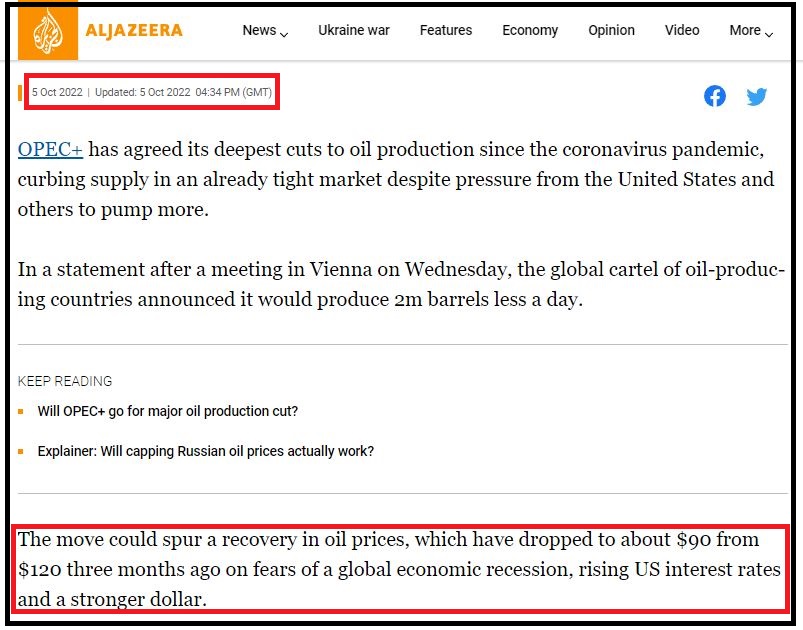

The Fed mentioned that they will clamp down on inflation by raising interest rates. Inflation originally caused by them mass printing money. From an original dovish tone, the Fed had turned increasingly hawkish. In this year alone they have raised the interest rates 5 times so far, from 0.25% to 3.25%. We still have 1 more rate hike to go for 2022, and an unknown number of hikes in 2023. The Fed had made it clear: that they will clamp down on inflation even if it makes the economy suffer for a short while.

This article is longer than usual, so it may take some time to read.

To recap, the textbooks told us if interest rates go up, the cost of borrowing increases. Businesses, the stock market, the property market etc will suffer as people borrow lesser to spend and invest due to increasing cost. It is more worthwhile to save rather than spend, resulting in a drop in the demand for goods and services, leading to a drop in prices. What this also means is that employment rate will drop as the various sectors simply do not need that much labour for production anymore as demand falls.

But this is the textbook version. Textbook theories are often far from reality. The above can only be effective if the country is a closed or weak economy. For a country as big as the US in this globalised world, the exact opposite can happen. Throwing out a textbook explanation to the masses only serves to confuse them and to reap them off as much as possible.

In my first article on this, I mentioned that the other countries respond by first increasing their own interest rates too and secondly to dump US treasuries in order to make the yield high. This will increase the cost of US trying to collect back and consolidate their capital, beef up the countries’ foreign reserves and stabilise or even appreciate their own currencies.

Economic warfare is like physical war. Strategy is important, but at times in the face of overwhelming force, all strategies are rendered useless. This is like the same in the movies that we see. If I launch a punch at you, you may be able to block it. What I need to do is to throw out so many punches that you will not be able to block them all, or I hit you until your defence crumbles.

When the US raised their interest rates, China and Japan threw out US treasuries. The US will just keep on increasing their interest rates until one side cannot keep up. But just raising interest rates is no longer enough to pull in all the funds with so many countries trying to block such a move. There must be another pressing reason for the big monies to do so. If there is no pressing reason, create one. Just because one can win a fight does not mean it comes at no cost. Everyone is trying to find a more effective and efficient method to win.

War is a big thing for the countries directly involved. A war with one of the big powers is a very serious thing for many other countries, with immediate impact on the continent itself and secondary impact for countries further away. A world war is a life and death matter for most countries around the world. What is involved is not only the physical fighting, but also political struggles, economic warfare, diplomacy and foreign affairs are at full drive, media and propaganda are all out going against each other and of course many other sectors are also involved. When this happens, people are naturally scared. Those who sacrifice a big portion of their lives to earn their money, or those who risk their heads to get the obscenely huge wealth will first seek to protect their money. Whether it was Switzerland in World War II or the US today, people will move their monies to safe places.

That is why the Russian-Ukraine war cannot stop. From Russia’s special military operation in certain regions to an all out fight in Ukraine to the threat of nuclear weapons, we have seen even in Western media that Russia has been trying to de-escalate the situation and return to normalcy. But for some reason things just keep on escalating as Ukraine for some reason gets an endless supply of weapons.

So now we have the following situation:

- US continues to raise interest rates while the rest of the world coincidentally gets more and more chaotic.

- Monies will flow into safe havens such as the US.

- US exchange rates go up in view of higher demand.

- Other countries forced to sell off their foreign currency and US treasuries to maintain their currency strength or to let it die.

- More money flows into the US in view of the high interest rates, high bond yields and potentially higher exchange rate.

- The inflow of money caused inflation within US to go higher.

- US now has more excuses to raise interest rates even higher.

- Cycle repeats.

So by some genius strategy, we have a ridiculous situation where US bulldozed its way through and managed to create a cycle where the more monies flow into the US, the higher the inflation, the greater the justification to increase interest rates. This is why despite increasing interest rates so much, not only did inflation not go down, unemployment went down instead, signalling a small boost in the economy when it is supposed to have the opposite effect.

So, if this works, then why don’t the other countries copy what the US do? There are 2 immediate reasons one can think of.

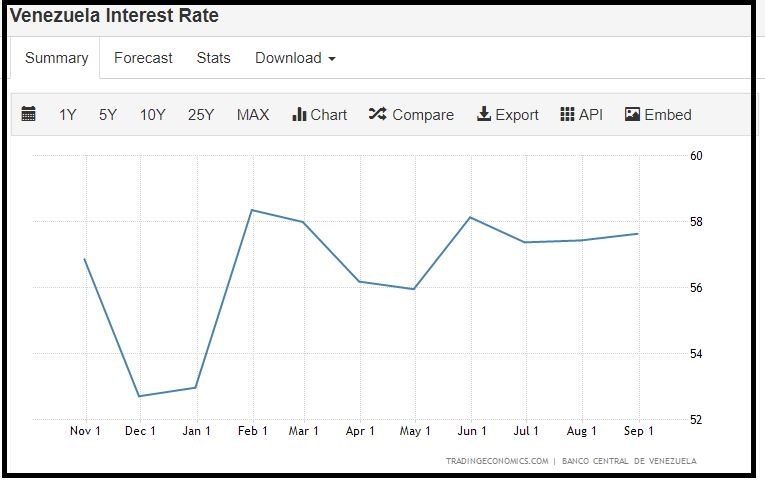

First, credibility issues. Not every country is credible in the eyes of others. Long term credibility in a country’s stability, financial strength, repayment ability and even the ability to survive a potential war well are all factors to be considered. The credibility issue alone determined that most countries cannot go along this route. 57% interest per annum, anyone interested?

Second, an interest rate that high also means that the cost of amassing all the monies is high. Will the US be able to pay off that huge amount of interest incurred? Money is worth borrowing if it can generate for you an even higher return. Currently, the US must be able to earn more than 3.25% per year for all the money depositors all around the world put with them. And the interest rate is set to get higher. Properties are crashing, the stock market is falling, the crypto market is too small and also dying. How can the US make effective use of the money?

The US is certainly making money from wars, from selling high-priced gas to Europe etc, but they can already do that on their own without the need to borrow from others. To put the money into effective use, they have to accumulate enough to go on a shopping spree when assets all around the world crash. Basically, the money they borrowed would have to help them earn more than what they could have done on their own.

Now if you are a leader on the opposite side of US, what options do you have?

- Rot till all the foreign funds they put in are liquidated.

- Buying of each other’s core assets

- Create a situation where they are unable to use the money they have borrowed and sink from the weight of all the repayment.

Rot Till You Are Liquidated

Turkey chose option 1. The whole world is plastered with media reports on how Turkey hit record inflations and how life is grim for the people. Yes it is indeed very difficult for the poor citizens temporarily. Unfortunately the common people are only considered as statistics and necessary sacrifices in the eyes of the politicians. If sacrificing 10 could save 100, the 10 would be sent to their death without hesitation and remorse. The trolley problem was never an issue in the first place.

Back to the topic, foreign funds have been coming in into Turkey to buy their assets under the name of offering them a helping hand to stand back up. However, after keeping the foreign funds, Turkey did not give them the easy way out. Instead it chose to rot and sink itself further, trapping all the foreign funds injected into it. The more these foreign funds want to catch Turkey’s assets at a low, the more Turkey showed them how much lower it is capable of going. In this way, Turkey is increasing its foreign exchange reserves while all these big monies who think they can make a killing all get trapped and liquidated.

Turkey is now behaving like that shit stock which keeps on falling every time investors tried to catch it at its low and ended up being forced to constantly average down to the point everyone lost faith or are liquidated.

Buying Your Assets Before As You Buy Mine

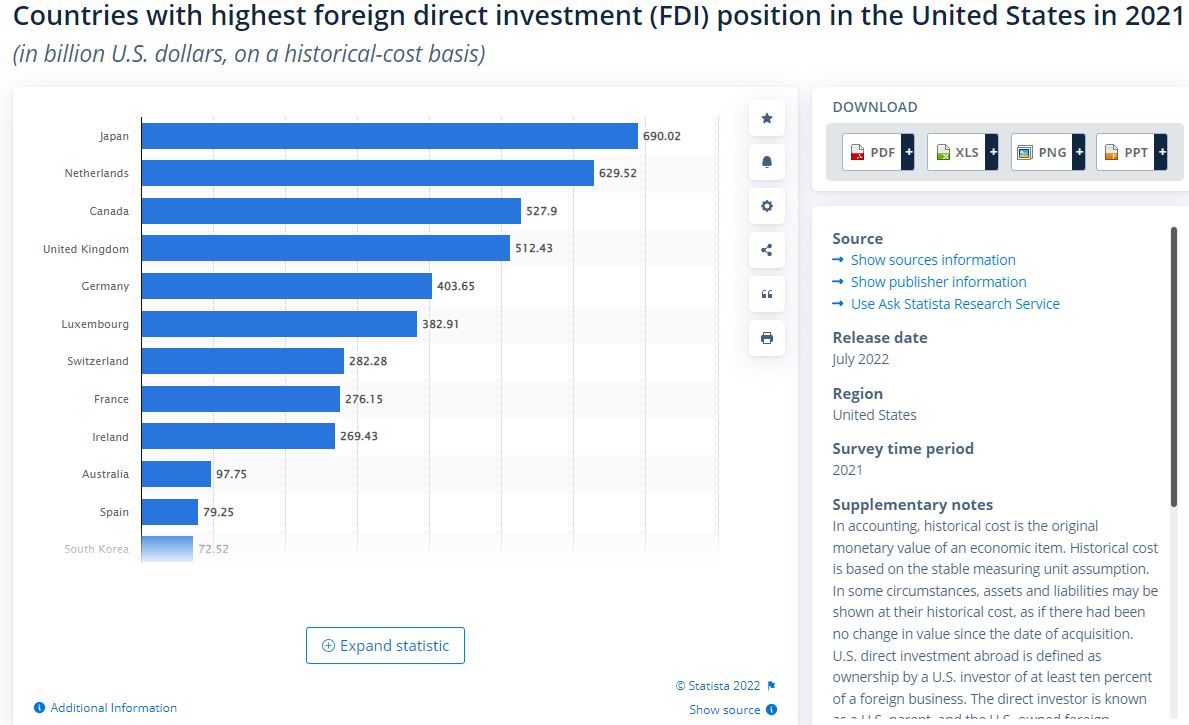

Japan chose the second option. If you can buy my assets, I can also do the same to you. Japan is like the long term safe investor in the stock market who just kept on buying in when he got money regardless of time and season, holding on to the stocks no matter what since there is only one way up in the long term. In fact, at 690 billion USD, Japan is US’ biggest source of foreign direct investment (FDI). According to Japan’s Ministry of Finance, US made up 40.5% of their FDI while China took up only 6.5%.

Interestingly as a side note, Singapore took the third spot at 10.6% behind UK’s 20.6%, proof of the confidence which the small country gives to the world. If you compare country size or GDP volume and the amount of FDI Japan puts in Singapore, it actually makes Singapore quite an impressive country.

We remember again that when US tried to increase interest rates, Japan dumped US treasuries along with China and made the US spent more effort in trying to get the capital flowing in. With lesser money at higher cost, US is also in a less advantageous position to acquire assets. From the results we know the impact is not that great. Despite dumping treasuries, Japanese Yen and Chinese RMB had been falling against the USD.

Japan’s case is unique, in the sense that the US is controlling Japan, as can be seen with all their military bases within Japan. By putting much money in the US, it serves as a double function – to show US their submission to them and also to let US know that if Japan dies, the US will be affected. Japan is the goose that lays golden eggs for the US. Japan is weak because it is not allowed to stand up on its own militarily, hence its struggle can only be a half-hearted one. It is a puppet. But it is a puppet which hopes to stand up on its own one day, but that is another topic for another article.

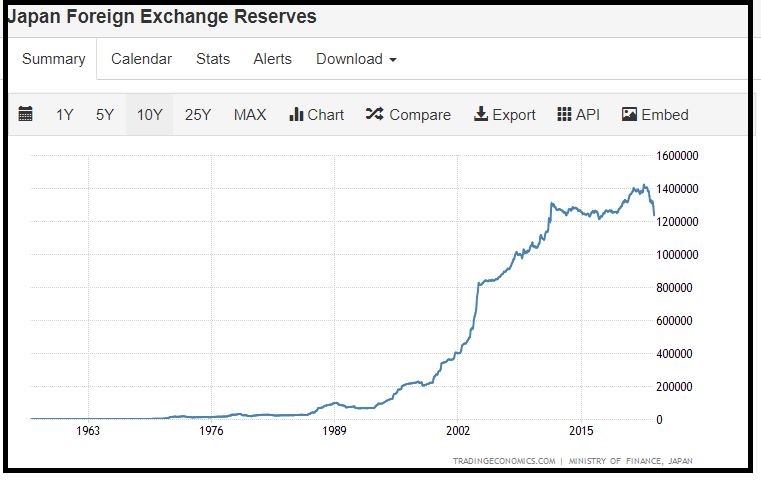

While the falling Yen is proof of its weakness, to me Japan had also considered that and made use of it as best as it could. The USD and SGD (Singapore Dollar) had been appreciating greatly against the JPY, hence the value of the bulk of its FDI is actually safe. Furthermore, rather than selling off foreign reserves to protect its own currency as Thailand did in 1997, Japan chose to face the inevitable head on and preserve their foreign reserves for future use. Similarly like Turkey, both of them are waiting for the right time to make a comeback with all that foreign reserves standing by and ready to be deployed any time.

Japan is definitely not as strong as what it would like to be. But through a series of smart moves, it did what it could in a handicap match in order to survive at the current and to prepare sufficient ammunition for the future.

Blocking Your Investments

Not every country outright block foreign funds from entering the country. However, by interfering with certain circumstances, one could achieve one’s objective in an indirect way. In this case we talk about the intention for US not being able to use its extra funds properly. The Russia-Ukraine war affects not only both the countries, but the whole of Europe as a whole. Russia wants to end the war quickly and peacefully but is unable to do so. Who is the biggest winner in the whole Russia-Ukraine war? China.

China wishes for Russia to win the war, but only by a slim margin. The longer the war drags on, the more Russia is dependent on China, the more concessions it has to give, such as access to central Asia to build their train lines as well as cheaper oil prices, among other benefits. China is also actively learning from the lessons of Russia so that one day it can be used on Taiwan. All these we know. But by sending in critical resources at critical times, Russia is able to continue fighting despite the weight of US and NATO on Ukraine’s side.

We now narrow down our scope. If we focus on economy alone, the whole of Europe sinks together in the war. Funds flowed out of Europe, investments gets halted, inflation is at unbearable levels etc all because of US stirring trouble up constantly. Take gas for example, while the US benefits greatly from selling insanely high gas prices to Europe, it comes at a cost of losing Europe as a critical ally. Just a gentle reminder here that NATO is made up of 28 European countries + US and Canada. NATO without US can still function very well, although it should already be disbanded after the collapse of Soviet Union. That being said, Europe also has its share of questionable decision making to answer for.

Although the media all over the world accuses Russia of bombing Nord Stream, common sense told us that Russia needs the gas pipe to hold Europe hostage. If Russia can just turn off the tap on its end, why would it need to bomb the pipe? Bombing the pipe is like killing the hostage. Who controls the world’s media and who in this case wins the most from the pipe bombing?

Note that I say China is the biggest winner in the war, not the US. This is taking into account the short and long term benefits. While US certainly wins in the short term at the expense of Europe, it had once again told the world that US will only turn around and betray its own allies for its own benefits. Once the other countries realised that, see how fast they react.

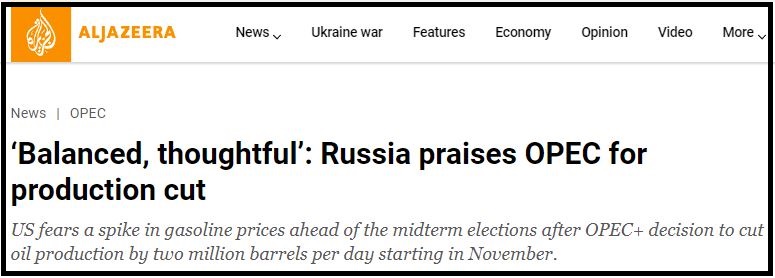

We now stand in US’ shoes. With so much money, they need to find a market big enough to fully capitalise on their resources. South America and Africa is out for obvious reasons. Europe as a whole is dying from US’ betrayal and no funds in their right mind will enter when they do not know whether it will live or die. Middle East is also turning against the US. China and US relationship is open for all to see. What we have left are a few countries which may be safe for investments, such as Singapore, but generally these countries are too small for the US. The US wants Russia to lose so they can safely go into Europe and Russia, but some mysterious force in the East will give Russia the critical support at the critical time.

With all those monies US is holding, one of the side quest is to let US crumble from the weight of its high interest rates. Since I cannot stop you from amassing all the funds worldwide, I will make it so that you cannot use it.

Conclusion

One thing many people are mistaken is that political decisions are made with a single objective and it has to achieve the goal. The truth is that any high level political decisions are made with multiple objectives in mind. Some of these objectives can only be seen as a side achievement alongside the main quest. These side quests’ objective may be to deal a critical blow, to hamper the advance of the enemy, to deceive the enemy, to trap the enemy etc. In fact, these side quests may even be given low priorities where it is good to but not need to succeed. Afterall, countries need to take into consideration the resources put in. Like humans, countries sometimes also fail in their attempts to achieve a certain objective even when they make it their main quest and try their hardest. Like humans, sometimes they have to do what they can in their current state, which may or may not yield good results.

As each country gets more and more wary of the US, as they see US swallow their own allies, slowly but surely, like the cycle which descends on all empires and dynasties way before us, the clock is counting down. That being said, the timeline of an empire is much longer than the lifespan of a human.

Showing 1 - 2 out of 2

Page 1 out of 1

| - | Resources | Price | |

|---|---|---|---|

|

|

$5.00

|

||

|

|

$1.00

|