Holding power is the ability to hold on to your investments without selling them, and it can greatly impact your investments. Holding power is affected by a few things – amount of borrowed money (leverage) you put in it, how much of it is your disposable income, how mentally and emotionally resilient you are to withstand the fluctuations and lastly the length of your investment period.

Investments need not be in the financial markets such as stocks, crypto, forex, options, etc. It can also be other things such as properties or even physical products such as graphic cards.

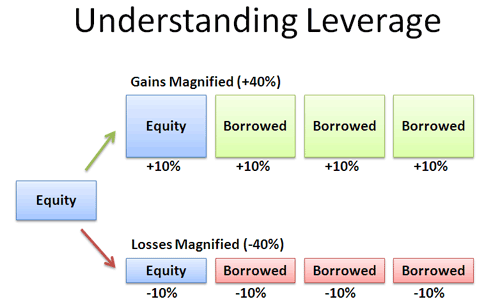

Leverage

The higher you leverage, the lesser your holding power. Assuming today Apple’s stock is $1000, and you only have $1000. If you use only what you have, then you can only buy 1 Apple share. But if you borrow money and leverage 10x, you can buy 10 Apple shares. When Apple shares rises to $1100, you will earn $100 x 10 = $1000. With $1000, you earned another $1000. But the converse is also true. When the share price drops to $900, you will have lost everything.

In such a situation, you will have limited holding power. With a 10x leverage, you can only tolerate a maximum of 10% fall in prices. With 20x leverage, you can only tolerate a maximum of 5%. I have seen people playing 100x leverage on crypto currencies in a high risk high reward fast gamble. Even if we do not talk about the very volatile crypto currency, it is very common for the more stable big company shares in the stock markets to fluctuate more than 10%. To prevent your portfolio from being liquidated, you will have to pump in more money. But what if you cannot do so, or even after you injected more funds the shares continue to drop? You will realise that you are unable to hold on to your portfolio and be faced with the inevitable of being forced to close your trade (liquidation).

The big monies know this, hence this is a game they always play. The manipulators would do a sudden short or sudden pump to weed out the people who go long or short on leverage, squeezing them out and after that the particular share would go back to the same price. Assuming that you did your homework and determined that Apple shares are worth $1200. You went in with 10x leverage at $1000. However the markets do not always go in one direction. Whether it goes up or down, it always fluctuate in prices. If this Apple share dropped from $1000 to $900, then went back up to $1200, you would have been correct in your price prediction in terms of end result, but you would also have been squeezed out at the $900 mark.

In the picture below we see the real Apple shares for the period from June 2022 to July 2022. At June it was trading at about 150 USD per share, falling to the lowest of 129 USD per share, a 14% decrease followed by a climb back up the original level. On the longer time period, there are many instances of such fluctuations happening. Imagine you went in at 150 USD per share at 10x leverage, you would have crashed out when it dropped in prices and lost everything, even though just a few days later it went back to its original price level.

The end result would place you correct in your price prediction but also make you a loser. That is because with the leverage system, you do not have sufficient holding power to see your portfolio through good times and bad.

Your Disposable Income

If we buy from the spot market, we would have a much greater holding power. We assume again Apple shares are $1000 each, you have $100,000 and you bought 100 Apple shares. Now, whether the Apple shares drop to $900 or even $200 per share, you could also hold on to your portfolio without any need to inject more funds. You have fully paid for your Apple shares, and you can just safely hold on to them while waiting for your price target. The downside to this safer way is that you earn much lesser than the one playing leverage. High risk high reward, low risk low reward is a standard rule for everyone.

However this time $100,000 is all that you have. You have emptied your bank account for this portfolio and is living from paycheck to paycheck for your daily needs. You are now in a typical situation also known as asset rich, cash poor. Your risk now do not come from the shocks of the financial market or whatever it is that you are investing, but from your life.

Let us assume you are suddenly down with a situation which requires you to use a significant sum of money, say $50,000. It can be an unfortunate thing such as a family member falling seriously ill or a happy situation such as finding true love and wanting to buy a house for your family building purposes. Now the Apple shares you bought at $1000 per share has fallen to $900 and has stagnated for some time with no indication as to when it will go back up. You are forced to sell part of your portfolio at a loss to pay for the medical bills or to fund your marriage. It will be a double whammy on an unfortunate incident or a dampener on a happy one.

Consider the possibility of once again after you sold part of your portfolio at $900, it shot up to $1200. This can very well happen. Often times we do not know when a stock would drop or shoot up suddenly. Your price prediction is still correct. This time you would have earned much lesser or just breakeven, depending on how much of your portfolio you still hold. In an unlucky event where you have to clear out most of your portfolio, the end result will still be you lost money despite correctly predicting the price.

Your holding power in this case has also proven to be weak.

Your Mental And Emotional Resilience

You have now learnt your lesson from the previous 2 experiences. You do not leverage, and you put only half of your savings in your investments. This time you buy 50 Apple shares at $1000, totalling $50,000. You are now safe from any shocks of the stock market and external events from your life.

This time the factor which could influence your trade is yourself. Many people make the mistake of not sticking to their original plan. You see Apple shares rose up to $1050 in just a week, and you think you have earned a good $50 x 50 shares = $2500. You know that the market fluctuates, and you decided to be smart and sell off at $1050 at 5% profit, taking the $2500 with the intention of buying back at $1000. Afterall 5% a week is 52 x 5% = 260% return on investment in a year. Maybe you managed to do this for 1 time or a few times and feel confident, then suddenly Apple shares rose to $1500. You lost the big money while chasing for the small money.

Or maybe your Apple shares dropped from $1000 to $900, then to $800 and after that to $700. At $700 you saw no hope and determined that your homework was wrong. Although you definitely still have the holding power, you could not bear to see your shares decline in value over time. You think that it will fall further and so you cut loss and took out the money, planning to go back in at a much lower price. Maybe you managed to do it successfully, but chances are you will not.

Most investors or traders do not have much mental or emotional resilience to stick through their plan. Everybody knows in theory that we plan our trades beforehand and stick to it no matter what happens, but when the actual reality happens, many of us fail to follow through, opting instead to act on our emotions. If you do not have a good plan or a high enough resilience, your holding power is also weak. You will sell on small profits or on bigger losses, missing out the main growth.

This is why for the common people, their biggest investment earnings usually comes from their residential properties, ie houses. They bought a house, and for good or for bad they keep it and continually paid for the home loan. They do not sell on small profits or big losses because that is the house they were staying in. Over a long period of 10 or 20 years, the houses had seen big fluctuations and finally emerged at a far higher price than before. The act of holding it and riding through the waves paid off big in the end.

Do note that borrowing money for a house is also an act of using leverage. Though the property market is generally stable and prices generally go up, it does suffer big crashes and crisis like how the China property bubble just burst, leaving thousands stranded without a house.

Length of Trade Or Investment Period

Every investment should have an investment period. Some of them are short, some of them perhaps for as long as the company exists. We now assume that instead of the financial market, you invest in actual products instead – graphic cards for example. Graphic cards have been all the rage in the recent years. High end graphic cards which were originally used for PC gaming were bought in bulk and installed in crypto mines, driving up the demand and prices. Naturally, some saw the opportunity and began to invest in graphic cards, buying them in bulk and reselling them. Such an act could be called business, but in this case could also overlap with investment, because people buy expecting them to go up in prices, much like how we play the stock market.

However, one has to take note that technological products such as graphic cards have a very short valuable period. Every few months a better graphic card is produced, each a better version than the last. Your investment window is only for that few months, after which the value of your holdings will drop. As you near the end of your investment window, your holding power will drop drastically.

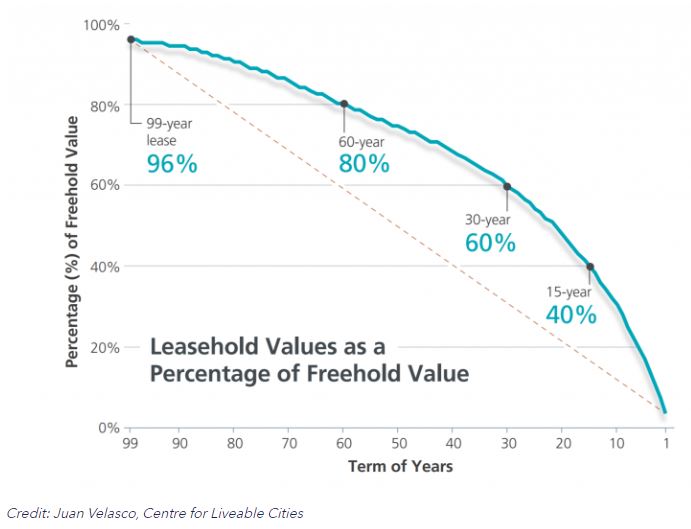

We not only can apply this to graphic cards, but also other products and even properties. Many properties have a 99 year lease period. While the lease is still long, it is still easily tradable. However, once the remaining lease drops to 70 years, it will shave off a significant portion of the value. As the lease continues to get shorter and shorter, the value of your property will get lesser and lesser.

Conclusion

When investing, do know well what you are investing in and determine your holding power. The stronger your holding power, the safer you are, and the more chances for things to flip around even if there are bad events affecting your portfolio. But do take note this applies for good investments. For bad investments, such as putting all your money in the crypto-currency shitcoin LUNA, you can wait 10,000 years and still see no comeback from the pits.

Investing is not gambling. We may not be professionals, but with sufficient homework, we can still earn a decent sum of money from it if we can follow the basics of investment.

Showing 1 - 2 out of 2

Page 1 out of 1

| - | Resources | Price | |

|---|---|---|---|

|

|

$5.00

|

||

|

|

$1.00

|