Despite the different types of property available, the residential property market is the favourite among the masses for those looking to enter the rental game. Previously I had touched on the non-financial considerations when buying a house as well as an introduction into the residential property market. Before you read this article, it will be good to read these 2 articles first as this current article builds on their foundations.

The residential property market is so attractive to the masses because firstly it is within their scope of knowledge. Most would have researched and/or experienced first-hand how different factors such as location, distance to amenities, orientation of house etc affect daily living and commuting. Secondly, it is something which has a relatively inelastic demand, ie demand for residential properties is strong as shelter is a basic need. Thirdly, this sector is in a comfortable zone in both the acquiring cost as well as the rental yield. Offices cost too much and carparks yield too little in terms of amount, graveyards are too off the norm and industrial warehouse are in totally unchartered territory for many. Hence, despite the options available, the masses remain fixated on living spaces. And today, we will dive deeper into this all-time favourite property type.

As usual, I will scope this in the context of Singapore, but the logic applies wherever you are. For Singapore readers, I get the fact that there is the Aditional Buyer’s Stamp Duty for second property onwards, one HDB (public) flat per couple, maximum of 6 occupiers per property etc, but that is a very specific topic which I can answer in the comments if necessary.

Be Willing To Crunch The Numbers

Many people do not like to go too deep into the math. But all you need is basic math and a willingness to find out what are the relevant numbers. If you are going into the rental market, then in a way this is a business. Just as a REIT (real estate investment trust) holds many income-generating properties, you are going into a 1-property business. Get the numbers wrong and you may burn to death. In this series, we will go through the different numbers that you may need to work out.

Understanding Your Target Population

We have a limited budget. Often times, our budget limits the type of property we can buy. Whether it is the higher-end penthouse or the lower-end 2-bedroom apartment, each of these properties have a different target tenant group. You may be buying a high-end penthouse firstly for capital appreciation and secondly for rental income, then in that case your target group may be rich expats from overseas, failing which you can still let your penthouse collect dust for the capital appreciation. However since my readers are probably the average masses, I will assume that it will already take a lot of effort to squeeze out the downpayment for the second property or a big-enough house to rent out rooms while one is staying inside.

So if your house is the middle or lower end type, then chances are your target population are foreigners who come from overseas, or people from another state (if your country is big enough). The Western context may be slighly different too as many are kicked out of their house when they hit 18. Whatever it is, your target population are probably the ones who go for value-for-money rental. In Singapore’s context, most of the landlords will rent out to foreigners, whether they are here as a white-collared professional or a blue-collared labourer.

Once we have decided on a target population, we will then be able to choose a general area to buy our house.

Choosing The Correct General Area

Every individual is different, so while there is no definite correct area for everyone’s situation, we can generally choose a more ideal area which fits our unique circumstance. Do note that an ideal rental property is often times not an ideal property for one’s own stay. So do not fall into the trap of choosing a property which you like but which is more difficult to rent out.

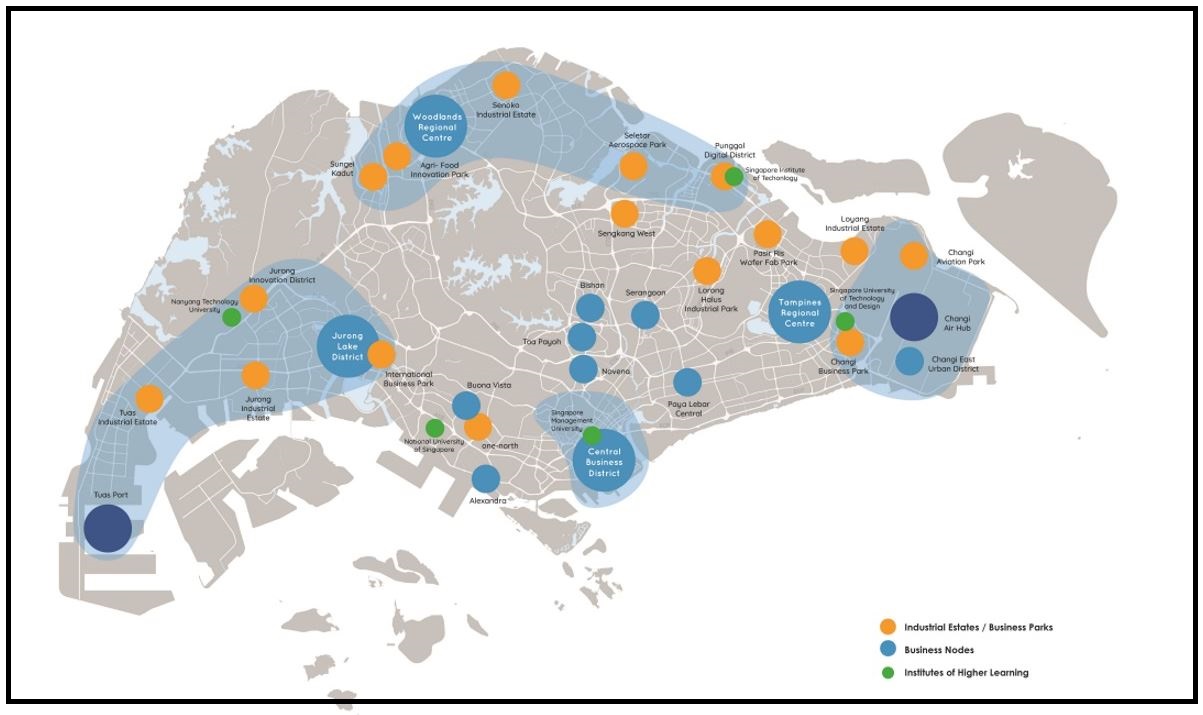

In Singapore, the Urban Redevelopment Authority (URA) which is in charge of city planning, draws out the zones for land use. Be it for industrial, offices, residential, farms etc, every property usage has been carefully planned and put into zones. University students and foreign workers (be it white or blue collared workers) are the ones who need to rent the most. Demand from the local citizenship pool is weak, at least in the Singapore context. With that, we should narrow down our feasible areas to regions which has institutes of higher educations, industrial parks, office areas and perhaps even hospitals. These are the places in Singapore with the highest demand for rental.

Look at your map, or your city planning agency’s zoning.

The above map is taken from URA’s website, specifically highlighting places which are of concern to us. Naturally, areas which contain as many nodes as possible are preferable because we want to have a broader tenant base. From this map I will look out for the following areas: North, West and East, either inside the blue zoning area or somewhere very near it. Central and South have too few nodes, and even if the node is big (eg CBD), prices are too expensive in these areas. At this juncture you should also roughly know the prices for the general regions in your map. There is no need to go too deep into the exact price range, but rather a rough concept of below average, average, higher than average prices will do.

Now that I have highlighted 3 areas, my own knowledge tells me that the East region is too overpriced. I take that out and focus on either the North or the West.

Just as a side note, many people have the common mistake of sticking to their familiar regions. For example, many people will say: ‘I grew up in the East region, so I prefer to stay in the East’. You can make this kind of emotional decision if you are buying a house for your own stay, but if you are going into the rental market, scrap this idea from your head. Be logical, move if you have to. Humans adapt faster than you think. There should be no emotions in any business decision.

Choosing The Correct Specific Area In The Region

Now that we have narrowed down to 2 general regions which we can consider, we can further drill down to the specific locations within the regions. Housing near public transport sell and rent well, simply because it is convenient. It is unlikely that a foreign worker or university student who has to rent a house will have a car in expensive Singapore. Public transport will probably be their main mode of transportation. Choose a place near a train line. Trains are generally preferred to buses because trains are faster and consistent in speed, predictable in timing and unaffected by traffic jams.

The above shows the train map of Singapore. At this point we should focus on areas near train stations, where the train stations are either in or very close to the zoning areas we have identified. As long as it is near the train station, people are generally fine with it. People are more willing to sit for 10 more minutes in the train to a general area slightly further away than to walk for 10 more minutes to their house.

Find out roughly the pricing of houses at each of your targeted train stations. Ideally walking time from the train station to the house should not be above 10 minutes. This time you will have to dig deeper and find out the range for the property type and size you want to have. For additional information, train stations which are also intersections between 2 train lines are worth more, simply because it is easier to get to more places and there is a higher human traffic.

Mini Conclusion

Today we manage to filter down to the rough locations we want to buy our house in. That is a very important step. Many people choose an area out of their own preference without doing much research, and end up either paying too much or unable to get suitable tenants easily. Get this ‘big picture’ wrong and you may find out that it will cost you greatly.

In the next article, we will go into some numbers such as cost and the number of years to breakeven, and perhaps the layout of the house if there is sufficient time. Else, I will do a part 3 for this series.

Showing 1 - 2 out of 2

Page 1 out of 1

| - | Resources | Price | |

|---|---|---|---|

|

|

$5.00

|

||

|

|

$1.00

|