In life there are a few big ticket items we have to pay for should we want to live a decent life. Education to ensure we are knowledgeable and skilled for better employability and higher salaries. Housing, so that we have a place to call home and the foundation of our family building. Medical, so that we do not die unnecessarily young and of course so that we can live to a ripe old age.

These 3 things are the items we spend most of our money on. The system is also designed in such a way that it will drain all our resources dry at the end of it, so that we and our descendants remain poor. The typical adult has to pay for their children’s education, their own housing and their parents’ medical bills. Yet the typical middle age adult, especially in Asia, is always at risk of being replaced by younger and cheaper labour. Even if they manage to hold on to their job, bosses know their financial stresses and hence do not often treat them well.

As commoners trying hard to level up financially, what can we do?

Education

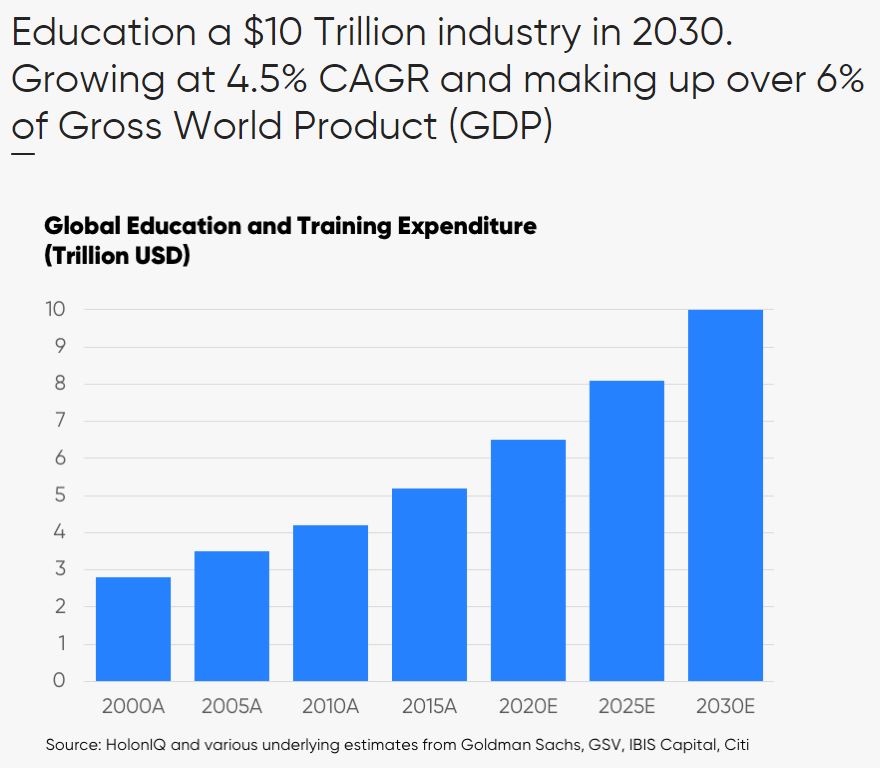

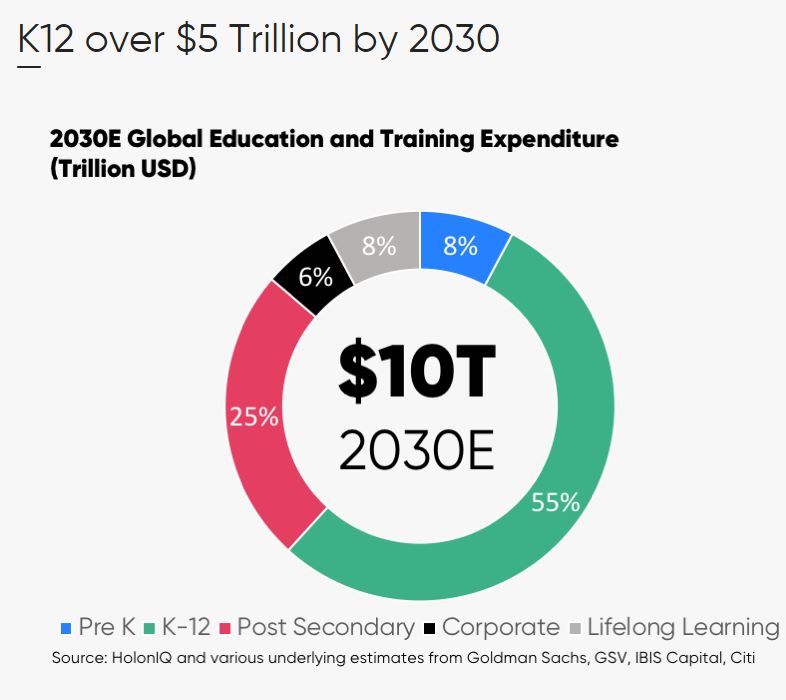

Education, a basic foundation for all modern society to train up a skilled labour workforce, and especially important for the individual if they want to climb up in this superficially self-proclaimed meritocratic world. That is why the Ivy League universities are much sought after and why people pay big monies to go in. From the commoners to the rich, people spend all they can, just to ensure that their children get good grades. Classes in the day school is not enough, private tuition is necessary. This is especially so in competitive Asia and such has become the new standard.

Yet private tuition can be an unnecessary cost. For as long as possible, teach your children yourself. Most of us are educated up to a certain level. Primary school work is definitely within our grasp, and secondary school levels are mostly within our understanding despite being out of touch. Anything above and the children should be independent enough to problem solve on their own. Schools are a training ground for society, where adults face many difficulties by themselves. As we spend time guiding our young children, we also train them to gradually problem solve and be independent. In the primary and secondary levels, I often see parents simply throwing money to private tutors when they could have just spent time teaching the children themselves. To me, this is simply a lazy act. Education is also not only limited to academics, but also critical thinking, problem solving, networking etc. Many of us do not remember the academics of what we learn in school, much less apply it in our daily work. Spend more time with your children, and impart not only academic knowledge but also life experience and practical skills to them. As long as they have a decent level of academic knowledge to get through the schools, all the non-academic portions they have learnt will prove far more useful than what they think.

Housing

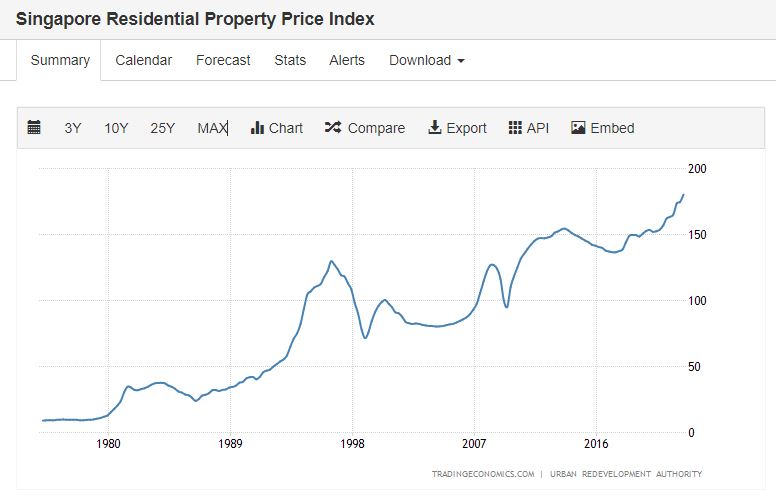

Housing, one of the basic needs of society. Yet houses these days are very expensive. In the US, the credit system is designed so if your credit score is not up to a certain level, you will not be able to get a housing loan down, despite being able to pay for the exact same amount for your monthly rental. What this essentially means is that you have to fork out the same amount of money every month, but does not have a single shred of asset added under your name. But let us assume now that we have a good credit score which allows us to take a housing loan, which to be honest is also not that difficult. Yet despite this, the price of housing has risen significantly over the years, making people trapped in a debt for the next 25 to 30 years of their lives.

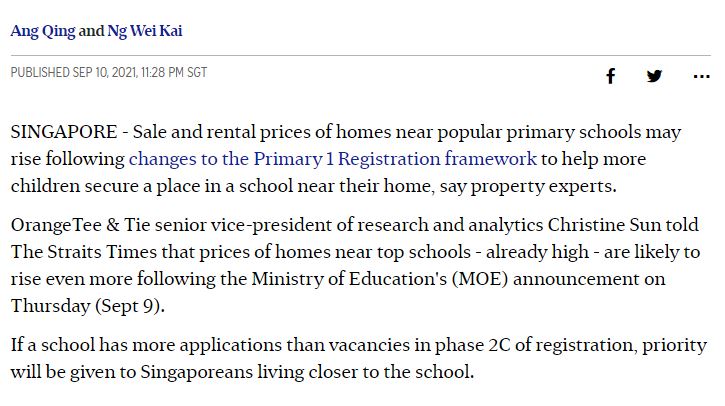

To add fuel to fire, in many countries houses near popular schools are in hot demand. That is because many primary schools prioritise 2 categories of new students – students whose parents graduate from their school and students who live near the school. This results in houses around popular schools to rise up in prices.

To prevent unnecessary financial burden, we do not buy expensive houses, be it fanciful big houses or an apartment unit in a good location, which cost significantly higher than a similar house in a not-so-good location. A location just 20 or 30 minute bus or train ride away from the city centre will give you a much cheaper but still decent house. You can use the extra money to pay for the deposit of a second house to rent it out, earning you passive income. Even if you do not do that, the amount of money saved would place you in a far lesser financial burden.

Not only that, many first time homeowners like to do a big renovation on their house. They wanted a nice beautiful cozy home, and in the process spent a lot of money hiring an interior designer and buying expensive materials for a total makeover. While I can understand this feeling, it places unnecessary burden on your finances. Renovation can be kept simple. A fresh coat of paint, a clean and organised house as well as new furnitures can make the house a very decent looking and comfortable one to live in.

Note: HDB (Housing Development Board) flats in Singapore’s context basically means public housing flats. The lease is 99 years and 75% of Singaporeans stay in HDB flats.

As for parents who are concerned about their children not getting into a good primary school, spend more effort and time with your children instead. The path of education is very long, and real competition often starts from secondary school onwards.

Medical

Medical affects people from all ages, but let us just assume for now it affects the elderly only. When people get old, all the health problems come out as the body starts to deteriorate till the day it eventually meet its end. Yet hospital bills are often expensive, and medicines also burns another hole in the whole family’s bank accounts. Take this medicine or die. When young, people often showed a defiant attitude towards death, neglecting their body or doing dangerous stunts. But when faced with the actual possibility of death, people often lose all reason, sacrificing everything including their children’s future just to live another day.

Minimally get a hospitalisation insurance for yourself and all your family members. If you have siblings, share the cost for the hospital plans of your parents together. The total cost of being sick can be generally defined as cost of hospitalisation and treatment + cost of medication + cost due to inability to work. The elderly are generally retired, so the last factor is taken out. For the younger people, it is good to start multiple sources of income early so that you still have income coming in at all times.

Hospitalisation insurance gets more expensive as you get older, but even so, it is still much more worth it compared to the hospital bill. Do not think that you can save up the money and buy the hospital insurance only when you are old. Insurance companies are not stupid. They will reject your application if you are too old. Furthermore, once you are down with a significant illness, it will be excluded in your hospital insurance if they even allowed your application to go through, such that in the future this particular illness which you already have will not be covered. Buy it when you are young. The cost is cheap and you have reserved for yourself and family a spot in which the insurance company will cover for every single illness you have.

Cost of medication is often expensive. Eat it or die. That is why pharmaceutical companies earn so much profit. On paper the reason is they spent a lot of money and time on research, that is why their final products are expensive. But it also does not change the fact that there is an oligopoly in that sector and medicines are an inelastic demand. Furthermore, hospitals are not a charitiable organisation. They are also driven by profits. Administrators push for expensive medication to be bought, and doctors are also under pressure as well as their own benefits to recommend expensive medications even if there are cheaper alternatives available.

Just as a side note, if you ever wonder why doctors and nurses are always overworked, think of the hospital sector as a business and not as a public good. The patients are customers, the healthcare is the service, the doctors and nurses are the workers and the medicine are the additional products tied to the healthcare service. By cutting manpower and making all existing workers take the job burden of more than 1 person, the hospital business is able to save on manpower cost. Profits are earned by driving up revenue (expensive healthcare service and expensive medicine) and pushing down the cost (manpower salaries).

There are 2 ways to avoid the expensive medication the doctors unnecessarily propose to you. First, act as poor as you can, and the doctors who believe you are poor will recommend you cheaper alternatives. Naturally this option entails staying in the lowest tiered hospital rooms and maybe suffer some snubs from a few doctors or nurses who have no respect for peasants. The second option is to buy medicine from India. India is a well-known pirated medicine producer. It cannot copy 100% of the branded medicines, but it can change just 1% of it and mass produce at a far cheaper price. With this alternative route, much cost can be saved on medicine. Of course, I take no responsibility for this recommendation. Do it at your own risk. What I can say is many people take this option.

But I recommend the above because this is what I did. I already have multiple sources of both active and passive income, bought the full coverage hospitalisation insurance early on and have already found sources for India’s medicine import.

Conclusion

By controlling these 3 basic needs in the society, followed by a system designed to drain away all your resources, the society is able to ensure that all of the labour force remain obedient for the sake of supporting their family. After working hard for their entire lives, they pass on without leaving much behind for their descendants, while carrying a false hope that their children would have a better future than them. Do what we can on our end, so that we can get the financial freedom we want, or at least leave something tangible for our descendants.

Showing 1 - 3 out of 3

Page 1 out of 1

| - | Shop Products | Price | |

|---|---|---|---|

|

|

$99,999.00

|

||

|

|

$1.00

|

||

|

|

Price range: $69.00 through $99.00

|