There are many types of insurances on the market, but today we will only talk about the common ones we may wish to consider and my opinion of them.

Life Insurances

Life insurances are basically buying on your own death. You get paid out when you are dead, totally and permanently disabled, or when you have a terminal illness. Basically in short, if you are not dead, you are as good as dead. People buy this so that in the event such an unfortunate thing happened, the person will leave behind a sum which is paid out by the insurance company for their family members. When we die, we still hope that our family is being taken care of and not being further burdened by the financial aspects.

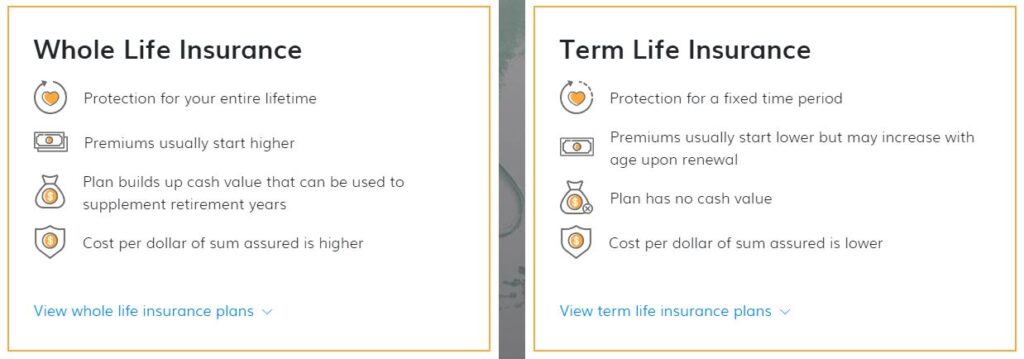

There are 2 types of life insurances – whole life insurances and term life insurances. Please look below for a brief summary. Picture taken from one of the many insurance companies’ website.

In short, whole life insurance covers you for the entire life time and contains a small savings / investment component which will slowly accumulate over the years. If all goes well, the sum of money you obtain at the end will cover back the total cost of premiums you put in, making the plan effectively free. Term life insurance protects you for only a certain number of years, for example till 60. It is significantly cheaper than whole life insurance, but once the money is paid out, you will never get a cent back. Also, if you are planning to buy term life insurance to cover yourself all the way to the maximum limit, you will find it will become more expensive than whole life insurance.

Many agents recommend a whole life insurance supplemented with a term life insurance to cover your golden years. The whole life insurance acts as a base which covers you all the way till you die, no matter how old you are. The term is an additional shield for the critical years, which can be abandoned once the golden years are over. They will work out the math this way:

Assume you are earning $4000 a month = $52,000 a year including one month bonus.

If you are 25 now, you will have 30 years till you retire. Even without factoring in future pay increment, you will lose this amount of money if you die today:

$52,000 x 30 = $1.56 million

Hence mathematically speaking, you should be covering yourself for at least 1.56 million. If you are to factor in future pay increment, the amount will be much higher.

The logical flaw:

You earning $4000 a month does not mean that you spend $4000 a month

In times of difficulty, you may actually only need to spend $1500 or $2000 a month to have a decent (though thrifty) life.

Hence your cover should be calculated as $2000 x 12 x 30 = 720,000 without factoring in inflation yet.

Who should buy such a plan? Many agents would encourage both husband and wife to buy. The logic is similar. If any of you die, the other will still have the money to live on. Your children will also have money to carry on with the daily necessities such as education. Some even go as far to say you should buy one whole life insurance plan for each of your children too, to protect them. Even if they had no use for it, they could choose to cash out the plan and take the amount of money accumulated in the plan for themselves when they grow up. Or that you buy the plan for them at a very young age where the premiums locked in are cheaper, and it would ease their burden when they grow up and start their family. They would have no more need to buy any life insurance anymore when they set up their own family, because they are already covered and their plan is fully paid for (more details below).

But do you really need a life insurance for every member in the family? In my opinion, only the person who is bringing in the main income source should buy. For example, if the husband is earning $5000 a month and the wife is earning $2000 a month, the absence of the husband would have a great financial impact, but the absence of the wife may not have critical impact on the household finances. In such a case, only the husband need to buy. Remember the rationale for buying life insurance – to leave behind a sum of money for your loved ones to carry on with what they need to do in your absence. If the husband and wife both earn $5000 a month or something similar, then the question they need to ask themselves is: Am I able to continue sustaining the family and take care of the kids if my spouse is down? Although young people die everyday, the probability of us dying at an older age is much higher. Hence there is no need to waste money on a life insurance unless there really is a need for the money should a family member goes down.

The next question they have to ask themselves is the total debt they are holding. One factor I consider when I buy life insurance is the amount of debt my wife needs to pay when I am gone, or the amount of debt I need to pay when she is gone. This is especially important because we were holding housing debts, which we still needed to pay off if one of us was not around. We would not have made it alone with all the debts. Hence we bought a term insurance each with a cover of 1 million, to protect us during that few years. We paid off our housing loan within 3 years and subsequently cancelled off the term insurance. This is what I meant by using term insurance to cover the critical years, or the golden years. If you only have a job and just want a normal and simple life without going for financial freedom, a term plan is also advisable as your kids will need it.

My wife and I chose term insurance because it is the cheapest way to get maximum cover only for that few years we needed. That was the few years where we were the most aggressive in accumulating our wealth, stretching our finances to the limit and get the housing loans for 2 houses. It was a period where we cannot fail. I cannot afford to lose my job (luckily we had the confidence as I was in the public sector). We cannot afford to die, that was why we got the insurance. Shortly after we finished paying for our house, we cancelled off the term insurance quickly. The insurance was there as a safety net as we made a mad rush to the next level. Continuing to maintain the term insurance was unnecessary as our debts were already paid off, we probably would not die that early, and each of us could survive financially without the other. There was no need to continue paying for a policy whose payout was although appealing, not necessary and most likely will never reach us unless we died young.

You may ask, what if you intend to get a third and fourth house again? Do you still need the insurance? While we entertained the idea of going for a third house before cancelling the policy, we came to the decision that we will not do so, mainly because it was not the right time. Also, we would already have accumulated a sum of money while waiting for the right time. And of course, there are many other methods of investments rather than buying a house and renting out. But of course, if you are still continuing for a third or fourth big ticket item, be it for own consumption or for investment, it would be wise for you to carry on with maintaining the term plan. You do not want to be crippled and sunk by financial debt because one earning member of the family is not around. The payout would be useful to clear off the debts in one shot so you do not have to worry financially in moments of stress and grief.

Once you have determined a certain sum to insure yourself or any of your family members, the next logical question would be – whole life insurance or term plan? On first look, whole life insurance seems to be a better deal. Yes it is more expensive than term plan, but one day you will get your money back. Furthermore, there are now whole life insurances which can be paid off in 10, 15 or 20 years and you are covered for life. The whole life insurance also covers an investment portion, which if left untouched long enough, not only covers back the premiums you put in, but also gives you more. A 2-in-1 package where you get insurance cover for free, but also earned some extra money at the end of it. At least, this is what the insurance agents will tell you.

But is it really true? I bought a whole life insurance plan in 2014, payable for 25 years with a coverage of $100,000 and annual premium of $2400. In 2018, I bought a term insurance with a coverage of 1 million and annual premium of $1700. At the rate the inflation is going, for all the money that I paid in the early years, how much is $100,000 worth to me in the end? At the end of 30, 40 years, the $100,000 probably means nothing to me.

Insurance should remain only as insurance. Investment remains as investment. Do not mix the 2 of them up. Paying $2400 a year for a $100,000 cover, and letting it slowly roll till 30 years later to cover back all the cost is an extremely foolish decision I have made, one which I regretted but is too late for me to cancel it off. With $2400 a year, I could have spent $1500 on a term insurance for a much higher cover and invested the rest, and still get higher returns myself. Then when my kids are older, for example 18, I could have cancelled my term plan and use the money saved for further investment. Even if by some freak circumstances I died the next day I cancelled the insurance policy when my child turns 18, I would have already taken care of the finances proper during the 18 years my child is growing up.

You may say: But term insurance gets more expensive as you grow older, and what is going to cover you when you are old? That brings us back to the original intention of life insurance – to ensure that the living ones get by financially while you are gone. Why do you need to leave behind 1 million dollars for your adult working children when you are dead at 70? Your 70 year old spouse can rely on the savings you have accumulated throughout your life when you are dead at that age.

Of course, there are some who will also say: Yes I want my death to be of value. When I am dead at 70, I want to leave behind a good sum of money for my kids. That will go into the territory of legacy planning, not under the scope of life insurance. Life insurance is for common people to take out a fraction of their money to create a safety net, so that when things go bad, their average family will not be held back in life.

Showing 1 - 3 out of 3

Page 1 out of 1

| - | Shop Products | Price | |

|---|---|---|---|

|

|

$99,999.00

|

||

|

|

$1.00

|

||

|

|

Price range: $69.00 through $99.00

|