Continuing from the first article, where we talked about choosing the right locations, today we will deal with the hated numbers. Numbers are important because first it determines the risk we are taking, second the time to breakeven and thirdly our future profits. Numbers should not only involve the cost of the house itself, but also the mortgage loan, the maintenance fee (especially so if your property is a condominium), taxes, stamp duties or additional buyer’s stamp duty (if applicable), renovation and any other potential costs. Again, this article focuses on earning rental yield. Profiting from capital appreciation is another topic altogether and the considerations may be quite different.

Purchase Price Of House

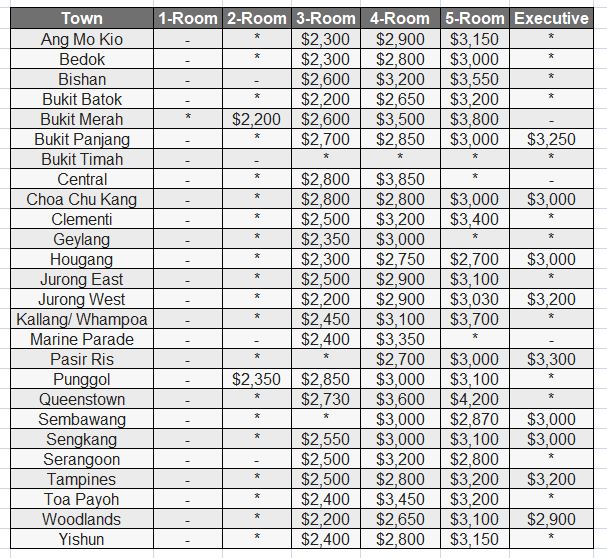

In any business, the basic idea is to minimise cost and maximise revenue. In this case, the biggest cost is the house itself, and the revenue is the rental yield. Hence we will need to pull out the necessary data in order for us to make good decisions. The pictures below show the median price of HDB (public) houses in different towns of Singapore in Q1 2023 as well as their rental in Q4 2022.

Just as a side note, Singapore’s HDB (public housing) has a weird naming system. A 3-room flat consists of 1 living room + 2 bedrooms, a 4-room flat consists of 1 living room + 3 bedrooms, but a 5-room flat is just a bigger living room + 3 bedrooms. Executive flats are bigger and may contain an extra smaller living room and/or a study room. We will consider 4-room flats as our example as they are the average size. We can see that when comparing the prices and rental yield across towns, prices may differ greatly but rental are more or less within a tight range. For example, the cheapest 4-room flat can be found in Jurong East with a median price of $470,000 and a median rental of $2900. However the most expensive 4-room flat is in Queenstown with a median price of $864,000 and a median rental of $3600.

Without considering mortgage loan, purely from these numbers alone we can work out a rental yield of ($2900 x 12) / $470,000 = 7.4% per annum for Jurong East, but for Queenstown it will be 5%. Do not look down on this 2.4%. Changing our perspective, we can say that Jurong East’s rental yield is (7.4-5)/5 = 48% higher than Queenstown. If you factor in interests from mortgage loan, the gap is even wider. Whether you are buying HDB flats or condominiums, the same calculation process applies.

For non-Singaporeans, Queenstown is nearer to the CBD than Jurong East and is one of the hot favourites among Singaporeans. But as I said earlier, if we are looking at this as a business, cast away your emotions and make your decision purely by logic as well as cost and benefits. Your rental yield determines how fast you can breakeven and start earning actual profits.

Renovation

As far as possible, try not to buy a newly renovated house. Houses with decent renovation and/or fittings often cost more, as such cost are factored into the selling price. Aim for a more run down house as they are the best types of houses to push for a lower price. A $40,000 difference in selling price due to the renovation can be more than a year’s worth of rental income.

Understand that for the common tenants, exquisite renovation is a deterrent. They do not mind living in a less fanciful house as long as their rental can be cheaper. Note that less fanciful does not mean run down. In fact, tenants will not even care if they end up dirtying your nice little house. There is no point in making a very nice house for short-stayers who will not bother about spending effort to maintain it. It is not their house afterall. Once we get the run-down house, we can spend just a portion of the renovation money to make the house neat, organised, decent and clean. A simple coat of white paint makes the house looks much newer and cleaner. Floor tiles, if there is no need to change, can just be made clean either by yourself or by hiring a professional cleaner for a few hundred bucks. With that, you have already got the basics down. A clean house with a fresh coat of paint works more wonders than what many may think.

Windows are an important but not critical part. If there is enough budget, try to make your windows the kind that goes down to the floor. It gives people a more expansive feeling compared to window grilles fixed onto a hole in the wall, which actually looks like a prison cell. If the change does not cost much, you can consider it if it allows you to increase your rental by a bit.

There is also the renovation part where we may have to build or knock down walls, but we will come to that later, perhaps in part 3 of the series when we look at floor plans.

Cheap and new furniture can be sourced from Taobao, a Chinese e-commerce and shopping platform. Basic furniture for tenants include bed, table, chair and a cupboard. If you are renting rooms out instead of the whole unit, most tenants will stay in their room when in the house, hence it is important to make them feel comfortable in the room. A spacious and well-lit room is the basic requirement for a happy tenant. Space saving furniture such as a cupboard with many layers will allow one to utilise vertical space. A double-decker bed, even for a one-tenant room, will allow the tenant to use the vertical space above his bed. While I recognise that there are many interior designs which can allow you to save space well, such options cost way too much. We are talking about cheap ways to make things happen. If I can spend 20% of the cost to achieve 80% of the objective, I will not spend the other 80% just to max out the remaining 20%.

The more you save on renovation, the cheaper is the overall cost of your house. Focus on the things that matter to the tenant. Tenants are generally short-stayers (1 or 2 years), hence their consideration is different from a house owner who intends to live in in the long run. All they want is a decent and comfortable roof over their head and a fuss-free landlord.

Estate Maintenance

If you are buying a condominium unit, you are likely to pay for the maintenance fee. The gym and the swimming pool, the barbeque pit and the function rooms etc are amenities which needs to be maintained. Usually the estate management will collect a monthly fee from the homeowners based on their unit size. The overall maintenance fee for the whole estate is hence split between all the owners of the condominium development. However, in certain developments where the total units are fewer, it will mean a higher fee per homeowner. Assuming you are renting out your unit at $4000 a month, a maintenance fee of $500 will mean 12.5% of the rental income gone, and that is a lot.

That is why if you have to or plan to buy a condominium unit for rental income, go for developments with a lot of units. Sure, it may make your condominium less premium, but unless you are renting out to the rich, a lower monthly maintenance fee goes a long way. And this is also another sacrifice you have to make when faced with a logical business decision or your personal preference.

Mini-Conclusion

Numbers are important. Calculate it well, and you can breakeven in a much faster time than others. Let the cold hard, unfeeling numbers decide for you, not the emotions in your heart.

Showing 1 - 2 out of 2

Page 1 out of 1

| - | Resources | Price | |

|---|---|---|---|

|

|

$5.00

|

||

|

|

$1.00

|