There has been many articles and memes, complains and frustrations about why our current generation could not save up enough money either for a house or just simply to live decently. The most common one being things become too ridiculously expensive. For example, an average sole breadwinner could buy a house and support the whole family but now it takes 2 people to work their ass off to barely scrape by. Or that $10 could buy a trolley of goods in the supermarket but now it takes $50 to last only for 2 days. Beyond the seemingly exponential increase of cost, let us look at a critical reason why our generation just simply cannot save up a decent pot of money, even for emergency purposes.

Readers may have realise that my posts are not as frequent as the past. Recently I have been very busy with life and working towards the future. As mentioned about 8 months ago, shit happened in life and many of my plans were thrown off. I had to review and re-plan everything, at times taking risk I would not have considered taking. But definitely, I am still moving ahead whenever and wherever I can. I do not know whether it will go well or not in the end, but hopefully it will. I will still write when I can, so do continue to keep a look out every now and then for new posts or subscribe to my Facebook page. Today’s article has lesser substance due to my busy schedule. I will try to go back to more solid writing where possible.

The previous generation spends money on a need-to basis, while our generation spends on a good-to-have basis. Indeed, prices have risen more than proportionately compared to the previous generation. But so do the opportunities and channels to earn money. The previous generations were generally restricted by their physical locations. To take on opportunities elsewhere they would have to move. But with our generation, technology has made everything much easier. E-commerce, internet, mobile phones, etc are things that let us earn money remotely at our convenience – opportunities which the previous generation did not have. Even many of the full time work these days allow you to work from home.

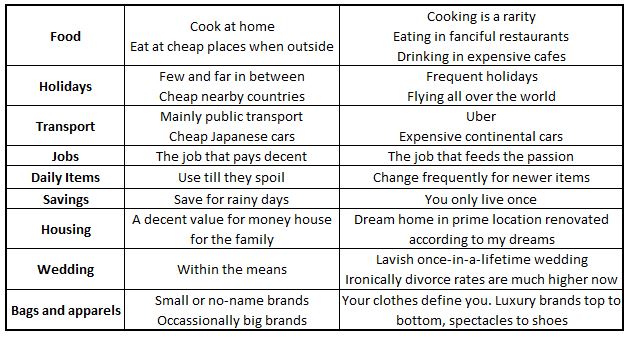

Yet before we complain about not being able to save up money, let us take a hard look at our generation’s spending habits.

If we look at the above chart, one will realise one common difference: that the previous generation are more prudent in their spending, buying what they needed more than what they wanted. Of course, I am not saying every one of the previous generation is like that. Rather, when put on the weighing scale, they are more inclined to be practical while we tend towards enjoying the current moment.

Wealth is earned, not saved. Definitely. You cannot save your way to riches, just like how the Japanese attempts to even till this day but fail. One cannot just depend on the meagre salary and try to save as much as possible. The Japanese are experts at saving money, coming up with a lot of tips and tactics to do so. However with only one breadwinner in the family bringing in perhaps about $5000 a month, the best one can do without eating, drinking or paying bills is still $5000 less taxes.

But without a decent saving habit, no matter how much you earn, you will end up with nothing at the end of the day. I used to have a friend who was earning $10,000 a month in her 20s, but only managed to save $500. Her spending includes expensive dinners, various entertainment, luxury bags, frequent holiday trips etc. And this is the exact issue our generation is facing now, regardless of whether one earns $10,000 or $3,000 a month. I have seen $3,000 earners buying $7 Starbucks coffee when there are cheaper $1 options elsewhere. $5,000 earners queuing and crowding in seemingly ‘high-end’ restaurants, when in actual fact the really rich will go to exclusive and very expensive restaurants where each dish cost $500. Unfortunately, the really rich will not crowd and queue together with peasants, but will dine in a quiet and peaceful place with exceptional service.

As much as we may be unwilling to admit, we have got to face the fact that for many of us, our spending habits are simply different in the sense that we are not willing to sacrifice current comfort for future security. Whether we deserve the luxury or not is another separate matter, but just like the marshmallow experiment, this generation is like the child who refused to wait 15 minutes for the second marshmallow, opting to eat one right there right now.

Showing 1 - 3 out of 3

Page 1 out of 1

| - | Shop Products | Price | |

|---|---|---|---|

|

|

$99,999.00

|

||

|

|

$1.00

|

||

|

|

Price range: $69.00 through $99.00

|