An average human in a country not ravaged by famine or war has about 80 years to live, of which the first 20 years should be spent growing up and learning to be independent and the last 20 are spent doing things you like. That gives you the middle 40 years to work, save and grow your wealth to meet all your financial needs till the day you go back to the earth, be it 60, 80 or 100 years old.

Yet, our earning power is not a constant throughout our working years, nor is it a slow upward graph. It usually is a curve, where it peaks when you are around 40 and slowly drops till you are totally out of the workforce. In short, your earning power should look something like this:

We would like to think we have the trajectory of the red arrow, up till the end. Unfortunately the reality different. Ours is perhaps more like the blue line in the curve. Yet along our lives, our expenditure will increase – housing, cars, children (more so if you are Asian), holidays etc. The list does not end. Throw in insurance and the out of nowhere hospitalisation bill, and you will find yourself spending more than what you expected.

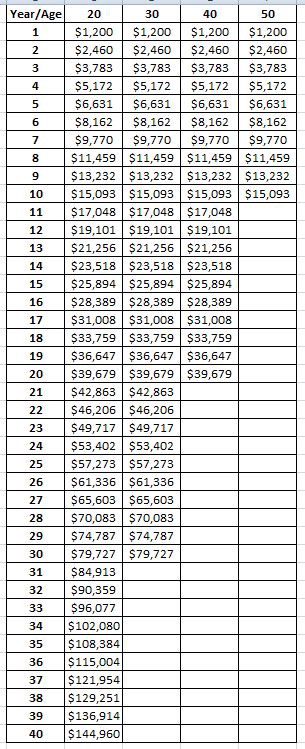

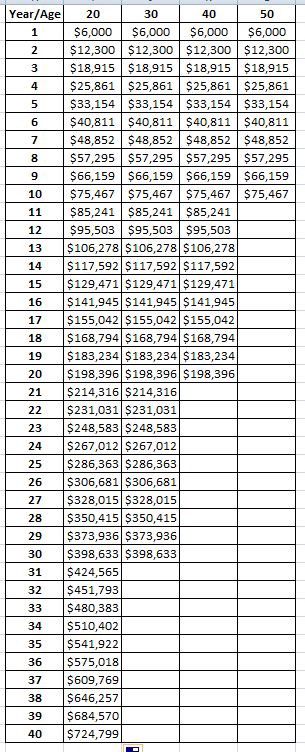

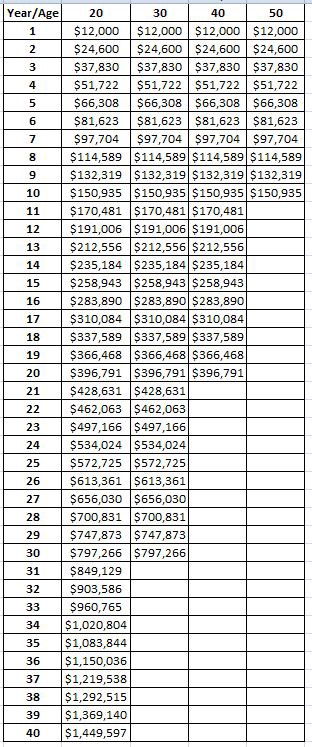

Rome is not built in a day. Neither does financial freedom. That being said, a little contribution each day to your own retirement fund does goes a long way. Let us look at a simple example:

The 3 graphs show a simple example where one puts in only $100, $500 and $1000 every month into his or her savings, which translates to $1200, $6000 and $12000 a year. We assume a simple interests of 5% compounded yearly, and the savings will stop at 60, our expected retirement age where we stop bringing in income. We can see that the big difference from starting just 10 years later.

You may say: But I have a pile of student debt! I have a house to pay, kids to feed, parents to take care of!

Yes I do agree with that. Life is not easy. Everyday when we wake up there are bills to pay. We will come to that another day. But for the purpose of this post, you will need to agree that financial planning, or at least saving money, starts from as young as possible. If you are unable to save $1000, then save $500 a month. If not, then $100 a month. It has to start somewhere, no matter how little. Build the habit first, get into the routine. Take the first step and you will find ways to continue the journey.