Now that you have saved up a portion of your money, your next step will definitely be growing your money. At this stage most people will tell you that passive income is the way to go, letting your money work for you even when you are sleeping. Even if you are doing very well in your job or your business, setting up a passive income will only add to your snowball of wealth, so why not?

While active income is about trading your time and energy for money (jobs, businesses), passive income allows you not to spend too much effort and time on it. Basically, earning money without doing anything much after everything is set up. Note that not doing anything much does not mean not putting in any effort at all. It just means that the source of income can auto-run by itself after the initial set up and the occasional maintenance.

But! Passive income is not the only way to grow more money with your existing money. There are a few ways to go about it, and passive income is but one of the many ways, which all of us should still aim for.

Passive Income

One of the more common forms of having a passive income is buying a property and renting it out. There are different types of properties which we may consider, from residential units to industrial warehouses, from farmlands to carparks. Do not restrict yourself to only residential properties but explore different types and choose what that suits your needs and constraints. Yes you do need to put in effort to research for a good house to buy and get it rented out, but once all that is done you only need to occasionally maintain it to make sure all goes well. As long as the tenant do not call you up everyday over stupid things, you should be able to enjoy rental income every month without much effort put in. As you already have known by now, you need a certain amount of savings to get started on this. There is a barrier of entry which, while involved certain level of difficulties, is still achievable. Many of the common people have been able to do it.

One of the recent trending ways of earning side income is to put in crypto savings. While crypto currency such as Bitcoin has made the news for some time and everyone would have heard of it, the take up rate is still actually very low. Crypto currency holders are still in the very small minority, and many are wary of it despite it being out there for so many years. While there are definitely some risks in it, as long as we manage it well, we can make good use of it. For example, you are unable to stomach the volatility of crypto currencies, having pumped up 20% yesterday and then dumped 50% today. That is perfectly understandable. Crypto trading is not for most people, but crypto savings may be a good deal. With the more conservative form of crypto savings, you are able to earn 10% interest rates per year (accurate as at today) by putting stablecoins such as USDT or USDC inside. I will write more on crypto savings at a later time, but for now one can take the value of stablecoins to be 1 USDC = 1 USDT = 1 USD, which is fairly stable since these types of crypto currencies are pegged to the USD, meaning in all probability you will not wake up a millionaire tomorrow nor get your savings wiped out. By putting your stablecoins in platforms such as Celsius, Hodlnaut or Crypto.com, these platforms act just a little bit like the banks we know, where we put our money with them and they give us interests. In very simplified terms, you can take it as putting the crypto version of USD into crypto savings and earning the high interest. Should you wish to take out your savings another day, your 1 USDT will still be able to cash out to 1 USD tomorrow. Do take note that crypto currencies do comes with certain risks which you will need to take note of. But then even Lehman Brothers collapsed, sinking a whole bunch of investors with them.

Some people buy blue chip stocks and keep them till forever with no intention to sell unless something significant happened, earning dividends every year. As with every purchase, you will need to do homework, review it periodically then sit back while waiting for the dividends to come in every year. The idea for these blue chip stocks is that their prices are generally consistent in the long run, or slowly increase in value over the years. They are not like penny stocks which earn you big bucks fast (you might as well play crypto if you play penny stocks), but rather the main rewards for investing in these blue chips are the dividends. While this may be true for many of the older generations, recent markets manipulation made me doubt that even blue chip stocks will hold as well as it should.

There are many different ways of having passive income, with many of them a different variation from the above. From renting out properties to putting your money in crypto savings or various foreign currencies fixed deposits, from buying blue chip stocks for their dividends to buying REITs (Real Estate Investment Trusts) for their frequent payouts, one need not stick to the common methods of passive income. Look at yourself, what you can do, your resources and your situation, to see if there are other forms of passive income that you may be able to do.

Investments and Trading

In very simple terms, investments are long term and trading are for the short term. In this case I am specifically talking about the financial markets, such as the crypto market, stock market, etc. For both, you will still need to do your research, although the things to look out for may be very different. Investments are sort of like a passive income – you do your homework, you do up a plan, you buy, you maintain. Short term fluctuations which include pumps and dumps are of no concern to you. For trading, I feel that it is more like active income. You need to continually look at the markets and react accordingly. But for both, the more money you put in, the higher your rewards. As mentioned in the second article of this series, even with the same return of 4% per year, 2 people putting in different amounts of money will get different sums of money in absolute terms. Do note that investments and trading do come with risks. There is no guarantee that you will succeed. You may even lose your money.

That being said, I am not discouraging people to not touch the financial markets. You may have noticed that throughout my articles, I have been encouraging people to learn and get experience about the markets early if this is their cup of tea. For example, you need not only start when you have $50000 in the bank. Even if you have $500 in the bank, you can still start trading and/or investing. Of course, the money you are going to earn with $500 is not going to amount much, so do not expect to achieve financial freedom with only $500. We are not in the movies. But as you are in the initial stages earning and accumulating your money, you can use the $500 to invest and trade, of course with the intention of earning money, but with the main purpose of learning and gaining experience. With your actual hard earned money inside, you will experience a range of emotions as you see what happened to the markets at different times, and get a sensing of how your behaviour, decisions, emotions and actions are like. You will be able to reflect and review what you have done wrong, how it can be better and what to look out for. In fact, you will even gain an understanding as to whether this option is viable for you or not. If it is, hopefully by the time your pot of savings have grown to a sizable amount, you will have learn much and be in a much better position to invest and/or trade. There is no 100% success. Even Warren Buffet fails at times. But what you are aiming is for higher win rates and lower lose rates. As long as your win rates are more than your lose rates, then you will be in a better position than before.

Increasing Purchasing Power

What I meant by this is not the amount of luxury or useless items or services you can buy in your life, but with higher purchasing power, you can often times get things cheaper when in bulk. How often do we see a good deal which we cannot afford, passing up a good opportunity.

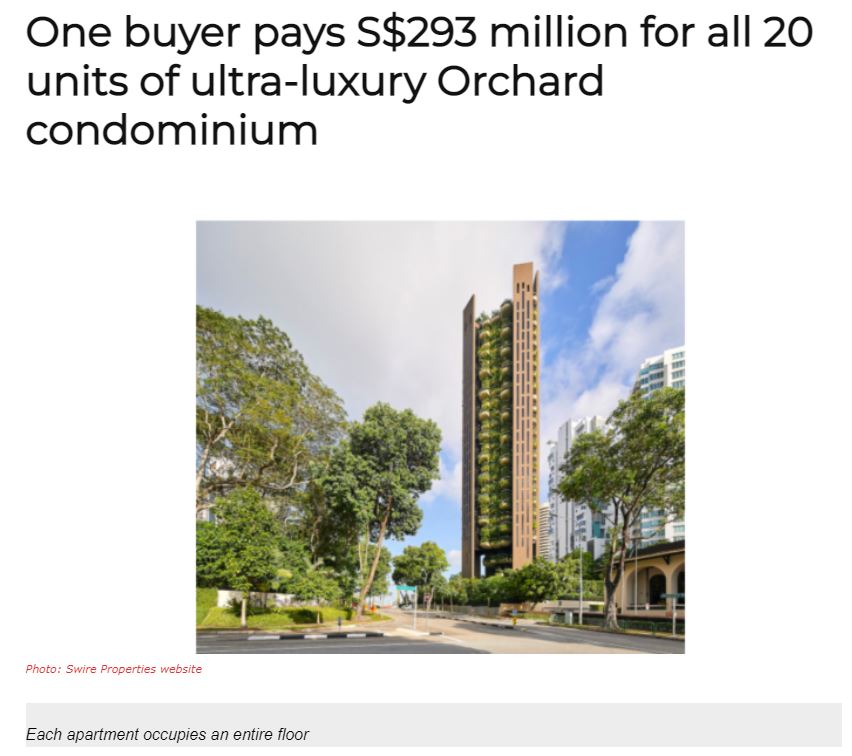

For example, in this news article we can see that one single buyer purchased all 20 units of an ultra-luxury condominium in Singapore.

In the process he got himself a 20% discount.

There are of course many more of such activities across the world, not only in Singapore but also in the US and everywhere else. Of course, few of us would have the capability to buy 20 condominium units at one go. But in times of crisis, I have seen sales which went ‘Buy 2 condo units and get the third one free!’. This is not a joke. When we lower the condition for bulk purchase to only 2 units, then a lot more of us will be able to afford it. That being said, despite this, the majority of the common people is still unable to afford even one unit, much less 2. You will also see bank auctions of properties by previous owners who could no longer pay the mortgage, which you can get at heavily discounted prices at times. During times like this we can only see with open eyes what we know is a good investment opportunity but has no capability to make use of it. This, is the importance of having a high level of purchasing power backed by your income and your savings.

Of course, I can bring it down another level closer to the common people, such as talking about discounted items at supermarkets and how if you do not have money you are unable to capitalise on the discounts. But since this blog is talking about financial freedom, we shall set our targets higher, such as the above example of buying condominium units. There are of course other examples, such as auctions like what I mentioned above. Auctions can be organised by banks selling properties of people defaulting on payment, by big pawn shop organisations selling pawned items which the customers did not redeem, by all sorts of other companies and sometimes even government organisations. The items ranged from properties to jewellery, from cars to wine etc. Each of these items can be bought cheaply (though not at all times), allowing you to have a bargain, which can either help you save money if you are buying for your own use, or to earn money if you resell them.

Businesses

We all know that to grow a business, we need money. While I did say that dropshipping is a low cost minimal risk venture, scaling it up will require more capital. From hiring a professional website designer to upgrade your self-created starter’s website to renting a warehouse to keep inventory, levelling up will require more capital. To achieve economies of scale, you will need to bulk buy items and have a more efficient system. Your funds have to flow, and you need turnover capital. That is why even big corporations borrow money from the banks. But I do not recommend you to go that far. Afterall, there are risks in businesses. I still recommend starting from small and minimal cost if you can help it, such as building your own basic website, then only pump in the extra money once your business slowly gets better, spending only what you have. The more we grow our business, the more money we need. Hence if you find that one day your business is doing well and intends to grow it, you will find the savings you have will come in handy. Rather than borrowing and paying interests, spending what you have is a safer way to do things. While there are some who will say there are good and bad debts, I have already explained this in my post on leverages, so I will not go into that again.

Conclusion

There are many ways to grow your money, ie making use of your money to earn even more money. Some of which are passive income, some of which are active income. There is no need to constraint yourself to the thinking that growing money with money has to be passive income. While one should still work for passive income, it is also important to look at your resources and your situation to determine how you can grow your money most effectively and efficiently. To do that, you need to earn well and save well. With more resources on hand, you can grab hold of more opportunities. It would definitely be a regret if there are opportunities right in front of us yet we are unable to make use of it. Opportunities do not come by often, and we want to be prepared when the time comes.

Showing 1 - 3 out of 3

Page 1 out of 1

| - | Shop Products | Price | |

|---|---|---|---|

|

|

$99,999.00

|

||

|

|

$1.00

|

||

|

|

Price range: $69.00 through $99.00

|