In 1957, Dr. Curt Richter from John Hopkins did an experiment with rats. By placing a few rats in a bucket or jar of water with no way out, he watched how long the rats would last before drowning. Do note that rats know how to swim. Within a few minutes, the rats all began to drown. Curt Richter got a second batch of rats, this time just before the rats gave up and started to drown, he took them out and nursed them back to normal. Then he put them inside the water again to see how long they would last. Amazingly, this time they clocked up to 60 hours. The difference between these 2 batches of rats was hope. Both gave up within the first few minutes, but the second batch saw hope. They had experienced it for themselves that there was the possibility of being saved. With that hope in mind, they struggled and they worked till the best of their abilities, waiting for the moment their hope was realised, until physically they could not do so anymore. Curt Richter only provided them with a hope that will never be realised. He never planned to save them from the start.

In 1931, the term ‘American Dream’ was coined by James Truslow Adams, saying that ‘life should be better and richer and fuller for everyone, with opportunity for each according to ability or achievement’, regardless of social class or circumstances. In short, it is a system based on merit in which those who are capable will be accorded the appropriate opportunities and in return, the achievements and prosperity that comes with their success.

The Singapore Dream of the previous generation included the 5Cs – cash, condominium, credit card, car and country club membership. Most of the Singaporeans in that era lived in public housing (as it is till today), hence living in a condominium meant you made it into a higher strata of the society. Credit cards were not widely available then, and only the higher earners were qualified to get one. The only change from then perhaps, is that credit cards are now widely offered to people across all levels of society, as long as you have a somewhat basic (not necessarily high) income. In fact, when I was a university student, Citibank even offered me a credit card with a monthly limit of $500. That aside, it can be seen that generally the Singapore Dream is quite focused on material needs and material wealth. Singapore also touted a meritocratic system in which those who are capable will be given the appropriate opportunities as well. In short, material wealth and social mobility that depends on your skills, modelled and tweaked after the American Dream.

The Chinese Dream is slightly different though. It consisted of China as a nation achieving a moderately well-off society by 2021 and the rejuvenation of the Chinese people by 2049. China as we know from history, used to be a great country, but had suffered at the hands of other countries in the last 2 centuries. They seek to reclaim back their past glory and be the centre of the world once more. Of course on the individual level, there are also the dreams of material wealth and happiness. In the words of their Chairman Xi Jinping, at the root of China’s dream are the dreams of the Chinese people, and hence (the country) needs to work for the benefits of the people. The Chinse Dream ties the goal of the country, the people as a whole, and the individual together.

There are of course dreams of different versions elsewhere. But one thing we can see, is that there are different kinds of dreams being publicised and being promoted in societies. All of them have one common trait – work hard and achieve success of your own, and contributing to the country while doing so. The country will provide you with the means to do so. The country will draw up a system for you to do so. The dream is there, people have achieved it. All you need to do, is to work hard for yourself and for the country.

In every society and in every era across history, there are people who made it in life, and there are those who will never see the light of success. Not having success does not mean you are at the lowest. It can very well be just being the average person your whole life. The average person did not fail in life, but neither did he succeed in terms of material wealth. But in every dream, society will always take out the few who have achieved it, and tell you that this could be you one day. Granted that there are always a few who made it up there by themselves, but for most of the people, success of the current generation is usually built upon the foundation of the previous one.

The following may very well be the commoner’s route map:

- Being born

- Study, which may include getting into debt to get a university education

- Work for free for the first 3 years in order to pay back your university loan

- Get married and have your savings wiped out

- Buy a house and be in debt for 25 years

- Have a family of your own and see your babies sap all the money out from you

- Continue to work hard to pay off your debt and support your family.

- Retire.

- Spend a big part of your savings on medical bills and leaving almost nothing behind

- Die.

- Your children will restart the cycle.

Along the way you will definitely be able to save some money, which you will probably use it to buy things like a luxury bag, a fanciful car, holidays etc. Nothing wrong. You worked hard, you deserve it. No sarcasm intended, although whether it is a financially sound decision or not is another topic altogether, which I have already gone through. It probably does not help that we are constantly bombarded with peer pressures and advertisements all around us. We constantly see people living the high life, driving a nice car and staying in a fanciful place, having an expensive dinner at a high-end restaurants. We may not achieve it all, but perhaps I could at least afford a Chanel bag or buy an Audi. I shall celebrate my wedding anniversary or my birthday in a high-end restaurant, afterall it is not as if I do that frequently.

First we ask ourselves with all the definition of dreams above, what exactly is the dream that these people want? They want material wealth, yes. They want to enjoy life, yes. They want to feel respected and be in the upper end of society, yes. But most of us are average people, so we do things averagely and we earn averagely. Because that is the limit of our capabilities. Unless you are going for quick and big money, if not that is all that we are. At the end of it, I probably could summarise all these dreams into one very simple phrase: financial freedom. Sufficient money to do what I want without being too concerned about the money, within the boundaries of a stretched reasonability.

But having a dream handed down to people, and then take out a few examples and show it publicly, encouraging them to work hard for a dream most will never get is necessary for the progress of the economy and society. The harder the people work, the faster the country progress. But most of the people are doomed never to achieve the success they hope for, having stuck in the same place all the time. In fact, the system is rigged such that the majority of the people will only see the light of success but never actually achieve it.

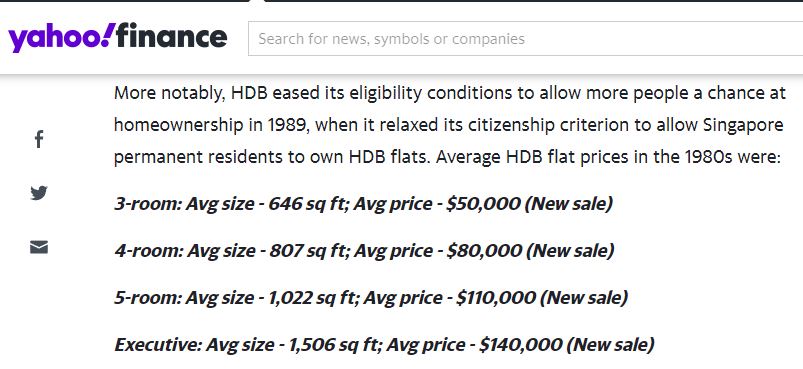

To quote one example in Singapore, which can similarly be applied elsewhere in the world. In the 1980s, an average Singapore public housing flat cost $80,000. Take note that in the picture below, HDB refers to Housing Development Board, a public housing agency which builds public housing for Singaporeans. Most Singaporeans live in public housing (HDB) flats. A 4 room flat would consist of 3 bedrooms, 1 living room, a kitchen and 2 toilets. A 4 room flat is considered an average-sized house by Singapore standards.

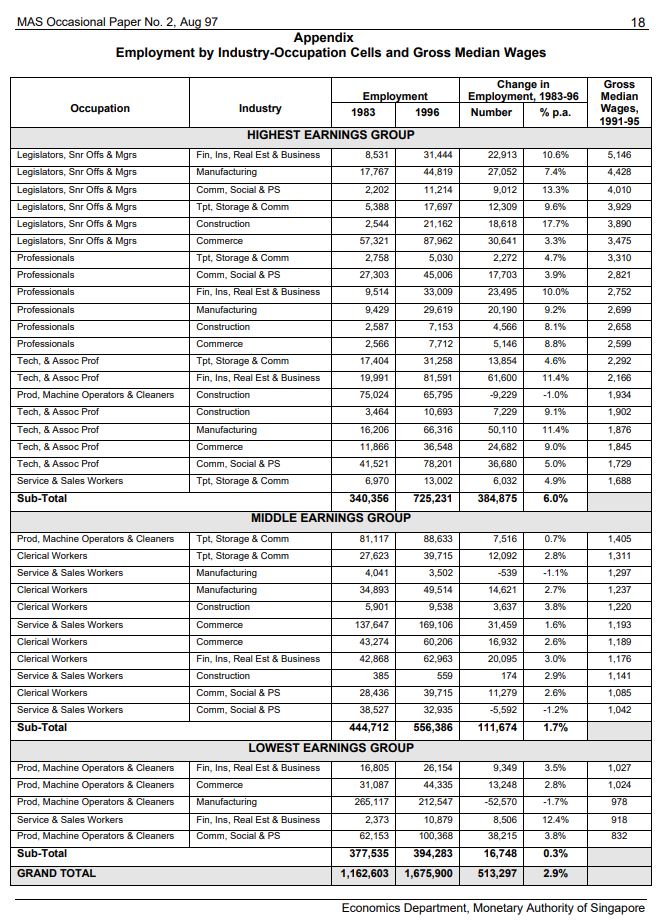

Of course, when looking at the prices of that time, it is also necessary to look at the wages of the employees in the same time period. What percentage of your salary is required to buy a certain item? How many months of an average worker’s salary is required to buy an average house? Let us look at some statistics published by the Monetary Authority of Singapore (think central bank of Singapore).

I do note that the above chart shows the median salary from the year 1991 -1995, while the cost of a house mentioned above was in the 1980s. But that was the closest data I could find. This may seem like a complicated chart, but let us look at the middle part, the ‘Middle Earnings Group’, which has the lowest median salary of $1042 a month and the highest of $1405 a month. We take the middle ground, and we have (1042 + 1405) / 2 = 1223.5 = $1224 per month. If we do it the simple way and take only into account the salary and cost of house, it will take an average worker $80000 / $1224 = 65.36 = 66 months to pay off for a house, not factoring in interest rates. Note that the average salary of the 1990s should be higher than the 1980s, so the calculation of 66 months to pay off for an average house could actually still be revised lower by a little bit.

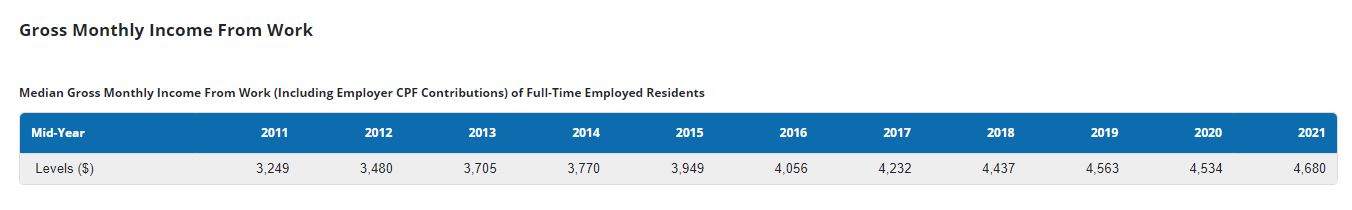

Now let us look at the average housing price and the average salary of Singaporeans now.

You may have noted that the housing price above are separated into mature and non-mature housing estate. A mature housing estate is a developed estate which contains all the amenities and that it is self-sufficient on its own. To make things fairer, since in the 1980s there was no such thing as a mature estate, we will take the average price of a 4-room flat in both mature and non-mature estate, coming up with the calculation of {[($253,000 + $381,000) / 2] + [($311,000 + $617,000) / 2]} /2 = ($317,000 + $464,000) / 2 = $390,500

With this price, it takes an average worker to $390,500 / $4680 = 83.44 = 84 months to buy a house. Mathematically speaking, an average house is now (84-66) / 66 = 27.27% more expensive for the average man on the streets. Our salary may have increased, the houses may have become fancier than the past, but it does not change the fact that a longer time is needed to pay off an average house. In this respect, we have regressed in the Singapore Dream, not progressed.

Other than housing, there is the cost of cars, food, water and electricity bill, daily household expenditures etc which I will not go into. You get the concept. Everything in our lives has become more expensive, not in terms of the absolute figures (eg $100, $300, etc) but in terms of percentage of our monthly salary. If you remember, it used to be that only one person in the family works to support the whole household (2 adults and 3 children). But right now for most couples, both the husband and wife needs to work to be able to keep the family running.

Our salary may have increased over the years, but our purchasing power is another thing altogether. Indeed, we have gotten more comfortable. We now live in a much better life compared to the previous generation. But are you really free? Are you really achieving the freedom which was sold to you in the form of a dream?

Are we simply upgrading our cage instead of achieving the financial freedom we are supposed to have? We have a more comfortable cage, but consequently we are trapped inside this cage more than before. Our retirement age keeps increasing, all for the sake of squeezing every last drop of labour and value out of your body till the day you drop dead. Yet, compared to the previous generation, which generation are the ones that actually got out of the rat race earlier?

Note that the above is only using Singapore as an example as it is a country I am most familiar with. But countries all over the world do that in their own way. From US to China, from Singapore to Europe, which country actually did achieve the dream for the people?

To be fair to the Governments all around the world, if I am in their position, I will also do the same thing. If everyone achieves success so easily, who would be left working and to push the economy? That cannot be so. The Governments have their own agenda, and we should exercise our critical thinking to plan for ourselves. If you do not even help yourself, who will you expect to help you? Work hard, save as much as you can, grow your money and/or set up other sources of income and keep on persisting. Always prepare for the worst case scenario but aim for the future. We may not be able to get rich quick, but slowly and steadily, as an average person, we can slowly move towards success.

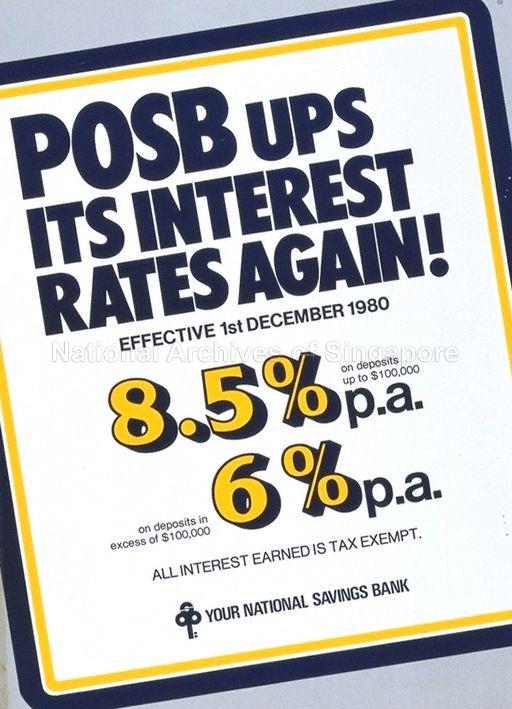

Lastly, just another picture from Singapore to remind you of the past.

Showing 1 - 3 out of 3

Page 1 out of 1

| - | Shop Products | Price | |

|---|---|---|---|

|

|

$99,999.00

|

||

|

|

$1.00

|

||

|

|

Price range: $69.00 through $99.00

|