gold prices should see a fall back to below the 2000s level. What level it will reach, I do not know. But once it goes below the 2000 level, regardless of whether it is the 1900s or the 1800s, it will be in my buy-zone again. With the US dollar and the actual power and influence of US weakening day by day, I believe that 2000 is the new benchmark for buying or selling gold. Naturally, because I am dealing with spot gold, I will not be buying and selling that frequently. Afterall, gold’s primary purpose is to hedge against crisis.

Economic crisis is inevitable in the system of capitalism. Once every decade it has to reset. The year 2018 should be the year to reset, but Donald Trump forcibly propped the market up, and Joe Biden who took over in the Covid era further inflated the bubble. To test whether our hypothesis has a basis, we can look at what other countries are doing. Of course, this does not mean that our hypothesis will definitely come true, but that our hypothesis is not based on gut feel plucked from thin air.

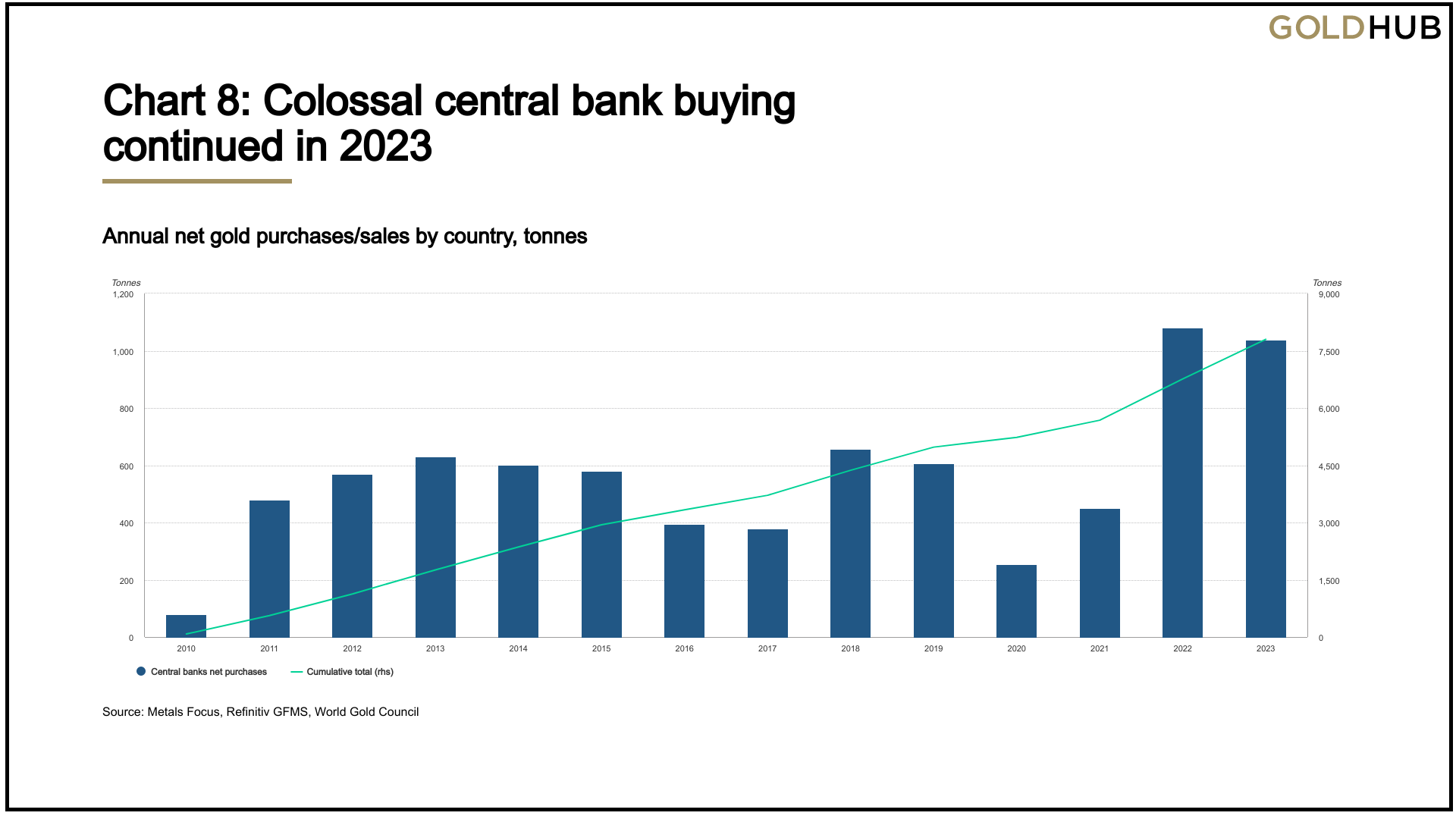

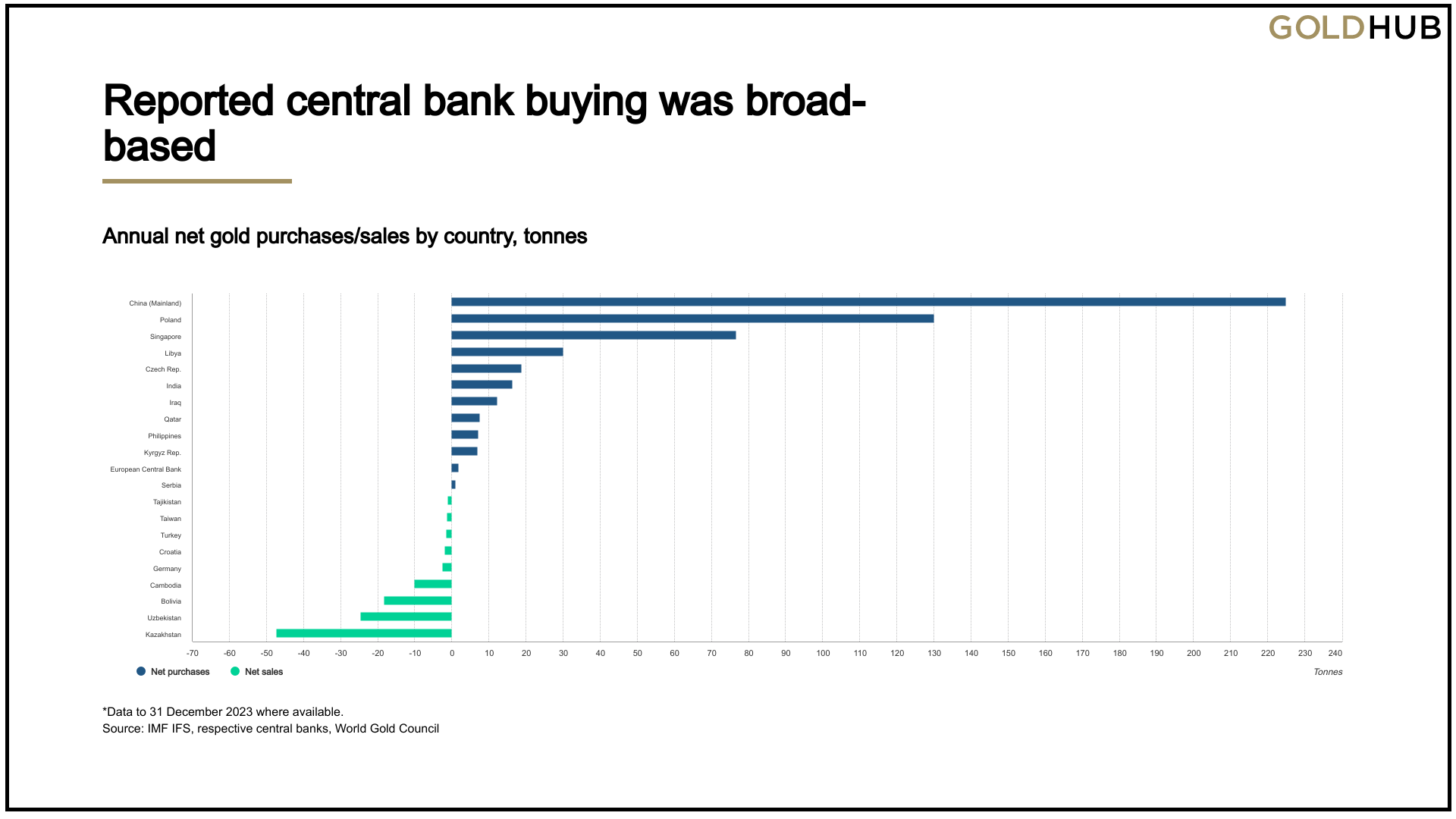

Central banks around the world has been bulk buying gold, an indication that they are preparing for trouble and that trouble is coming soon. The buying started from 2022, and carries on till today. Do take note that the timeline of a country is different from the timeline of an individual. Combining what we have known so far, preparing for the bubble burst in 2025 is a fair assumption to make.

But first, a facade of prosperity.

What You Should Do

The all-important question of: What should I do now?

Below are some of my suggestions:

- If you currently have physical gold (not contracts played on leverage) and if you are risk adverse, do nothing. Hold your gold and wait for another 2 or 3 years. I would expect gold to go higher in price from next year onwards.

- If you currently have physical gold and are willing to take some risk like me, sell your gold now and wait for a price drop. Do note that nothing is 100% certain in the future though and there is a possibility of missing the boat.

- If you do not have gold and wish to get some, do wait for the price drop. There is no need to FOMO (fear of missing out) and chase after high prices. You will find yourself hard to breakeven and get out without a loss.

There is no need to follow what others do. Know thyself, know thy own resources, and make thy own decisions.

Showing 1 - 3 out of 3

Page 1 out of 1

| - | Shop Products | Price | |

|---|---|---|---|

|

|

$99,999.00

|

||

|

|

$1.00

|

||

|

|

Price range: $69.00 through $99.00

|