Property investment is one of the default investment types people go for. I have talked about this topic from rental to capital appreciation, from the various types of properties to the factors which you should consider when buying one, so I will not repeat all these again. All along we have not really considered one important point: What if you really do not have sufficient money to buy one? Whether it is a second property purely for investment and/or rent collection purposes, or the very first for your own stay with the potential for future capital appreciation, there are times when people simply do not have enough money to buy.

Many people have different approaches to overcome this. The default way for most people is to maximise their loans. Getting a healthy loan is one thing, but from there people have been testing the limits of ‘maximum’. Many couples borrow from the financial institutions (generally banks) up to the limits of their combined salaries and repayment period. The next level up is to have their parents contribute to the housing payment, be it for the initial deposit or also for the monthly instalment. If we still want to go up another level, that would be also borrowing from relatives and friends on top of whatever was said earlier.

The above generally happens when housing prices are very expensive, but people still see hope in the housing market. One typical example is the big cities in China. To these people, the $1 million they put in may well become $2 million in the future. That is why they do not hesitate to borrow, even though one small change in their lives (eg retrenchment) may flip their world upside down. However, in certain societies, borrowing from parents or friends is a no-go. There will then be cases where housing simply becomes unaffordable.

Where possible, we will then have to consider alternative options.

Leverage

When we borrow to buy something, be it property or stocks, we are actually using leverage. Leverage itself comes with risks. There are people who made much money, and there are also others who jumped down from the very apartment which they borrowed money to buy. If we consider property itself to be a financial tool, we can look at things in a different light. Yes properties have the added function of giving us a roof over our heads, but this function will be invalid if you already have your first house. If you cannot afford your first house, then it is either rental or buying one run-down house at a remote location.

Consider Stocks

Stocks are one good alternative to properties if we are looking purely at the investment point of view but when we do not have enough money. Unlike properties, where one item cost a lot of money, we can buy as many shares as our money allows us. This means that we can play well within our means on the spot market, without using leverage (borrowings). However, we will want to choose stocks which still gives us the same investment return as compared to properties while minimising risks.

Below are some suggested recommendations which one may wish to consider.

The Country

Many countries has an asset class in which the majority of the population’s assets is invested in. For example, in the US, their stock market holds a bulk of their population’s money. Hence over the years, while there were recessions, their stock markets has seen an overall growth in value. Many so-called experts also said that if one does not know how to invest, just put it into S&P 500. However this is not true for China. In China, most of the population’s money are in their property market. That is why their property prices kept on going up but their stock market had been a deadbeat to the point the Chinese themselves gave up on their own stock market.

In order to maintain public order, to sell people a dream that one day they will get out of slavery, the asset class in which most of the country is invested on has to be protected. The asset class can take a beating in the short term, but in the long term it has to grow. Hence, choosing a country where the stock market is somewhat ‘protected’ would be a more logical choice.

Note: China has reversed their housing policy recently and caused their property to drop greatly in value, causing a lot of social problems. They have been trying to reverse or contain the situation but the damage has been done. But that is another political topic which I will not go into today.

The Company

Investing in shares is the same as investing in the company. Since in this article we are opting to invest in shares instead of properties, we will want to invest in safer shares instead of risking unnecessarily for potential big gains as we want to stay at similar risk levels. Companies mentioned from here on are only used as examples for the various scenarios and does not necessarily serve as a recommendation for readers to invest in them.

Warren Buffet had in recent months invested heavily in the 5 trading houses of Japan. To recap, these 5 trading houses formed an oligopoly in areas of minerals, metals, infrastructure, energy, chemicals, food, IT & communication, finance, machinery, construction, textile, real estate, transport, consumer good and more. With such firm grip on the core resources of the country, it is not difficult to see how they will profit.

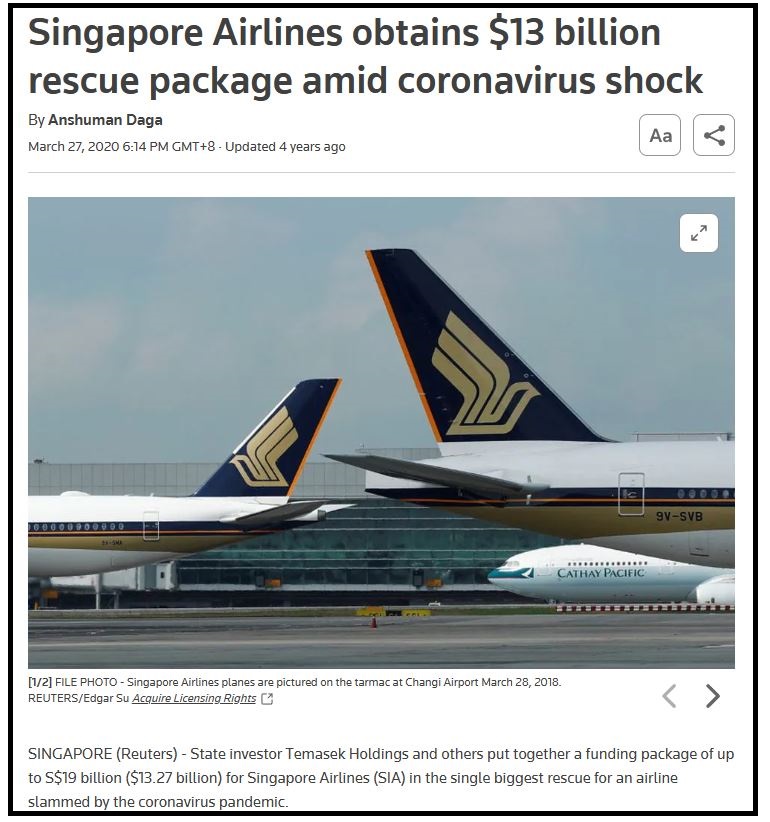

Or perhaps we can consider state-backed companies. Certain companies while publicly listed, are so tied in with the country that they will not be allowed to fail. Investing in such companies therefore comes with a safety net that even if you suffer for a period, you will definitely not die. Just like how even if your property price crash, you will minimally have a shelter over your head as a safety net.

Although not many have faith in the Chinese stock market, there are still some companies worth investing in, such as their power grid. I do not think I need to explain why investing in a power grid company in China may be a viable option. This also links us to the section below.

The Payouts

Different stocks have different benefits. Some have nothing at all – no dividends, no fringe benefits etc, and you buy only with the aim of capital appreciation. Others have a yearly dividend. But since we are considering properties as an investment, ideally we will also want to ensure that there is something to substitute the rental we could have even while holding on to the property for capital appreciation.

Certain companies pay an annual dividend, while some pay quarterly. Real Estate Investment Trusts (REITs) are a favourite among many because they regularly pay out dividends, and the structure of REITs is that of real estate investments, which many believe it is a good alternative as it still dabbles in properties. Personally I am not a fan of REITs. Banks is another category of stocks which one may consider. Banks generally also have quarterly dividend payouts. This is where banks are different from REITs. Certain banks are allowed to collapse, while certain banks are protected by the state / country and will not be allowed to close shop. If one can identify which bank has a strong enough backing and deemed not allowed to fail, then you will have found yourself a safety net + a regular payout stock.

Although I will not invest in Japan, but Japanese stocks has an added benefit of 株主優待 (Kabunushi Yutai), which means shareholder benefits. Currently about 1/3 of Japanese companies offer this to their shareholders. Essentially, if you own a certain amount of shares and above, you will be given additional benefits, often related to their businesses. For example, you may be given a voucher for a restaurant or grocery chain, a discount fare for an air ticket, or even daily items such as towels. If you pick the right company to invest in, these fringe benefits will be an added cost savings in your daily life.

The Mathematics And Policies

I will just briefly cover this segment, as I am sure my readers are smart to work out the mathematics themselves. If we purchase a property, we are aiming for capital appreciation + rental income which a stock investment can also achieve via capital gains + dividends. However, going the property route will generally incur stamp duties + mortgage interests + property tax + agent fees (if we decide to hire one) + maintenance fees (either as part of the property development or within the house itself) + income tax from rental + reduced earnings for any gaps in rental.

On the other hand, while the US has capital gains tax, certain countries like Singapore does not have it. Not only will you save all the fees above on properties, your capital and dividend gains are not taxed. Every single cent earned goes into your pocket.

Conclusion

Property investment is somewhat like stocks investment. We see more people coming out a winner in the property market compared to the stock market simply because of the illiquidity of the property market. When the value of a property falls, people generally have no choice but to hold on to it as they need a place to stay, or it is simply much more difficult to sell it off. Stocks on the other hand can be easily bought or sold in the financial markets, and people generally could not stomach seeing the value of their portfolio dropping over time. However, if one treats their stock portfolio as they would for their properties, it is achievable for a man on the streets to come out a winner with some homework and patience.

Do your homework. Do the math. Make the correct decision free from emotions.

Showing 1 - 2 out of 2

Page 1 out of 1

| - | Resources | Price | |

|---|---|---|---|

|

|

$5.00

|

||

|

|

$1.00

|