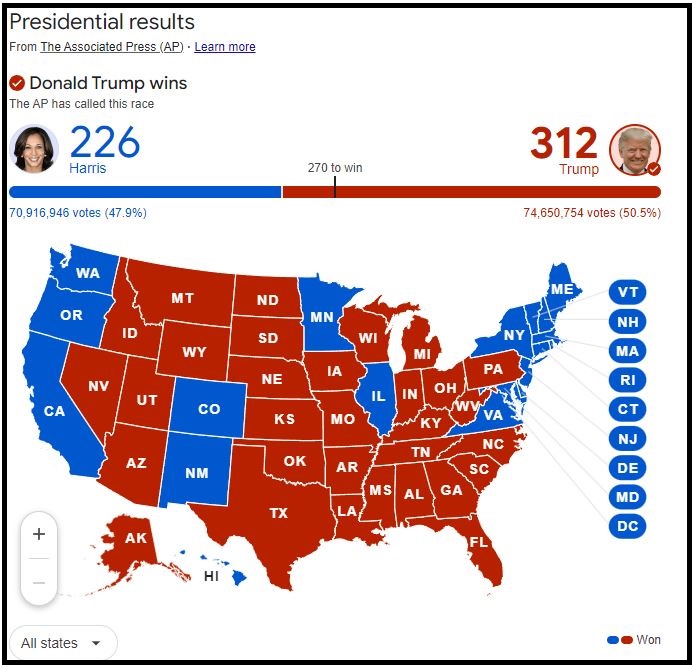

On 5 November 2024, the US presidential election was held, and Trump won a huge victory. The impact on stocks, the USD, and gold, among many other things, was evident. Earlier I had written a few articles on gold, with the most recent being the impact on gold when the Fed finally drops its interest rates. Unfortunately I was wrong on that one and I had to review what went wrong. Gold continued to achieve a new record at $2790.07 after the interest rates adjustment, much to my dismay.

The General Consensus

The general consensus is that no matter who wins the presidential election, the price of gold will continue to go up. If Kamala Harris wins, there will still be regional instability, pushing the gold price higher. If Donald Trump wins, he will continue to print money, and gold will continue to rise against the depreciating USD. This is because gold is generally denominated in USD. In fact, I know that there are Youtubers who mentioned that have loaded up on gold and said that this is a sure-win asset no matter who wins. Now that Donald Trump has won overwhelmingly, the belief that gold will appreciate against the USD is now becoming prevalent as money printing is expected to continue.

Money Printing Has Little Impact

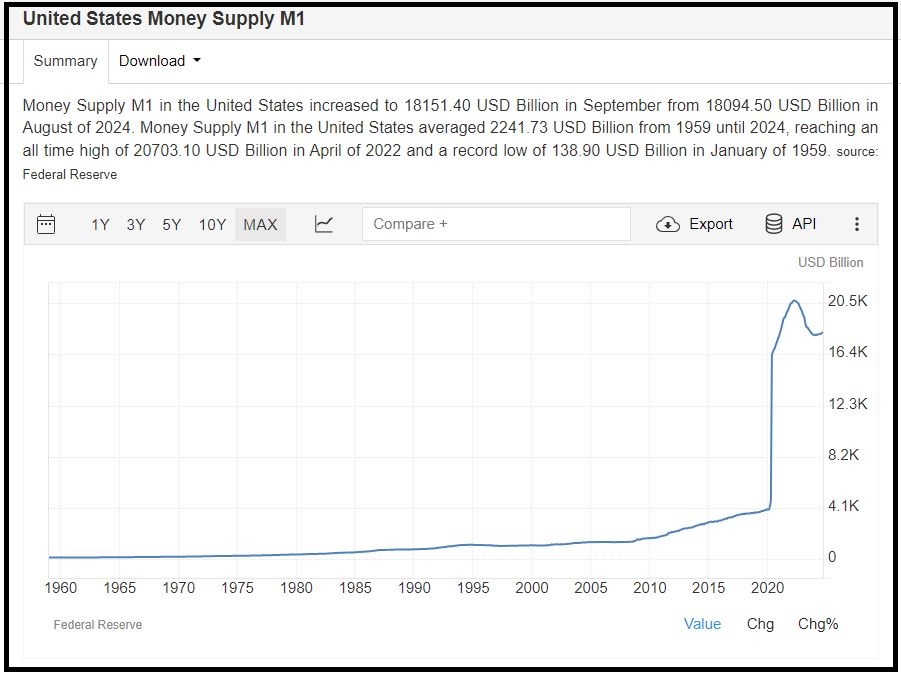

However, while it sounds sensible in logic, will it really come true? We first look at the yearly chart of US money supply and gold prices.

We see that money supply shot up in 2020 due to mass printing, then reached its peak at about 2022 before coming down slightly. Gold on the other hand, while moved up in 2020, was actually quite stable from 2021 to 2023 regardless of money supply. However gold prices shot up in 2024 when money supply has been reduced. This meant that with the exception of 2020, there does not seem to be any correlation between money printing and prices of gold. We think back what happened in 2020.

2020 was when the Covid pandemic took over the world by storm. It is not a surprise that gold prices went up. However in 2020 money printing began, and from 2021 to 2023 the market was in a boom despite the failing economy. Money flowed into the capital markets and gold was relatively stable. In 2024, the regional instability was a concern. Adding to the Russia-Ukraine war, we also have Israel’s conflict with quite a few of their Middle-Eastern neighbours. Even the North-South Korea was having tension. People were feeling the heat.

The Nature Of Gold

Gold is primarily used to guard against uncertainty, and is not really a good investment option. Gold is generally stable, and though it appreciates over time, is generally countered-off by inflation, giving it a very modest gain over time. Where there are better investment opportunities, gold will not be considered. That is why money printing is not the primary factor that will affect gold price. It is how peaceful or turbulent the world is that will affect the prices – which can be affected by pandemics, financial crisis and wars etc.

With Donald Trump winning the election, there is a general positive feel that geopolitical tensions will be resolved quickly, or minimally concrete steps and tangible results should be seen. Even if there cannot be total peace, we can expect the threat level from the different countries to de-escalate. The market has made its assessment following Trump’s win, with gold prices falling about 100 USD per oz on the election results day. Gold bulls will say this is a very short term market volatility, and that such retracement is fairly standard and that gold price will recover soon.

Under Trump’s Time

We can roughly expect this to happen when Trump takes over as President of the US:

- Geopolitical peace – gold price will fall.

- Capital (stock) market boom due to policies favouring companies and lower interest rates – gold price will fall as capital go to other better investment options.

While I expect a big financial crisis soon, when it will come is yet to be determined as it has been proven that it can be artificially manipulated as it had been done so during the Covid period. However, we know that the world will at least be a more stable and peaceful place in the next few years. Trump is a businessman, and peace is necessary for business to flourish, unless of course you are profiteering from war.

Again, gold is primarily used to guard against uncertainty. Where there is peace and better investment options, the capital will flow towards greener pastures such as the stock market. Demand for gold will fall, and prices will drop.

Conclusion

I am holding on to my gold shorts.

Showing 1 - 3 out of 3

Page 1 out of 1

| - | Shop Products | Price | |

|---|---|---|---|

|

|

$99,999.00

|

||

|

|

$1.00

|

||

|

|

Price range: $69.00 through $99.00

|