In the world of the financial markets, there have been many so-called experts proclaiming and predicting a bunch of things. From Youtubers to legit analysts from well-known banks, there are numerous analysis from the stock market to the forex market, from the crypto market to the commodities market. Yet if one were to look at it, half of the analysis were given on hindsight. Whenever there is an event, these people will always try to stick an explanation to it, even if it is ridiculous.

To give an example, when the Fed raised its interest rates by 50 basis points (0.5%) instead of the expected 75 basis points in early May, the market rallied. An illogical outcome, yet this was what was explained.

The news article explained this result as the market being confident that the Fed has opted for a soft approach rather than a more aggressive one in clamping down inflation, giving the market an assurance that all is well. For background, higher interest rates generally means that the stock market will not do so well. With lower interest rates, people can borrow money to spend and invest, boosting the economy and the stock market. But if we are to look at more immediate results, we can say that when interest rates are low, people can borrow money cheaply to invest in the stock market, which gives a higher rate of return. When interest rates are high, the cost of borrowing increases, and people borrow lesser to trade in the financial markets. Hence it did not make sense that just because the Fed increased the rates by 0.5% instead of 0.75%, the market would rally.

This is the same as me telling you that I will slap you 3 times. But when the time comes, I slapped you 2 times instead of 3. When I did that, you actually felt happy because I slapped you 1 time lesser. But no, this is not a logical action. You should still feel pain and anger. It is the same for the stock market. If interest rate goes up, the stock market should fall. Results later told us that just after one day, the market realised its mistake and dropped to a lower point, as can be seen in the S&P 500 chart below.

On the other hand, we see experts making absurd price predictions.

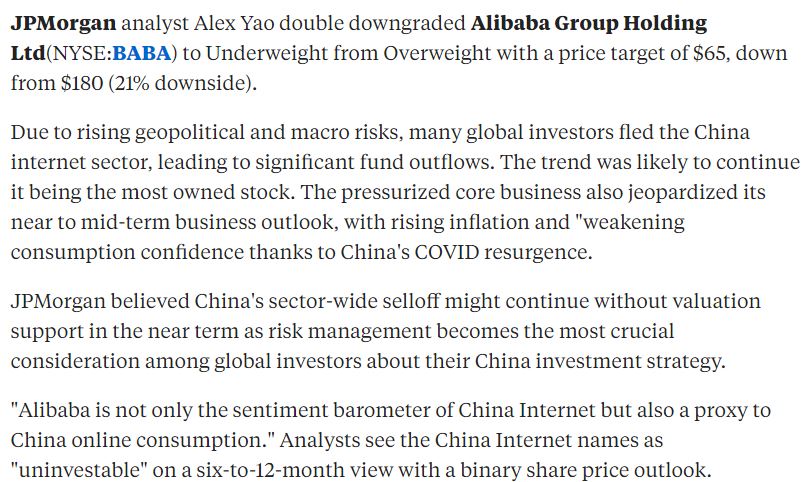

This is what happened to Alibaba’s share price.

For context, Alibaba’s IPO (Initial Public Offering) price was $68.

Let us see why is JP Morgan’s rating unreasonable and what are the actions behind it. In September 2014, Alibaba offered its shares at $68 for its IPO. Nearly 8 years later, after accounting for inflation and Alibaba’s expansion over the years, JP Morgan actually downgraded its rating and gave it a value of $65, lower than its IPO price. It even called Alibaba and other China tech stocks ‘uninvestable’ for the next 6 to 12 months. Now I am not pro-China, but with logic and common sense, we can see that such a rating is simply nonsense.

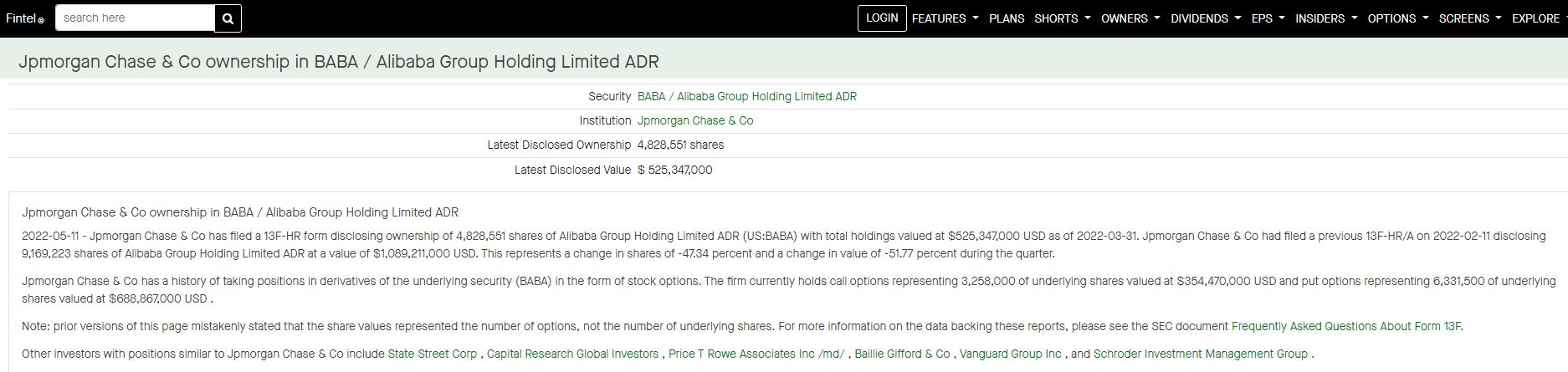

Just 2 months after its original ‘uninvestable’ call, it flipped and upgraded its rating of the tech stocks, saying it is time to buy.

When retail investors like us manipulate the market, it is against the law. Yet at the same time, double standards are applied when it comes to the big corporations. It has been known that for the longest time, market manipulation is a right given to the privilege few – the few who has the money or the power. By revising the market rating downwards, these corporations create panic selling and drive down the price, and at the same time they sweep up the shares at a very low price. Then they revise the rating upwards.

But what do the banks and financial institutions tell you to do? Invest with them, slowly and steadily, and with the power of compound interests, you will earn a decent sum of money 30 years later. While I believe in compounding interests and the benefits it brings, it is clear that the short and quick way of earning money is only reserved for a chosen few, while the rest of us have to slog our guts out slowly over the years, reaping the benefits of our labour and patience when we are already one foot into the grave.

And they ask us to believe in these so-called experts, who draws the salary from these big corporations. Will these analysts and experts speak for your benefit, or for their bosses’ benefits? Do not believe blindly. Everyone has an agenda. Nothing is free in this world, especially advices or opportunities that are supposed to help you earn money quick.

From the above we can draw 2 conclusions. The first being that the market is irrational. Market behaves in nonsensical ways all the time, without logic but with raw emotions. The second is that the market is heavily manipulated. Retail investors like us often lose out simply because we do not have the necessary information or the power to move billions of dollars. Elon Musk’s words are powerful partly because he has somewhat of a cult following, but more so because he controls billions of dollars. He alone is sufficient to move markets. We do not have information like the big banks, which employ teams of professional analysts and has a network of information coming in. We do not have the power to move markets with the $1000 in our bank accounts.

Given the above, what can we do? What should we do?

I would like to offer 2 potential solutions.

The first solution is to buy and hold. The market is irrational over the short term, but it generally has to follow the rules of the economics over the longer term. Many of us would like to think we can do quick trades and capitalise on the fluctuations. Chances are we are not and we lose money doing that. Research the stock well, buy it at a good price and hold it long term. Do not bother about the short term gains or losses. Hold it well and not touch it unless something very significant happens. Over the long term, a good stock should go up. This is also a good way to negate the market manipulation by the big corporations. Afterall, such market manipulation only works for the big monies in the short term, reaping off the impatient noobs. As to what is a good price and when is a good time to buy, that is another article altogether. Anyway I am also a noob trying to be a lesser noob.

The second option would be to invest in the funds of the big monies. If you cannot beat them, join them. Afterall they also have a reputation to maintain, and it is in their interests for their funds to perform well over the long run. This is because when you invest with them, they will charge a small annual management fee. The more you put with them, the more their funds can utilise the money to move markets, the more they can collect in terms of fees, and the more their standing increases. However, there is a slight pitfall in this method, causing me to not like this option. The traditional way to buy these funds is to go through the financial advisors of the big banks, who in order to earn more commissions, often promote the idea of portfolio rebalancing. While portfolio rebalancing is definitely needed every now and then, financial advisors keep promoting it because they can earn money from that. Every regular period interval, usually yearly, they will contact you to review your portfolio, come up with some excuses to rebalance and update your portfolio to keep up with the latest market changes and have you change some of your fund holdings. When you do so, there will be another round of fees that they charge you. In the end, you do not really earn as much as you should. If it is me, I will buy the funds of these big corporations direct without the need of going to the financial advisors. Nowadays there are many platforms around which offers a wide range of funds for you to buy.

Whatever you do, it is important for us to know what is going on. Politics, economics, current affairs and a good grasp of general knowledge so we can make good decisions. That is why learning never stops. The rules are not in favour of us, and if we are to play their game, we have to learn how to survive it well. If not, you might even be better off putting money in the bank and losing to inflation. At least you are losing slower than the big corporations reaping off you.