One of the favourite insurance plans agents like to introduce or convince people to buy is that of a savings plan or an Investment-Linked Plan (ILP). Savings plan, is like what its name suggested – a savings plan but with some insurance components. ILPs is about half insurance and half investments.

Just to recap, when I was still an insurance agent, successful sales of these 2 types of plans will give the agent a 55% commission for the first year, with reducing commission payout over the next 4 years (total commissions payout period 5 years). The director of the agency will also get a cut if an agent under him clock a sale – 22% for the first year. If the director secured the sale himself, he gets the full 77% commissions. I believe that this is still the case today.

For example, if I buy a savings plan with an monthly premium of $200 which equalled to $2400 per year, the insurance agent will get $2400 x 55% = $1320. His director will get $2400 x 22% = $528, or $1848 if the director clocks the sale himself. As mentioned earlier, they will still get their commissions over the next 4 years at decreasing amounts. This is also why if you cut off the plan in the first few years, you get almost nothing back.

These 2 types of plans have one of the highest commissions payout, which is why agents always aim to sell either of them. They would sweet-talk you, lie to you and do everything else just to get you to sign the plan. Let us look at what each type of plan provides and the traps that comes along with it.

Savings Plan

Generally marketed mainly as a savings plan as it rightly should, agents will also make the free insurance cover a selling point. Basically the plan goes like this: There are 10 year, 15 year and 25 year plans. For each year of the plan, you will put a certain sum of money you agreed on (be it $100 per month, $200 per month etc) The insurance company will then help you invest the money you put in and provide a return in the form of interests to you.

The interests consists of 2 parts – a guaranteed portion and a non-guaranteed portion. I had forgotten the numbers, but the guaranteed portion is quite a low percentage. The non-guaranteed interest portion will be dependent on the market and of course, how well the company did their investments. They will usually quote 2 percentage points, for example 3% and 5%. They will then churn out a list of figures telling you if your savings earn you a return at the respective rates, what will be your returns for each year, and when accumulated will snowball to the figures indicated.

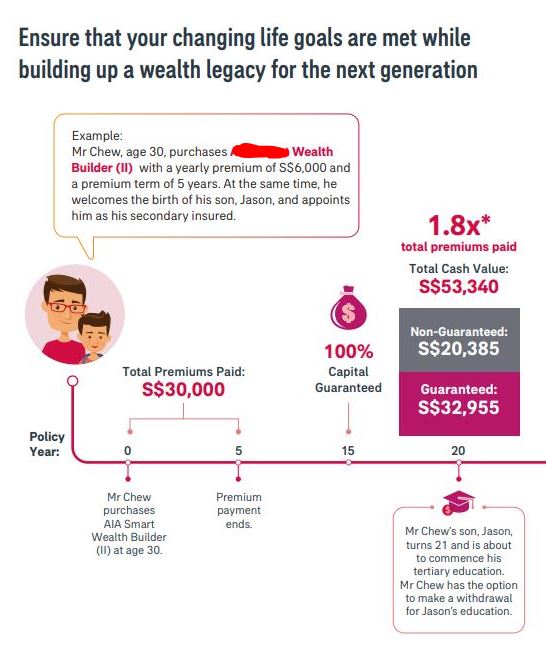

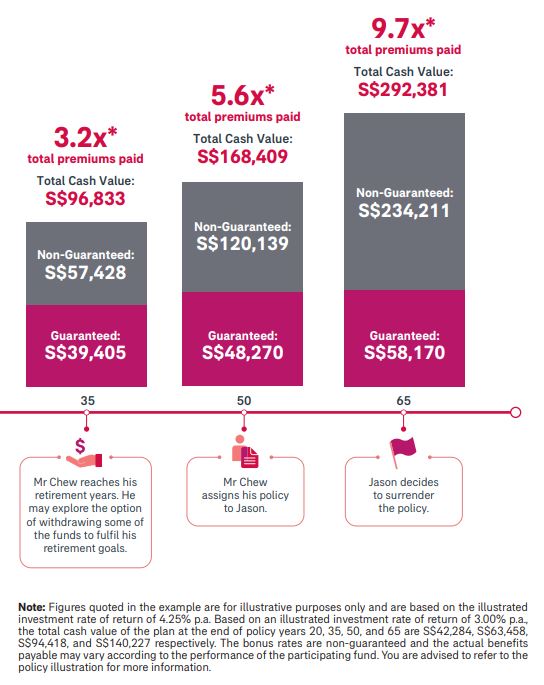

The above are snippets from a savings plan brochure I took from a big insurance company. Will not mention names here.

You will then realise by now if you take up such a savings plan, your money will be stuck inside for the duration of the plan, which can be as long as 25 years. They explain this first by saying this is a type of forced savings, forcing you to be disciplined and save up for your future in this climate of overspending. After that they will offer you a way out – that after 3 or 5 years you will be able to withdraw a portion of your savings in the plan to meet with urgent or important cash needs, such as for your wedding or any medical expenses.

By now you will be hooked to it – a disciplined savings plan with an option to withdraw if you need it.

But what they did not, or may not, tell you is this: That during the first few years, the amount that is accumulated in your savings plan is very low. For example, if you cancel during the first 5 years of the savings plan, you can only get back 10% of all the premium you put in. That is because the majority of your premiums is being used to pay the agent. If you cancel it, the company cannot possibly claw back the commissions from the agents (if they do so, who will work for them?). The losses will all be passed to you. If you see from the picture above, you will see that in their example above, only at year 15 is 100% of your capital guaranteed. This means that if you cancel your plan at any time before year 15, you will suffer a loss. Only at year 15 will you breakeven. Only after year 15, will your money actually start growing.

15 years! How long is 15 years? 15 years later you are at breakeven with 0% gains, and getting hit hard by inflation. If you put in at any blue chip stock or even at the bank for 2% interests per year, you would have gained much more!

Secondly, the guaranteed portion of your returns is very low. The non-guaranteed portion is the critical one. Agents will always have a disclaimer to say they cannot predict the future, but based on historical records, the payouts of the non-guaranteed portion are usually nearer to the higher end. What if you get hit with a financial crisis and the non-guaranteed portion is close to zero? What if for all the years your payout simply is low? You will have nobody to blame. It is the market which is not doing well. Agents will say they represent a big company with a long history. But even Lehman Brothers can collapse. Trusting companies whose main goal is profits at your expense to take care of your returns is like giving a piece of meat to the lion and asking them to take care of it for you.

Look at the footnote of the second picture of the brochure above. You will see that in the event that the investment return is lower, you will get a lower return. The picture itself shows a higher return of 4.25% per year. Let us consider the worst case scenario, that the economy is really messed up and for $30,000 you put in, you get only $32,995, $39,405, $48,270, $58,170 after 20, 35, 50 and 65 years respectively. In the event that the company decided to play punk and tell you you only earn $3000 for your $30,000 after 20 years, how will you feel? How much is your $33,000 worth after 20 years?

Thirdly, even if they give a decent payout at the maximum amount illustrated and you have the ability to consistently put in money for the full 15 or 25 years (depending on what type of plan youy buy), the sheer amount of money trapped in the plan without liquidity is a critical flaw. Who is able to predict that they will not need that $30000 stuck inside for the next 25 years? What if something happened and you desperately need the money, only to find out you can take out only a portion and at a loss? That money becomes only yours on paper, but in reality belonging to the company selling the savings plan.

Fourth, the insurance cover portion is a small added portion to entice people to sign up, but in reality serves no practical function.

25 years later, or 15 years later, the inflation of the economy would already have rendered the money you put inside useless. You will get a miserable sum of money which cannot do anything much. You do not need to have the power of fortune telling. Just take a look back at historical prices, and you will realise that things get more and more expensive over the years.

If you ask me, I would rather consider the following:

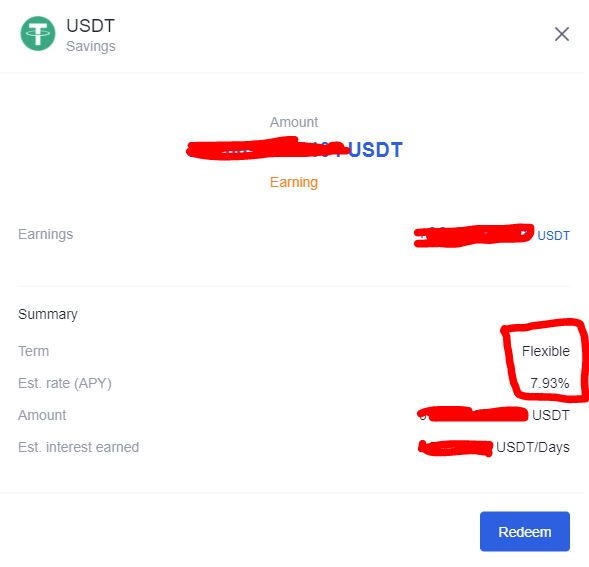

Crypto savings or staking – USDT savings generate different interests at different times, but as of now my USDT is generating a 8% interest rate per year, with daily payouts.

Putting money in foreign banks with higher interest rates – I am earning a 4% interest rate by converting my money into Chinese RMB and putting in their banks, with monthly payouts.

Blue chip stocks – stocks have ups and downs. But blue chips are generally steadily going up with decent dividends.

Even putting money in Alipay (the Paypal of China) also allows you to generate 2% of interest per year, rolled daily.

Any of the above will allow you much higher liquidity and more control of your money. Yes there are some risks, but putting money in a company which does not allow you control of your funds for such a long period is a much higher risk.

Take note my above suggestions are alternatives to the savings plan provided by insurance companies. It is not to say you should put all your money inside crypto savings, foreign banks or blue chip stocks. These are the safer bets to put your money in, in an attempt to outrun inflation. Doing this alone will not allow you to gain financial freedom. Your portfolio to financial freedom should consist of safe foundations and riskier but calculated and informed investments.

If you wish to try crypto savings, do consider signing up for a Celsius account. They provide good savings rates for USDT and other crypto.