Many of us play the financial markets. Chances are many of us would have at least played the forex, stocks, bond, commodities, crypto etc market at some point or another. These markets are a zero sum game, meaning what you win is what other people lose and vice versa.

These financial markets are a risky venture by itself, made more adventurous with the concept of futures, options, margins etc and the like. If we reclassify these financial markets, we can say that the financial markets in general can be further split down into the spot market, options market, futures market etc, of which you can play with a variety of methods such as using margin. But as the game gets more complex, it also becomes more dangerous.

Let us attempt to explain things very simply. Of course, with technology, there are certain tweaks here and there which deviate from the explanation I am giving below.

Base assumption: 1 watermelon cost $10.

Spot market – You take 10 dollars and go to the fruit seller to buy a watermelon. You use your $10 to exchange the fruit seller’s watermelon. You use what you have to buy the actual available product, and you own the product at the end of it. This is the most common form of transaction we see and actually practise in our everyday life.

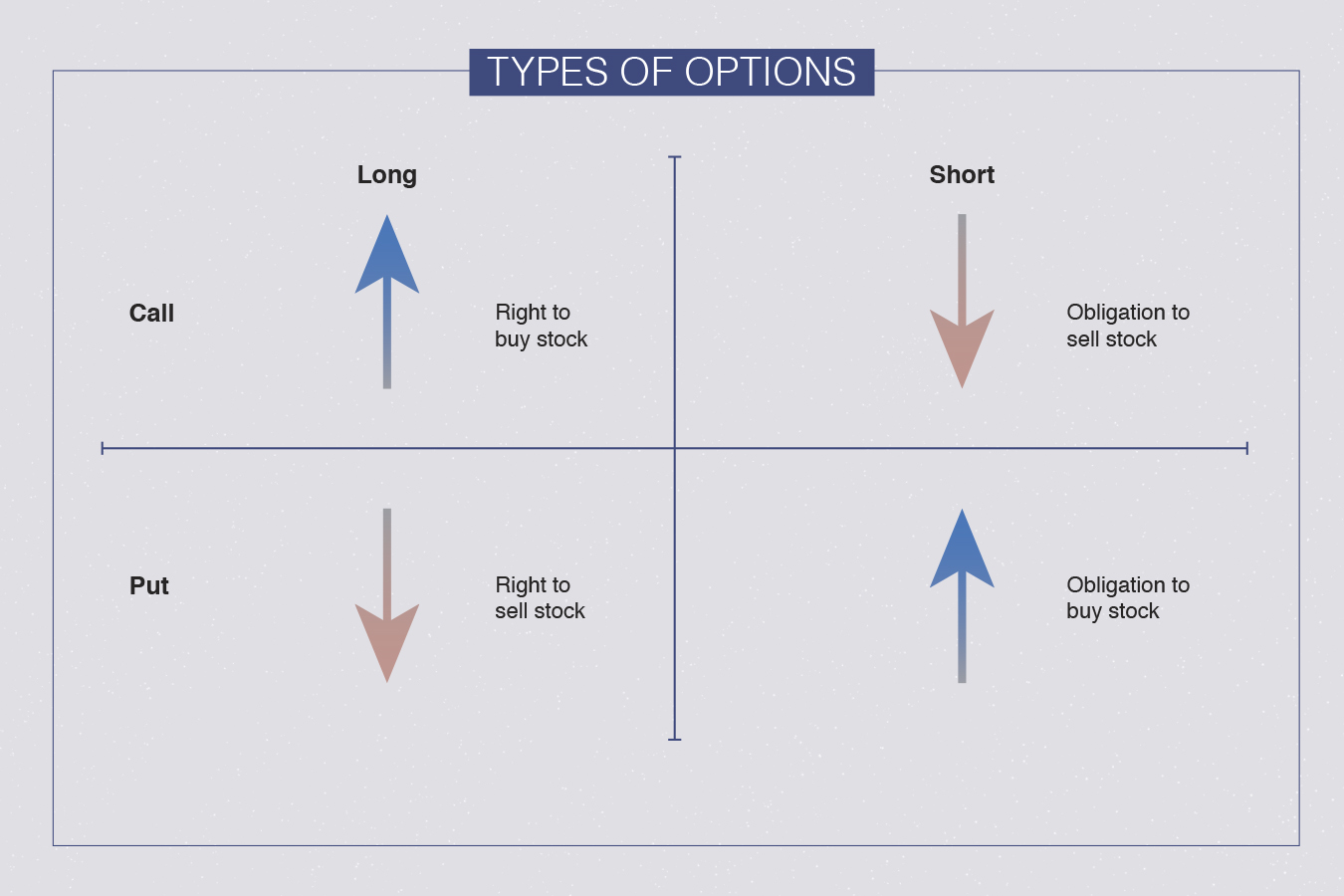

Options – You expect the watermelon to be $12 in the future. You pay the fruit seller $0.50 to have the right to buy the watermelon at $10 within the next 1 week, 1 month, 1 year etc. The fruit seller is willing to sell you the option because the seller thinks that the watermelon will not reach $12 during that specified time period. If the watermelon becomes $12 at the end of the time period, you can exercise the right to buy the watermelon at $10, incurring a total cost of $10.50. If the watermelon becomes $8 at the end of the time period, it will not be logical for you to exercise the right and still insist to buy the watermelon at $10. You lose $0.50. There are call and put options, both of which you can buy or sell, making it a combination of 4 situations for you to play with. I will not go into details here though.

Futures – You expect the price of watermelon to be $12 in the next week/month/year etc. You pay $10 to the fruit seller, with a contract stating that at a specific date (example: last day of next month) you must give me 1 watermelon. Regardless of the price of watermelon at that time, the fruit seller must deliver that 1 watermelon to you on that specific date.

Shorting – Extending from the above example, as a fruit seller now you expect the watermelon to drop to $8. So you sell watermelons to the buyer at $10 with a contract that at the specified date of the contract, you will deliver the watermelons. Regardless of whether you have the watermelons or not, you can still enter the contract to sell. You just need to be able to buy the watermelons somewhere and deliver it at the end of the time period, regardless of the price at that time. In this case, you are now the seller of the futures rather than the buyer. Assuming you sell watermelons even though you do not have stock, if the watermelon rises to $50 at that time period, you will still have to buy the watermelons at $50 and deliver it to the buyer. The potential loss for this is unlimited but the potential gains are limited. On the other hand, if the price of watermelons is $7 now, you can just buy it at $7 and close the contract. You earn $3 because the buyer paid you $10 for it.

Margin – You only have $10, but you wanted to buy 10 watermelons. You put down $10 as collateral and borrow another $100 with interests to buy 10 watermelons in total. You hope that when the watermelon rises to $12, you can earn $20 profit less interests after paying off everything. But if each watermelon drops by $1, all your $10 will be gone. We can see that with such leverage, your $10 can easily earn you another $20 with only a slight movement in prices. But the converse is also true. A tiny movement can wipe you out.

The safest way is of course always to buy with what you have. If you have only $10, buy only 1 watermelon on the spot market. Forex is usually played with margin / leverage due to its very small movements, making it difficult to deal on a spot level. But stocks and crypto can be played on the spot market even for retail traders and it is recommended that you do that, unless you are a professional.

Let’s us take the example of Meta (parent company of Facebook). Assuming I bought only 1 share at a high of $400 per share on the spot market at its recent high, it means that I am holding the actual share of Meta at my stock depository. I legitimately own that 1 share. It later drops to the price of $200, which is its actual stock price today. While my shares have lost a value of $200, I do not suffer from anything else. I still own the share and I can hold it for as long as I want. If I believe that Meta stock will rise to $600 in the future, I simply hold on to my stock and wait. There is no hurry. However, if I am playing it on margin, every single day I hold the stock will result in interests that I have to pay, because I am buying on borrowed money. I will be stressed out over the length of time it will take for Meta to go back to my buy price. In fact, many would have cut loss simply because their holding power is not strong enough. One cannot be paying interests forever. Or if I play in the options market, where I pay $2 to have the right to buy Meta share at $400. If it falls to $200, I will not exercise my right to buy Meta shares at $400 when I can easily buy at $200. But I will lose $2 for nothing.

Or this scenario can happen. You bought 1 Bitcoin at 40,000 USDT per coin using margin. Russia prepares for war in Ukraine. Market panic and Bitcoin drops to 34,000 USDT per coin. Because you played with leverage, your losses are amplified and you got margin-called (basically wiped out) when Bitcoin hits 36,000 USDT. It did fall further to 34,000 as mentioned earlier. But after Russia actually started the war, the market rebounded. Bitcoin now rises back to 40,000 USDT for example. If you are playing the spot market and holding on to the actual Bitcoin you have, you are not affected. You simply go back to square 1 with your Bitcoin in hand. But if you are playing with margin as described above, you will find yourself losing both your Bitcoin and your money, even though within a span of 1 week it drops and goes back to its original price.

The above 2 examples on Meta and Bitcoin are real examples based on recent price and political movements. It is not an example cooked up from thin air.

Of course there are many variations on the different methods above. While the above examples states the big potential losses, one can also argue that conversely there is a huge earning potential. We can see that other than the spot market, all other derivatives are usually a high risk high return adventure. I have tried futures and leverage too, and lost a sum of money. One must understand that the ability to preserve capital is more important than earning money. If one does not know how to manage risk, you may earn 9 times, but that 1 failure will wipe out everything you have earned so far. It happened to me.

Playing the spot market still have its risks. Afterall many people lost money on the spot market too. But compared to the others, its risk is definitely significantly lower. Trade and invest safely. Play with what you have, and you will be able to sleep better at night. One guiding principle I use when buying crypto or stocks is: If I buy this and it crashes tomorrow, will I still be able to sleep well at night and function normally during the day, and at the same time maintaining the confidence that given enough time it will rebound back to my buy price and nett me a profit? If my answer is no, I will not touch it. If my answer is yes, I will buy. Naturally, the ‘yes’ answer has to be backed by sufficient homework.

Stay safe. Trade and invest wisely. Be patient and success will come to you.

Showing 1 - 2 out of 2

Page 1 out of 1

| - | Resources | Price | |

|---|---|---|---|

|

|

$5.00

|

||

|

|

$1.00

|