This week has been a slow boring week. I did not manage to open a new grid as I did not see any suitable opportunities for me to do so. Prices for GBP/USD were more or less stagnant, and EUR/CHF and CAD/CHF has been rising for the past few days. While I intend to go long for these pairs, the current situation is not suitable for a grid strategy. Buying slightly bigger lots to aim for the appreciation will be slightly riskier as any downturn will mean that I am jammed. I have 2 older traders I am unable to clear because of this.

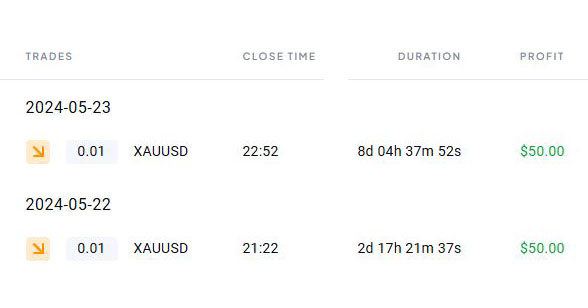

Fortunately, I have 2 other grids operating – my normal operating XAU/USD grid and my test XAG/USD grid. While the XAG grid did not manage to close any trades, the XAU grid closed 2 trades with a total profit of 100 USD.

While there is nothing much to update in terms of my weekly trades and investments, I bring to my readers today another gift pack – the CFTC Commitment of Traders analysis report. Previously I had written an article on the movement of the big monies on the market and put up a sample report. The big monies are what we would want to monitor because these are the ‘invisible hands’ which reap and fleece off the masses. From this week onwards, I will publish the latest report every week while updating my trading portfolio. So do check back regularly. My trading portfolio series can be accessed from my website’s home page > Trading Portfolio, or simply the Portfolio category.

Download this week’s CFTC Commitment of Traders (big monies) analysis here.

Do note that the financial markets are volatile and unpredictable. The above report is only another set of tools to help with our analysis, and by no means is a 100% indicator as to what will follow. It should be used together with other necessary research which a trader or investor should do.