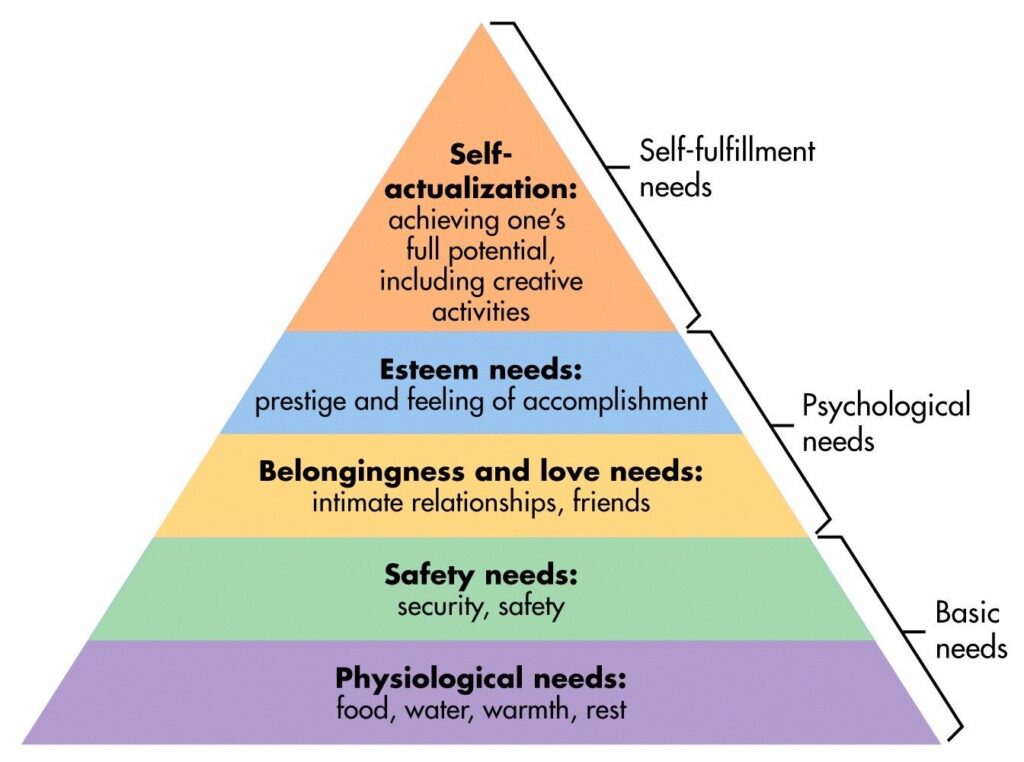

Once people has a certain amount of money they want to use for long term investments, one of the first category of investments they usually think about is property. It is not surprising, seeing how a roof over our head is one of the basic needs. In fact, a roof over our head ranks just above our basic survival needs of food, water, warmth and rest.

Even though in many countries the rental market is the more common mode of housing, but a human’s basic needs for a roof over his head is in-built into his instincts. Only with your own house is there stability. You may have the money to rent a house, but ultimately it is the landlord who decides whether to let you continue renting, how long to let you stay, how much to charge you for rental, etc. Often times, nightmare landlords have caused endless troubles to our lives, simply because their house, their rules. But if you are the owner of your own house, you are the boss. The stability gives people a peace of mind. There is truly a home belonging to me after a day’s tiring work. It is a shelter for me from which I can be cozy in.

Hence it is no wonder that one of the first solid investments is always a house, be it in the financial sense or just simply ‘investing’ in your own security and stability. But in this topic we will assume investment in the financial sense. That being said, I realise that people always restrict themselves to only a type of property – residential property. Basically houses for people to live in. There are a wide range of properties available for investment consideration, that you may find the alternatives actually a more viable option compared to a residential property. We will go through a few different types of properties one may consider for long term investment, but first we will go into detail everyone’s favourite – the residential property.

Residential Properties

The default option almost everyone first considers. Although you can find people willing to rent houses almost everywhere, knowing where and how to choose is also a useful knowledge. Choosing a house for own’s stay and for investment purposes is different. The criteria involved may or may not be the same. For example, if you are buying to stay, then you may prefer a quiet and peaceful area if that suits you. But for investment purposes, we may want to choose a place that has future developments or a place with higher demand. The priority when buying a house for own’s stay may be comfort and personal preference, but for investment purposes, only one thing matters – profits.

For example, if I know that the Government will construct a new train line in that particular area, then I might want to consider the houses in the surrounding patches. From thousands of years ago till today, we learnt that where there are land or water roads, human activity and trading increases. Similarly, when an area is made more accessible by transport, the business for that area will grow. Human traffic will increase. We can therefore expect that the housing and rental prices will go up, from which you can make capital as well as rental gains.

Buying and renting out houses in places where there are higher demands will also make your life easier, although you may wish to take into account housing prices into that as well. Houses near universities have always been in high demand. Not all students live in university hostels, either because they do not like the rules, not enough housing spaces for them or simply because they just want to live outside the university. With all the students in the area, there is no issue with renting out your house to them. Places near working areas such as offices and factories are also the same as people tend to live near their work locations to save on travelling time and cost.

From the above we can gather 2 points. First, before buying a house, check if your local Government has announced any plans for future developments. Critical developments such as building a transport network, schools, factories and stuff are things to take note of. Building a garden or a library is not a development which I will consider when choosing my investment house’s location. If your local Government does not have the practice of announcing such plans, then you may have to observe more, ask around more and try to dig out some ‘insider news’. Secondly, open up the map of the area you are considering and find out where are the areas you should consider – universities, CBDs, business parks and industrial areas. Basically areas with a high density of work or study population. Then compare the rental and resale market of these areas, ie how much does it cost to buy a house and how much you can get from renting it out. By comparing these 2 figures, you can get a better idea of which area’s properties give the most value for money investment.

That being said, there is also no need to be so fixated in residential properties in your own local area / state or country. People in China often buy properties in other provinces / states. I know people who, and have personally done it myself too, bought properties in foreign countries. The homework to be done is more, but it also opens up more opportunities for you to choose from.

Thailand is one of the countries in China’s One Belt One Road initiative, connecting Thailand into China’s grand infrastructure plan of linking many countries by trade. As mentioned earlier, where there are trade routes, there the economy will flourish. As China rises up in the region, so will the countries that follow its lead. Thailand is still a developing nation with much room for growth. Thailand has also been a relatively economically stable country despites its never ending political turmoil, which is surprising to me too.

Secondly, Bangkok is the capital and financial centre of Thailand. The capital and the financial centre of every country must develop first as they represent the political and the financial powers of the country. New opportunities are always in these 2 areas. Being both the capital and financial centre, Bangkok will see major developments, one of which is their public transport train system which they are going to expand massively in Bangkok to resolve the huge traffic jam. On the other hand, I am not consider buying a house in Chiang Mai even though it is much cheaper there, simply because that place is a tourist area and a retirement place. If you are going to do rental in a place which only has tourism and nothing else, then you can only do Airbnb. I would much prefer to find a tenant who lives there for years instead of days. It will be a ton load of trouble trying to find new tenants everyday. I am trying to earn passive income, not active income.

As mentioned earlier, Bangkok has many opportunities and its young people is moving into the city. Every year, more and more young people enter the city to find work, making it a vibrant and active city. Making your choice in a city which grows in population every year is a good move. More companies will be set up, and more expats will also be sent there. It is a good and healthy cycle. This will mean only one thing – capital appreciation and increasing rental income.

But always remember, all the homework done on paper does not beat going down physically to see. I have personally flown down, recced the area and did my homework. From seeing how people live their life, to the area which you are buying, you get a sense of what is going on. True, it does not beat the knowledge one has from staying over there long term, but still a short term recce in the area you are buying is a must, in my opinion.

I have also seen others doing residential properties out of the conventional brick and mortar houses. While holidaying in Switzerland, I stayed in an area where all the houses are built on shipping containers. Shipping container houses have been around for very long, but due to Government regulations not everywhere is allowed to build and install container houses. Yet these type of houses are relatively cheap and are very suited to rent out because of their low purchasing cost. As long as constructed and renovated well, these houses can be very comfortable too. If there is a chance to go into that, you may wish to take a serious look at container houses options. I know people doing up container houses for sale and they really sell well.

Next Article

In the next article we will talk about other types of properties which one can also consider.

Showing 1 - 3 out of 3

Page 1 out of 1

| - | Shop Products | Price | |

|---|---|---|---|

|

|

$99,999.00

|

||

|

|

$1.00

|

||

|

|

Price range: $69.00 through $99.00

|

It’s great that you highlighted the importance of considering factors such as future developments, proximity to universities and work locations, and even opportunities in foreign countries

This is a super informative and thought-provoking post about residential properties. I have always wanted to invest outside of the States, and this blog puts some ideas in my head. Great post!

Your rental property types guide is incredibly informative! It’s a great starting point for anyone exploring real estate investments. The clear explanations and examples make it easy to understand. Can’t wait for Part II!

This was informative, thanks for sharing!

I am glad to find out more about rental properties. This is the type of investment that I would prefer!

This is really nice and informative, what a really great advice you have here! Thanks For sharing

This is a really great and very informative post! Thanks for sharing this with us

What informative information and well-researched. My sister would really be able to use this information and I’m going to send it to her. I’m a renter, she has rental properties.

This is good for some people, but for me I’m more in to owning.

Having rental properties is a great investment. This flow chart has helped me understand things.

I’m more of an “owner” type of person. The only time I rented was when I was right out of college and just starting my first job.

This is some great advice about rental properties. I don’t know much about them!